Market analysis from FOREX.com

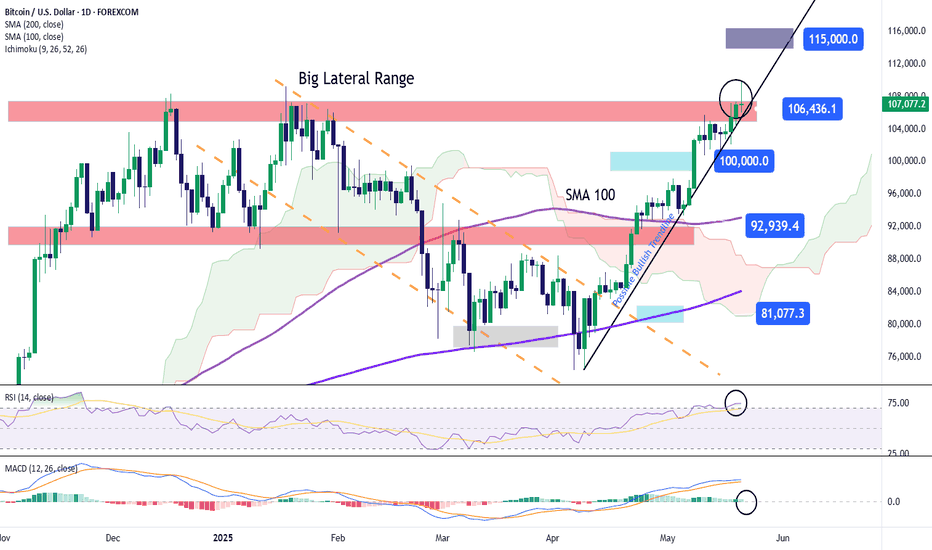

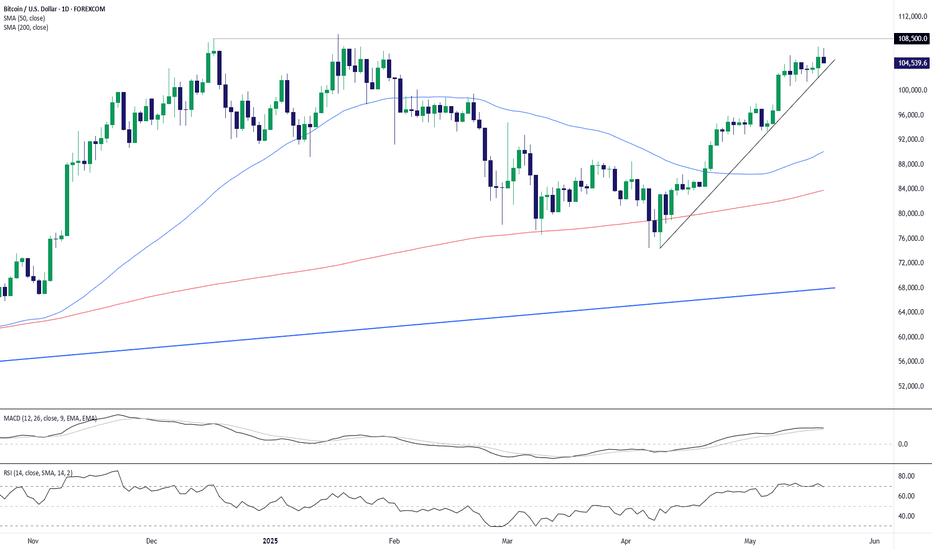

Over the past three trading sessions, BTC has gained more than 5%, marking a new all-time high above the $109,000 zone. The current bullish bias can largely be explained by optimism surrounding cryptocurrency regulation, as the U.S. Senate debates new pro-crypto legislation. However, the strong upward momentum has started to ease gradually, and the price is...

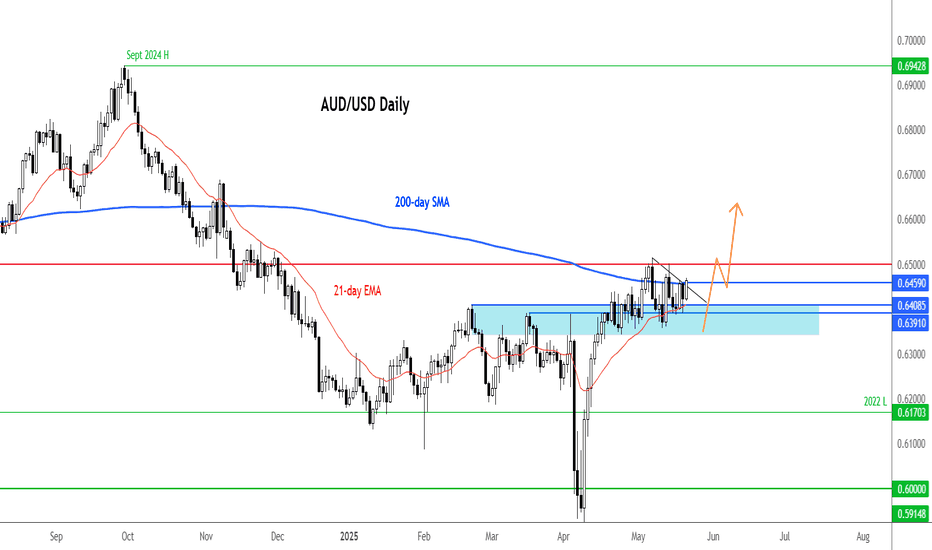

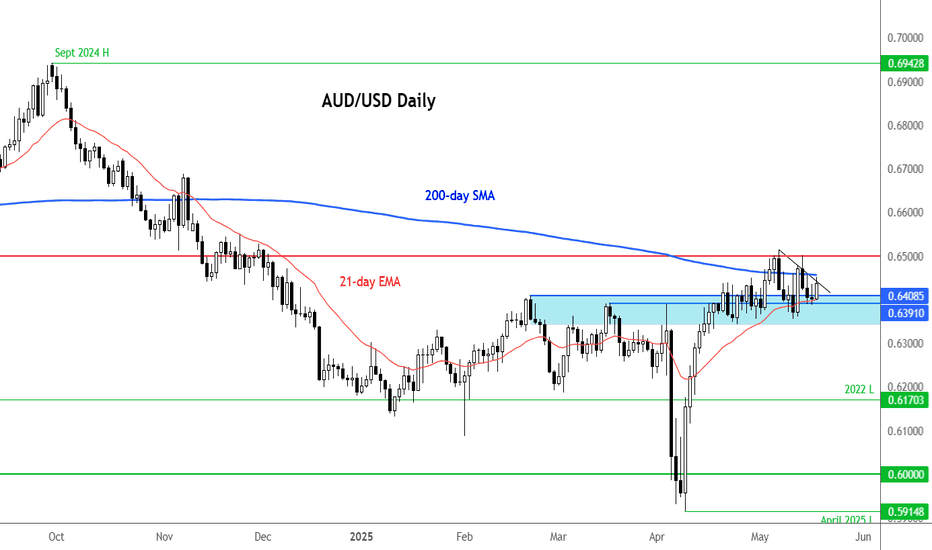

Following the dovish RBA rate cut on Tuesday, the AUD/USD has bounced back. The US dollar has fallen across the board, while the Aussie has been boosted by rallying prices of precious metals and a firmer yuan. While equity markets have been relatively subdued, the commodities space has seen some notable action — particularly in precious metals. Platinum and...

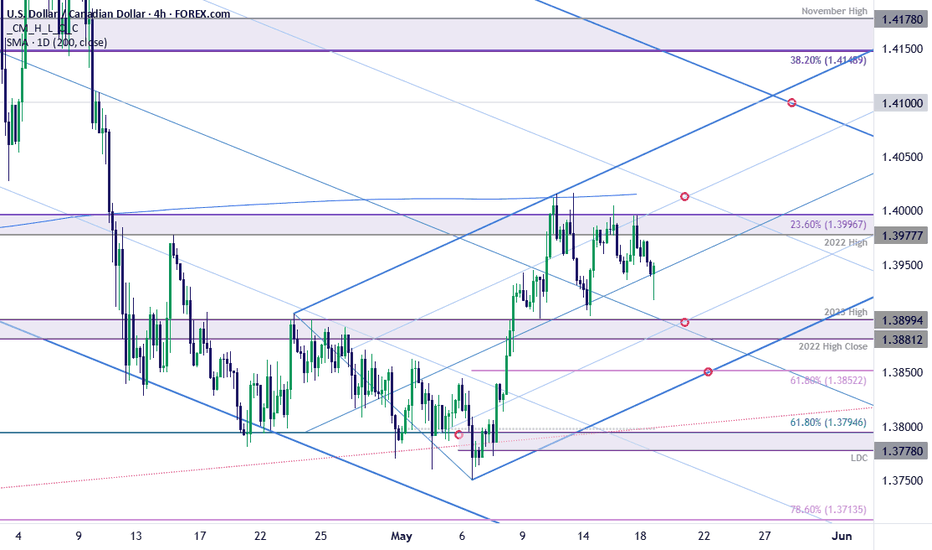

The Canadian Dollar is attempting to mount a counter-offensive this week with USD/CAD trying to snap a two-week rally. A reversal off technical resistance is now approaching initial support and the first test for the US Dollar bulls. Initial weekly support rests with the 61.8% retracement of the recent advance at 1.3852 and is backed by key support at 1.3729/94-...

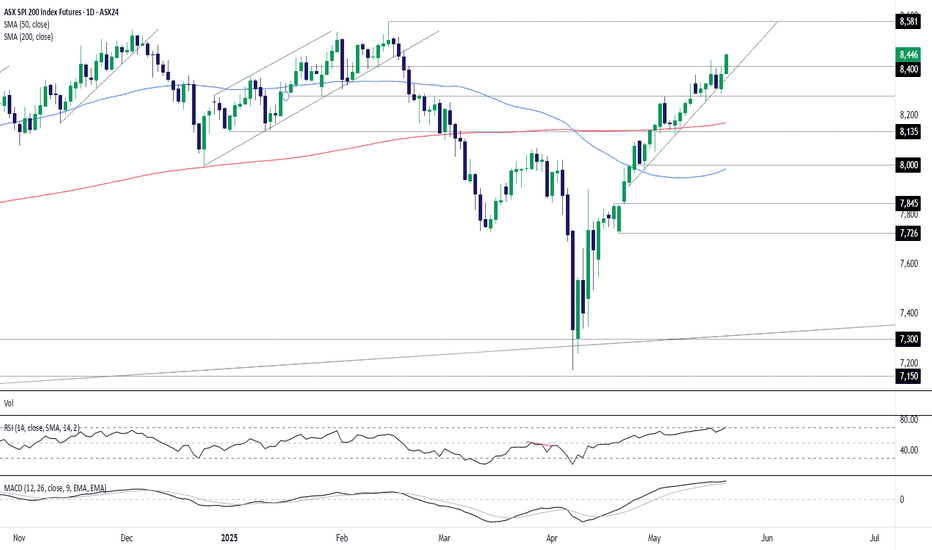

ASX 200 SPI futures have broken above the 8400 level and May 16 high of 8424, opening the door to a bullish setup—provided the price holds these levels into the close. Longs could be considered above 8424 with a stop below 8400 for protection, targeting a retest of the record high at 8581. While momentum indicators are nearing overbought territory, they continue...

Over the past five trading sessions, Alphabet's (Google) stock has managed to sustain a moderate bullish bias, with a gain of over 4%, as the price has settled around the $170 level. So far, the stock has avoided significant pullbacks amid recent announcements of new integrations and advancements in artificial intelligence within the Google ecosystem. On one...

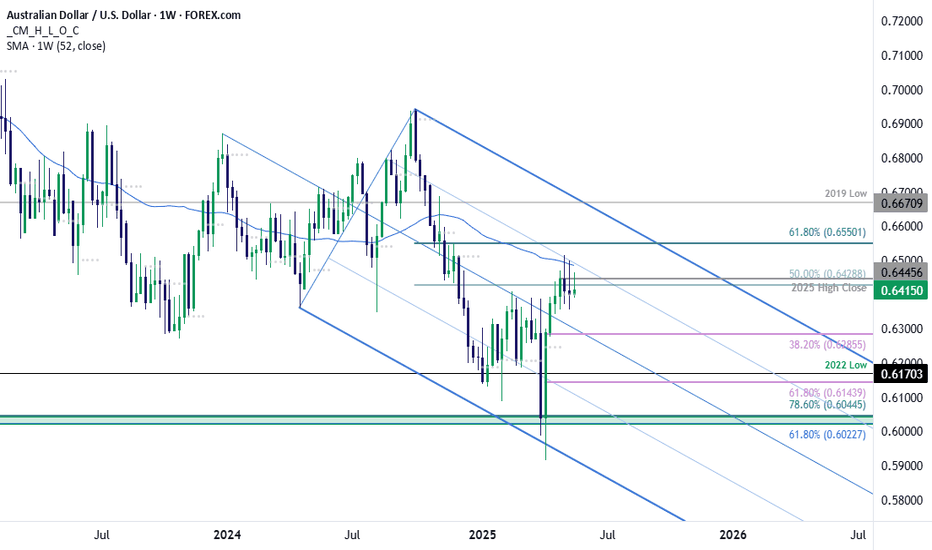

Aussie has held below resistance for nearly five-weeks now with multiple breakout attempts failing at the 52-week moving average. Weekly resistance now stands with the 2025 high-close / 50% retracement of the September decline at 6429/45 and is backed again by the yearly moving average, currently near ~6485. Critical resistance is eyed with the July close low /...

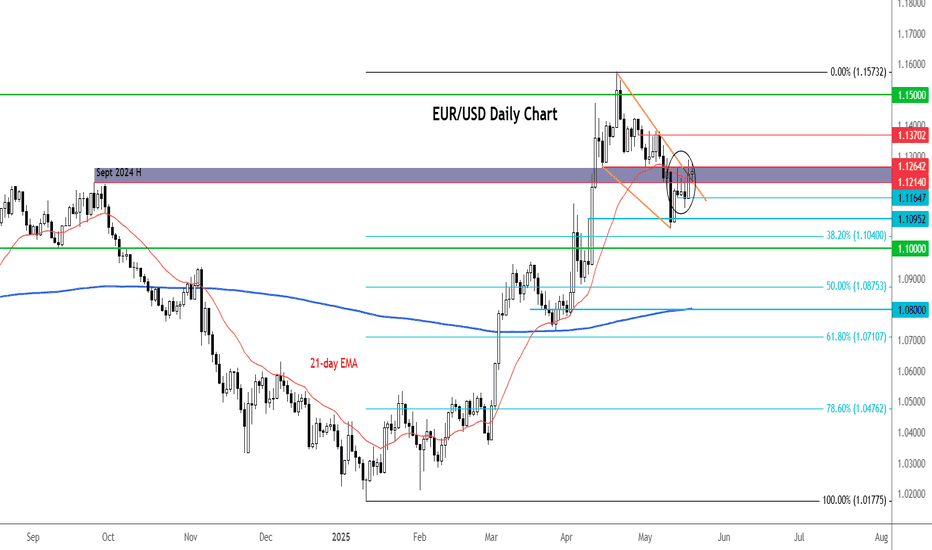

The EUR/USD is looking quite interesting as it tries to break out from a continuation pattern to the upside. So far, we haven't seen strong upside follow-through, which could be concerning for the bulls. Nevertheless, if it manages to break above the trend line of the falling wedge pattern, then this would suggest that the short-term path of least resistance is...

Bitcoin (BTC/USD) remains in an aggressive uptrend but is showing early signs of hesitation near a major resistance level: Trendline Intact (for now): Price is still riding an ascending trendline, but today's bearish candle hints at momentum cooling. Resistance at 108,500: This level has capped multiple rallies; rejection here could signal a short-term...

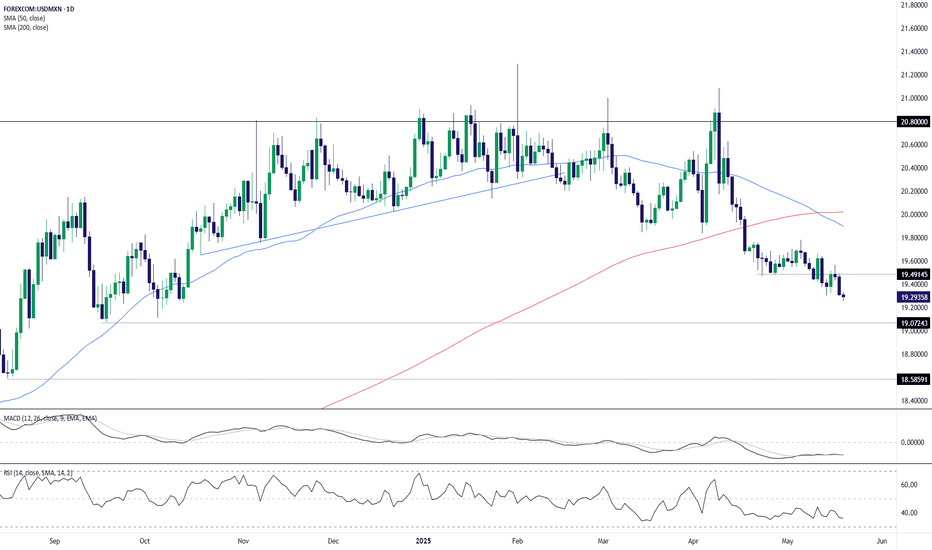

The USD/MXN daily chart is displaying signs of continued weakness: Downtrend Intact: The pair trades firmly below its 50-day and 200-day moving averages, reinforcing bearish control. MACD Bearish: Momentum remains to the downside with the MACD line below zero and the signal line. Key Support Zones: Price is approaching horizontal support at 19.07; a break could...

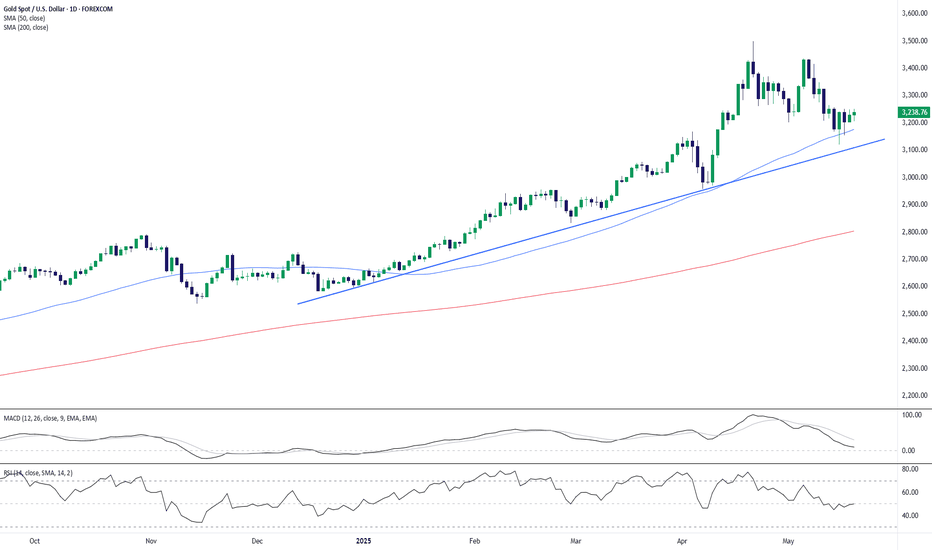

Gold is holding just above rising trendline and 50-day SMA support (~$3,175), but the rebound has been tepid so far: 📉 Price action: Small-bodied candles reflect indecision 📊 RSI stuck near 50, suggesting a lack of directional momentum 📉 MACD still trending lower, though starting to flatten 📍Support: Rising trendline and 50-day SMA: $3,175–$3,180 Below that:...

Despite Nasdaq's recent 400-point pullback from the 21,446 high, silver has extended its one-month consolidation, with momentum and price action suggesting the calm before the breakout. The intersection of haven demand and renewed interest in tech-sector investments—particularly around AI—could reestablish silver as a preferred alternative asset. From a daily...

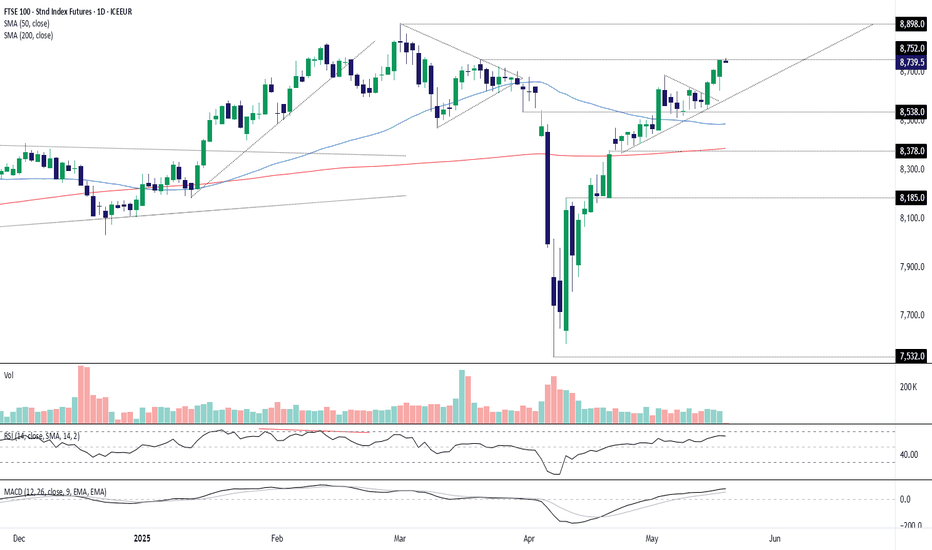

A clean break above the March 20 high of 8752 would generate a bullish setup, allowing for longs to be established with a stop beneath for protection, targeting a retest of the record high at 8898. Price action has been bullish in recent days, with a break of minor downtrend resistance on Thursday triggering another wave of buying, backed by solid volumes....

Over the past four trading sessions, gold has shown oscillations of around 1% in the short term. For now, indecision is beginning to emerge in the price of the precious metal as market confidence gradually recovers. The CNN Fear and Greed Index is already holding near the "extreme greed" zone, and as confidence continues to rise steadily, this could become a...

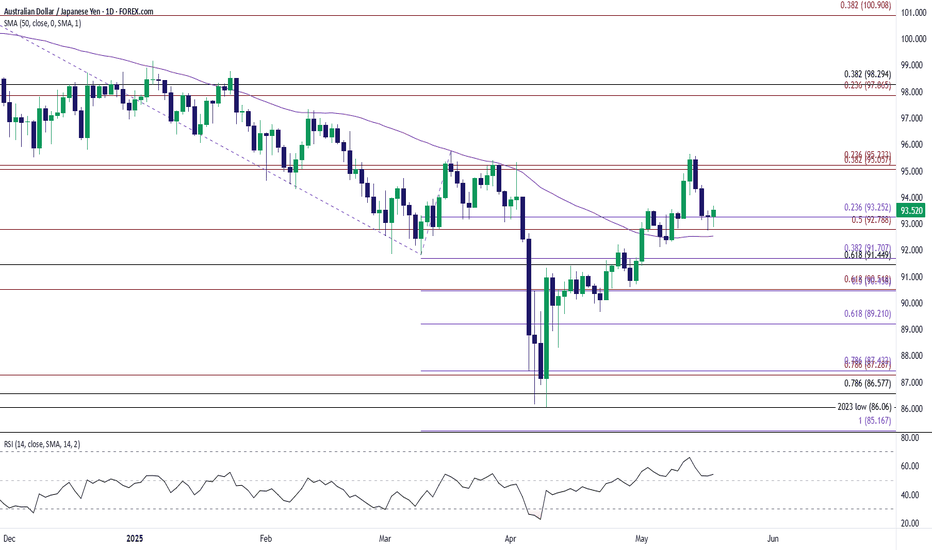

AUD/JPY appears to be bouncing back ahead of the monthly low (91.42) as it snaps the series of lower highs and lows from last week. Lack of momentum to close below the 92.80 (50% Fibonacci extension) to 93.30 (23.6% Fibonacci extension) zone may push AUD/JPY back toward the 95.10 (38.2% Fibonacci extension) to 95.20 (23.6% Fibonacci extension) region, with a...

The USD/CAD rally failed into confluent uptrend resistance at the 200-day moving average last week with price breaking below the median-line today in early U.S. trade- threat for a deeper set-back here towards the 2022 high close / 2023 high at 1.3881/99 and the 61.8% retracement at 1.3852. Losses would need to be limited to this slope IF price is heading higher...

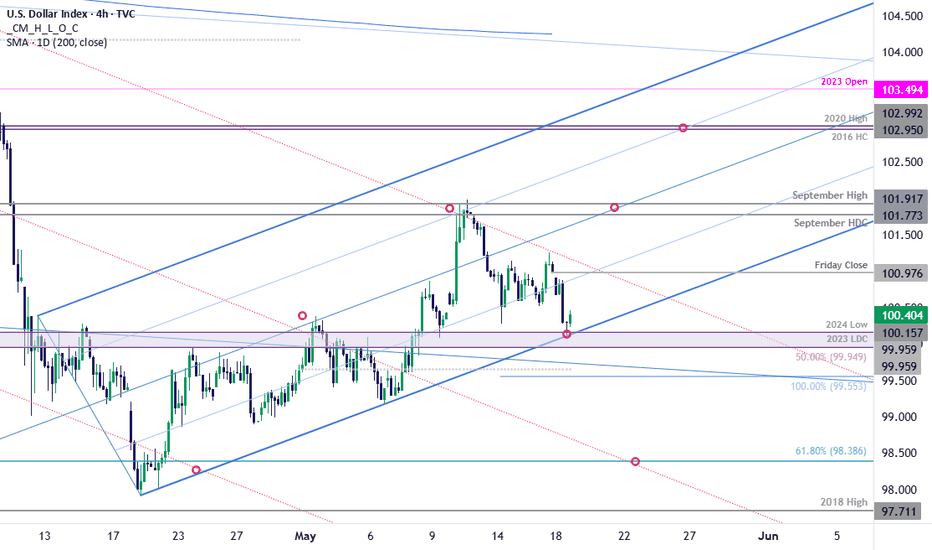

The U.S. Dollar dropped into support early in the week at 99.95-100.15- a region defined by the 50% retracement of the late-April advance, the 2023 low-day close, and the 2024 low. Note that the 100% extension of the decline rests just lower at 99.55 and losses would need to be limited to this level IF Euro is heading higher on this stretch. Initial resistance...

The AUD/USD has been coiling in the last few weeks after making a v-shaped recovery following the tariffs announcement plunge. Is it now ready to finally resume higher? From a purely technical point of view, the price action looks bullish as it the consolidation below the 200-day moving average and key resistance in the 0.6500 handle suggests price is gearing up...

Despite Nasdaq's recent 400-point pullback from the 21,446 high, silver has extended its one-month consolidation, with momentum and price action suggesting the calm before the breakout. The intersection of haven demand and renewed interest in tech-sector investments—particularly around AI—could reestablish silver as a preferred alternative asset. From a...