Market analysis from FOREX.com

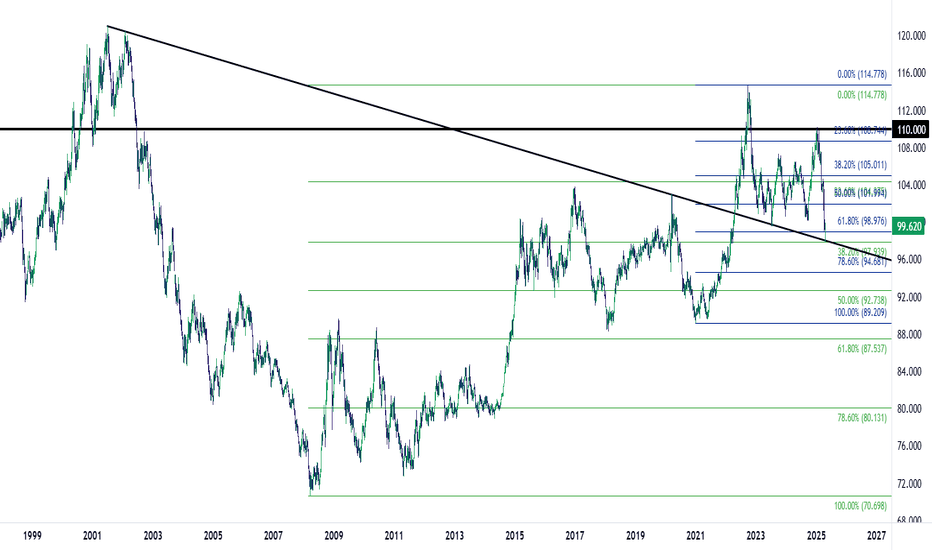

Last week I highlighted the oversold reading on the weekly DXY chart. While bulls didn't exactly put in a massive showing it was also one of the first green weekly bars in a month. Notably, the monthly April bar looks very bearish but the bulk of those losses were in the first 11 days of the month and last week, on Monday, a massive spot of support came into...

EUR/USD is working on its first red weekly candle after four consecutive weekly gains, and that had extended a strong showing in early-March as bulls started to take over. Interestingly this happens with the backdrop of a dovish ECB and this leads to CPI data for next week. There's increasingly attractiveness behind swings, as taken from that indecision on the...

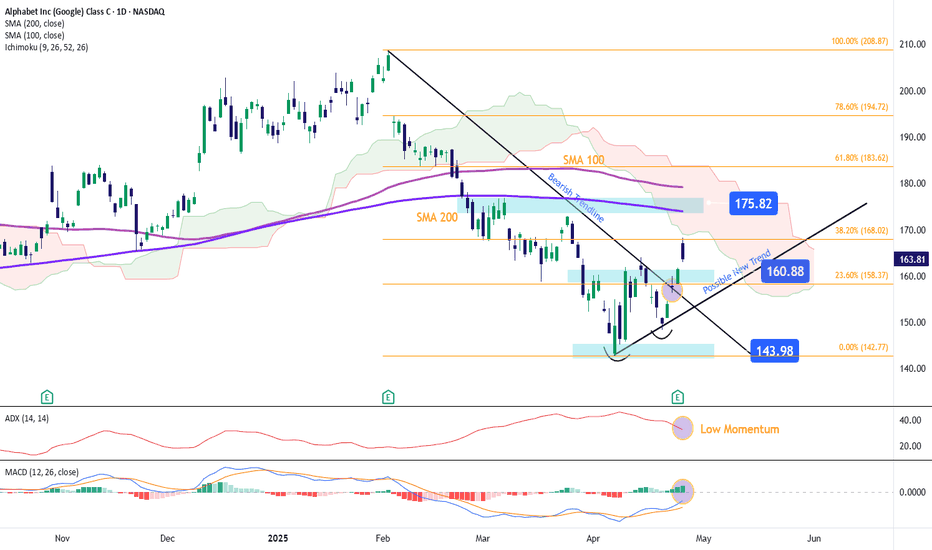

Google's stock managed to post a bullish gap of more than 3% in the last session, shortly after the company announced its quarterly results. Initially, it was reported that total sales for the last published quarter reached $90.23 billion, compared to the expected $89.12 billion. In addition, the company posted earnings per share of $2.81, beating expectations of...

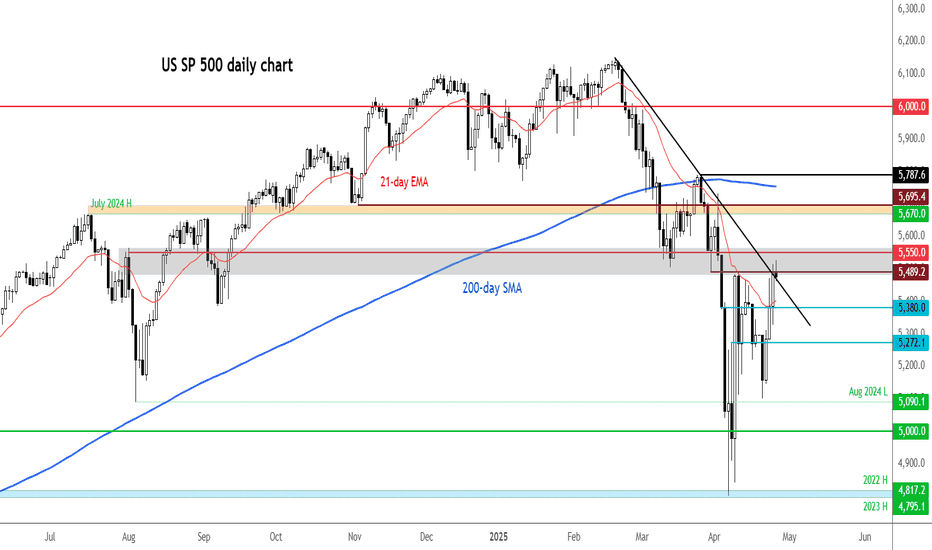

Trump continues to say positive things - just now suggesting that they are very close to a deal with Japan on tariffs. But it is China where the bulk of uncertainty lies. He has been quite upbeat this week, but China continues to push back against the optimism. European indices extended their gains, buoyed by the previous day’s upbeat mood, while US futures have...

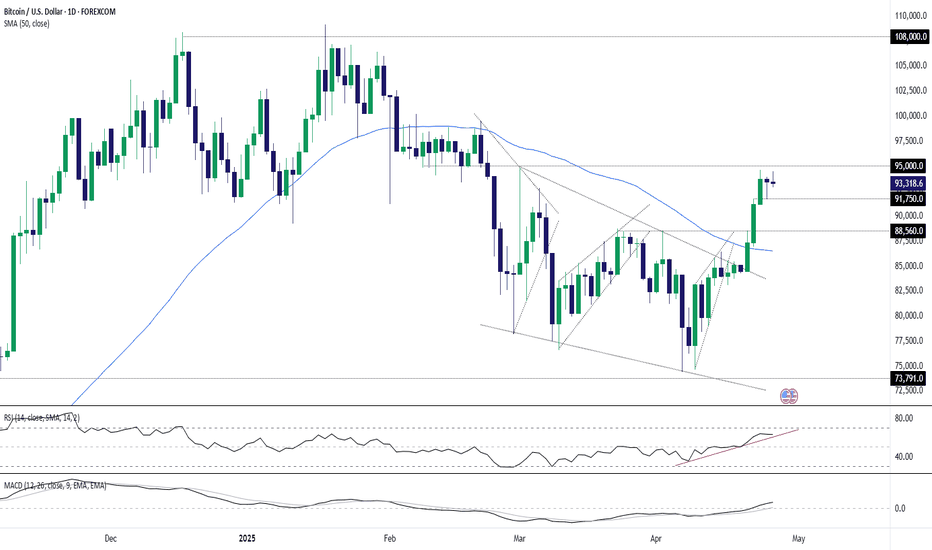

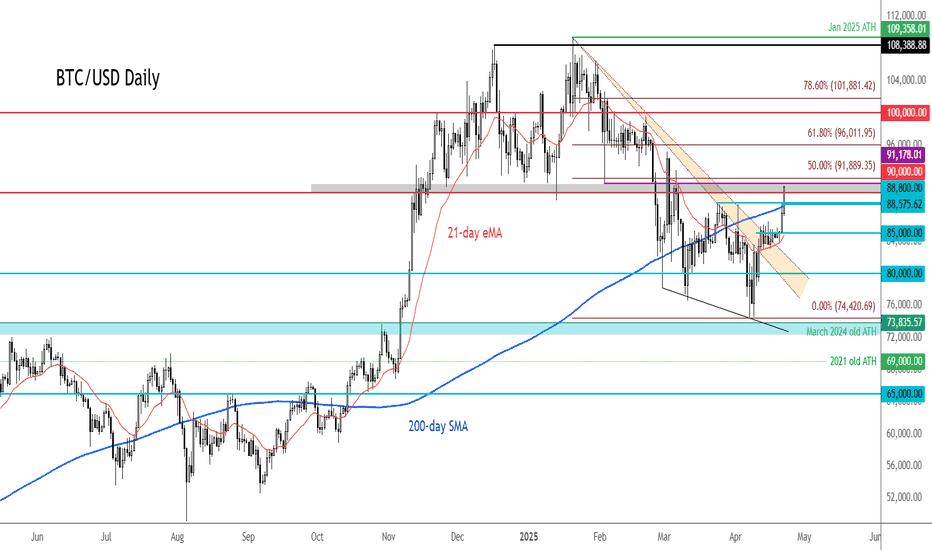

After a bullish wedge break and having cleared the key 50-day moving average earlier this week, bitcoin bulls will now be eyeing a break above $95,000, especially with indicators such as RSI (14) and MACD signalling strengthening topside momentum. A break and close above $95,000 would generate a bullish setup, allowing for longs to be established above with a...

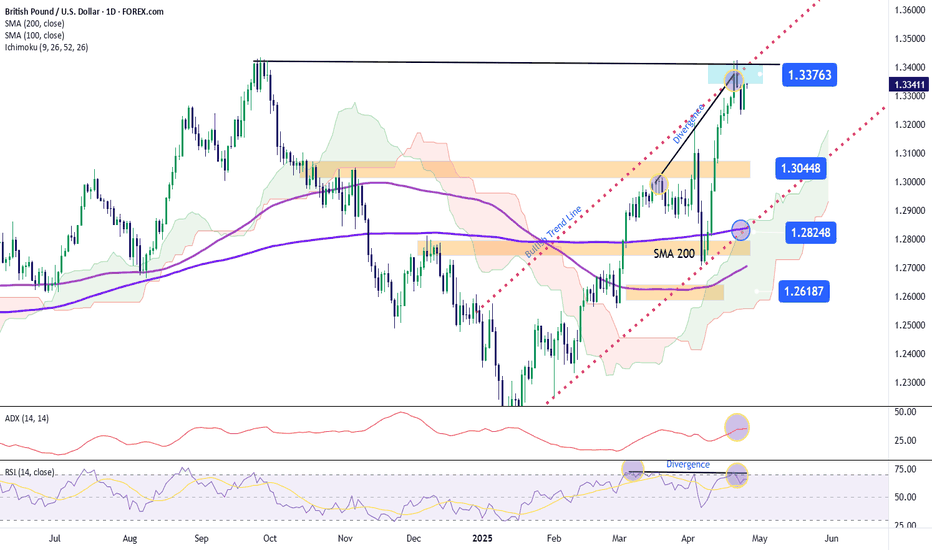

During the last trading session, the GBP/USD pair posted a gain of more than 0.5% in favor of the pound, as U.S. dollar weakness continues, even after some positive remarks regarding the U.S.–China trade war. For now, it seems that investors are viewing European currencies as a potential safe haven amid the current wave of economic uncertainty across markets. This...

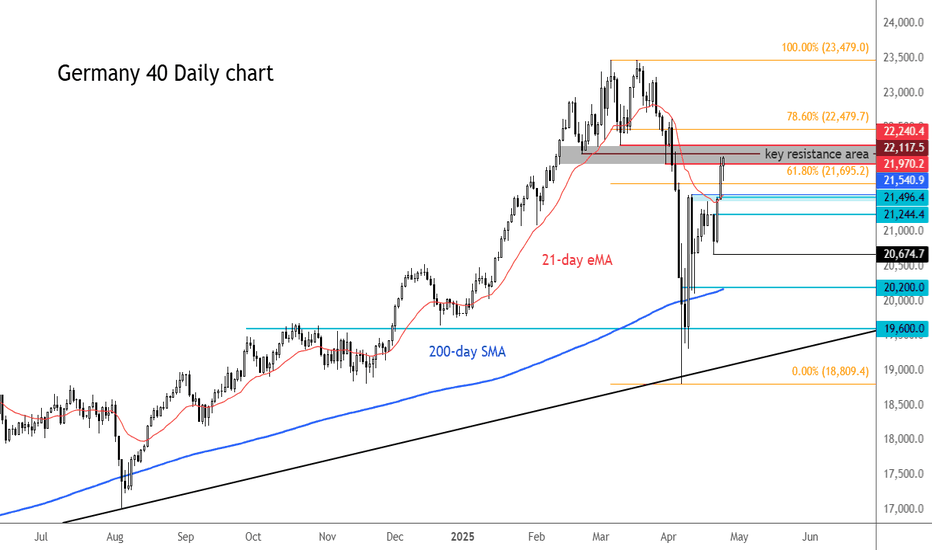

The DAX has enjoyed a very good recovery from its lows made earlier this month, outperforming many global indices. However, even the flying German index could be due a pullback now that it has reached a major resistance area. As per the chart, the area between 21970 to 22240 marks a major zone. This area was previously a key support zone which gave way during the...

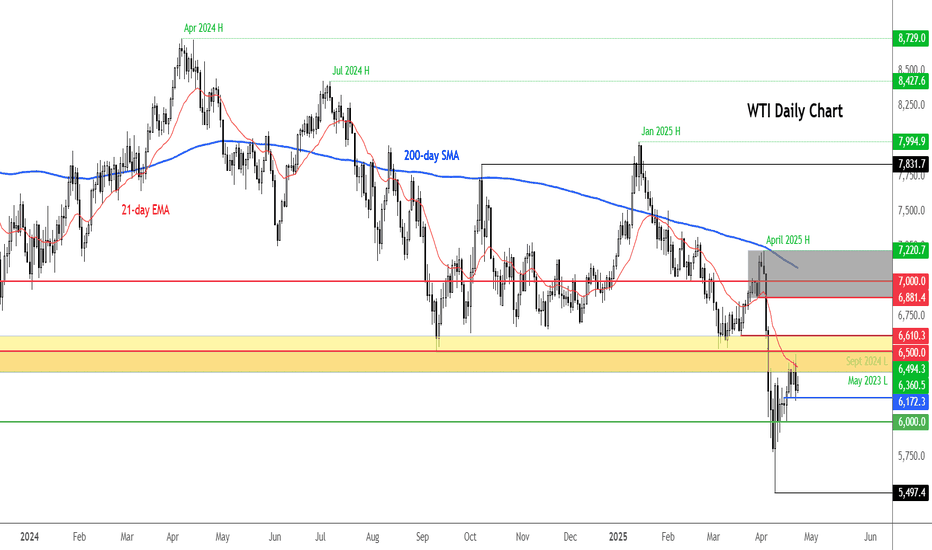

WTI formed a large bearish engulfing candle on its daily chart yesterday near the key $65 resistance level. Was that an indication that prices have ended their corrective bounce? Time will tell, but today's oil prices have bounced back. With the trade uncertainty in the background, demand concerns remain high. So, I wouldn't be surprised if prices were to resume...

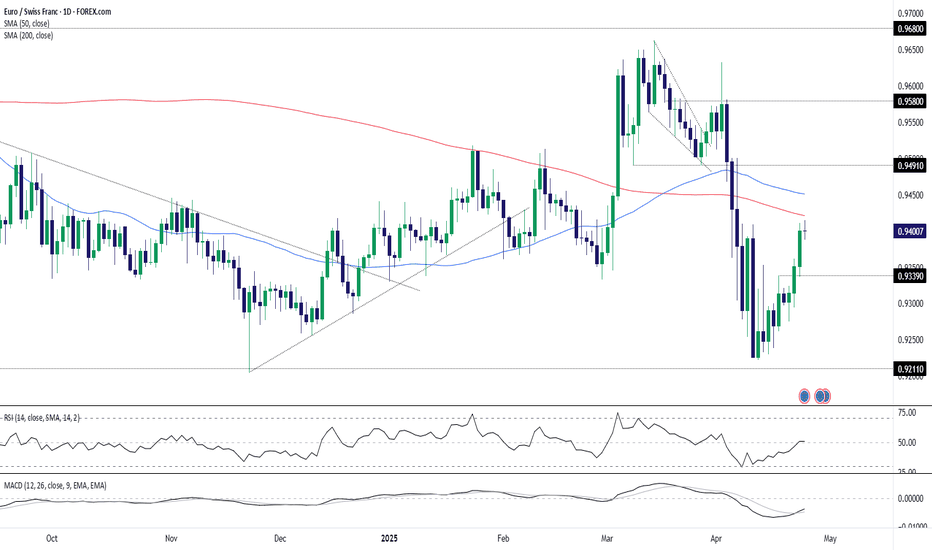

With the key 200-day moving average overhead and having failed to sustain pushes above .9400 earlier this month, EUR/CHF finds itself at an interesting level on the charts, generating multiple potential setups depending on how near-term price action evolves. If the price is unable to hold above .9400, shorts could be initiated with a stop above the 200-day moving...

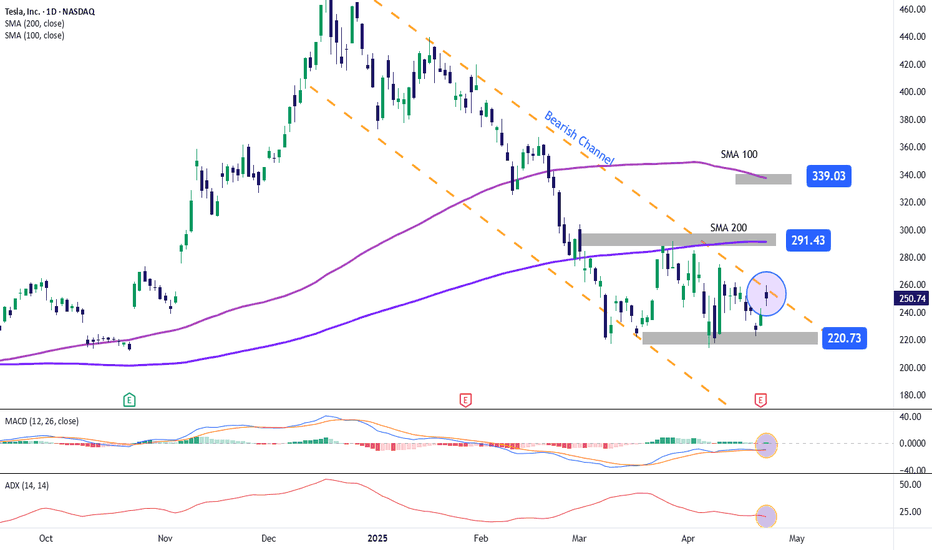

Tesla’s stock is currently hovering near the $250 level, after a bullish gap formed following the release of its latest earnings report. Initially, the company's results fell short of expectations: earnings per share came in at $0.27 versus the expected $0.39, and total revenue reached $19.3 billion versus $21.11 billion anticipated by the market. Despite this,...

Gold has extended its slump, now off by more than $230 (-6.5%) from yesterday's record high of $3.5K. Unwinding of "Sell America" trades continue as risk assets rally on Trump's trade optimism. Key levels to watch With short-term support broken at $3,342, this level has already turned into resistance. The next support was at $3,284. This level has just been...

USDJPY is currently retesting its 2024 lows and the 0.618 Fibonacci retracement level of the uptrend from January 2023 to July 2024, near the critical 139 zone. The daily Relative Strength Index (RSI) is now in oversold territory—levels that have previously marked key reversals for USDJPY in both 2023 and 2024. If a reversal takes hold, potential resistance...

From a monthly perspective, Gold’s broader trajectory appears to align with a classic cup and handle formation, targeting the $3,700 and $4,000 per ounce levels—supported by a clear hold above $3,500. However, given the steep momentum currently in play, significant headwinds are likely as the market consolidates. These may serve to recharge monthly momentum that...

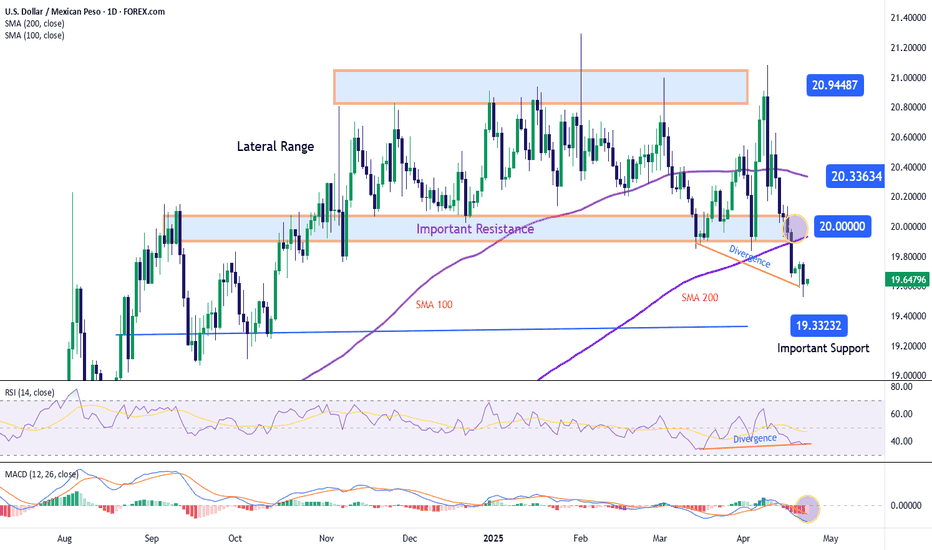

Over the past five trading sessions, the USD/MXN pair has declined by more than 2%, as the Mexican peso continues to gain ground against the U.S. dollar. This bullish trend in the peso is partly driven by the ongoing weakness in the U.S. dollar, as reflected in the DXY index, which has fallen to 99 points, its lowest level in the past year. The dollar’s weakness...

The signal from last week’s bullish engulfing candle on ASX 200 SPI futures has proven reliable so far, with the price rocketing above 7900 on Monday, providing a platform to establish long positions around. With optimism building over trade deals between the United States and major partners, including China, bulls may look to enter above 7900 with a stop beneath...

Bitcoin has climbed above the $90K level for the first time since early March. Is this an indication of risk appetite improving, or are investors buying Bitcoin for the same reason they are buying gold? In any case, as traders, we care about the HOWs and WHEREs more than the WHYs. With that in mind, it is worth keeping an eye on the next areas of potential...

AUD/USD sits at a key level, banging up against the dominant uptrend dating back to October 2022. You can see from past price interaction how pivotal this trendline has been — initially acting as support before flipping to resistance after being broken late last year. The bullish engulfing weekly candle from early April flagged what’s since played out, hinting...

Over the last three trading weeks, the GBP/JPY pair has depreciated by more than 3%, establishing a firm bearish bias in favor of the yen in the short term. This perspective has remained intact primarily due to growing expectations of a more dovish monetary policy from the Bank of England, which left its interest rate unchanged at 4.5% in its latest meeting....