Market analysis from FOREX.com

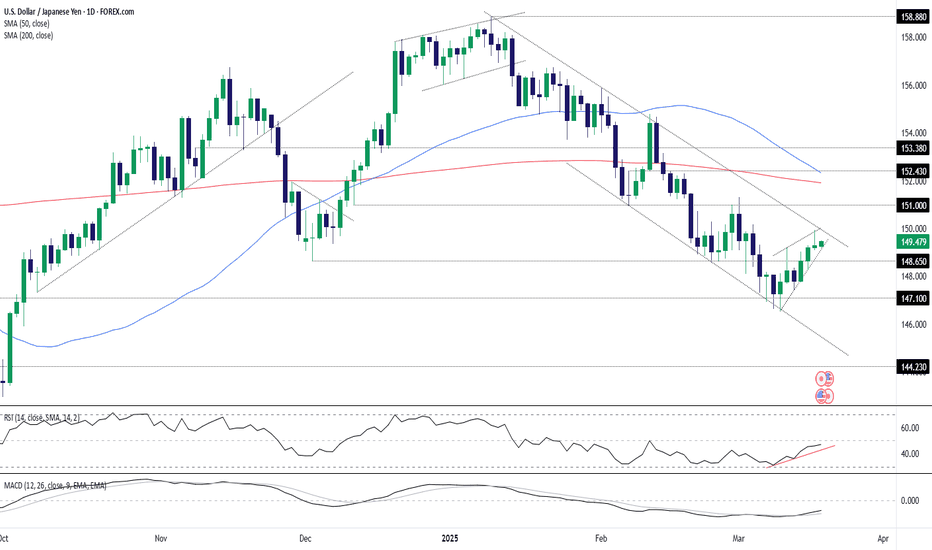

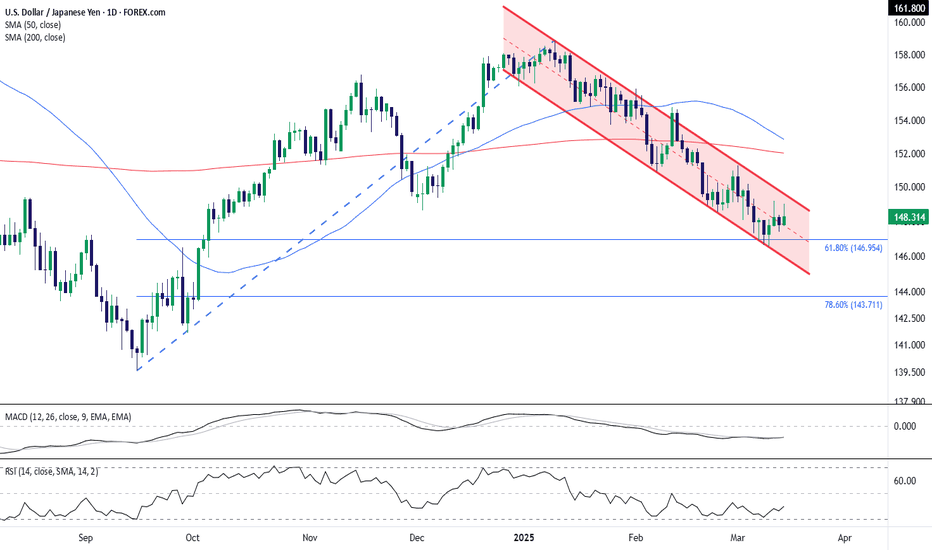

The ducks may be lining up for a resumption of the USD/JPY downtrend. Firstly, it remains in a defined falling channel. Secondly, Tuesday’s reversal delivered a bearish pin candle, often seen around market tops. Thirdly, the rebound from last week’s lows resembles a bear wedge pattern, warning of a potential downside break and resumption of the bear...

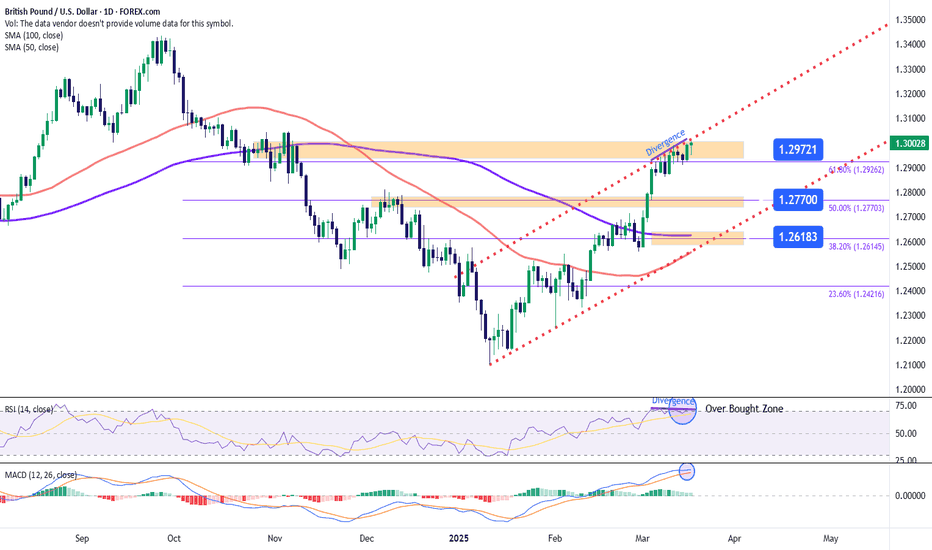

Since March 3, an unprecedented bullish movement has emerged on the GBP/USD daily chart, with the pair accumulating a gain of over 3% during this period. The bullish pressure continues to be driven by uncertainty surrounding the trade war, which has gradually weakened the U.S. dollar, prompting investors to seek refuge in European currencies. Today, the market...

Both oil contracts are now lower on the day, giving up earlier gains. From the day's high, WTI is now 2.8% lower and counting as prices test the day's lows. Oil prices moved lower on hints/hopes of peace from the just-finished Trump & Putin talks. The rationale here is that any peace progress would increase the chances of removing sanctions on Russian oil...

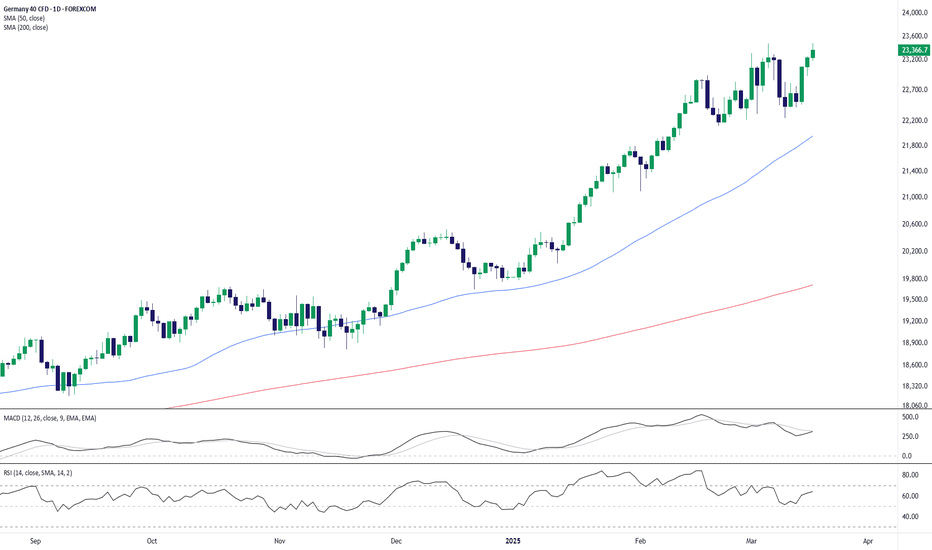

The Germany 40 (DAX) continues its impressive rally, climbing to 23,378.7, up 0.60% on the session. The 50-day SMA (21,954.8) remains firmly below price action, signaling sustained bullish momentum, while the 200-day SMA (19,713.1) provides a solid long-term support base. Momentum indicators support the uptrend: ✅ MACD remains in bullish territory, showing...

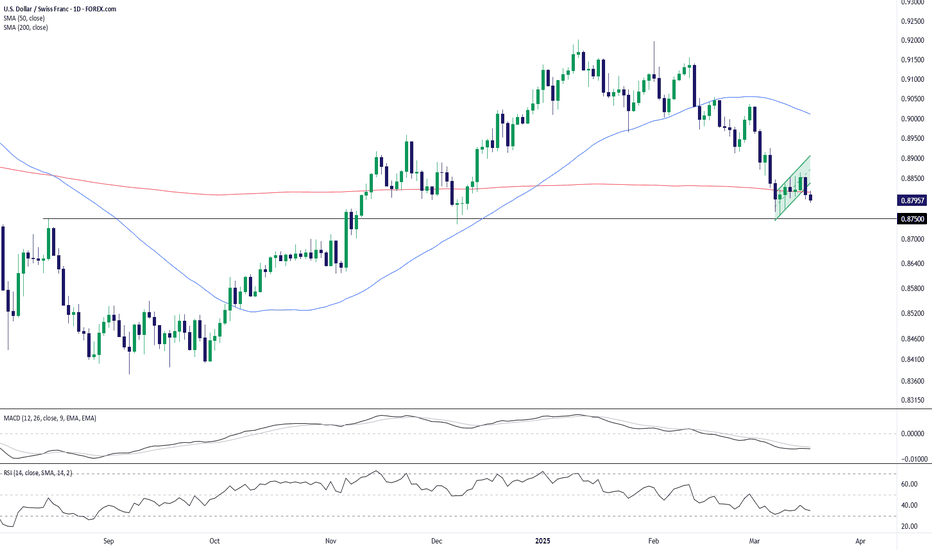

USD/CHF remains under pressure after breaking below the 200-day SMA (0.8815) and failing to reclaim it. The pair has formed a bearish flag pattern, indicating the potential for further downside. The next key support level sits at 0.8750, which, if breached, could accelerate selling pressure. Momentum indicators confirm the bearish outlook: 📉 MACD remains in...

EUR/USD has surged higher, reclaiming both the 50-day (1.0493) and 200-day SMA (1.0272), signaling a shift toward bullish momentum. The pair is now testing a critical resistance level at 1.0940, which previously acted as support before the late-2024 decline. Momentum indicators confirm strong buying pressure: 📈 MACD is crossing into positive territory,...

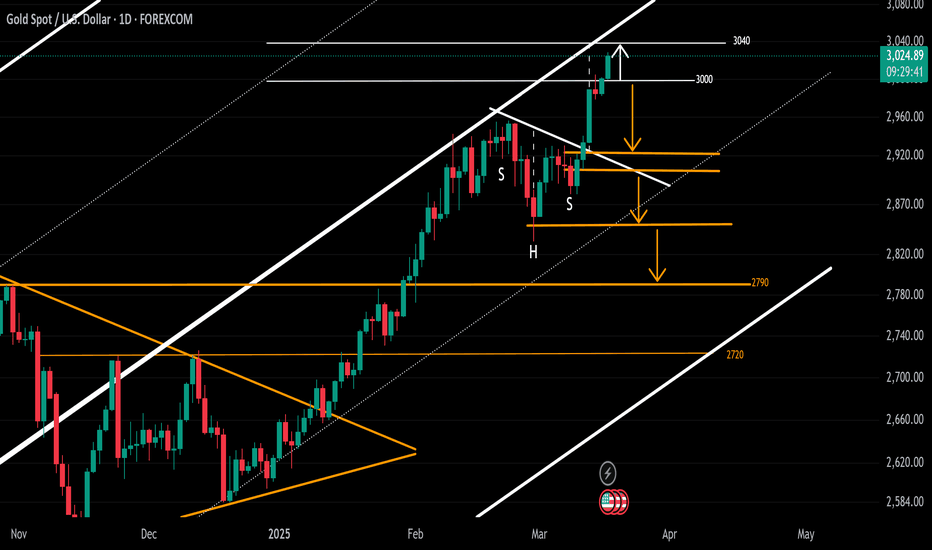

Gold remains persistent in targeting its inverted head and shoulders pattern on the daily timeframe, eyeing the 3,040-resistance. However, monthly overbought conditions—seen in 2024, 2020, and 2011—raise caution for potential sharp reversals. • In 2011, an overbought RSI led to a nearly 900-point retracement • In 2020, a similar overbought condition resulted in...

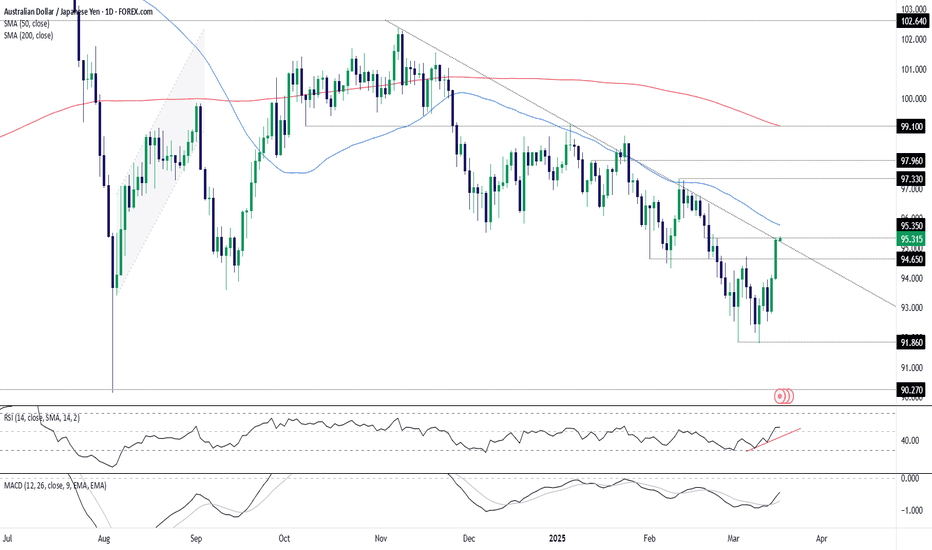

AUD/JPY is testing downtrend resistance established in November, with a potential retest of the 50DMA in play. Momentum indicators, including RSI (14) and MACD, are flashing bullish signals, favouring an upside bias near-term. If we see a break of the downtrend and minor horizontal support at 95.35, longs could be established above the latter with a stop beneath...

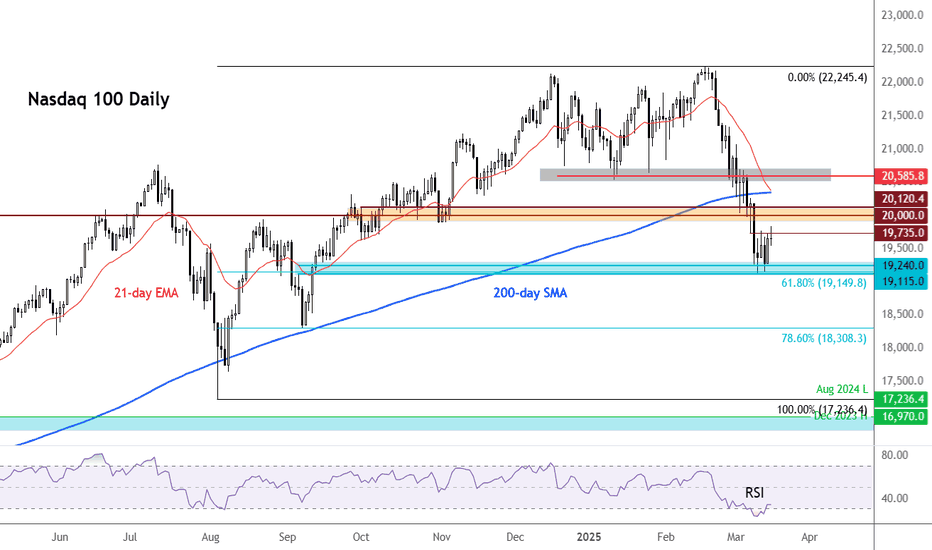

Markets have been grappling to establish a definitive bottom in recent sessions, before finally the bulls showed up on Friday to stage a strong rebound from oversold levels. Could the Nasdaq 100 now be poised for a more substantial recovery? After Friday’s recovery, the big question now is whether we are witnessing the early stages of another rally or just a...

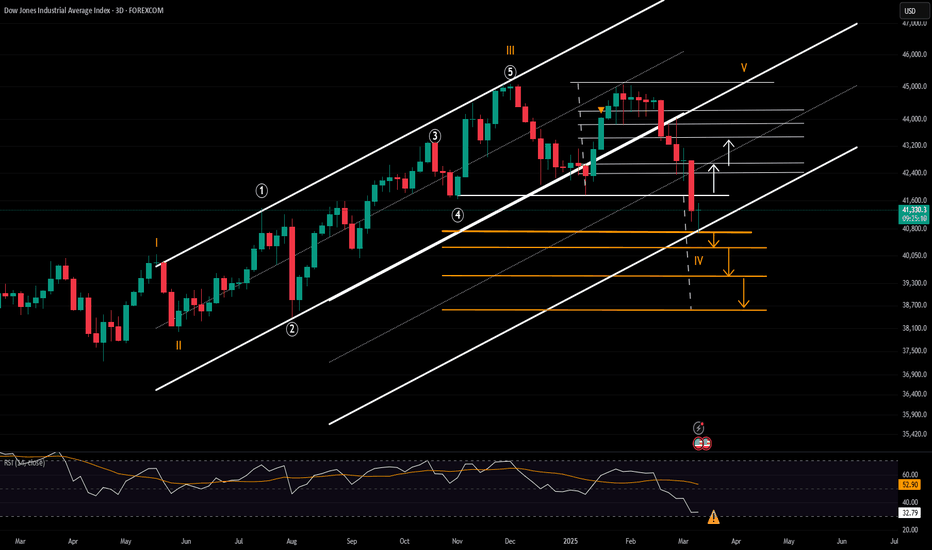

Unlike the Nasdaq and SP500, Dow did not trace the full potential of its double top formation between 2024 and 2025 peaks, yet in a similar manner to the US indices, it rebounded from the 0.618 Fibonacci retracement of the May 2024-Jan 2025 uptrend, coinciding with oversold levels on the 3-Day RSI previously seen in October 2023. The Dow’s rebound from the 40,660...

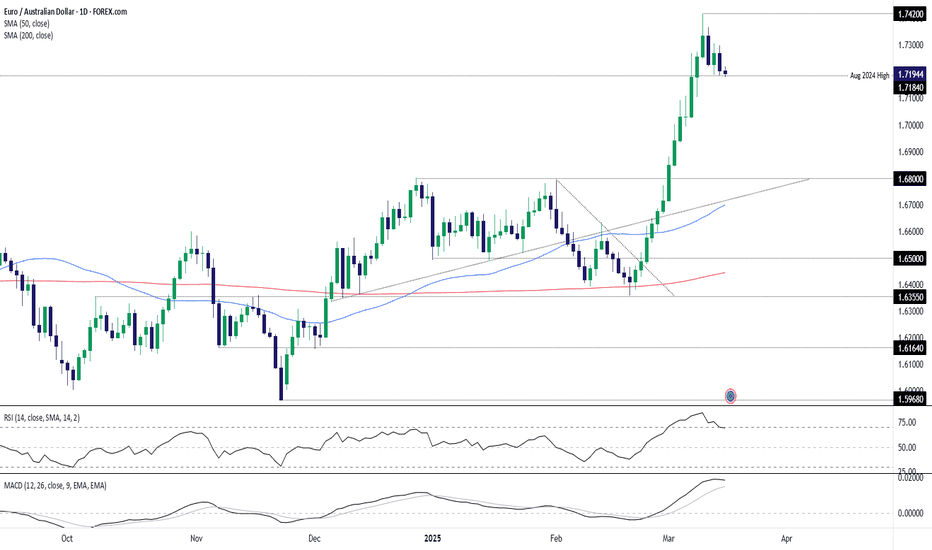

EUR/AUD looks heavy and vulnerable to downside following Friday’s bearish engulfing candle, leaving the price teetering just above 1.7184—the blow-off top high from August last year. A break below 1.7184 could encourage bears off the sidelines, creating a setup where shorts may be established beneath the level with stops above for protection. EUR/AUD has tended...

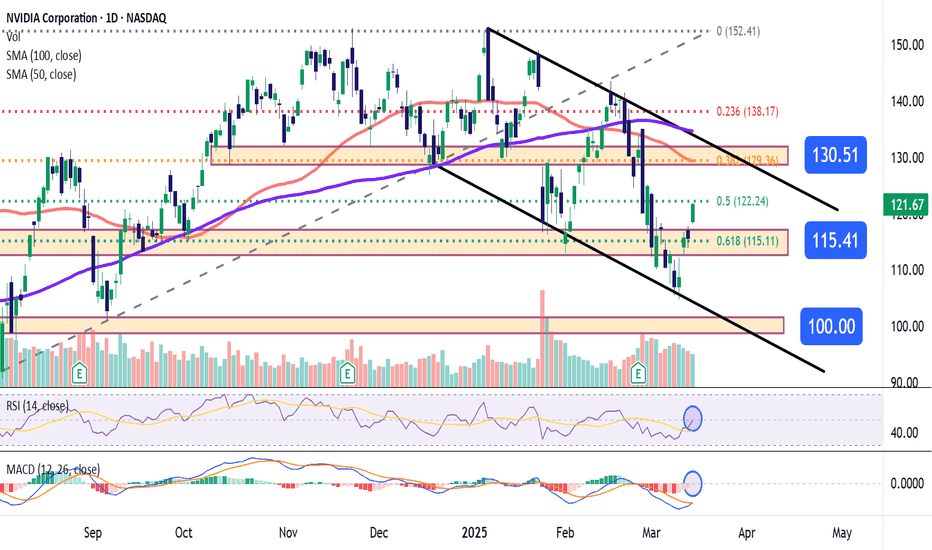

By the end of the week, Nvidia's stock has surged to $120 , with the strong bullish movement likely driven by positive results from its largest supplier. Taiwanese company Hon Hai Precision Industry (Foxconn) reported revenues exceeding $30 billion and announced plans to establish the world's largest chip manufacturing plant in Mexico, aimed at improving supply...

GBP/USD came very close to a 1.3000 test last week but fell a bit short. To be sure, the bullish breakout in Cable lacks in size and scope to that of the Euro, but with an oversold US Dollar showing potential for pullback, that highlights the possibility of pullbacks in GBP/USD and EUR/USD, as well. In Cable, there's a couple of clear spots of support potential,...

EUR/USD strength continued through the early part of the week, but a big level came into play that ended up holding the high at 1.0943. That's the 50% mark of the 2021-2022 major move, and it's related to the 1.0200 level that came in to hold support in February, leading to a stall in the sell-off that month that pushed into a bullish breakout in March. Bulls...

Bitcoin is attempting to stabilize after finding support at the lower boundary of a well-defined descending channel. The price has rebounded +5.44%, climbing back toward the $85,000 level, but remains below the 50-day SMA (94,968), which has acted as dynamic resistance. Despite today's bounce, BTC remains in a broader downtrend, with both the MACD and RSI showing...

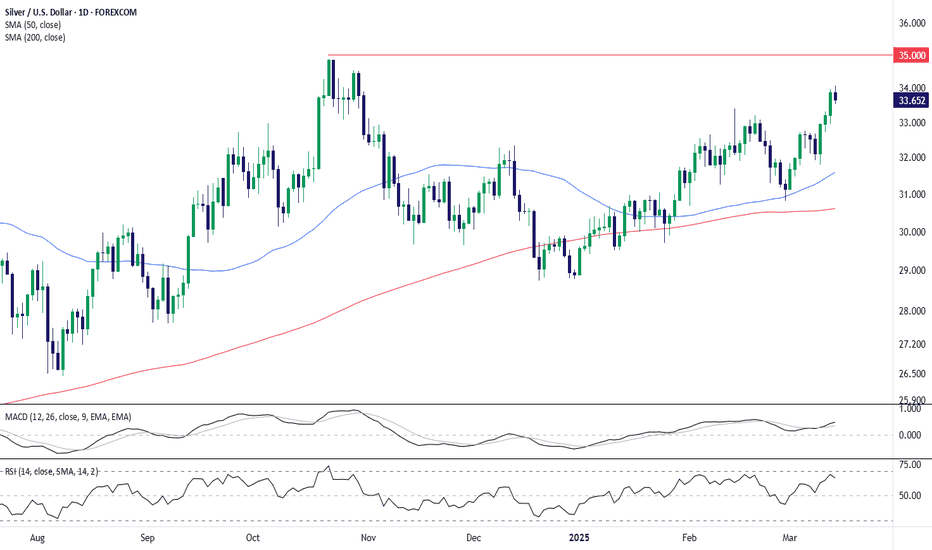

Silver prices have been climbing steadily, finding support above the 50-day SMA (31.58) and 200-day SMA (30.60), signaling a strong uptrend. The metal is now approaching a major resistance level at $35.00, which previously triggered a sharp pullback. Momentum indicators are supportive of the rally, with the MACD ticking higher in positive territory and the RSI at...

USD/JPY pair has been trending lower in a well-defined descending channel, respecting its upper and lower boundaries. Price action recently tested the 61.8% Fibonacci retracement level (146.95), where a mild rebound is now taking shape. Despite this, the 50-day SMA (152.84) and 200-day SMA (152.01) remain above price, acting as resistance levels should a reversal...

Ahead of the UoM consumer sentiment data, the US dollar remains on the backfoot, after this week's weaker inflation data and last week’s sharp decline. The EUR/USD has been among the strongest currencies out there, driven largely by Germany’s ambitious spending plans. Chancellor-in-waiting Friedrich Merz is racing against time to persuade parliament to approve a...