Market analysis from FOREX.com

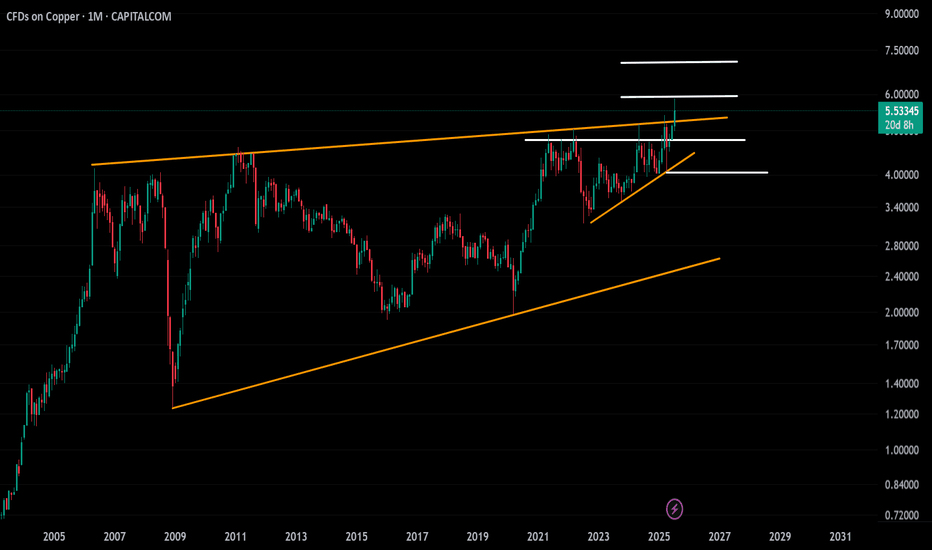

From a monthly time frame perspective, copper has broken above a major resistance zone defined by consecutive highs dating back to 2011. The breakout above $5.40 marks a significant technical milestone. A clean move above the $5.87 high could open the door for further upside, potentially targeting $7.00 and beyond as bullish momentum continues to build. On the...

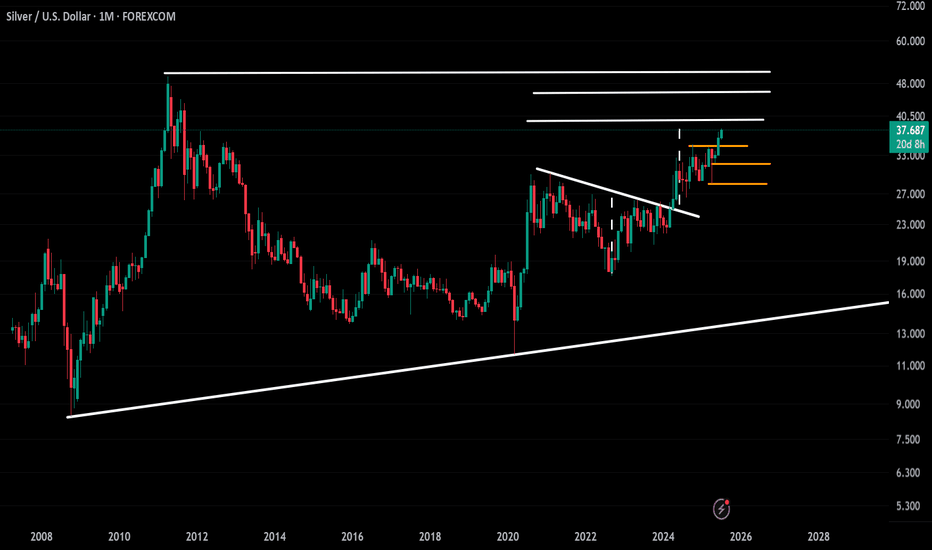

As silver traces new 2025 records, surpassing 2012 highs above 37.50/ounce, it aligns further with the target of the inverted head and shoulders pattern that has extended on the chart between 2020 and 2024, within the 38–39 price zone. This aligns with overbought momentum from the perspective of the monthly RSI, at levels last seen in 2020, strengthening the case...

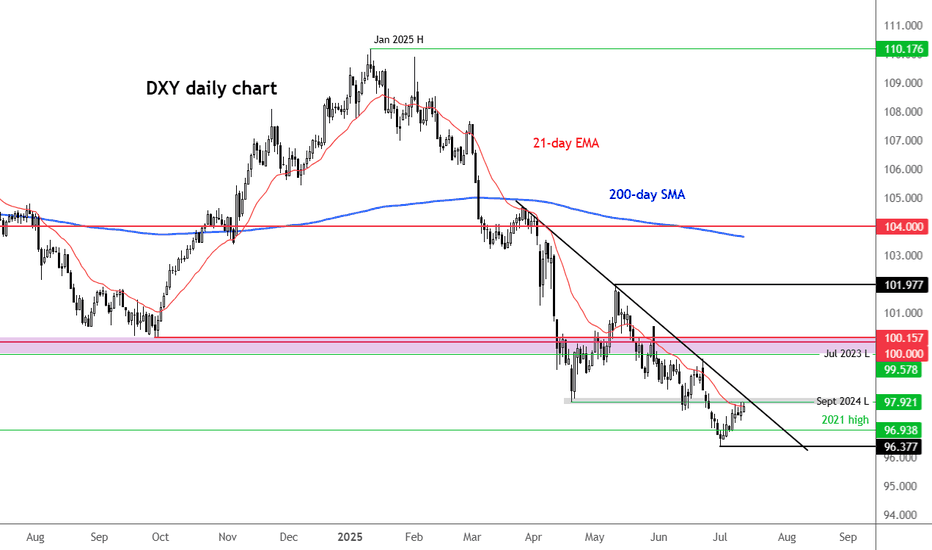

The US dollar has gained ground this week, with the Dollar Index rising to retest the previously broken April low near the 97.92 level—an important technical zone. The short-term bias would flip to being bullish if this area breaks. The greenback’s strength has been underpinned in part by unexpectedly strong economic data. For instance, Thursday’s weekly jobless...

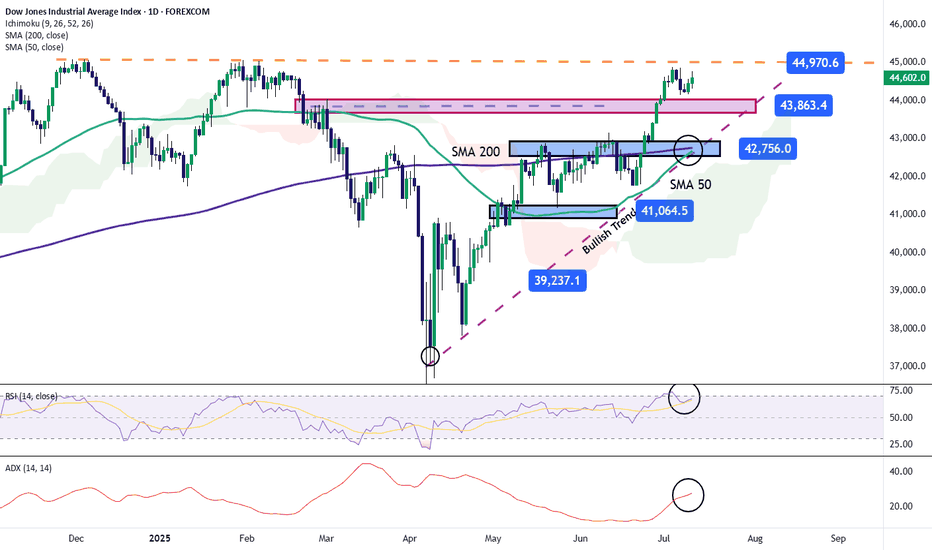

Over the past two trading sessions, the Dow Jones Industrial Average has gained nearly 1%, approaching the all-time high zone near 45,000 points. For now, the bullish bias remains intact, supported by the Federal Reserve’s announcement that a rate cut may occur later this year, despite renewed concerns over a potential reignition of trade war tensions. If buying...

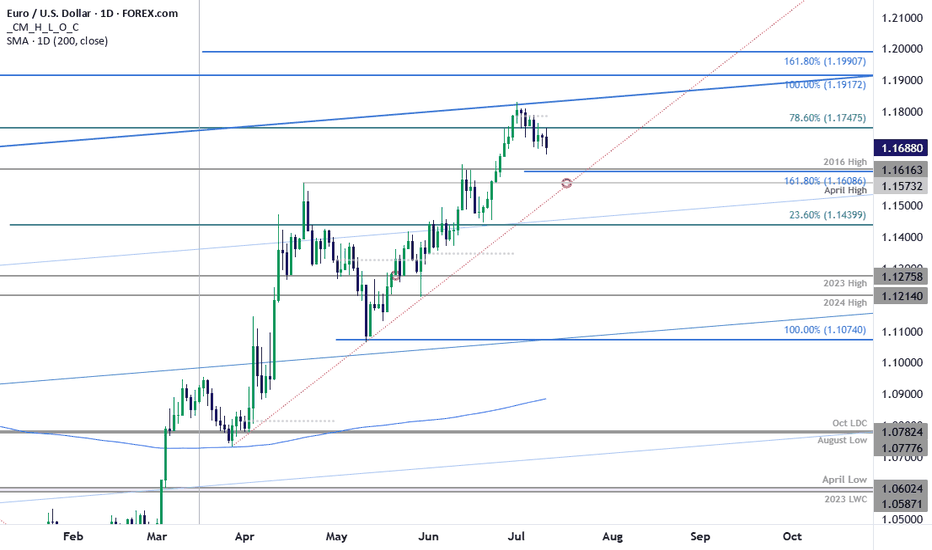

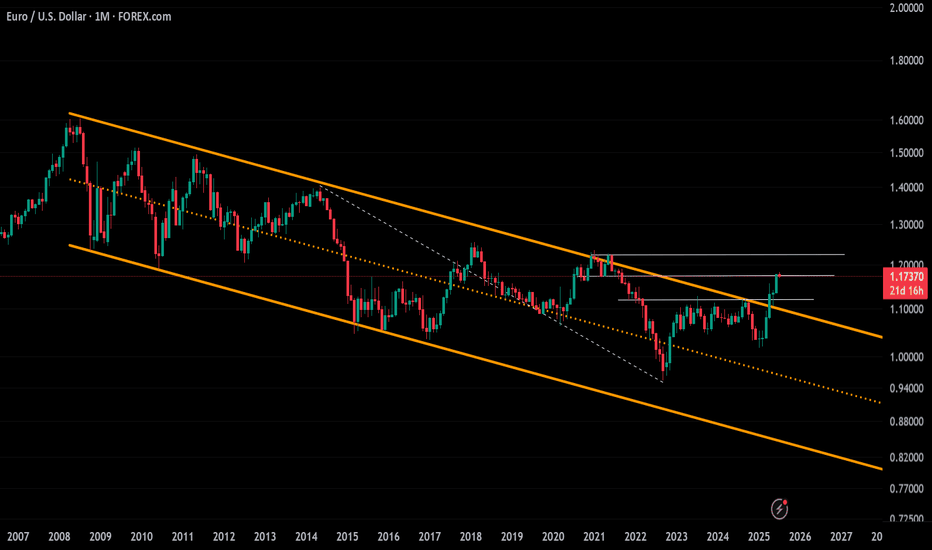

The Euro rally exhausted into uptrend resistance into the start of the month with EUR/USD threatening to snap a two-week winning streak at fresh yearly highs. Price has fallen more than 1% from the high and the near-term threat for a larger correction remains below the weekly open at 1.1775. A break below the weekly opening-range today threatens further declines...

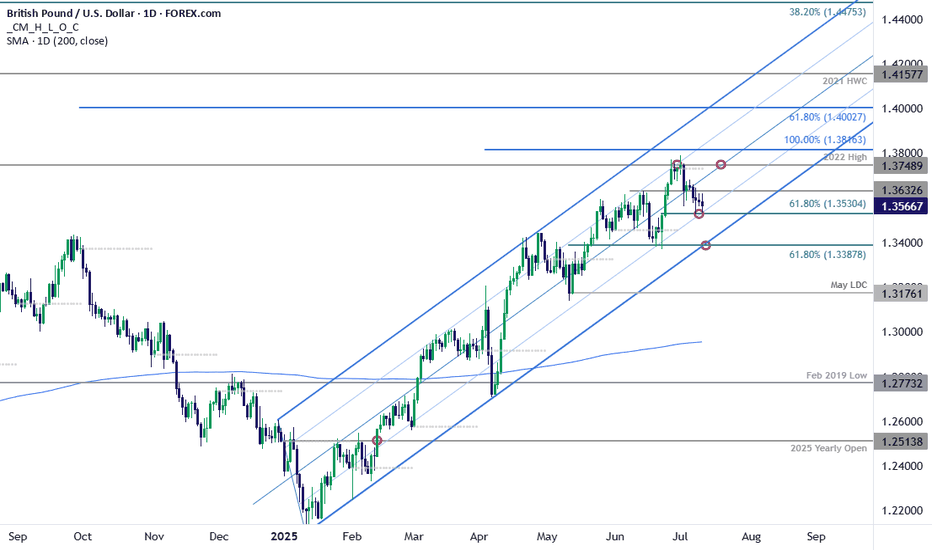

The Sterling rally failed to close above confluent trend resistance at the 2022 high near 1.3749 with GBP/USD now off more than 1.8% from the monthly / yearly high. The July opening-range seems set here at 1.3530-1.3750 and the focus is on a breakout in the days ahead with the broader outlook still constructive while within this formation. GBP/USD is testing...

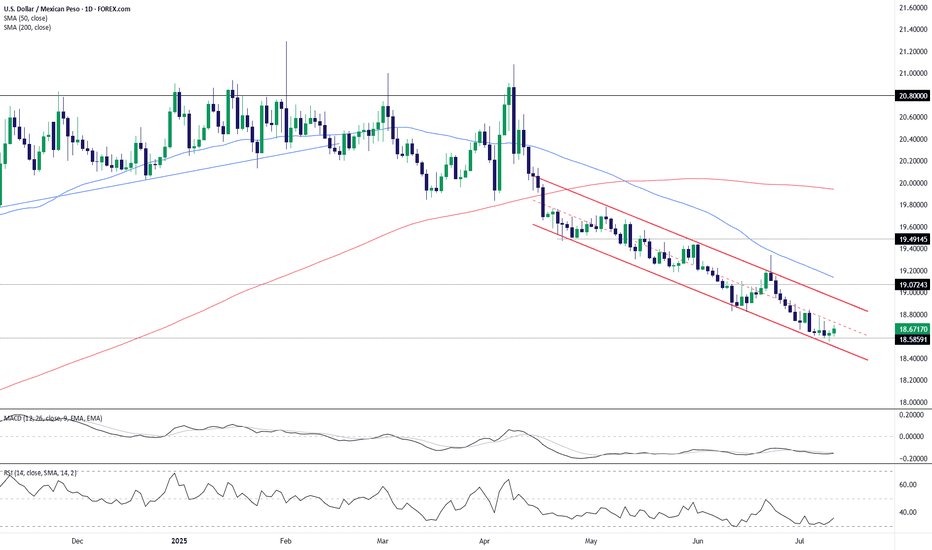

The USD/MXN pair continues to grind lower within a well-defined descending channel, marked by a series of lower highs and lower lows since April. Although the pair has shown short-term stability near 18.58 support, the broader trend remains bearish. Price is currently testing the channel’s upper boundary near 18.70, with both the 50-day and 200-day SMAs well...

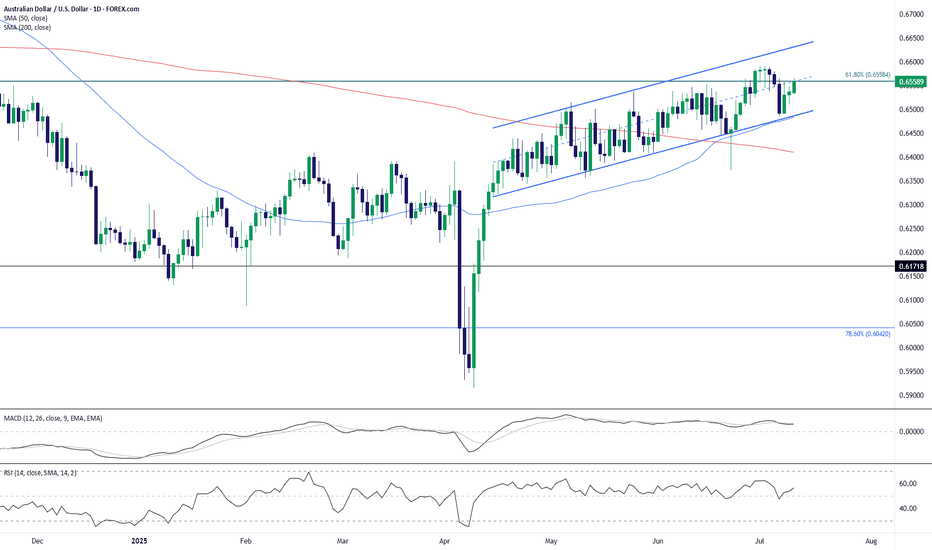

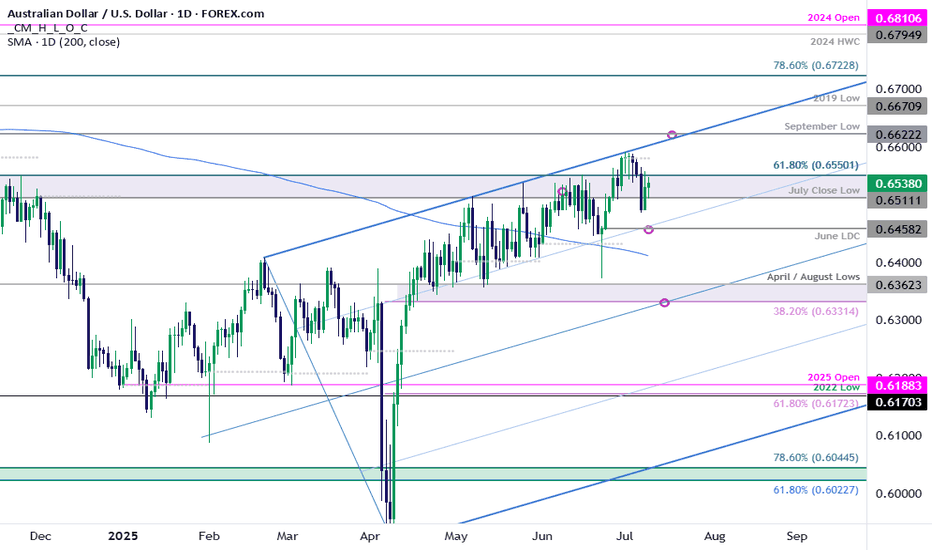

The Australian dollar is pressing higher against the U.S. dollar after rebounding from the lower boundary of a rising parallel channel. Price remains above both the 50-day and 200-day SMAs, with the latter recently reclaimed — a bullish sign for medium-term trend strength. The pair is now testing the 61.8% Fibonacci retracement of the July 2023–April 2024 decline...

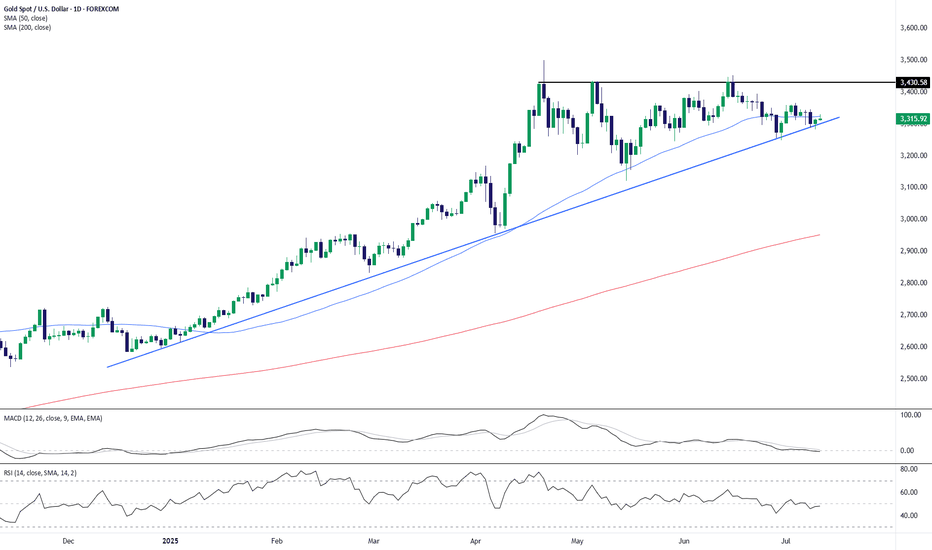

Gold remains in a consolidation phase after its sharp rally earlier this year, but the broader uptrend remains intact. Price action continues to respect the ascending trendline that has been active since late 2024, as well as the 50-day SMA which currently offers dynamic support around the $3,323 level. The key horizontal resistance at $3,430 continues to cap...

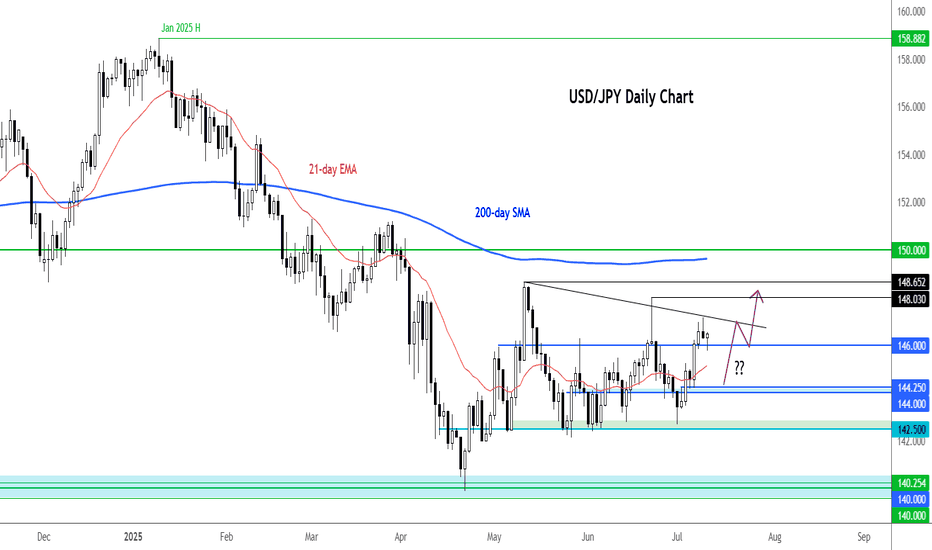

Today's main data release was the weekly jobless claims figures, which came out better than expected at 227K vs. 236K eyed, down from 232K the week before. In response, the dollar extended its rebound, and the USD/JPY has turned positive on the day after yesterday's reversal. In recent days the UJ has been pushing higher, thanks to a weakening JPY amid threats...

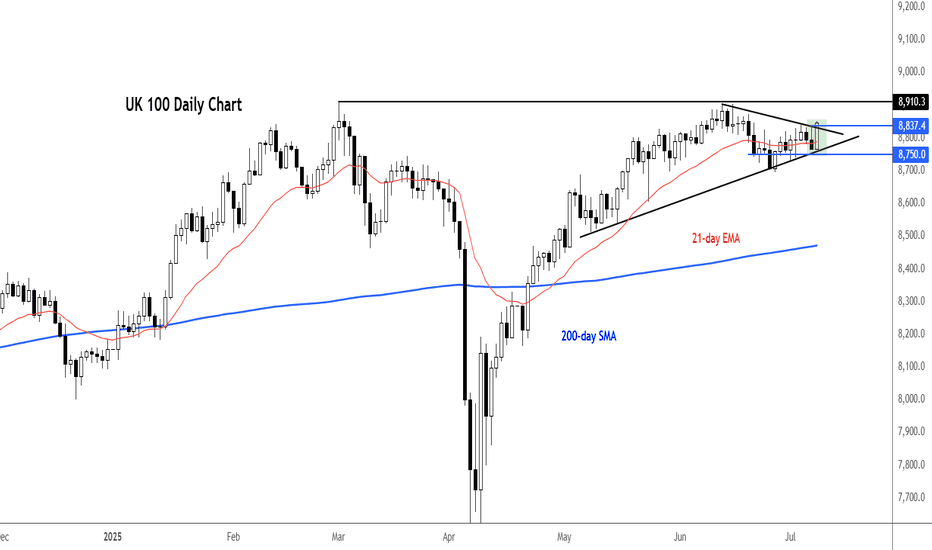

Following a lengthy consolidation, the FTSE appears to be poking its head above the resistance trend of a triangle formation and resistance circa 8830-35 area today, potentially paving the way for a run to a new all-time high. This comes as markets have taken the latest tariff threats from Trump in their stride. Equity indices were quick to recoup most of their...

Unlike the DXY, EURUSD has broken above the upper boundary of its 17-year descending channel. However, further upside may be capped as the DXY retests its 17-year support and monthly RSI retests 2020 overbought levels. A clean break and hold above 1.1830 could open the path toward 1.20 and 1.24. On the downside, if the pair pulls back below 1.17, support levels...

The EUR/USD pair has depreciated by nearly 0.5% over the past three trading sessions, favoring the U.S. dollar. At the moment, this appears to be the prevailing short-term trend, marking a new and steady bearish bias that has started to weigh on the euro. The current selling pressure has remained consistent, as the U.S. dollar shows renewed strength. The DXY...

AUD/USD is now nearly 1.6% off the highs with the weekly opening-range taking shape just below Fibonacci resistance- looking for a potential breakout in the days ahead. A look at Aussie price action shows AUD/USD reversing pitchfork resistance with the weekly opening-range taking shape just below resistance at the 61.8% retracement of the 2024 decline / weekly...

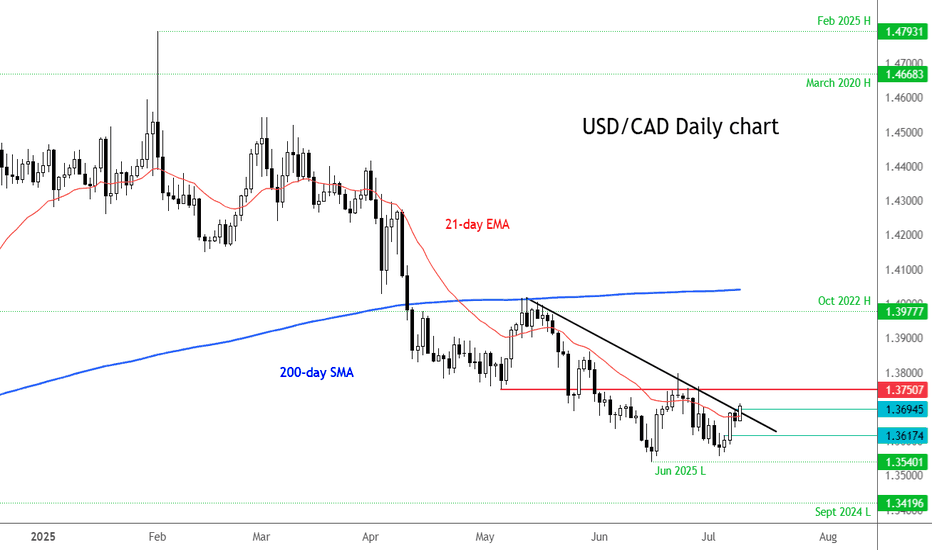

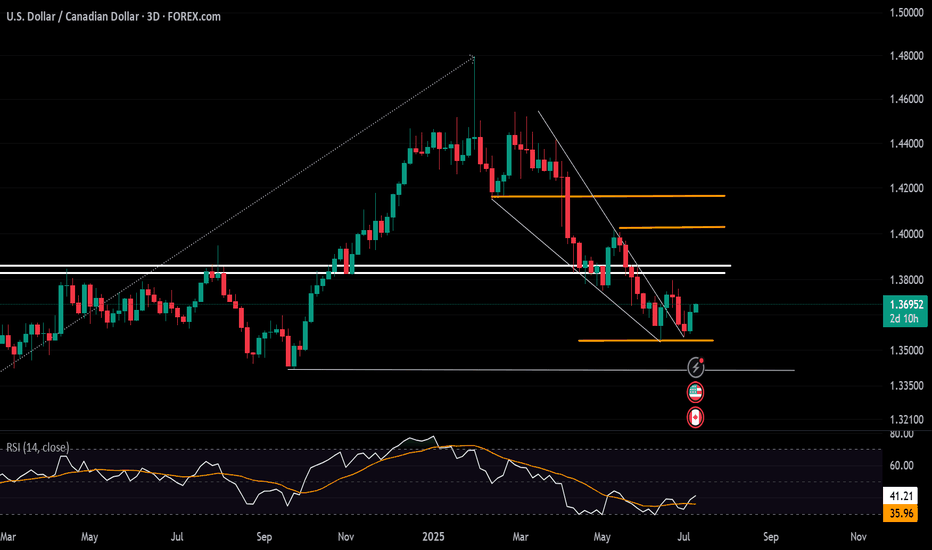

The USD/CAD is poking its head above a bearish trend line that has been in place since mid-May, in one of the first signs that suggests we may have seen a low in the Loonie. As well as the trend line, the 21-day exponential is also now below price, further suggesting that the tide is turning. Key levels Support levels off this daily chart are seen around...

In parallel with the DXY’s rebound from the 96-level, USDCAD has bounced from its 1.35 support zone, coming off oversold conditions last seen in 2021. The pair is also respecting a breakout from the 2025 contracting downtrend pattern. Key upside levels for the ongoing correction are 1.3830, 1.3860, and 1.40 — aligning with a significant support/resistance zone...

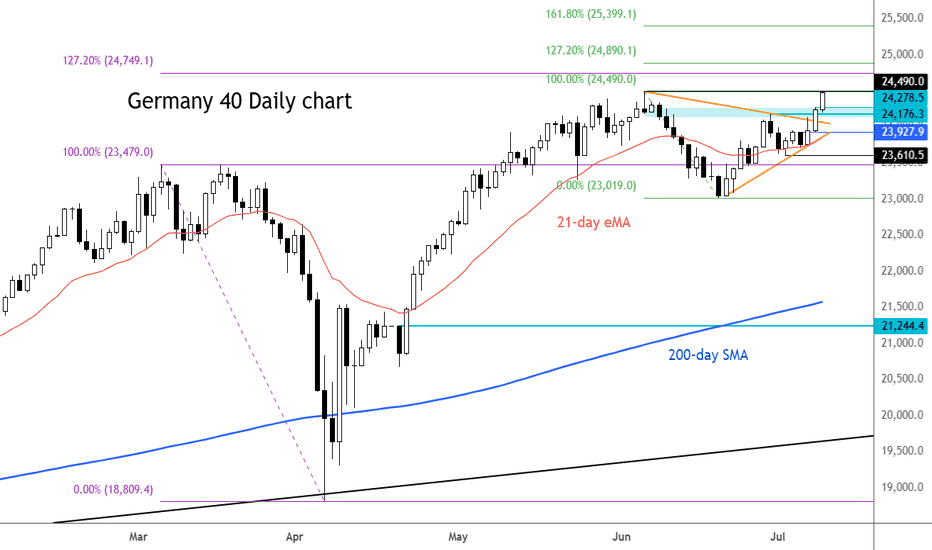

After breaking out of the triangle formation a couple of days ago, the DAX is now flirting with the previous record hit in early June at 24490. With Trump's tariffs uncertainty at the forefront again, there is a possibility we could potentially see a double top or a false break reversal formation here, so do watch out for that. However, we will continue to focus...

WTI has rebounded cleanly from the neckline of an inverted head-and-shoulders pattern—formed ahead of the June Middle East conflict—establishing a strong support zone above $63.40. Prices are currently trading above $67. A sustained hold above this level could target $69 and $72, aligning with the upper edge of the 3-year declining channel. A confirmed breakout...