Market analysis from FOREX.com

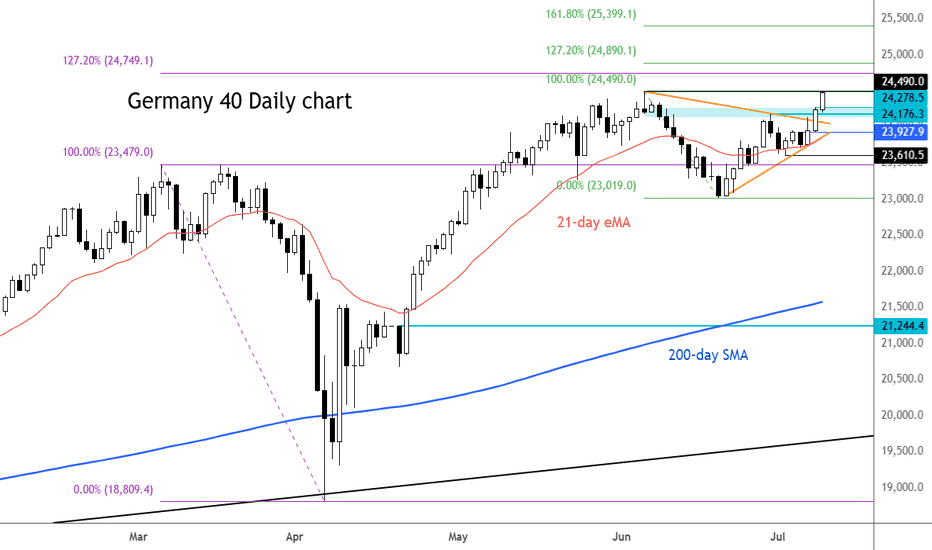

After breaking out of the triangle formation a couple of days ago, the DAX is now flirting with the previous record hit in early June at 24490. With Trump's tariffs uncertainty at the forefront again, there is a possibility we could potentially see a double top or a false break reversal formation here, so do watch out for that. However, we will continue to focus...

WTI has rebounded cleanly from the neckline of an inverted head-and-shoulders pattern—formed ahead of the June Middle East conflict—establishing a strong support zone above $63.40. Prices are currently trading above $67. A sustained hold above this level could target $69 and $72, aligning with the upper edge of the 3-year declining channel. A confirmed breakout...

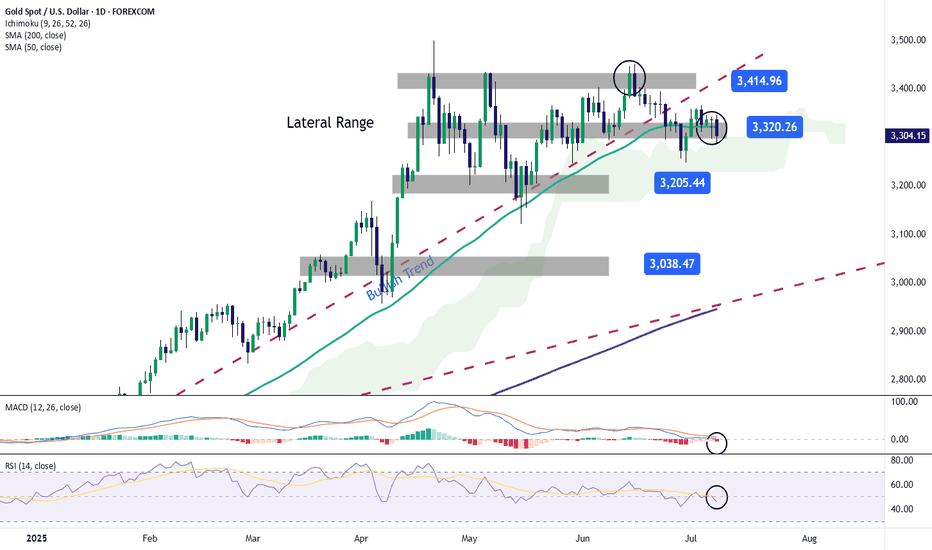

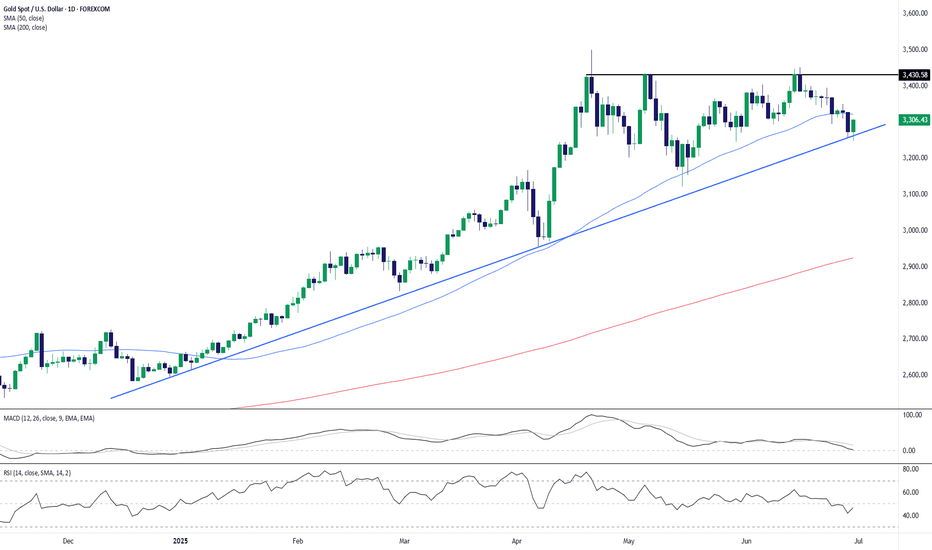

Over the past two trading sessions, gold has depreciated more than 1.5%, as a consistent bearish bias begins to emerge in price action. For now, selling pressure has remained steady, supported by a temporary decline in global economic uncertainty and a recent rebound in U.S. dollar strength, factors that have led gold’s upward momentum to steadily weaken. ...

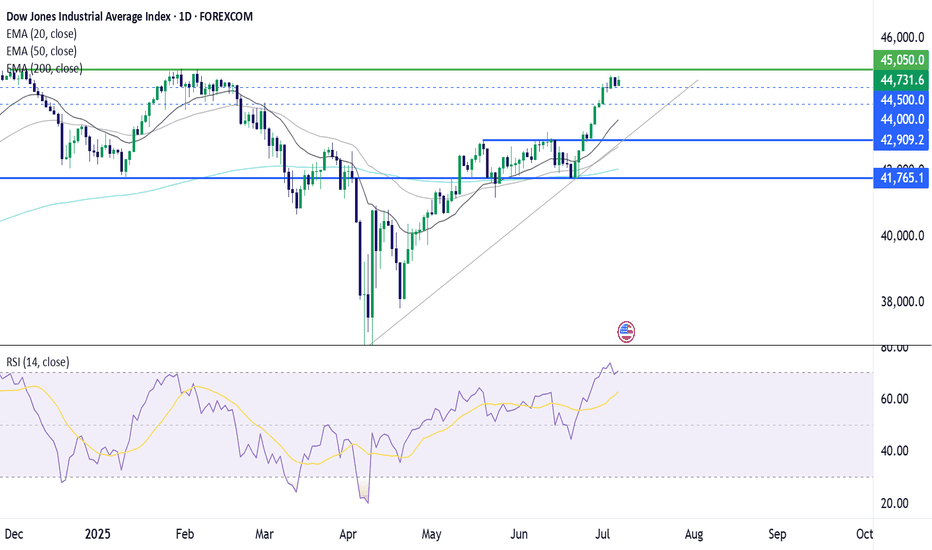

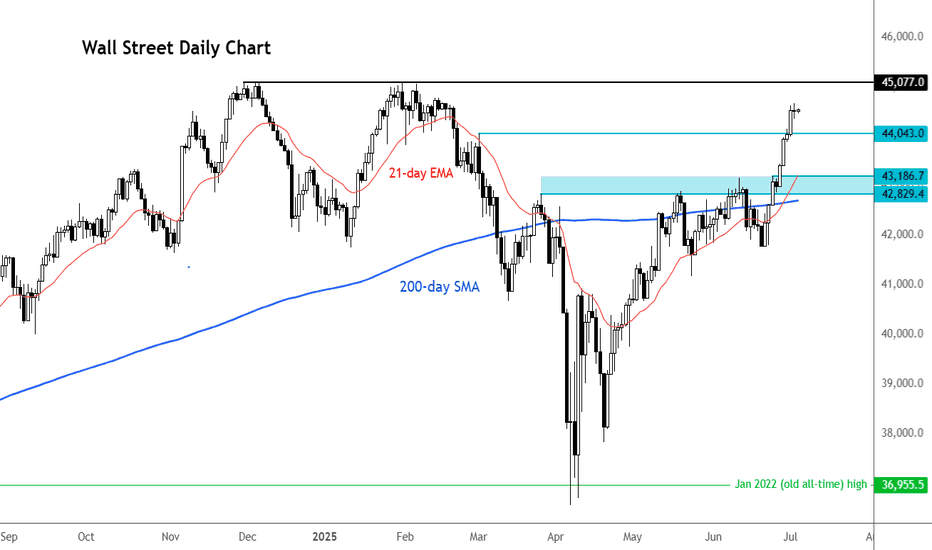

The Dow Jones has extended its recovery to 44,800, just shy of its 45,000 record high reached in January. The RSI is tipping into overbought territory, so some consolidation could be on the cards. Buyers will look to extend the bullish run above 45,0000 to fresh record highs. Meanwhile, immediate support is at 44,500. Below here, 44,000 could offer some support....

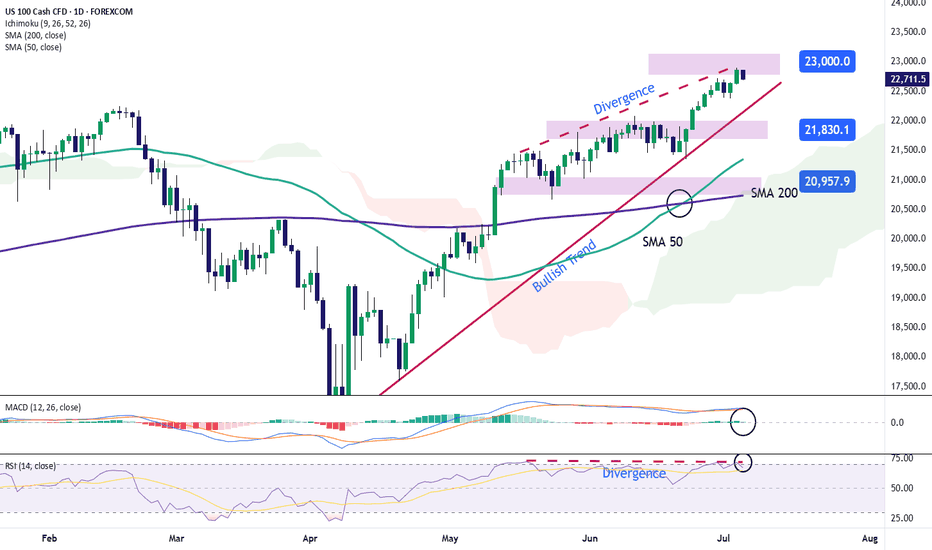

Over the past five trading sessions, the U.S. Nasdaq index has posted a gain of more than 1.5%, supported by a recent rise in market confidence that has pushed the equity index to new all-time highs. The NFP employment data released yesterday surprised markets with 147,000 new jobs, compared to the 111,000 expected, reflecting a recovery in the labor market that...

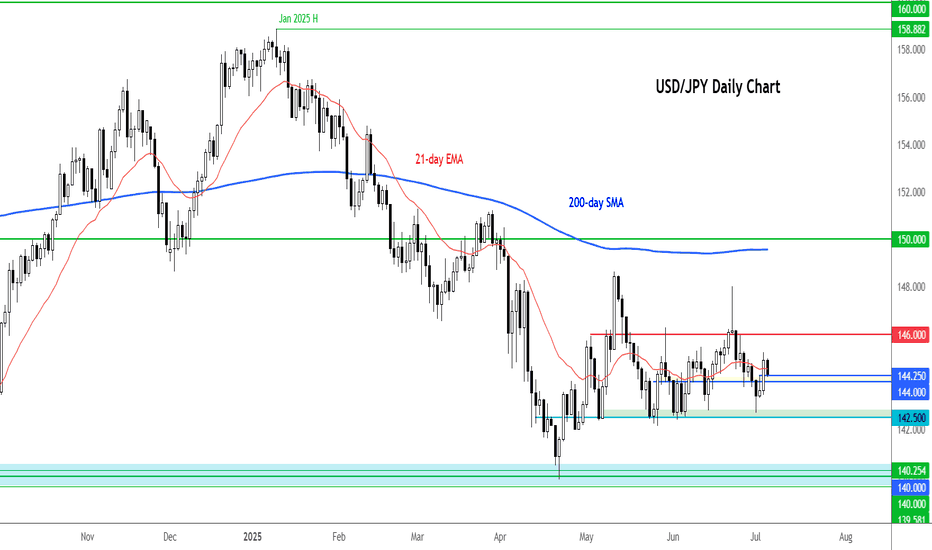

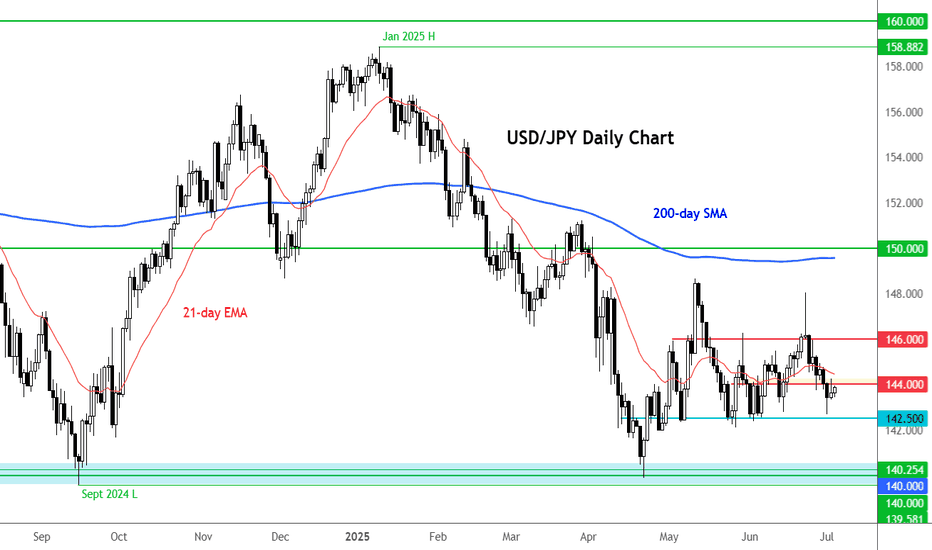

The USD/JPY has given back a bulk of yesterday's NFP-driven gains. Although the data was not as strong as the headlines suggested, the fact that we saw decent moves in bond and equity markets suggests investors were overall impressed by the figures. So it seems the market is preparing itself for some more tariff-related volatility as we approach the 9 July...

The USD/JPY hasn't dropped like the other dollar crossed yet, but could we potentially see a clean break down below 142.50 support? Well, we will need to see a big miss on the NFP print for that to potentially happen. The consensus is for a 110K increase in non-farm payrolls, but recent data has been less than convincing. The ADP private payrolls figure released...

While the likes of the S&P 500 and Nasdaq 100 are already record highs, the Dow has not achieved that target yet. It continues to make higher highs and higher lows, and the momentum seems to be getting stronger. Soon, it may even flirt with fresh all-time highs, as investors ride the tailwinds of a robust rally that kicked off in early April. There have been a few...

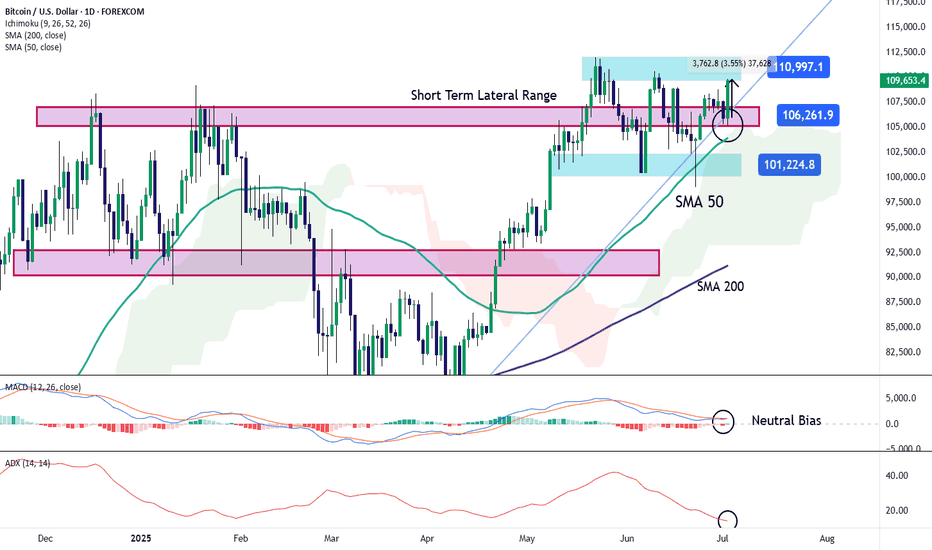

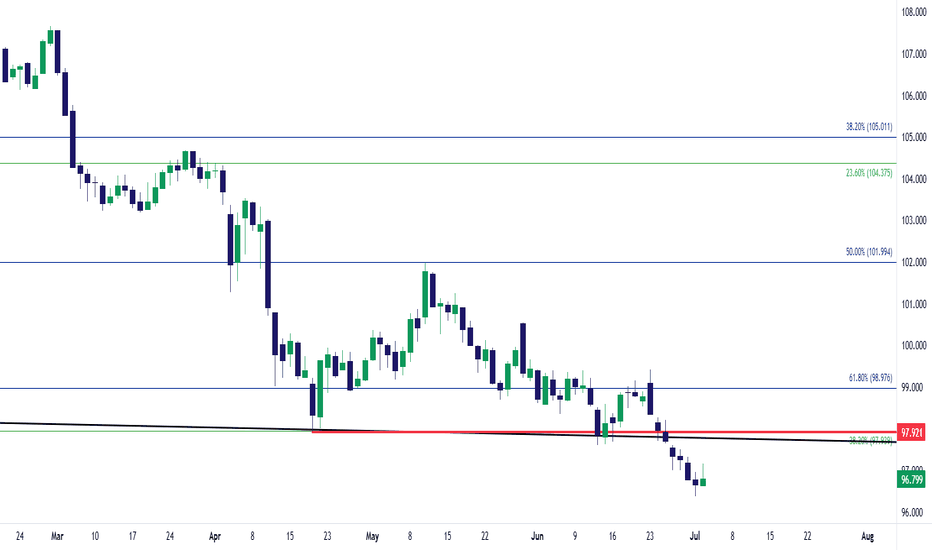

During the latest trading session, Bitcoin gained over 3%, as renewed buying momentum entered the market. For now, the cryptocurrency appears to be approaching its historical highs once again, driven largely by the growing weakness of the U.S. dollar. This is reflected in the DXY index, which measures dollar strength and is now hovering around 96 points,...

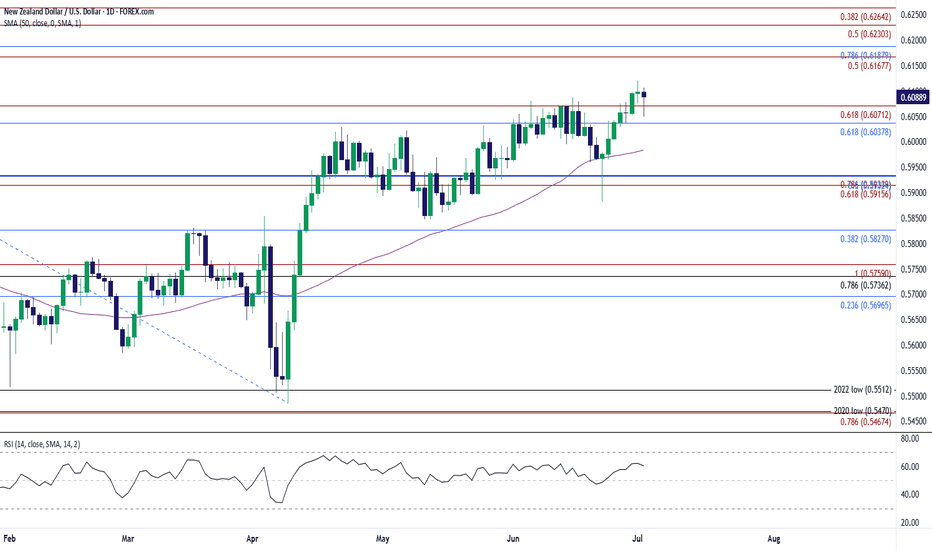

NZD/USD snaps the recent series of higher highs and lows as it pulls back from a fresh yearly high (0.6120), and lack of momentum to hold above the 0.6040 (61.8% Fibonacci retracement) to 0.6070 (61.8% Fibonacci extension) zone may push the exchange rate toward the June low (0.5883). Failure to defend the May low (0.5847) may lead to a test of 0.5830 (38.2%...

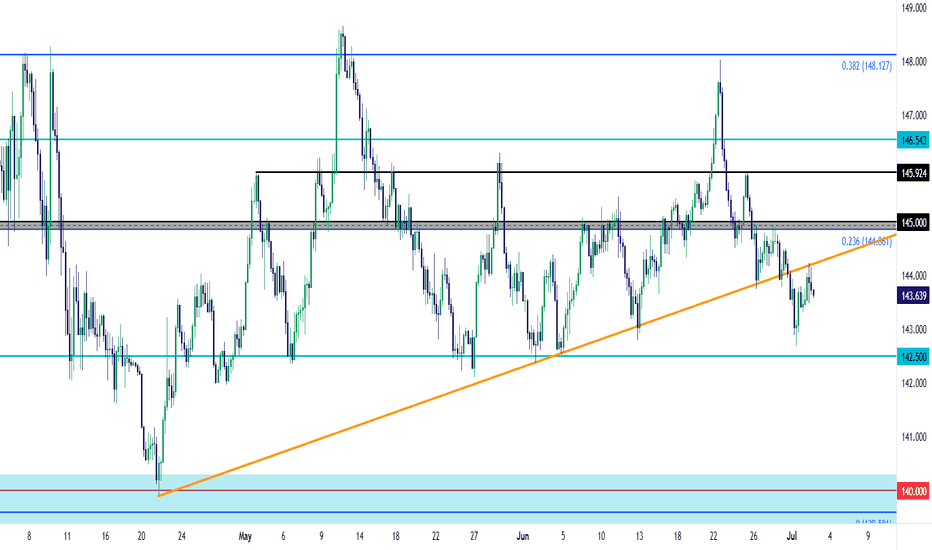

Despite the massive move of weakness in USD in Q2, USD/JPY has held up relatively well, especially over the past two months. The 140.00 level held the lows in April and then it was the 142.50 level. The bullish trendline connecting those two points had some additional higher-low context. But as looked at last week, the 145.00 zone was now set up as possible...

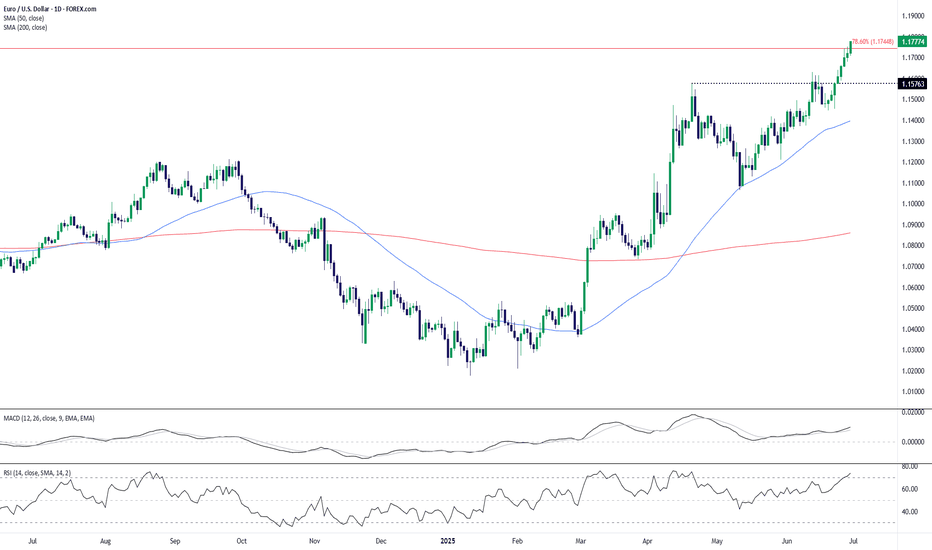

EUR/USD has stretched the rally into the opening days of Q3 trade but at this point, the pair is overbought from both daily and weekly charts. On the weekly, RSI is nearing the 75 level and the last time the indicator was that high was back in January of 2018, just ahead of an almost 2,000 pip sell-off that ran for the next year and change. Overbought doesn't...

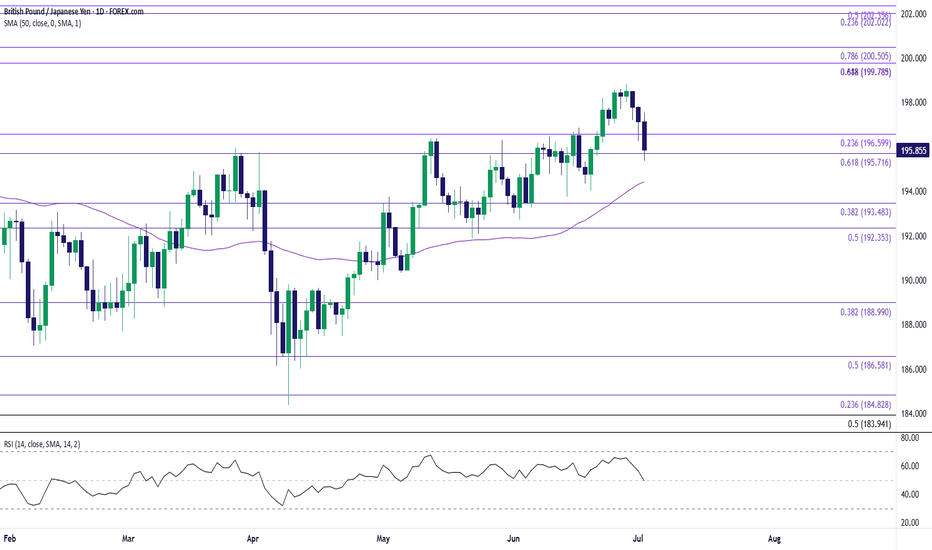

GBP/JPY carves a series of lower highs and lows after failing to test the December high (198.96), and a close below the 195.70 (61.8% Fibonacci extension) to 196.60 (23.6% Fibonacci extension) region may push GBP/JPY back towards the June low (192.73). Failure to defend the 192.40 (50% Fibonacci extension) to 193.50 (38.2% Fibonacci extension) zone may lead to a...

It's been a painful week and a half for the USD. Around the June FOMC meeting a hopeful bounce had built as the Fed sounded a bit less-dovish. While inflation remains below their expectations the labor market had held up relatively well, and with the threat of possible inflation from tariffs they didn't seem to be in any hurry to cut rates. But then last week...

Gold (XAU/USD) has rebounded sharply from its rising trendline support and 50-day SMA (around $3,221), suggesting that the broader bullish trend remains intact despite recent consolidation below the $3,430 resistance. The uptrend from the December 2024 lows continues to hold, anchored by a sequence of higher lows and a clear ascending trendline. The recent dip...

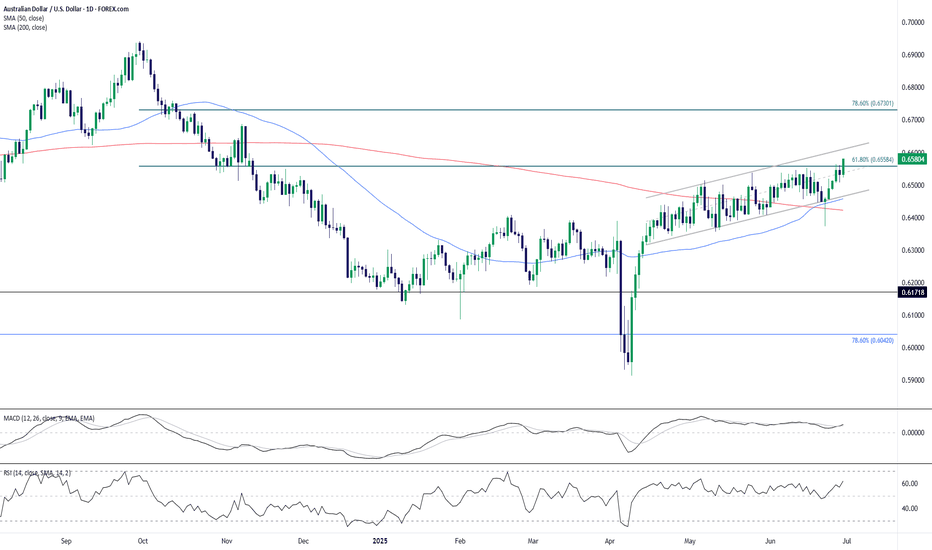

AUD/USD has extended its steady climb and is now challenging the 61.8% Fibonacci retracement level (0.6558) from the July–October 2023 decline. The pair is trading within a rising channel structure and has cleared both the 50-day (0.6457) and 200-day (0.6422) SMAs, confirming a medium-term bullish shift. Price action remains constructive, with higher lows and...

EUR/USD has punched through the 78.6% Fibonacci retracement level (1.1744) of the July 2023–October 2023 decline, signaling strong bullish continuation. The breakout above the recent swing high near 1.1576 confirms the uptrend is gaining traction, supported by rising moving averages. The 50-day SMA has crossed well above the 200-day SMA, maintaining a strong...

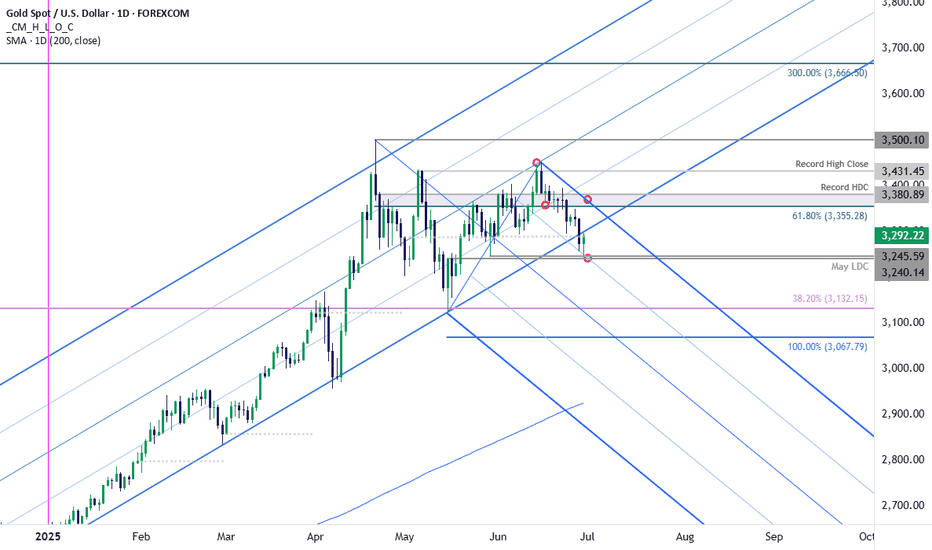

Gold is threatening a break of the yearly uptrend with Friday’s decline clearing the monthly range low. The focus into the start of the month is on technical support at the 5/29 swing low / May low-day close (LDC) 3240/45. A break / close below this threshold would be needed to suggest a more significant correction is underway towards the 38.2% retracement of the...