Market analysis from FOREX.com

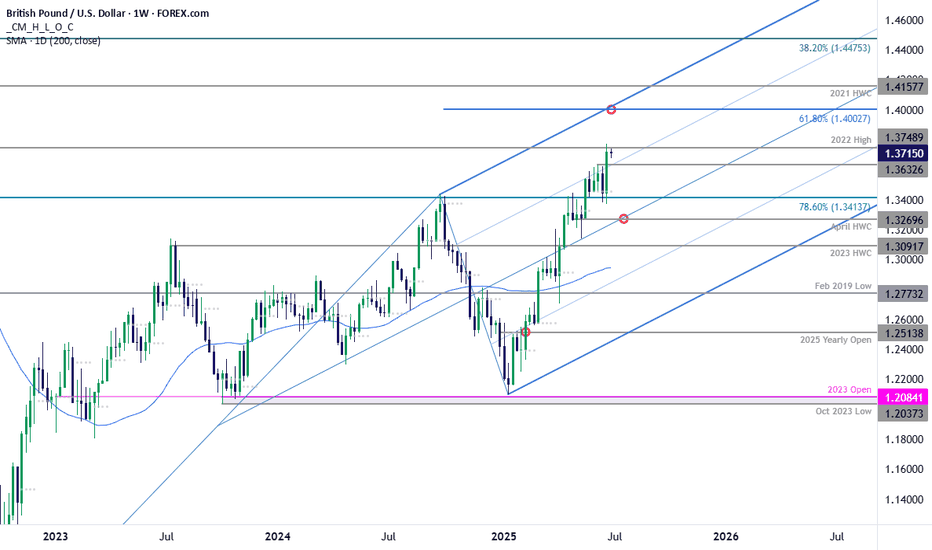

Sterling marked an outside weekly-reversal through slope resistance last week with the rally trading just below resistance into the close of the month at the 2022 swing high at 1.3749. Look for support at the June high at 1.3633 IF price is heading higher on this stretch with a breach / close higher exposing the 61.8% extension of the 2022 advance at 1.4003....

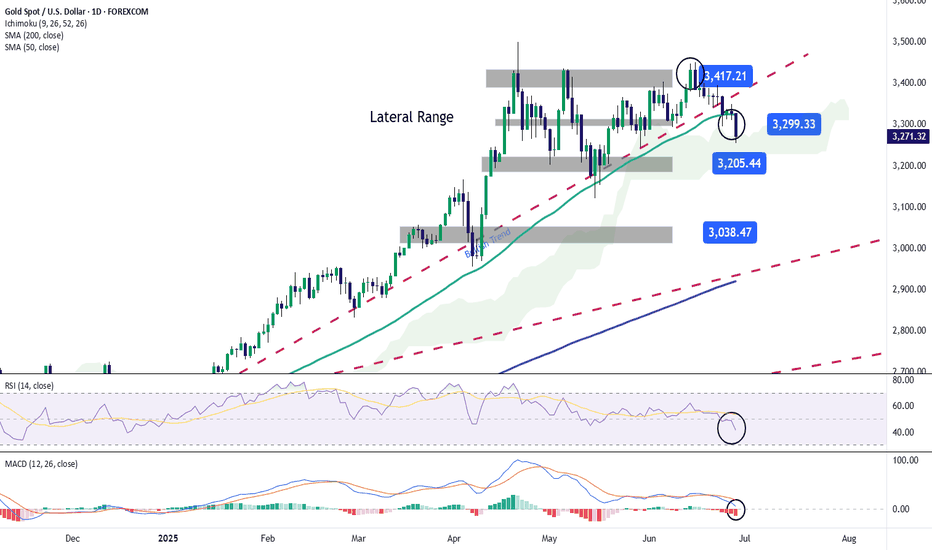

As the week comes to a close, gold is on track for a decline of more than 1.5% during the latest trading session. So far, the bearish bias remains firmly in place in the movements of the precious metal, as demand for safe-haven assets continues to fade, mainly due to the ceasefire agreement in the Middle East conflict, which has helped restore market confidence....

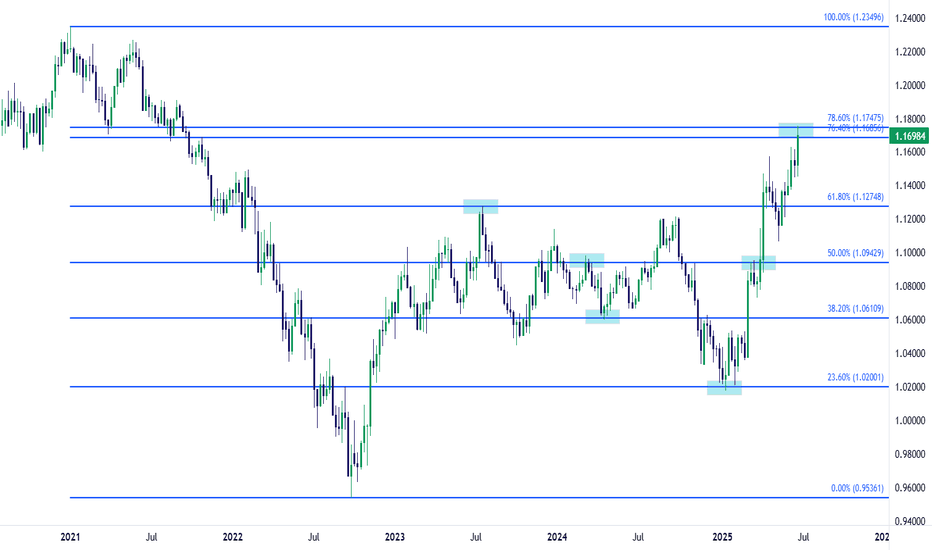

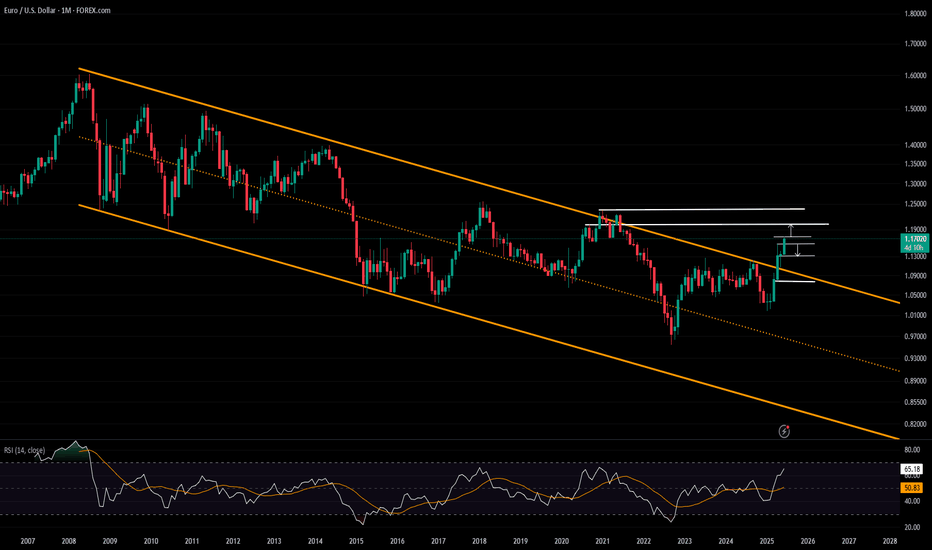

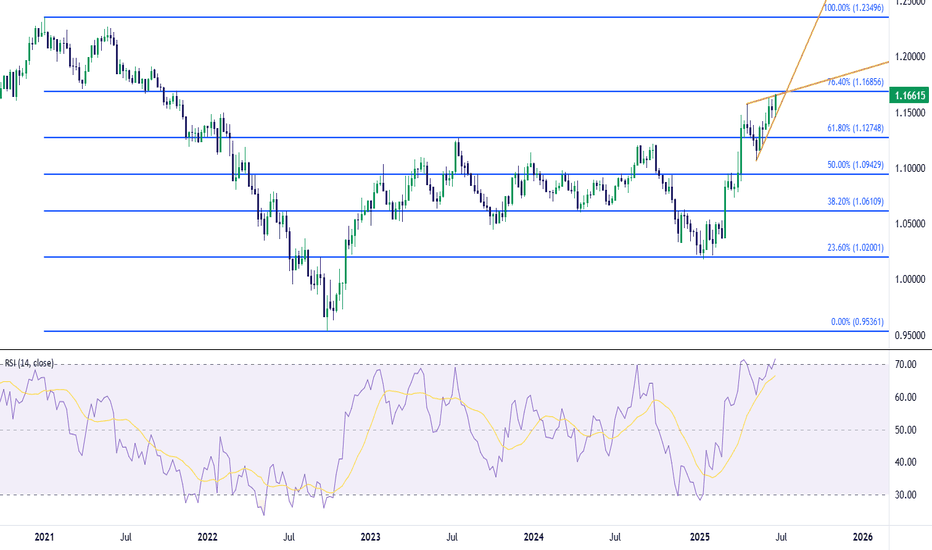

It's been a strong first-half of the year for EUR/USD. As we came into 2025 it seemed a story of doom and gloom for the Euro, and calls for parity were practically everywhere. But the pair found support in January, held that support in February - and then broke out in a big way in March. As we wind down Q2 that breakout remains in-play and EUR/USD is pushing...

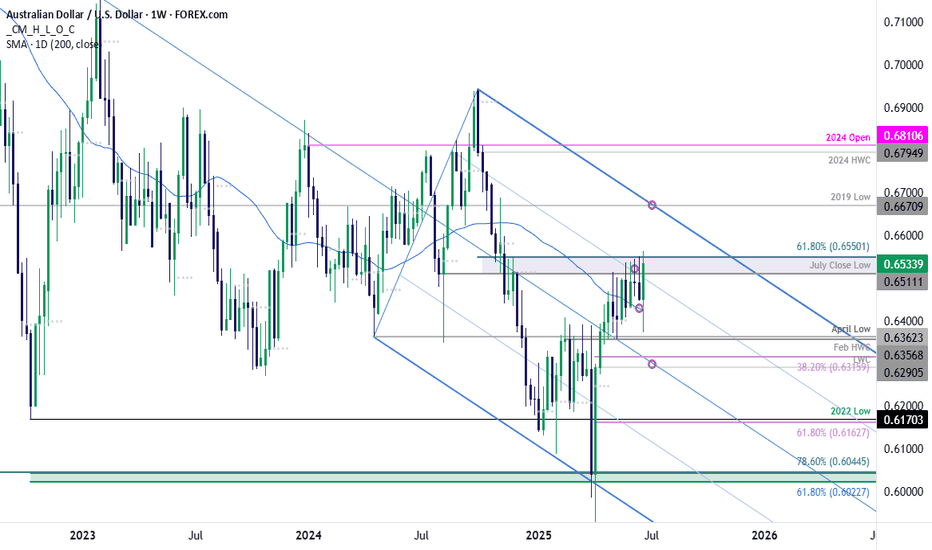

The June range is preserved heading into the close of the month with a massive outside-weekly reversal taking Aussie back into key resistance on Friday. Note that momentum is approaching the 60-level for the first time this year and a break higher alongside a breach above 6550 could fuel a substantial rally here- watch the weekly close. Initial support rests...

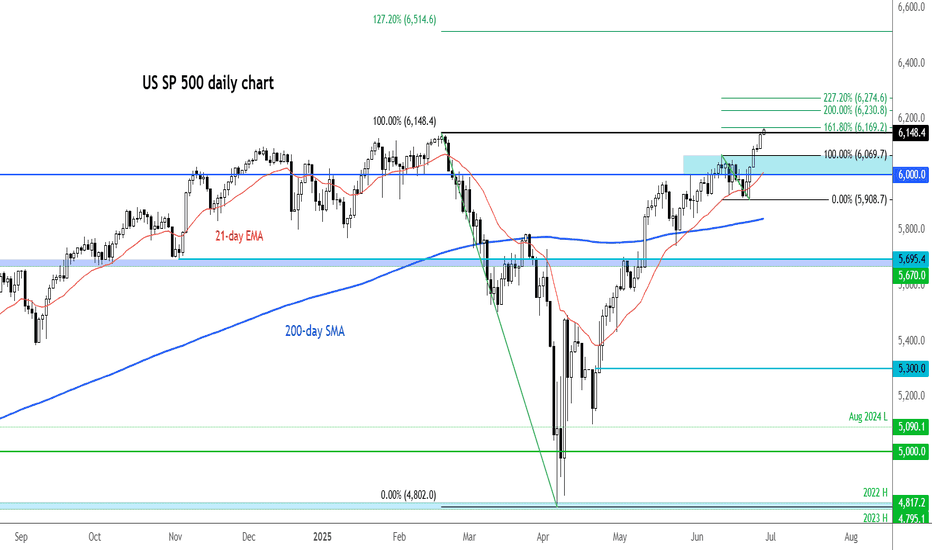

Breaking its February peak, the S&P 500 has joined the Nasdaq 100 in hitting a new record high this week. The latest gains came on the back of a sharp de-escalation in the Middle East and mounting pressure on the Fed to cut rates. They question is whether it will kick on from here or we go back lower given that trade uncertainty is still unresolved. Indeed,...

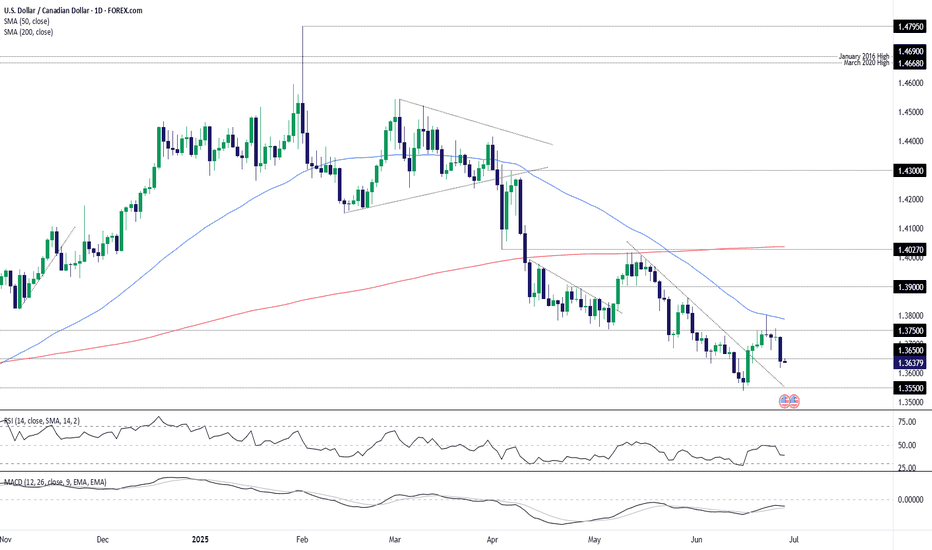

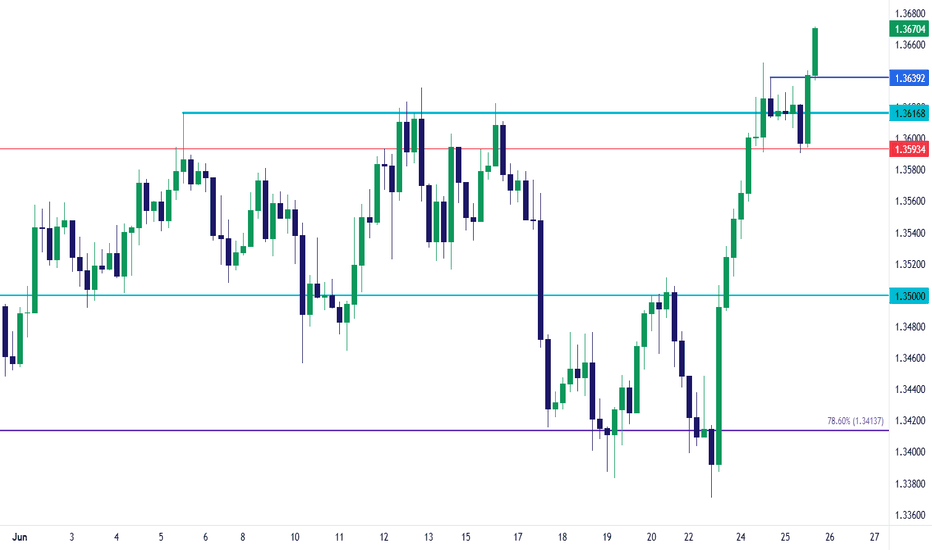

Downside risks flagged in a separate trade idea earlier this week finally materialised for USD/CAD, resulting in the initial target being achieved. With the price now trading marginally below those levels and momentum indicators still bearish, another short setup has presented itself. If USD/CAD continues to hold beneath 1.3650, shorts could be initiated below...

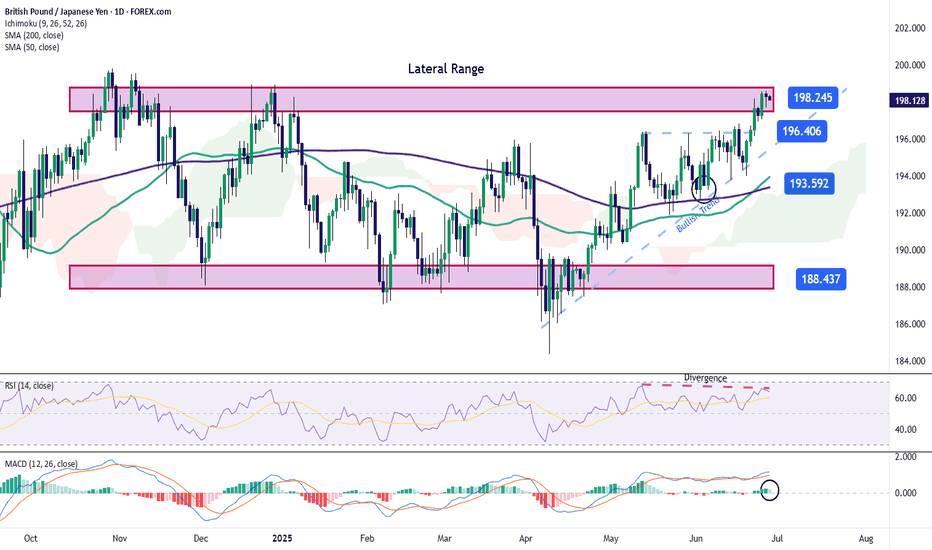

Over the last four trading sessions, the GBP/JPY pair has appreciated by nearly 1%, favoring the British pound against the yen. This move has been driven mainly by the strength of the British currency, which for now has allowed a consistent bullish bias to take hold in the short term. At the moment, the pound has remained strong in part due to the neutral policy...

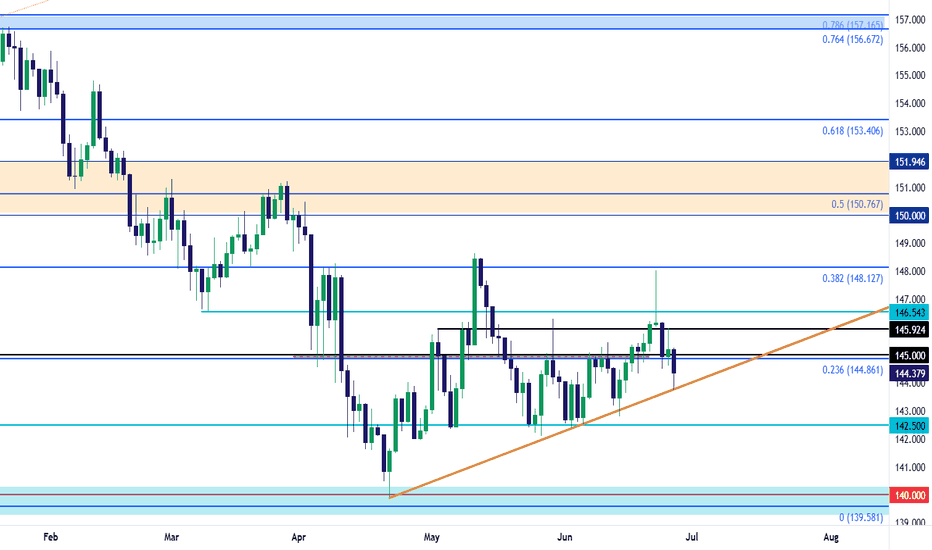

As USD has broken down against most major currencies, USD/JPY continues to hold on to higher-lows as taken from a trendline connecting April and early-June swing lows. The intra-day reversal on Monday was stunning, with price rejected at 148.00 and going all the way down to 145.00 for a mild bounce on Tuesday morning. But sellers reacted to that, as well,...

Sterling held slope resistance for more than three-weeks with a defense of support this week attempting to mark an outside-weekly reversal candle. The advance is testing resistance today at the 2022 swing high near 1.3749 and the focus is on the weekly close with respect to this pivot zone. Initial weekly support now rests with the June opening-range highs near...

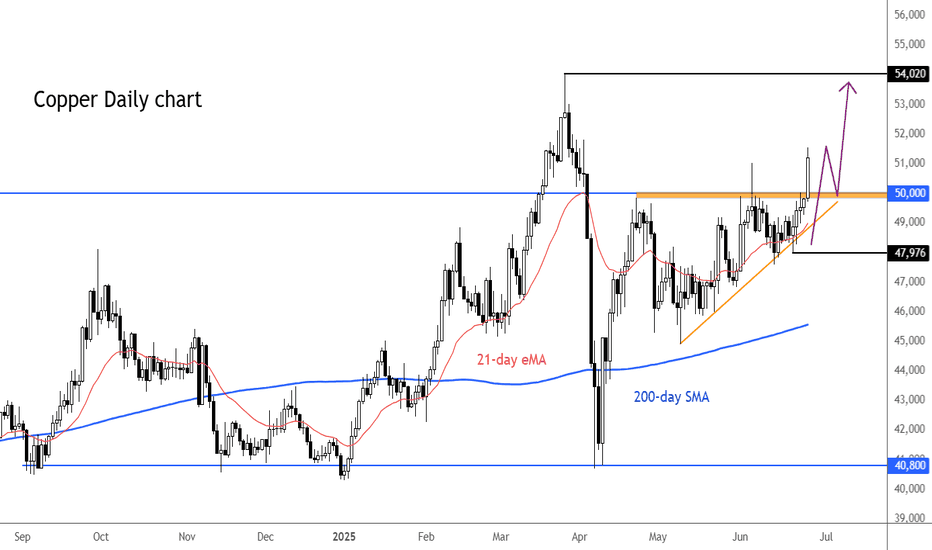

Finally joining silver and platinum, copper has broken out above key $5.00 level. With prices making higher highs and higher lows ever since bottoming in April, dip-buyers will be keen to step in on any short-term weakness we may see moving forward. For as long as support now holds at $5.00, the bulls will be happy. The line in the sand is now at $4.79, marking...

As EUR/USD breaks further above the upper boundary of a 17-year descending channel, U.S. dollar dominance over the pair appears to be fading, leaving room for long-term upside potential. The pair has now reached levels last seen in September 2021 near 1.1750. A decisive close above this level could extend gains toward the 1.20 mark, aligned with the 2021...

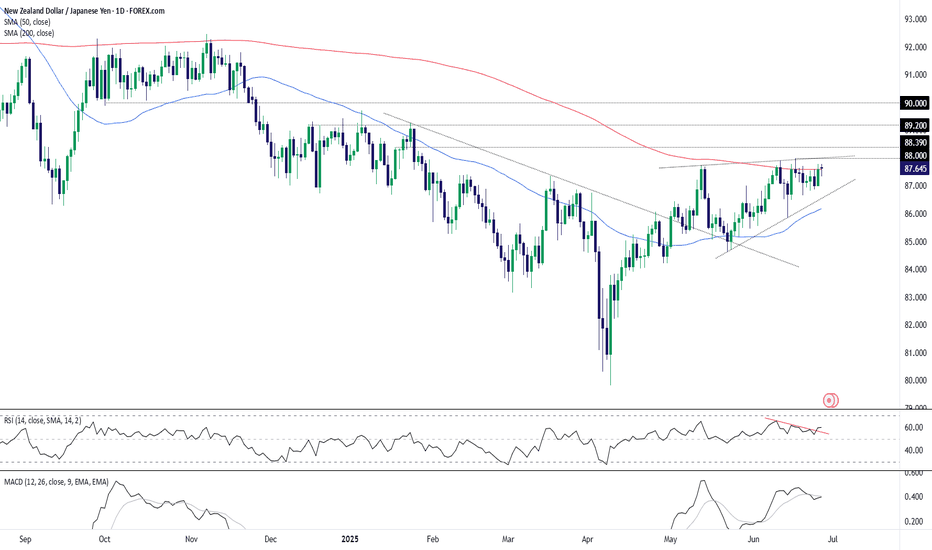

NZD/JPY hasn’t closed above the 200-day moving average since July 2024, racking up more than ten failed bullish breaks in that time—seven of them in the past month alone. If today’s probe finds more traction, it could be the catalyst to bring bulls off the sidelines, especially on a close above 88.00 where wedge and horizontal resistance intersect. If that plays...

Sitting in a rising wedge with bearish divergence after running into resistance at 43100, the US30 contract finds itself at an interesting juncture on the charts. If it can’t stage a definitive break above these levels, a short setup could be on the cards. If the contract cannot break and hold above 43100, traders could look to initiate short positions targeting...

The Fibonacci retracement drawn from the 2021-2022 move in EUR/USD has continued to produce inflections in the pair. It caught the high in 2023 at the 61.8% retracement of 1.1275. And then last year, it set the low in April that led into a vigorous bounce into the end of Q3. Along the way, the 50% marker of that major move was a sticking point producing multiple...

GBP/USD had a mild pullback earlier in the morning until the 1.3593 level came in to help set the lows. I had looked at that price in yesterday's post and that's held the lows for today ahead of another strong breakout with the pair pressing into fresh three-year highs. Chasing breakouts can be tough especially when they've already started, so at this point...

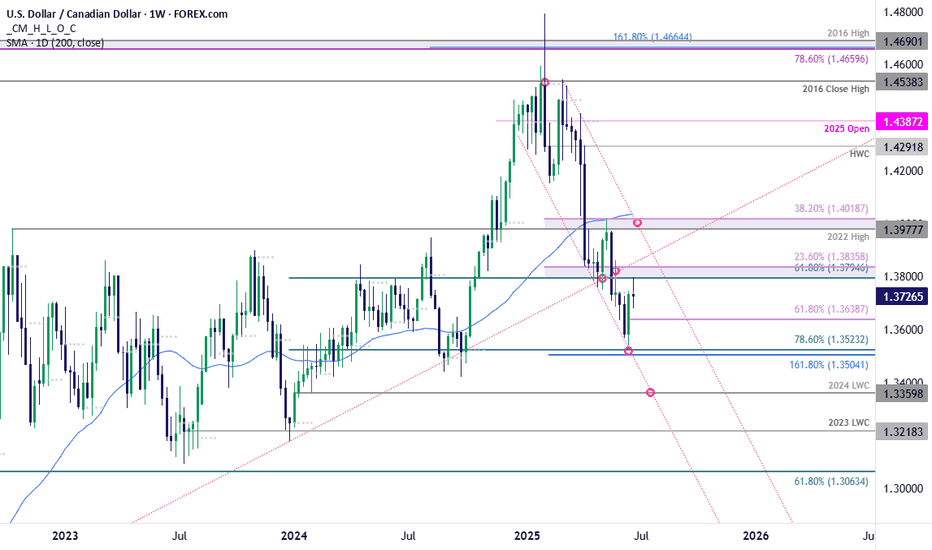

USD/CAD briefly registered in intraday low at 1.3540 last week before mounting a massive outside-weekly reversal off the yearly lows. The subsequent rally extended more than 1.9% off the low with the advance exhausting into resistance this week at 1.3795-1.3836- a region defined by the 61.8% retracement of the late-2023 advance, the April low-close, and the 23.6%...

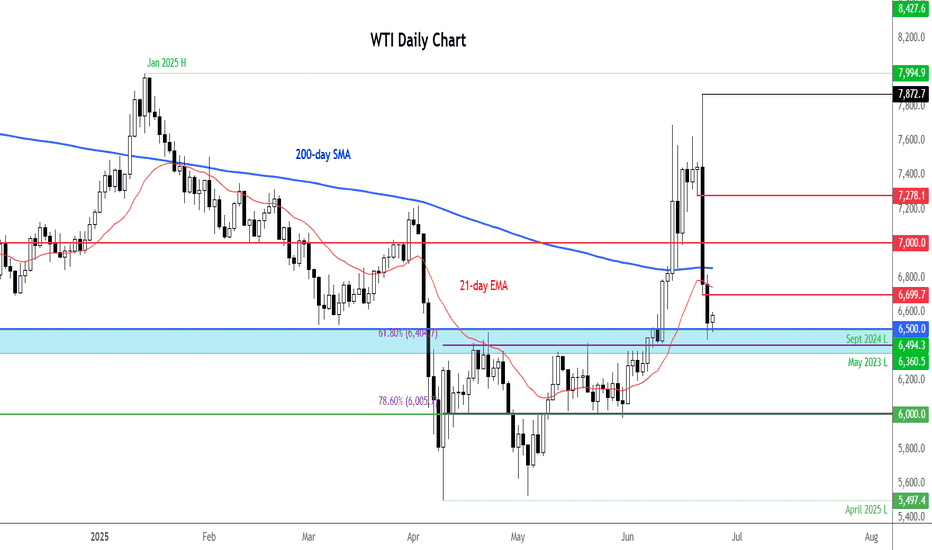

We have had some more bullish oil news from the weekly US inventories report. It remains to be seen whether the news is enough to lift the oil price. Following the API data overnight we had even more bullish-looking official inventories report from the US Department of Energy. The fact that crude stocks fell for the 5th straight week certainly points to strong...

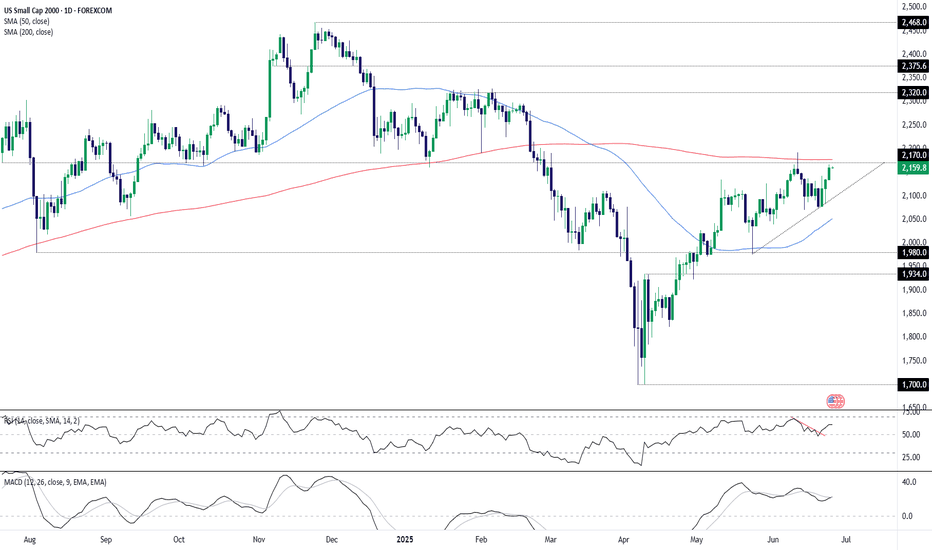

Unless it’s accompanied by a recession, there are few things U.S. small cap stocks enjoy more than rate cuts—especially given how many rely on the kindness of others to fund their growth ambitions. With another soft core PCE report expected at the end of the week, and with some Fed officials signalling a preparedness to cut rates again as soon as July, the ducks...