Market analysis from FOREX.com

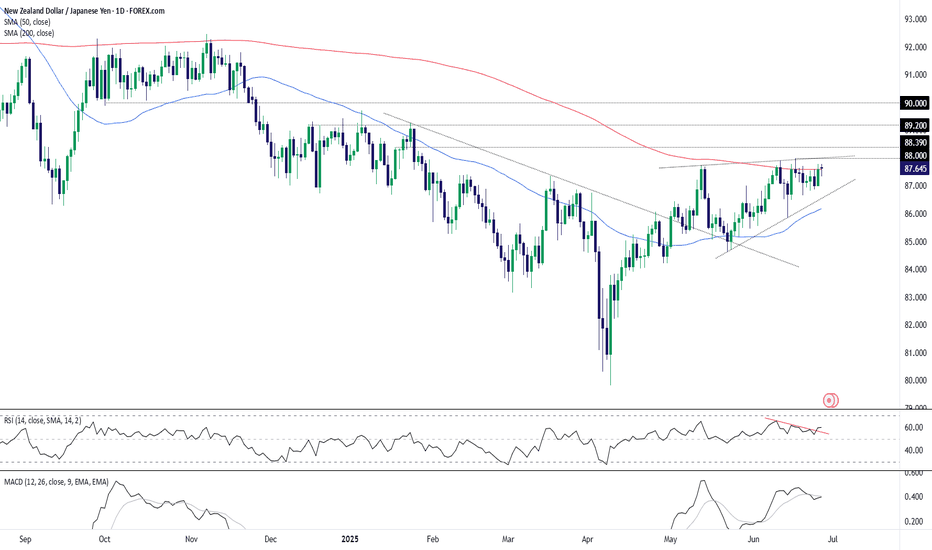

NZD/JPY hasn’t closed above the 200-day moving average since July 2024, racking up more than ten failed bullish breaks in that time—seven of them in the past month alone. If today’s probe finds more traction, it could be the catalyst to bring bulls off the sidelines, especially on a close above 88.00 where wedge and horizontal resistance intersect. If that plays...

Sitting in a rising wedge with bearish divergence after running into resistance at 43100, the US30 contract finds itself at an interesting juncture on the charts. If it can’t stage a definitive break above these levels, a short setup could be on the cards. If the contract cannot break and hold above 43100, traders could look to initiate short positions targeting...

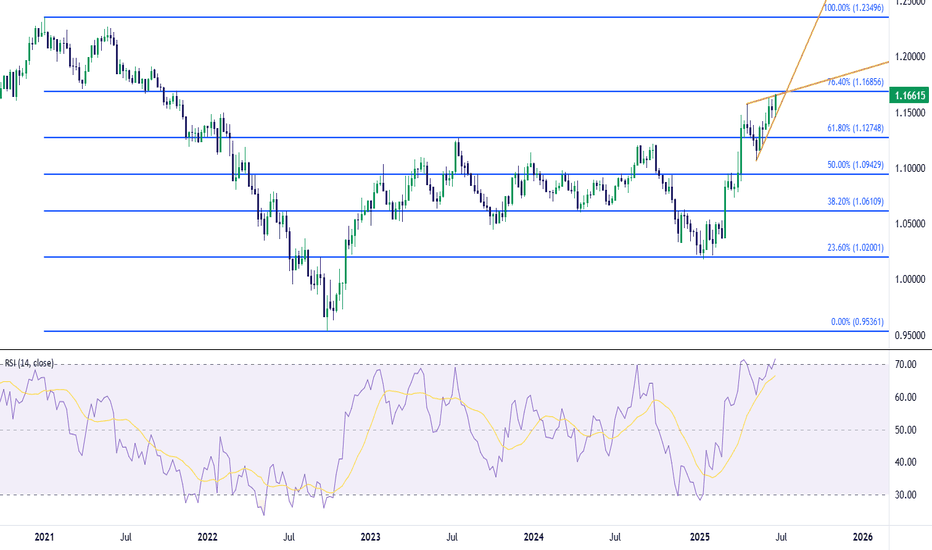

The Fibonacci retracement drawn from the 2021-2022 move in EUR/USD has continued to produce inflections in the pair. It caught the high in 2023 at the 61.8% retracement of 1.1275. And then last year, it set the low in April that led into a vigorous bounce into the end of Q3. Along the way, the 50% marker of that major move was a sticking point producing multiple...

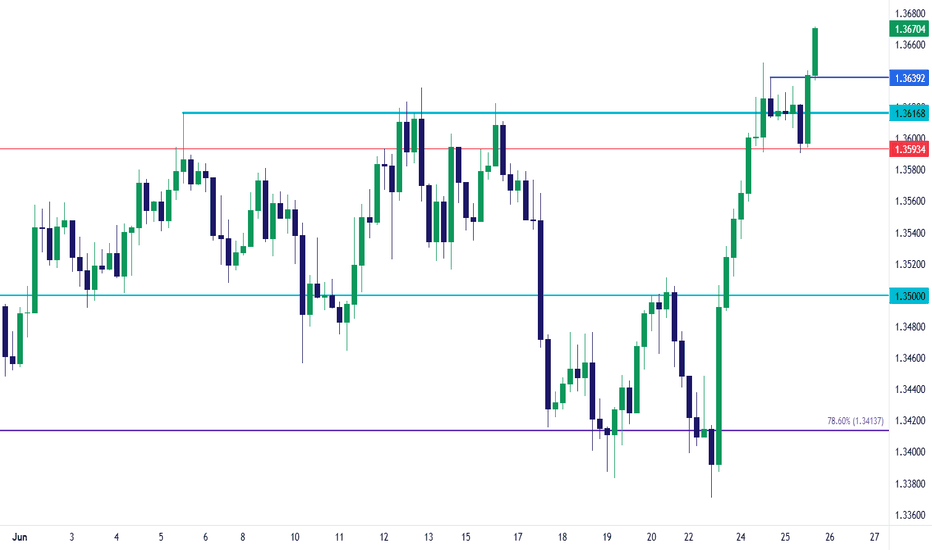

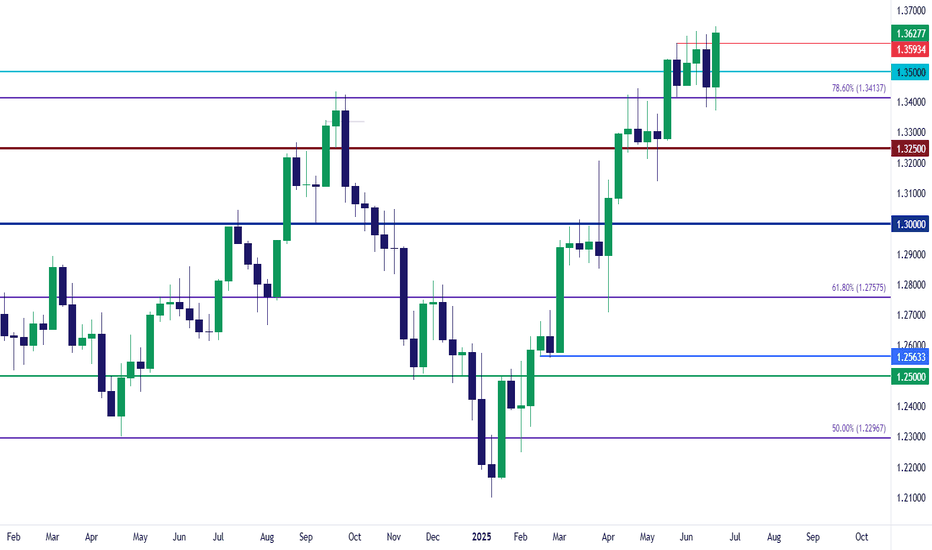

GBP/USD had a mild pullback earlier in the morning until the 1.3593 level came in to help set the lows. I had looked at that price in yesterday's post and that's held the lows for today ahead of another strong breakout with the pair pressing into fresh three-year highs. Chasing breakouts can be tough especially when they've already started, so at this point...

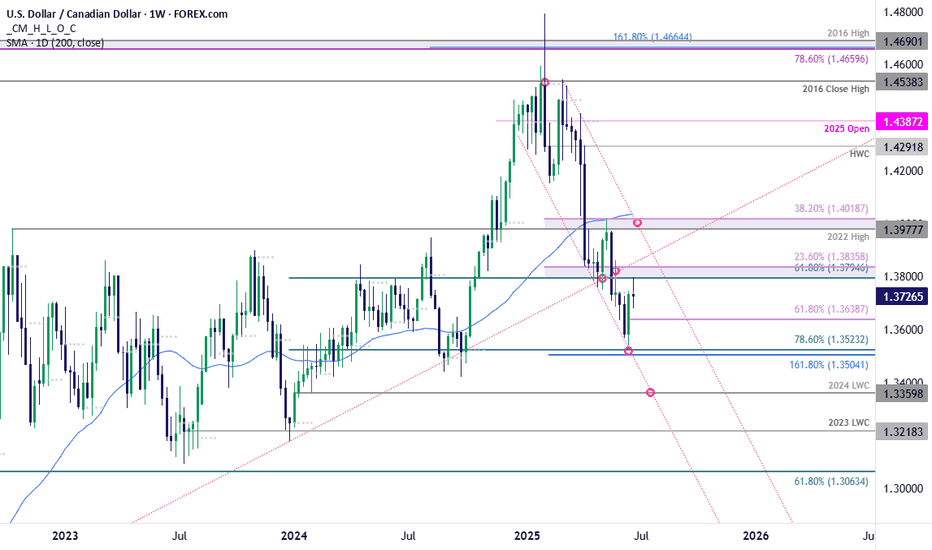

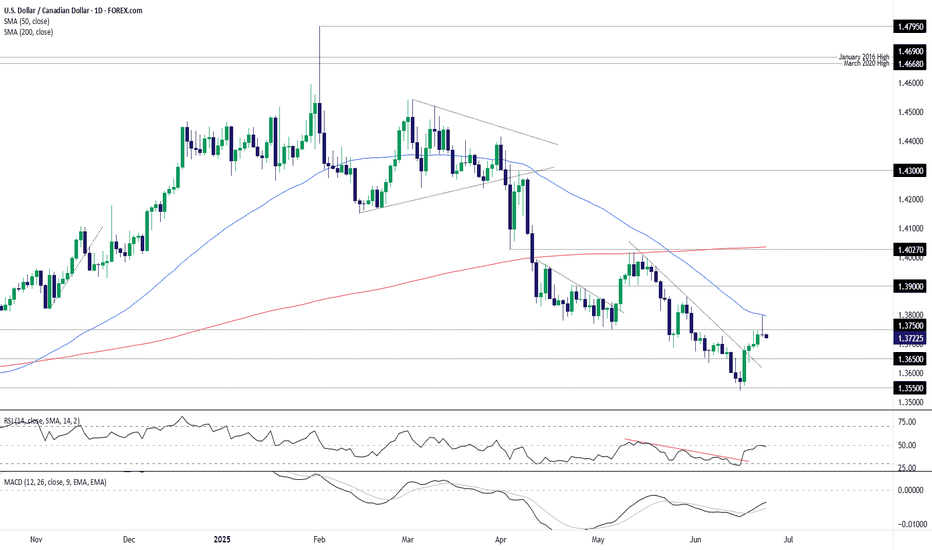

USD/CAD briefly registered in intraday low at 1.3540 last week before mounting a massive outside-weekly reversal off the yearly lows. The subsequent rally extended more than 1.9% off the low with the advance exhausting into resistance this week at 1.3795-1.3836- a region defined by the 61.8% retracement of the late-2023 advance, the April low-close, and the 23.6%...

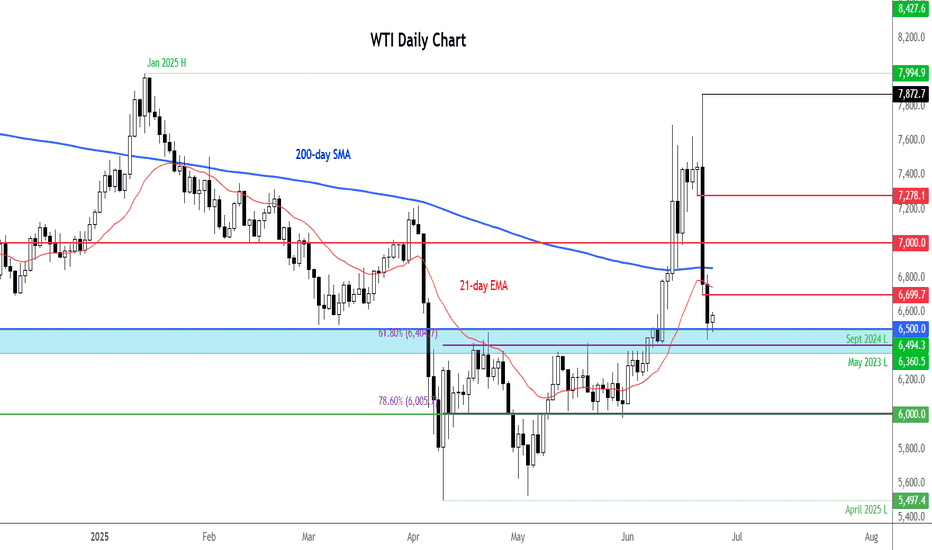

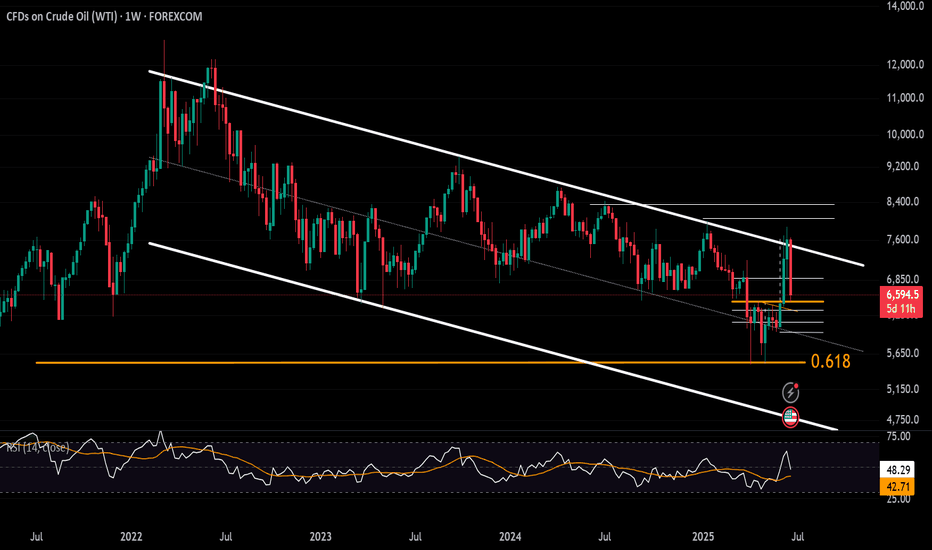

We have had some more bullish oil news from the weekly US inventories report. It remains to be seen whether the news is enough to lift the oil price. Following the API data overnight we had even more bullish-looking official inventories report from the US Department of Energy. The fact that crude stocks fell for the 5th straight week certainly points to strong...

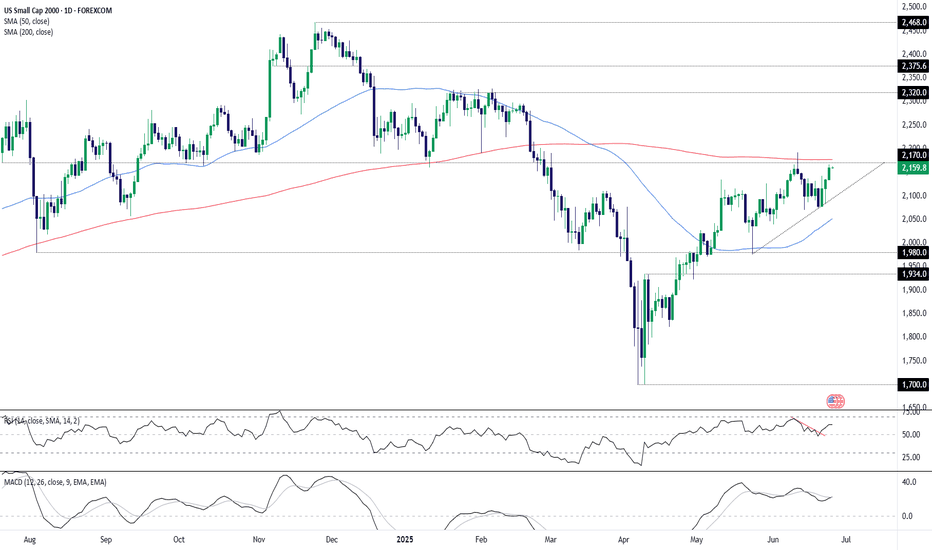

Unless it’s accompanied by a recession, there are few things U.S. small cap stocks enjoy more than rate cuts—especially given how many rely on the kindness of others to fund their growth ambitions. With another soft core PCE report expected at the end of the week, and with some Fed officials signalling a preparedness to cut rates again as soon as July, the ducks...

The Fibonacci level at 1.3414 has put in some work on GBP/USD over the past year. In Q3 of 2024 it held the highs over a two week period, leading into the sell-off in Q4. And then in April of this year, it once again held the highs, but this time, the pullback was brief and buyers were able to power through a month later. And now, over the past two weeks, this...

With geopol tensions easing, gold prices have continued to pullback and this morning brought the first re-test of $3300 in a couple of weeks. So far, that support has held and with the Fed talking up rate cut potential even in light of higher inflation projections, that's a factor that could contribute to bullish moves in gold. The bigger question is price action...

Following renewed Middle East ceasefire hopes and signs of exhausted buying momentum on the gold chart, the yellow metal has pulled back toward a key trendline—connecting higher lows since December 2024—currently near the 3,300 level. If gold holds above 3,300 and continues to respect this broader trend support, the bullish trajectory may re-align, with potential...

After failing to close above the upper border and the 78 resistance level, and amid renewed hopes for a Middle East ceasefire, oil prices dropped sharply back toward the neckline of the inverted head and shoulders formation—initially broken ahead of the recent war escalation—at 64.70. A sustained move below that neckline could target crude prices toward the...

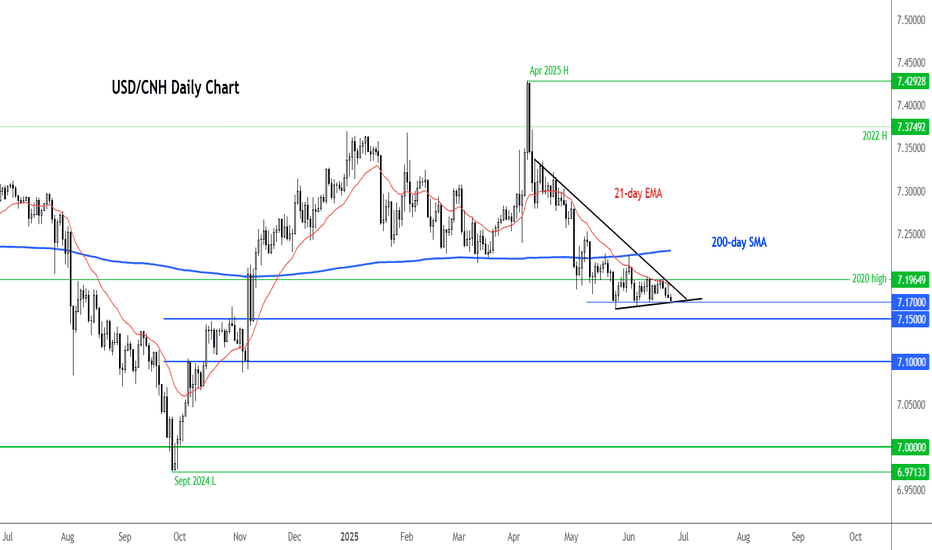

Over the past several days, the USD/CNH has been coiling inside a tight range, awaiting direction from the oil market. Well oil prices collapsed, and down went the dollar and up went risk assets. The net impact on the yuan was positive. The USD/CNH pair has weakened a little bit more today. If it can take out support at 7.1700 on a daily closing basis then this...

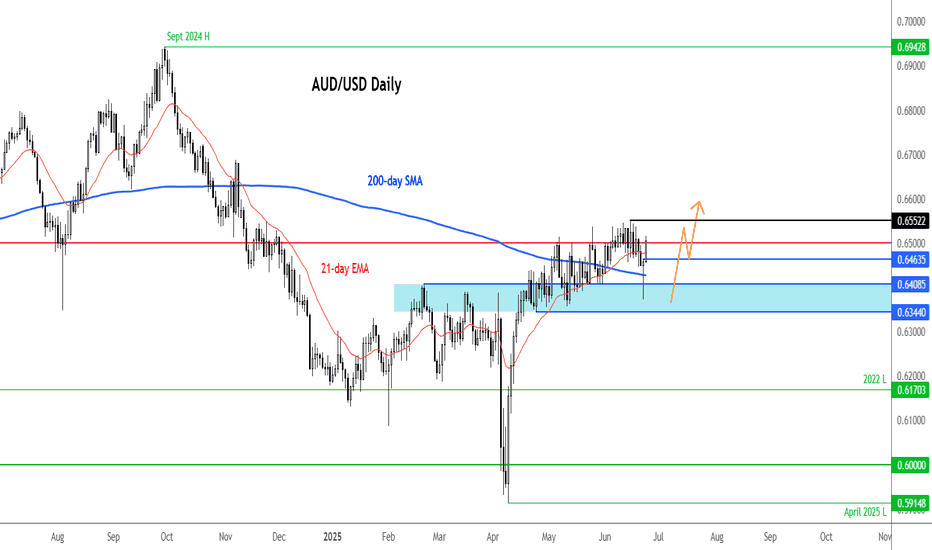

Following the collapse in oil prices and the rally in all risk assets, the AUD/USD created a hammer candle on the daily time frame yesterday as it held key support and the 200-day average in the shaded blue area on the chart. We have seen some further upside so far today, suggesting that the AUD/USD may finally be ready to lift off from the congestion zone it has...

Whether it’s Monday’s bearish pin candle, the rejection at the 50-day moving average, or what increasingly looks like an evening star pattern forming, directional risks for USD/CAD look to be skewing lower following the false break of 1.3750. Those looking to position for renewed weakness could initiate shorts beneath 1.3750, with a stop above the level to guard...

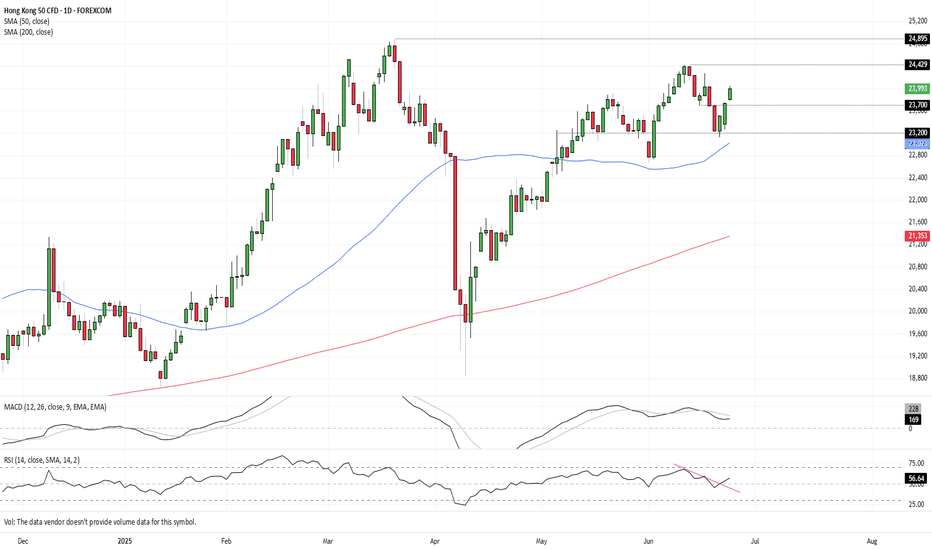

Monday’s bounce from support at 23,200 has seen the Hong Kong 50 push above minor resistance at 23,700, generating a potential long setup to play the broader improvement in risk appetite seen in recent hours. Longs could be initiated above 23,700 with a stop beneath for protection, initially targeting the June 12 high of 24,429. A break above that would open the...

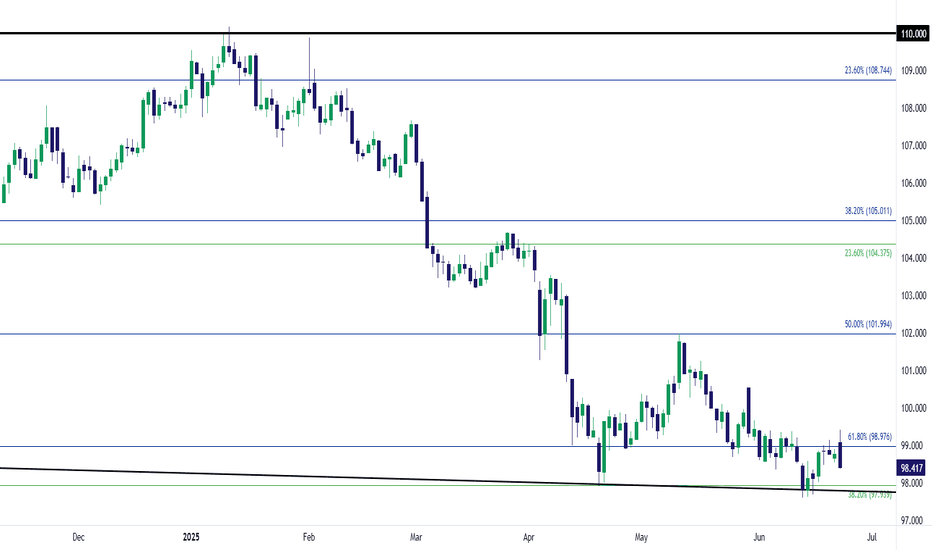

The bearish trend in USD has run for most of this year so far, and this has happened even as many members of the Fed refrain from talking up possible rate cuts. Last week, Jerome Powell once again reiterated that he thought tariffs would produce inflation, and he seemed to dismiss the forecasts that indicated two possible rate cuts in 2025. Another inflationary...

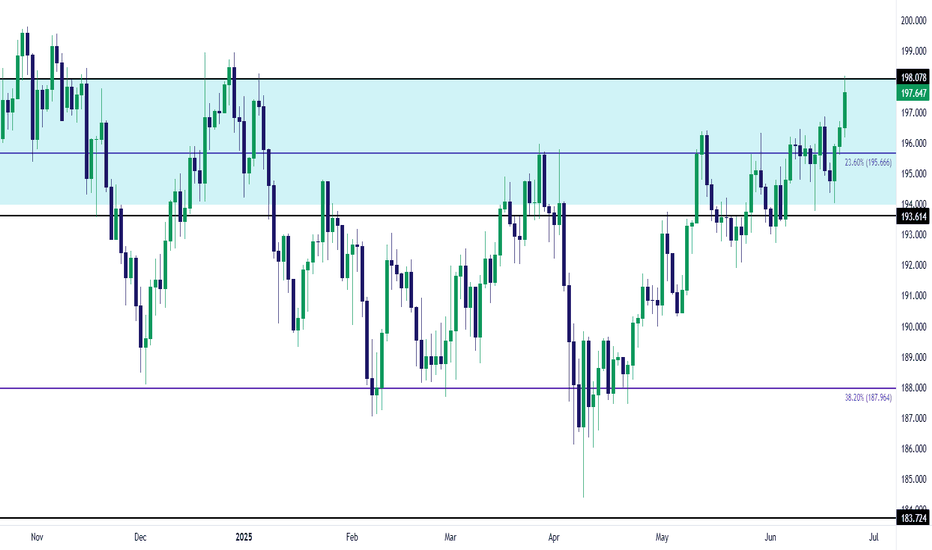

All the way back in 2008, around the Financial Collapse, GBP/JPY posted a massive gap on the monthly chart and here we are, more than 16 years later, and that space on the chart continues to loom large. The August 2008 close at 198.08 led into the September open at 193.61, and over the past couple of weeks those prices have played a big role in GBP/JPY price...

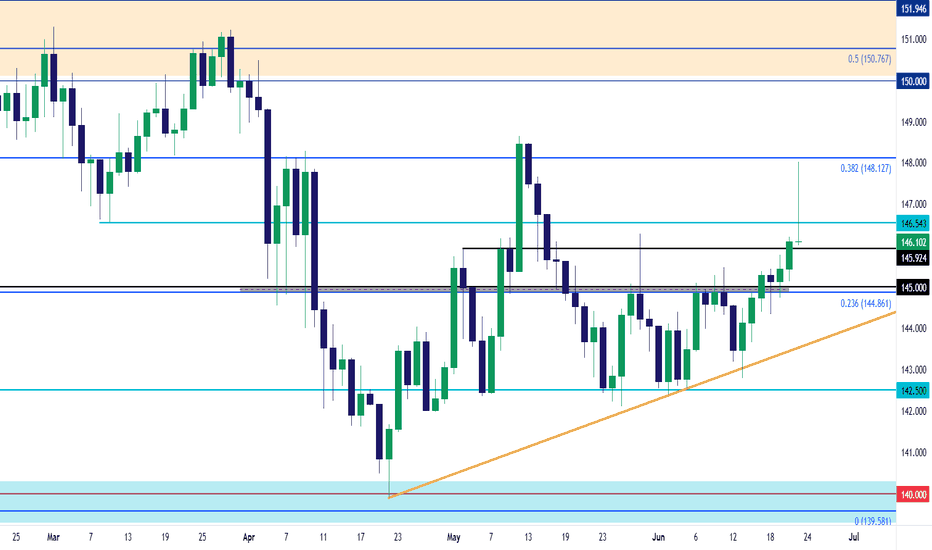

Bulls had an open door to make a run after this week's open but, so far, they've failed at the same 148.00 handle that snared buyers back in May. The daily bar at this point is brewing up a gravestone doji but there's still a couple hours left until the close of trading for the day, and this could end up as a pin bar. Behind the push is rate cut potential in...