Market analysis from FOREX.com

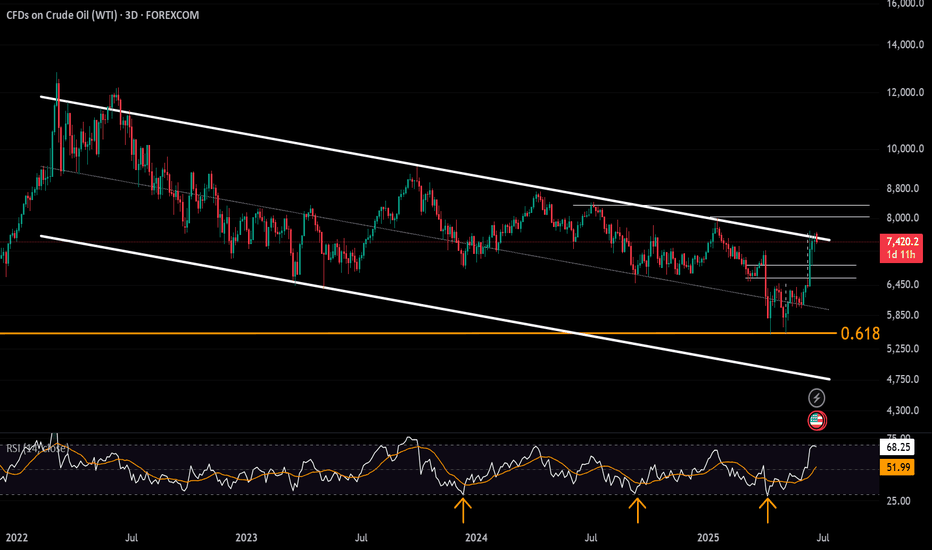

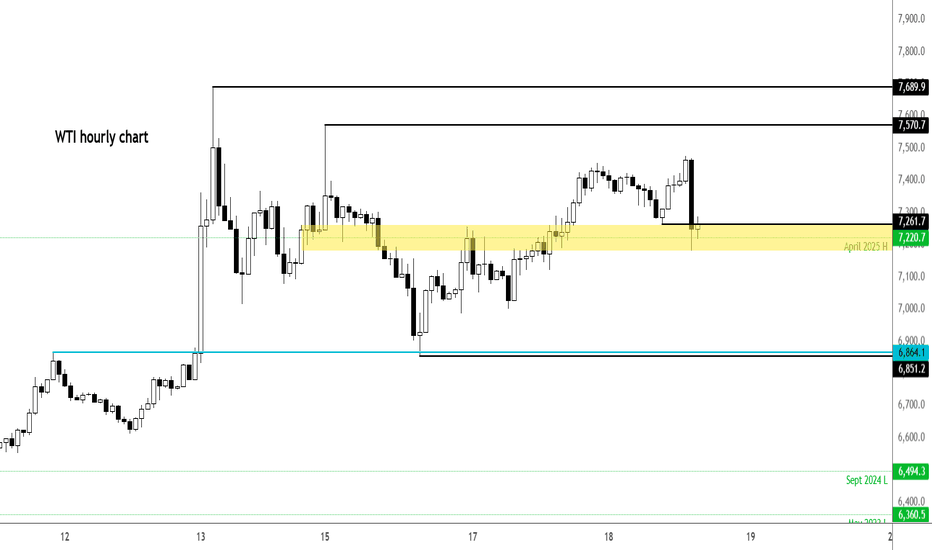

Crude Oil trades between Israel-Iran-Conflict supply risks, overbought momentum, and the potential for a 3-year channel breakout. While upside risks from a possible Strait of Hormuz closure remain uncertain, a firm hold above $78 could extend gains toward $80 and $83.50, keeping oil on a bullish edge for H2 2025. A pullback into the channel may ease inflation...

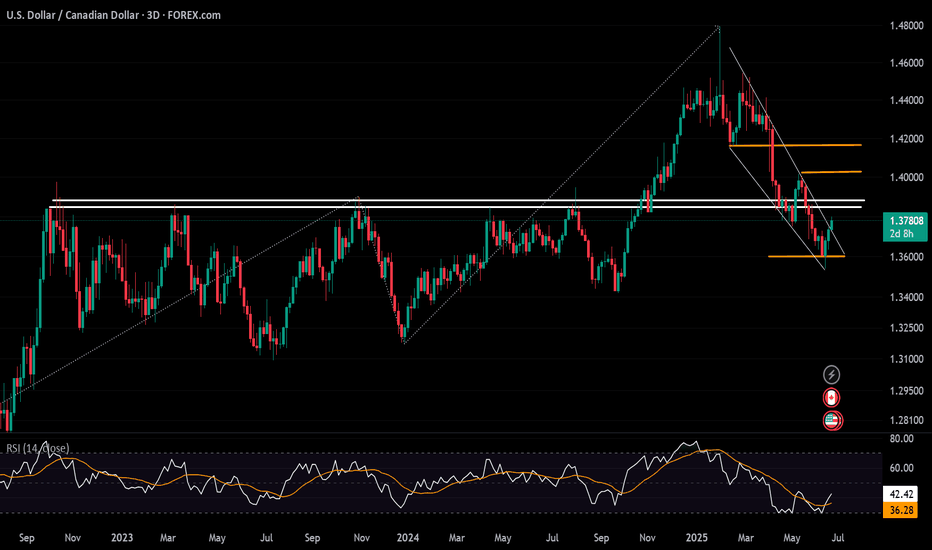

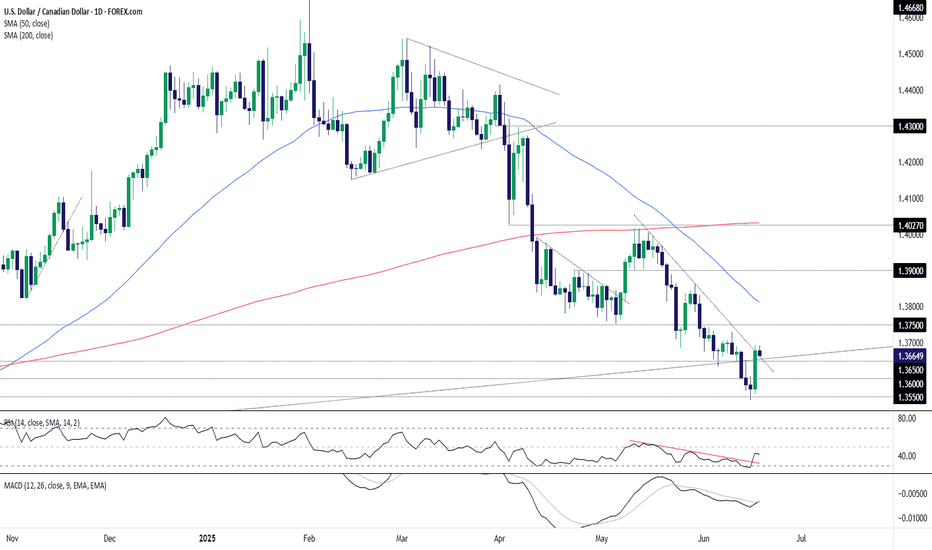

Following the U.S.–Iran strike over the weekend, the U.S. dollar strengthened, posting solid rebounds across major dollar pairs. The USD/CAD chart, in particular, climbed back toward the 1.38 level. The pair is now eyeing a key resistance zone between 1.3840 and 1.3880, a range that has consistently held since October 2022. A decisive break and hold above this...

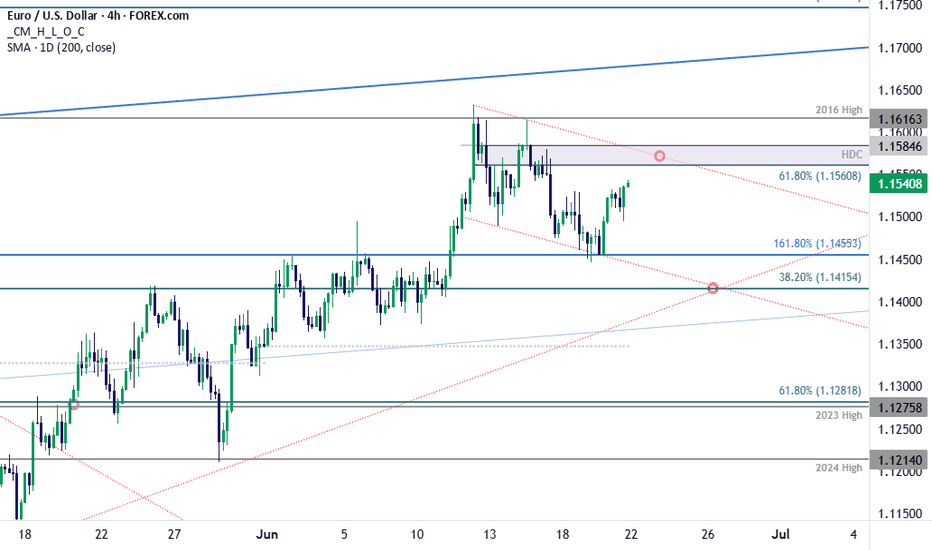

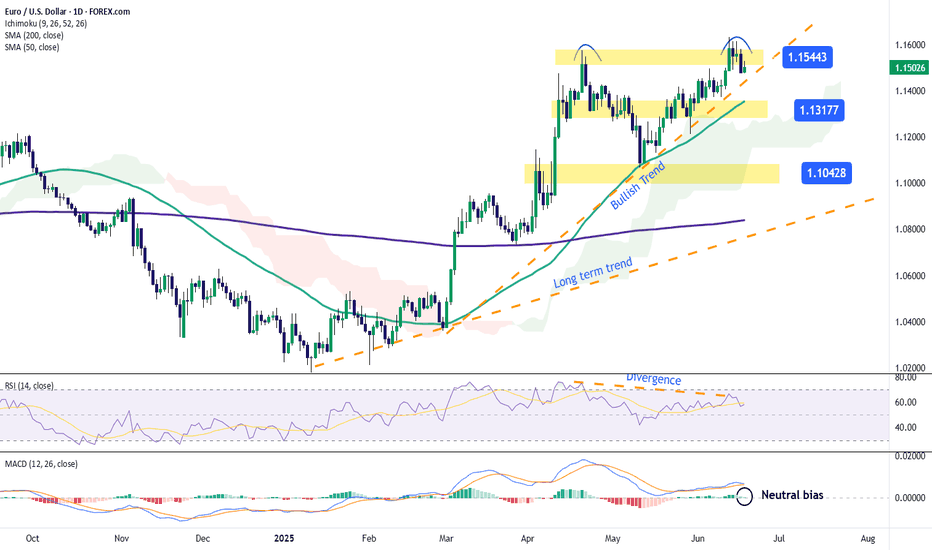

EUR/USD ran into resistance at 1.1630 before easing back below 1.15. However, EUR/USD continues to trade in its rising channel, holding above its 20 and 50 SMA for now. The RSI is pointing lower, suggesting momentum is losing steam. Immediate support is at 1.1450, the 20 SMA, and the lower band of the rising channel is being tested following weak EZ PMIs and as...

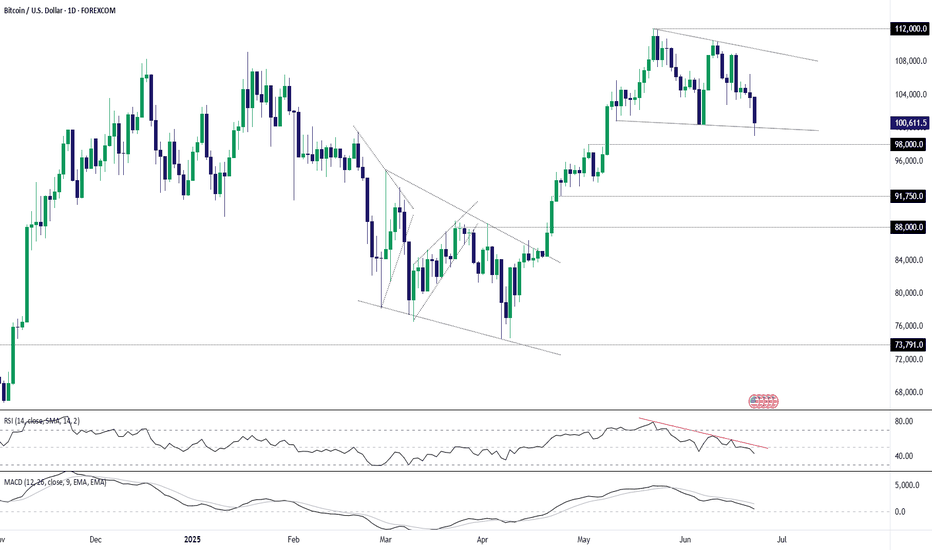

Weakness in risk assets has been relatively contained so far on Monday in Asia, despite the escalation in geopolitical tensions in the Middle East over the weekend—including in bitcoin. Yes, it’s down, but not by any margin that sets this open apart from the usual. And having bounced after a brief dip below the psychologically important $100,000 level—which also...

Euro plunged nearly 1.6% from the highs with price rebounding this week at former resistance at the 1.618% extension of the May advance. While the risk remains for a deeper correction towards the April uptrend, we’re looking for signs of support / that a low is in. EUR/USD is trading within the confines of a proposed descending channel with price rebounding off...

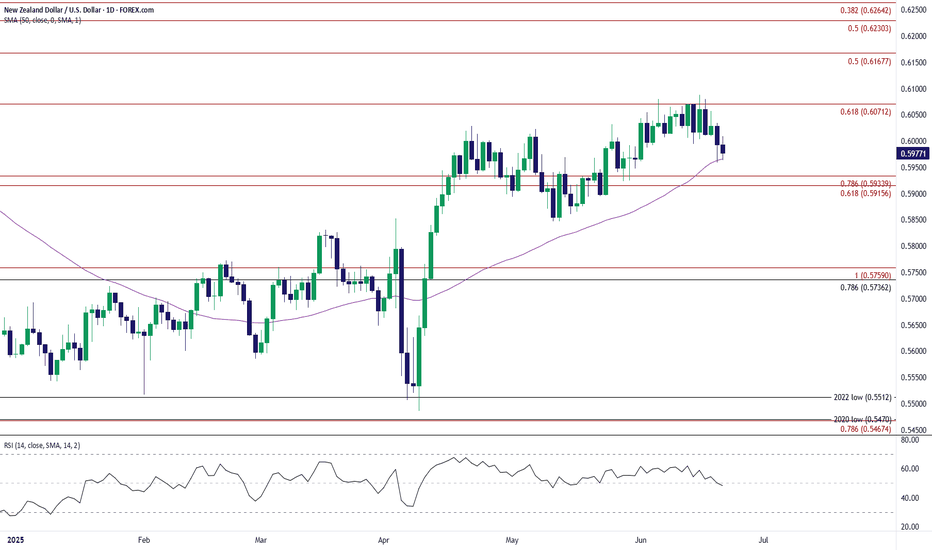

NZD/USD slipped to a fresh monthly low (0.5959) after struggling to close above 0.6070 (61.8% Fibonacci extension), and a move/close below the 0.5920 (61.8% Fibonacci extension) to 0.5930 (78.6% Fibonacci extension) region may lead to a test of the May low (0.5847). Next area of interest comes in around 0.5740 (78.6% Fibonacci retracement) to 0.5760 (100%...

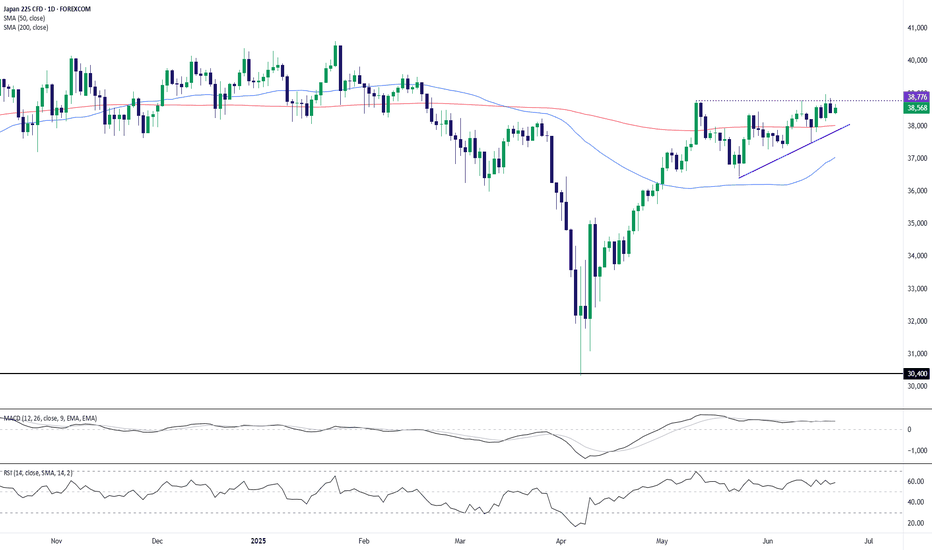

The Japan 225 (Nikkei) is consolidating just beneath a major resistance level around 38,776, forming a classic ascending triangle pattern. Price has been compressing into higher lows while repeatedly testing the horizontal ceiling, hinting at a potential bullish breakout. Key Technical Observations: Pattern Structure: The ascending triangle, defined by rising...

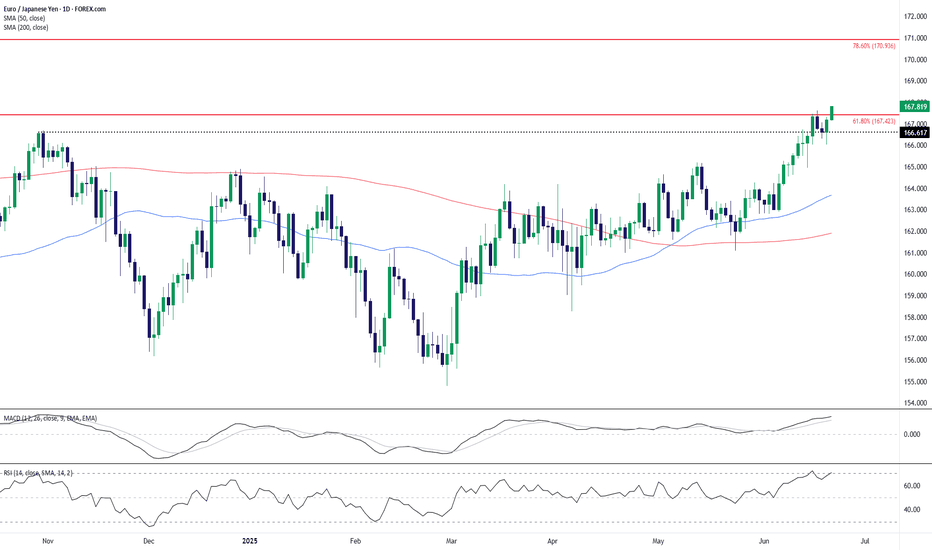

EUR/JPY has broken convincingly above the 61.8% Fibonacci retracement level at 167.42, clearing a major technical hurdle and reaffirming bullish momentum. This breakout also aligns with the pair's broader uptrend supported by the 50-day and 200-day SMAs, which are upward sloping and stacked in bullish order. Technical Highlights: Trend & Structure: Strong...

EUR/USD continues to trade within a strong uptrend, respecting the 50-day SMA while pressing against a key horizontal resistance level around 1.1576. The pair has recently pulled back modestly after testing this level but remains above the short-term moving average, suggesting buyers are still in control. Technicals provide a mixed, but slightly bullish...

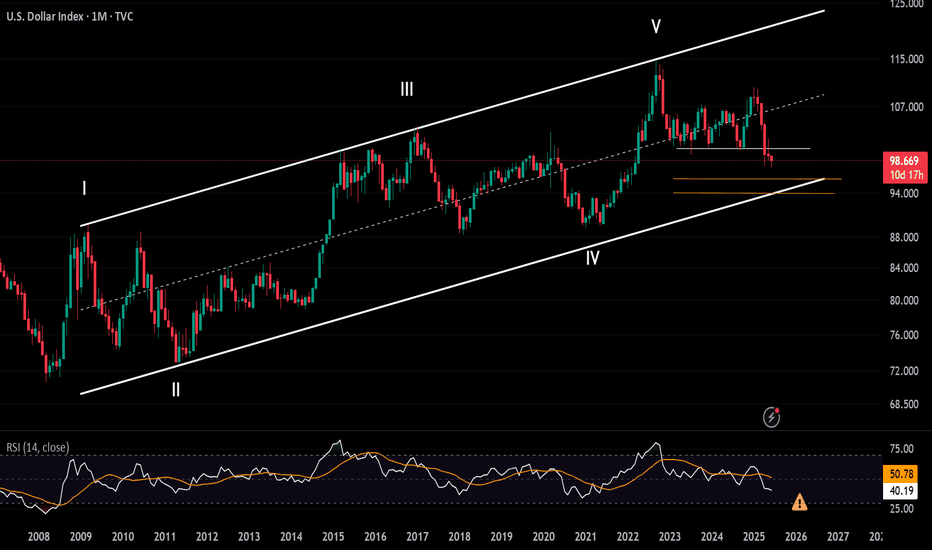

The U.S. Dollar Index (DXY) is currently trading near three-year lows, reflecting concerns over economic fragility and heightened geopolitical tensions. If price action holds below 97, the DXY could face additional pressure, potentially descending toward the lower boundary of a long-term channel that has held since the 2008 lows. Key support levels at 96 and 94...

Despite heightened geopolitical tensions alongside a weak US Dollar, gold's price action remains in pullback mode below the $3,400 level, awaiting a catalyst. Technically, gold remains at the upper boundary of a long-term ascending channel, anchored by the 2016 and 2020 highs. It also sits just beneath the projected breakout zone of a large cup-and-handle...

Sitting in a rising wedge and with momentum indicators rolling over, the ducks look to be lining up for a potential downside break for silver. Throw in signs the U.S. dollar may have bottomed—an adversary to commodity prices—and the unwind could be sizeable, especially if risk appetite were to evaporate. If silver were to break beneath wedge support and hold...

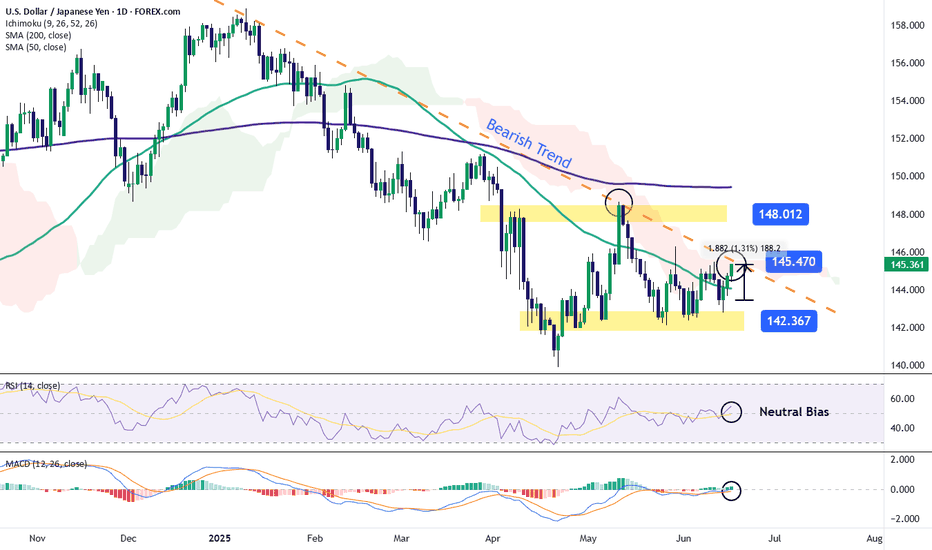

In recent hours, the pair has shown limited movement of just 0.5%, reflecting a neutral bias as the market prepares for the upcoming Federal Reserve policy announcement. At this point, expectations suggest that the U.S. central bank will maintain a neutral stance, keeping the interest rate steady at 4.5% in the short term. However, the key focus will be on the...

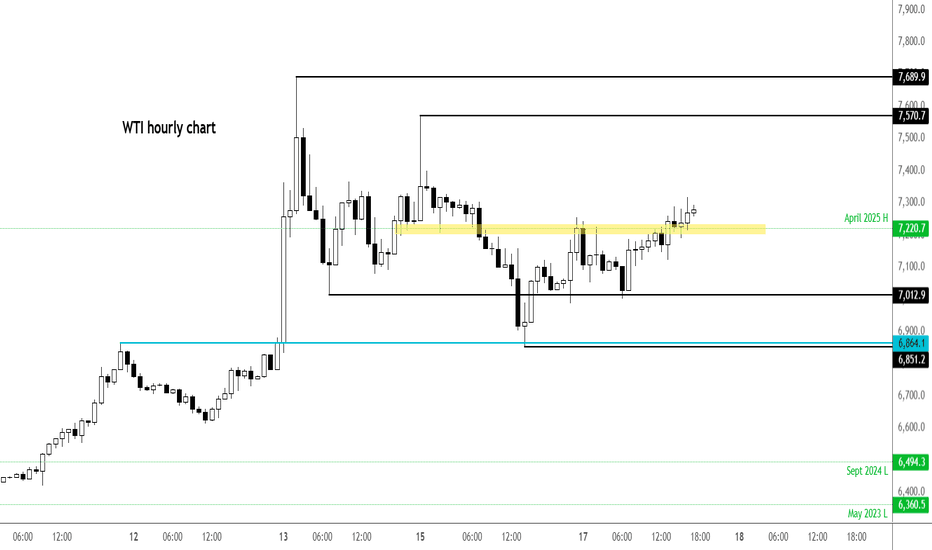

Despite a huge draw in US crude inventories - not that this was going to move the market given the focus being firmly fixated on the Middle East situation - oil prices fell as Trump kept markets guessing about US military involvement in Iran. The US president said: "I may do it. I may not do it. Nobody knows what I’m going to do." The US president also revealed...

Tuesday’s bullish move in USD/CAD has delivered a signal often seen at bottoms, taking out several key technical resistance levels in the process, including the December 2023 uptrend. With bearish momentum starting to reverse, upside risks look to be building. Those in the market for a long setup could initiate positions around these levels with a stop beneath...

Over the past three trading sessions, USD/JPY has risen by more than 1%, favoring the U.S. dollar, as the yen continues to weaken steadily. The bullish bias has persisted, supported by a rebound in dollar strength. The DXY index, which measures the dollar's performance against other major currencies, has been climbing in the short term and is once again...

The Israel-Iran situation is quite different this time and with Trump announcing that *we* now have full control over Iranian skies, suggesting the US is entering the fray – hardly a surprise to be honest - this is not going to end well. The conflict may get far worse in the short-term, and this will send shockwaves through the oil markets – especially if there...

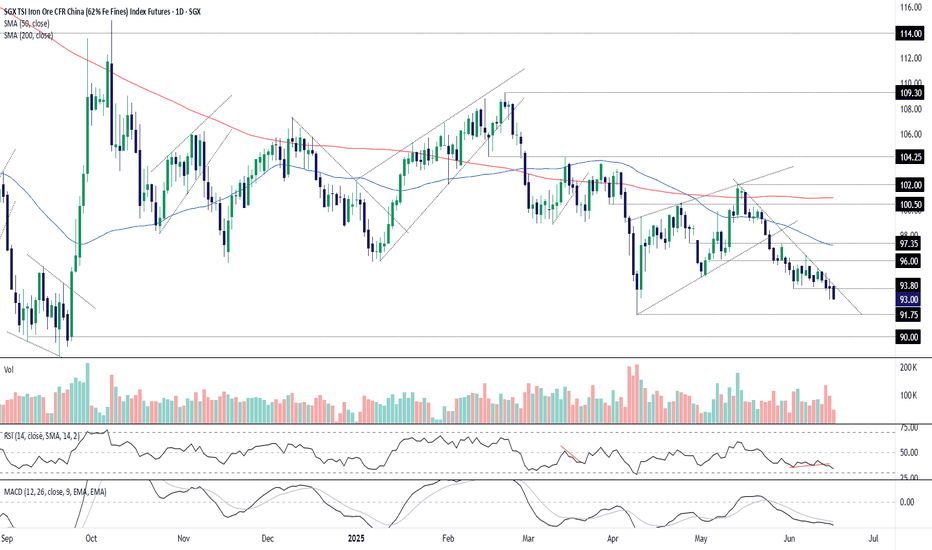

Sitting in an established downtrend and with momentum indicators providing bearish signals, a retest of the 2025 lows may be on the cards for SGX iron ore. A move below $93—where the price bottomed on Monday—would allow for shorts to be established targeting $91.75. A tight stop above would protect against reversal. Alternatively, if the price bounces towards...