Market analysis from FXOpen

Market Analysis: USD/CAD Breaks Higher USD/CAD is rising and might aim for more gains above the 1.3765 resistance. Important Takeaways for USD/CAD Analysis Today - USD/CAD is showing positive signs above the 1.3720 support zone. - There is a key bullish trend line forming with support at 1.3740 on the hourly chart at FXOpen. USD/CAD Technical Analysis ...

Market Analysis: GBP/USD Dips Below Support GBP/USD started a fresh decline below the 1.3620 zone. Important Takeaways for GBP/USD Analysis Today - The British Pound started another decline from the 1.3620 resistance zone. - There was a break below a connecting bullish trend line with support at 1.3460 on the hourly chart of GBP/USD at FXOpen. GBP/USD...

Oil Price Surges at Monday Open Amid US Strikes on Iran As shown on the XBR/USD chart, the Brent crude oil price formed a bullish gap at the opening of financial markets this Monday, surpassing last week’s high. Only three days ago, we drew attention to Donald Trump’s statement that a decision regarding US involvement in the Iran-Israel conflict would be made...

Market Insights with Gary Thomson: Canada Inflation, US Core Consumer Metrics, and Earnings Reports In this video, we’ll explore the key economic events, market trends, and corporate news shaping the financial landscape. Get ready for expert insights into forex, commodities, and stocks to help you navigate the week ahead. Let’s dive in! In this episode, we...

XBR/USD Chart Analysis: Oil Price Falls After Trump’s Decision As shown on the XBR/USD chart, the price of Brent crude oil has pulled back from yesterday’s 4.5-month high following a statement from the White House that President Donald Trump will make a decision within the next two weeks on whether the United States will take part in the Israel-Iran...

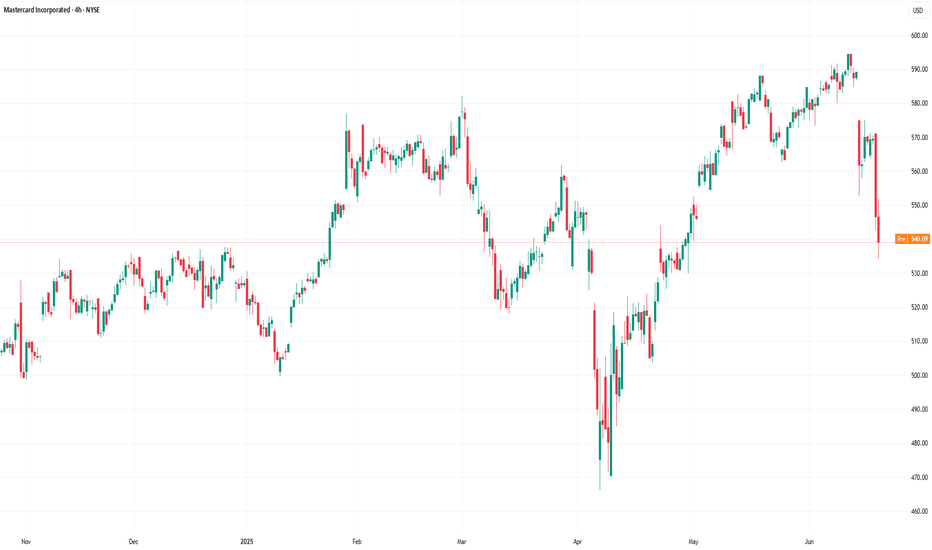

Mastercard (MA) and Visa (V) Shares Decline Due to Stablecoin Bill Yesterday, we reported that the US Senate had passed the GENIUS stablecoin bill, which establishes a legal framework for regulating the stablecoin market. This development led to a sharp rise in the share price of cryptocurrency exchange Coinbase (COIN), while simultaneously putting pressure on...

Silver Price Retreats from 2012 Highs As shown on the XAG/USD chart, the price of silver climbed above $37 per ounce yesterday — a level not seen since 2012. However, this morning, the price has dropped by approximately 2.5% from yesterday’s peak. The bullish driver behind the rally has been fears that the US could become involved in a military conflict between...

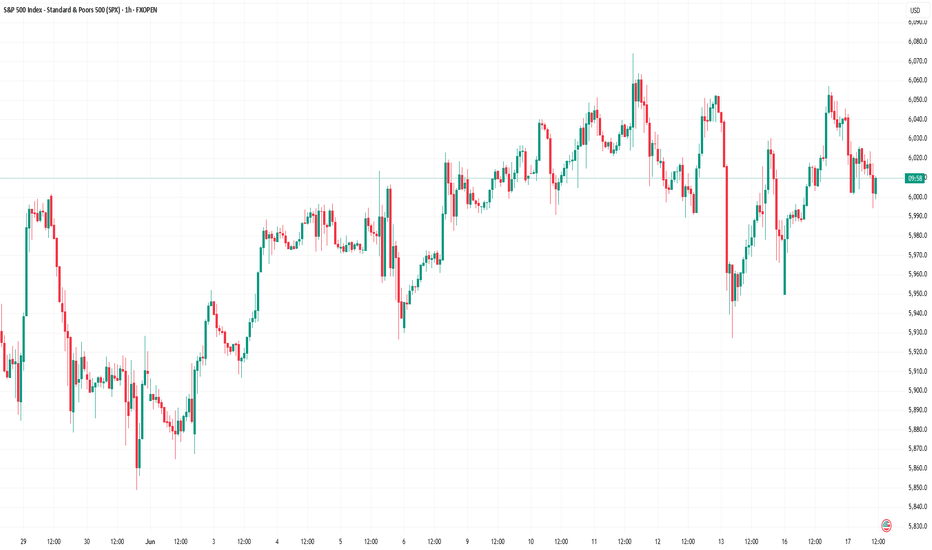

Coinbase (COIN) Shares Rise Following Stablecoin Legislation Approval Shares in Coinbase Global (COIN) surged by 11% yesterday, making the company the top performer in the S&P 500 index (US SPX 500 mini on FXOpen). The sharp rise was driven by news that the US Senate has approved the GENIUS stablecoin bill, which sets out a regulatory framework for the use of...

What Is T-Distribution in Trading? In the financial markets, understanding T-distribution in probability is a valuable skill. This statistical concept, crucial for small sample sizes, offers insights into market trends and risks. By grasping T-distribution, traders gain a powerful tool for evaluating strategies, risks, and portfolios. Let's delve into what...

GBP/USD Hits June Low As the GBP/USD chart shows, the pair dropped sharply last night, falling below the 1.34170 level. This move marked the lowest point for the pound against the dollar since the beginning of June. One of the main drivers behind this decline is the strengthening of the US dollar, which is attracting market participants amid heightened...

Natural Gas Prices on the Rise As shown on the XNG/USD chart today, natural gas prices are trading around $3.960 per MMBtu — the highest level in over a month. This week’s series of bullish candles confirms strong demand. Natural gas is becoming more expensive due to concerns over the military conflict between Iran and Israel. According to media reports: →...

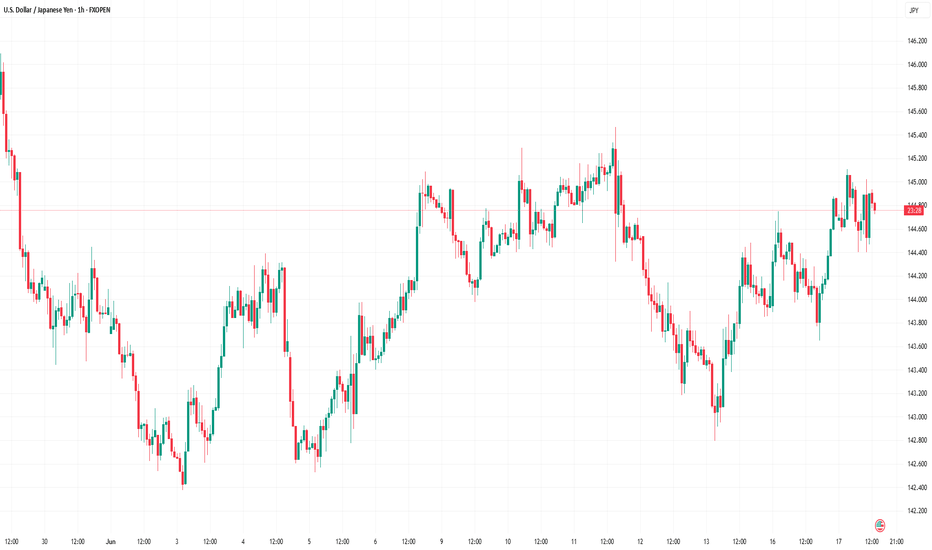

Market Analysis: USD/JPY Recovers Above 145.00 USD/JPY is rising and might gain pace above the 145.50 resistance. Important Takeaways for USD/JPY Analysis Today - USD/JPY climbed higher above the 144.00 and 145.00 levels. - There is a key bullish trend line forming with support at 144.80 on the hourly chart at FXOpen. USD/JPY Technical Analysis On the...

Market Analysis: EUR/USD Faces Rejection EUR/USD declined from the 1.1640 resistance and traded below 1.1550. Important Takeaways for EUR/USD Analysis Today - The Euro started a fresh decline after a strong surge above the 1.1600 zone. - There is a connecting bearish trend line forming with resistance at 1.1545 on the hourly chart of EUR/USD at FXOpen. ...

Bank of Japan Leaves Interest Rate Unchanged This morning, the Bank of Japan (BOJ) released its interest rate decision, keeping the rate unchanged as widely expected. According to Forex Factory, the BOJ Policy Rate remains at 0.5%. BOJ Governor Kazuo Ueda noted the following: → Japan’s economy is recovering moderately. → The Bank will continue raising rates if...

How Financial Markets Are Reacting to the Escalation in the Middle East The exchange of strikes between Iran and Israel continues. However, judging by the behaviour of various assets, market participants do not appear to expect further escalation: → Oil prices are falling. Monday’s candlestick on the XBR/USD chart closed significantly below the opening...

Trading at the Market Open The market open marks a critical juncture in the financial world, presenting a unique blend of opportunities and challenges for traders. This article explores the essence of trading at the open across stocks, forex, and commodities. It delves into the heightened volatility and liquidity characteristic of this period, offering insights...

Oracle (ORCL) shares surge 24% in a week, hitting an all-time high Last week, Oracle (ORCL) shares: → rose by approximately 24% — marking the strongest weekly gain since 2001; → broke through the psychological level of $200 per share; → reached an all-time high, with Friday’s session closing above $215. It is possible that a new record may be set this week. ...

WTI Crude Oil Regains Bullish Momentum WTI Crude oil prices climbed higher above $70.00 and might extend gains. Important Takeaways for WTI Crude Oil Price Analysis Today - WTI Crude oil prices started a decent increase above the $65.00 and $68.50 resistance levels. - There is a major bullish trend line forming with support at $71.50 on the hourly chart of...