Market analysis from FXOpen

Bringing together the two distinct worlds of penny stocks and forex trading requires a comprehensive understanding of the unique characteristics of each of these investment opportunities. The article discusses how the speculative nature of penny stocks compares to foreign exchange trading, helping traders gain a better understanding of the opportunities and...

Inflation in Australia Continues To Decline. AUD/USD Tests Important Support Data today from the Australian Bureau of Statistics on Wednesday showed the monthly consumer price index (CPI) rose 4.3% year-on-year in November, the slowest pace since January 2022. Value a month earlier = 4.9%. Market forecasts = 4.4%. This strengthened market expectations that...

USD/CHF is rising and might aim a move toward the 0.8620 resistance. Important Takeaways for USD/CHF Analysis Today USD/CHF is gaining pace above the 0.8500 resistance zone. There is a key bearish trend line forming with resistance near 0.8530 on the hourly chart at FXOpen. USD/CHF Technical Analysis On the hourly chart of USD/CHF at FXOpen, the pair...

EUR/USD started a fresh decline below the 1.0980 support. Important Takeaways for EUR/USD Analysis Today The Euro struggled to clear the 1.1000 resistance and declined against the US Dollar. There is a major bearish trend line forming with resistance near 1.0945 on the hourly chart of EUR/USD at FXOpen. EUR/USD Technical Analysis On the hourly chart...

The Swiss National Bank Suffered Losses of 3 Billion Francs in 2023 The Swiss National Bank (SNB) reported an annual loss of 3 billion Swiss francs (USD 3.54 billion) in 2023 and said it would not make payments to Switzerland's central or local government or pay dividends to investors. The loss is believed to have occurred as a result of interest rate hikes...

This week the reporting season begins — company results for the 4th quarter will certainly become one of the most important drivers of stock index prices, along with the publication of news about inflation, the labor market, and statements from the Federal Reserve. Large banks will traditionally be among the first to report: JP Morgan, Bank of America, Wells...

In the complex world of forex trading, a myriad of factors contribute to the ever-shifting landscape of exchange rates. Among these, geopolitical risks stand out as potent catalysts capable of triggering significant fluctuations in currency values. This article delves into the intricate relationship between geopolitical events and forex markets, exploring how...

As of Friday morning, the situation on the USD/JPY market deserves attention: → the US dollar is on course to demonstrate its strongest week since July 2023. The media writes that markets are adjusting expectations regarding the easing of monetary policy by the Fed. → The yen fell about 3% against the US dollar in the first week of the year, which could be its...

Crude oil price is rising and it could climb further higher toward the $75.90 resistance. Important Takeaways for Oil Prices Analysis Today Crude oil prices are moving higher above the $71.00 resistance zone. There is a key bullish trend line forming with support near $72.60 on the hourly chart of XTI/USD at FXOpen. Oil Price Technical Analysis On...

Gold price is correcting lower from the $2,088 resistance. Important Takeaways for Gold Prices Analysis Today Gold price failed to clear the $2,088 resistance and corrected lower against the US Dollar. A key contracting triangle is forming with support at $2,042 on the hourly chart of gold at FXOpen. Gold Price Technical Analysis On the hourly chart...

Fibonacci circles, a unique tool in the trading arsenal, offer a compelling blend of technical analysis and mathematical beauty. Rooted in the Fibonacci sequence, they provide traders with a distinct perspective on market trends and potential reversal points. This article delves into the practical application of Fibonacci circles, shedding light on how they can be...

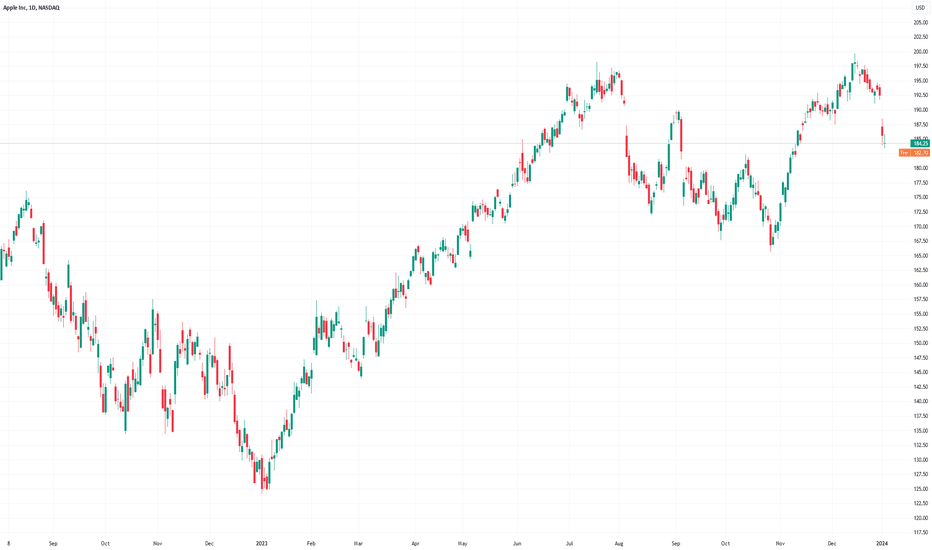

According to Yahoo Finance, Barclays analysts downgraded AAPL shares to “underweight” and lowered their price forecast: they expect the share price to drop to USD 160 (although AAPL traded above USD 184 yesterday). Analysts justified their decision by their expectations of a decrease in demand for new iPhone models. “Our checks remain negative on volumes and mix...

From the beginning of November to the end of December 2023, the dollar index futures price fell by approximately 5.5%, according to the CME exchange. The weakening of the USD was caused by the sentiment of traders who expected the Fed to cut interest rates in March. As a result of the sentiment that prevailed at the end of 2023, stock indices, gold (setting a...

The first Bitcoin block, also known as the genesis block, was mined on January 3, 2009 at 18:15:05 UTC. 15 years have passed and the value of Bitcoin is in the tens of thousands of US dollars. In the first days of 2023, bitcoin was worth about $16,600 — and, as it turned out, this was the minimum. After all, then the BTC/USD rate went up and by the end of 2023...

Navigating the currency markets can be complex, but arming oneself with simple euro trading strategies can provide a clear path through the volatility. This article unpacks straightforward methods designed specifically for trading the euro, offering clarity and practical steps for both novice and seasoned traders looking to refine their approach to this...

USD/CAD is rising and might aim for more gains above the 1.3330 resistance. Important Takeaways for USD/CAD Analysis Today USD/CAD is showing positive signs above the 1.3260 support zone. There was a break above a major bearish trend line with resistance near 1.3260 on the hourly chart at FXOpen. USD/CAD Technical Analysis On the hourly chart of...

GBP/USD declined below the 1.2715 support zone. Important Takeaways for GBP/USD Analysis Today The British Pound started a fresh decline below the 1.2715 support zone. There is a key bearish trend line forming with resistance near 1.2680 on the hourly chart of GBP/USD at FXOpen. GBP/USD Technical Analysis On the hourly chart of GBP/USD at FXOpen, the...

The Japanese yen has been one of the worst performing currencies over the past couple of years. The situation could improve in 2024, writes WSJ. The yen has lost about 20% against the dollar since the end of 2021, underperforming other major currencies. The reason is that Japan's central bank kept interest rates ultra-low while most of its peers raised them...