Market analysis from IC Markets

AUDUSD is approaching its support at 0.7106 (100% & 61.8%% Fibonacci extension, 78.6% Fibonacci retracement, horizontal swing low support) where price could bounce up to its resistance at 0.7197 (38.2% Fibonacci retracement, horizontal swing high resistance). Stochastic (55, 5, 3) is approaching its support at 4.08% where a corresponding bounce could occur.

Weekly Gain/Loss: -0.42% Weekly Close: 1.1551 Weekly perspective: Recently retreating from the underside of a weekly resistance area at 1.1717-1.1862 by way of a bearish pin-bar formation set the stage for further losses last week. Technically speaking, another wave of selling may be in store this week, given the next downside target on this scale is fixed...

USDJPY is approaching its support at 110.49 (100% Fibonacci extension, 61.8% Fibonacci retracement, horizontal overlap support) where price could bounce up to its resistance at 110.90 (38.2% Fibonacci retracement, horizontal pullback resistance). Stochastic (89, 5, 3) is approaching its support at 4.8% where a corresponding bounce could occur.

AUDJPY is approaching its support at 79.18 (61.8% Fibonacci extension x2, 61.8% Fibonacci retracement, horizontal overlap support) where price could bounce up to its resistance at 80.68 (61.8% Fibonacci retracement, horizontal pullback resistance). Stochastic (55, 5, 3) is approaching its support at 3.7% where a corresponding bounce could occur.

EURJPY is approaching its support at 127.94 (61.8% Fibonacci extension, 50% Fibonacci retracement, horizontal pullback support) where price could bounce up to its resistance at 129.69 (61.8% Fibonacci retracement, horizontal swing high resistance). Stochastic (55, 5, 3) is approaching its support at 2% where a corresponding bounce could occur.

EURUSD is approaching its resistance at 1.165 (61.8% Fibonacci extension, 61.8% Fibonacci retracement, overlap resistance) where a reversal to its support at 1.1595 (50% Fibonacci retracement, horizontal pullback support) could occur. Stochastic (55, 5, 3) has reversed off its resistance at 95% where a corresponding drop could occur.

USDCAD reversed off its resistance at 1.3194 (61.8% & 76.4% Fibonacci retracement, horizontal swing high resistance) where it could drop further to its support at 1.3089 (38.2% Fibonacci retracement, horizontal pullback support). Stochastic (89, 5, 3) reversed off its resistance at 97% where a corresponding drop could occur.

CADJPY is approaching its support at 84.34 (61.8% Fibonacci extension, 50%, 76.4% Fibonacci retracement, horizontal overlap support) where price could bounce up to its resistance at 85.34 (50% Fibonacci retracement, horizontal overlap resistance). Stochastic (55, 5, 3) is testing its support at 3.6% where a corresponding bounce could occur.

NZDUSD is testing its resistance at 0.6620 (38.2% & 23.6% Fibonacci retracement, overlap resistance) where a reversal to its support at 0.6561 (61.8% Fibonacci retracement, horizontal pullback support)could occur. Stochastic (55, 5, 3) has reversed off its resistance at 96% where a corresponding drop could occur.

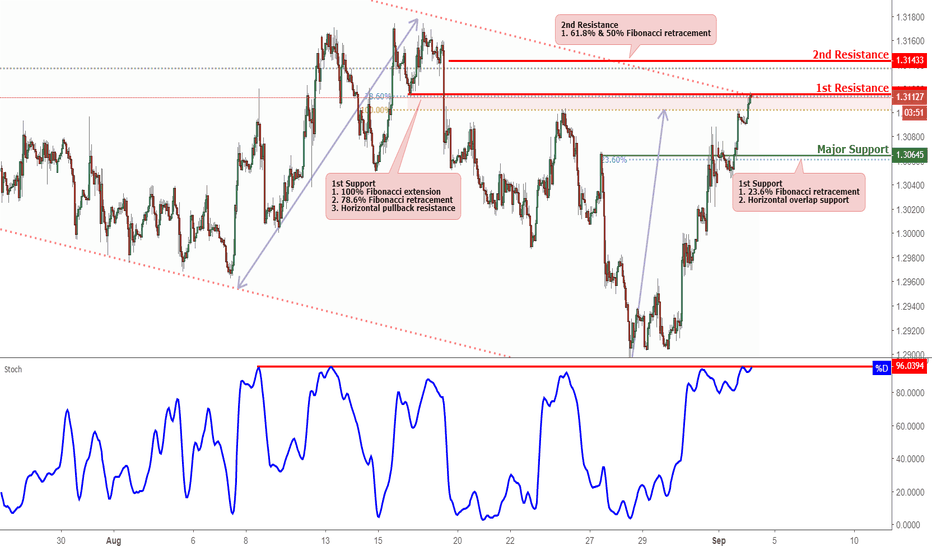

USDCAD reversed off its resistance at 1.3188 (76.4% & 61.8% Fibonacci retracement, horizontal swing high resistance) where it is could drop further to its support at 1.3055 (50% Fibonacci retracement, horizontal swing low support). Stochastic (55, 5, 3) reversed off its resistance at 97% where a corresponding drop could.

EURJPY is approaching its resistance at 129.67 (61.8% & 100% Fibonacci extension, 50% Fibonacci retracement, horizontal overlap resistance) where it could reverse down to its support at 129.04 (50% Fibonacci retracement). Stochastic (55, 5, 3) is approaching its resistance at 97% where a corresponding reversal could occur.

EURCAD is approaching its resistance at 1.5311 (61.8% Fibonacci extension, 76.4% & 38.2% Fibonacci retracement, horizontal overlap resistance) where it could reverse down to its support at 1.5088 (50% Fibonacci retracement). Stochastic (55, 5, 3) is approaching its resistance at 97% where a corresponding reversal could occur.

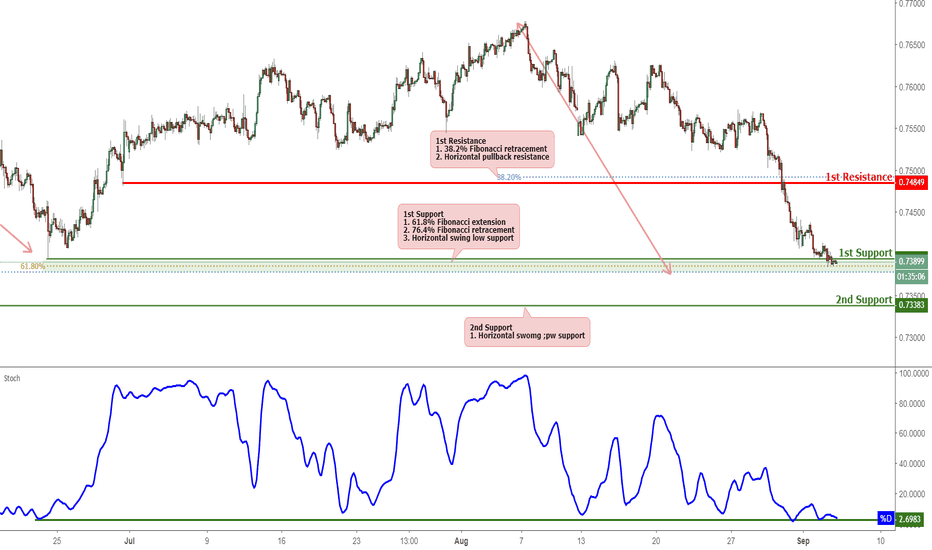

CADCHF is approaching its support at 0.7394 (61.8% Fibonacci extension, 76.4% Fibonacci retracement, horizontal swing low support) where price could bounce up to its resistance at 0.7484 (38.2% Fibonacci retracement, horizontal pullback resistance). Stochastic (89, 5, 3) is testing its support at 2.6% where a corresponding bounce could occur.

EURCAD is testing its resistance at 1.5220 (61.8% & 50% Fibonacci retracement, horizontal overlap resistance) where a reversal to its support at 1.5080 (38.2% Fibonacci retracement, horizontal swing low support) could occur. Stochastic (55, 5, 3) has reversed off its resistance at 97% where a corresponding drop could occur.

AUDUSD is approaching its resistance at 0.7215 (61.8% Fibonacci extension, 23.6% Fibonacci retracement, horizontal overlap resistance) where it could reverse down to its support at 0.7127(61.8% Fibonacci extension). Stochastic (21, 5, 3) is approaching its resistance at 95% where a corresponding reversal could occur.

USDCAD is testing its resistance at 1.3115 (100% Fibonacci extension, 78.6% Fibonacci retracement, horizontal overlap resistance) where a reversal to its support at 1.3064 (23.6% Fibonacci retracement, horizontal overlap support)could. Stochastic (55, 5, 3) has reversed off its resistance at 96% where a corresponding drop could occur.

NZDUSD is approaching its support at 0.6590 (61.8% Fibonacci extension, 76.4% Fibonacci retracement, horizontal overlap support) where price could bounce up to its resistance at 0.6637 (38.2% Fibonacci retracement, horizontal pullback resistance). Stochastic (89, 5, 3) is testing its support at 2.5% where a corresponding bounce could.

AUDNZD bounced nicely off its support at 1.0858(100% Fibonacci extension, 61.8% Fibonacci retracement, horizontal overlap support) where it could potentially bounce to its resistance at 1.0981 (38.2% Fibonacci retracement, horizontal overlap resistance). Stochastic (55, 5, 3) is bounced off its support at 6.8% where a corresponding rise could occur.