Market analysis from Markets.com

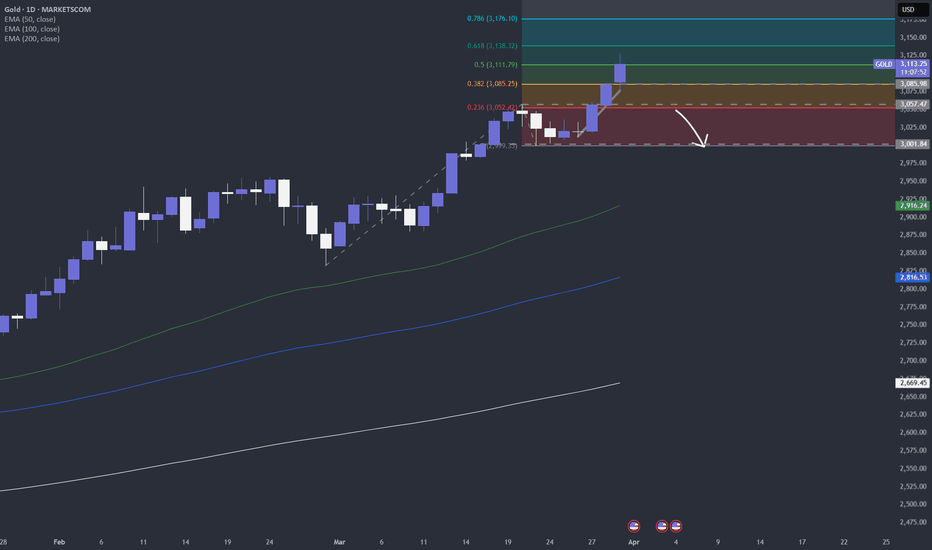

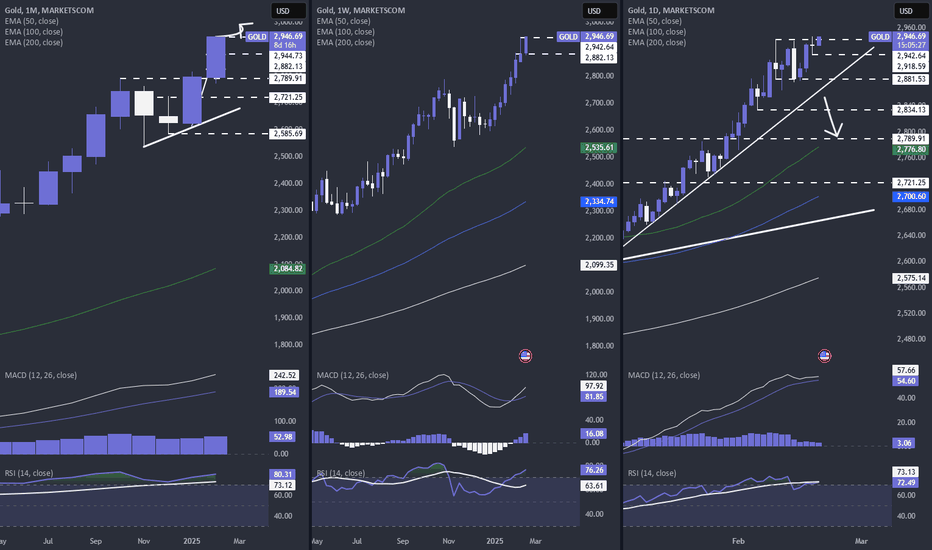

The month of March has been a strong month for the TVC:GOLD bugs. The commodity has been hitting new highs every week. Let's see where the next target could be. MARKETSCOM:GOLD Let us know what you think in the comments below. Thank you. 74.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you...

And once again we are at the spot, where MARKETSCOM:GOLD is trying to go for another all-time high. Will we see another strong push, or is it time for the commodity to slow down and retrace? Let's dig in! TVC:GOLD Let us know what you think in the comments below. Thank you. 74.2% of retail investor accounts lose money when trading CFDs with this provider....

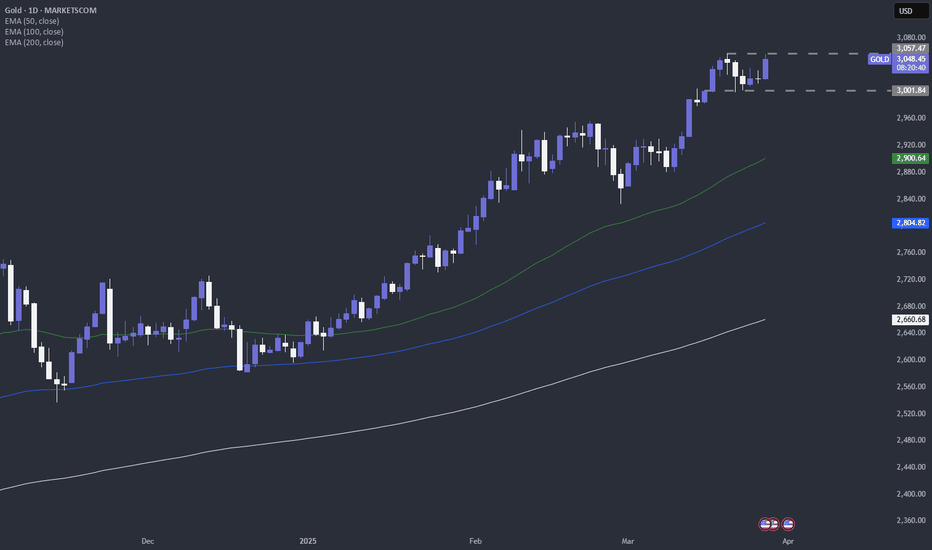

Well, it seems that FX_IDC:EURCAD could be forming either a bullish pennant, or a falling wedge pattern in the near-term. Both patterns tend to result in a bullish breakout. However, we still require a confirmation. Without it, there is still a chance to see a move lower. MARKETSCOM:EURCAD Let us know what you think in the comments below. Thank you. 74.2%...

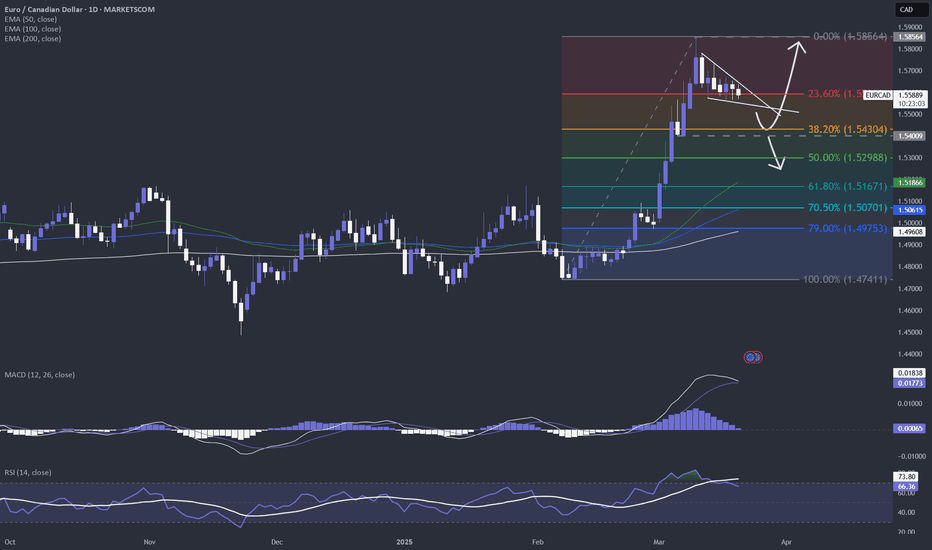

ICEUS:CT1! futures have been on a steady decline for some time now. Could potential further declines in DXY attract buying interest of MARKETSCOM:COTTON ? Let's dig in. Let us know what you think in the comments below. Thank you. 74.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how...

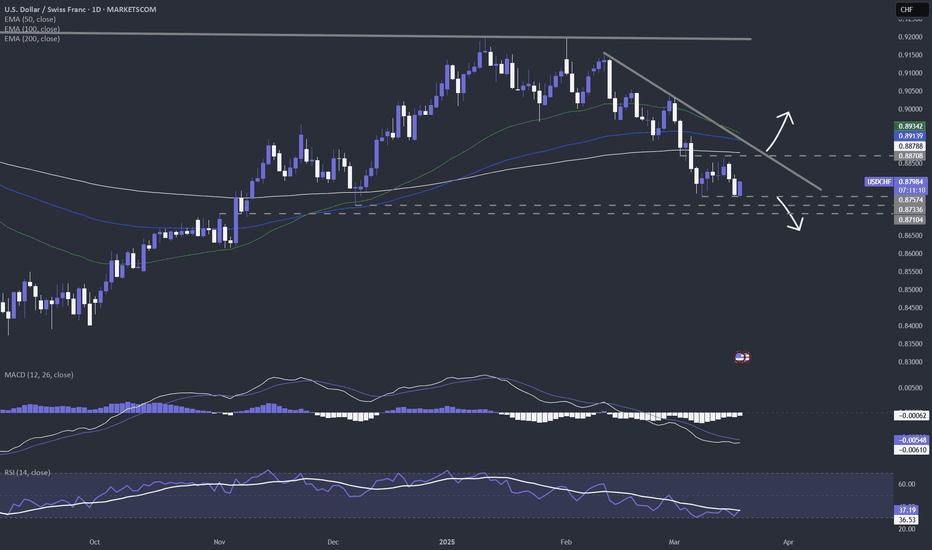

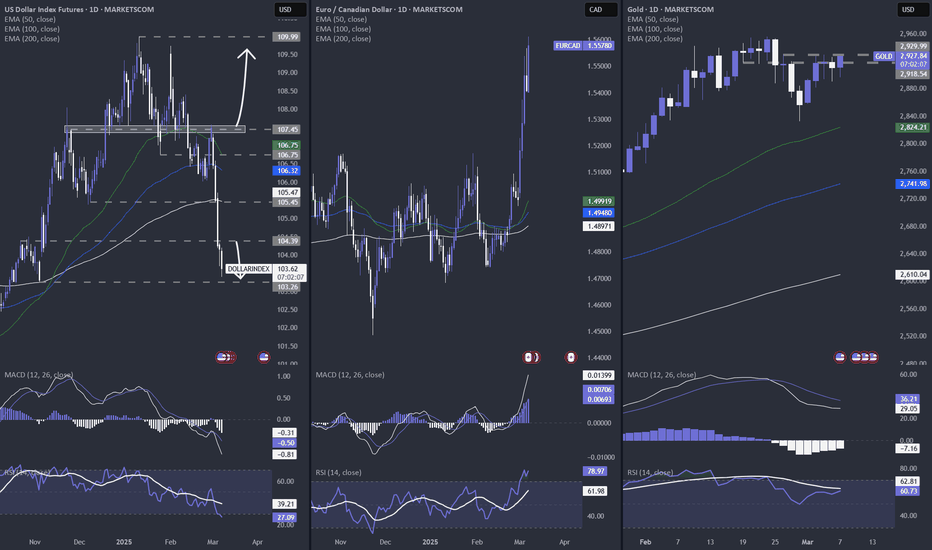

Today we are waiting for the Federal Reserve interest rate decision, where the Bank is expected to keep the rates unchanged. However, it's the press conference, which we are more bothered about. Keep your eyes on TVC:DXY , but if you don't have MARKETSCOM:DOLLARINDEX , then MARKETSCOM:USDCHF will be just as good. Let's dig in. FX_IDC:USDCHF Let us know...

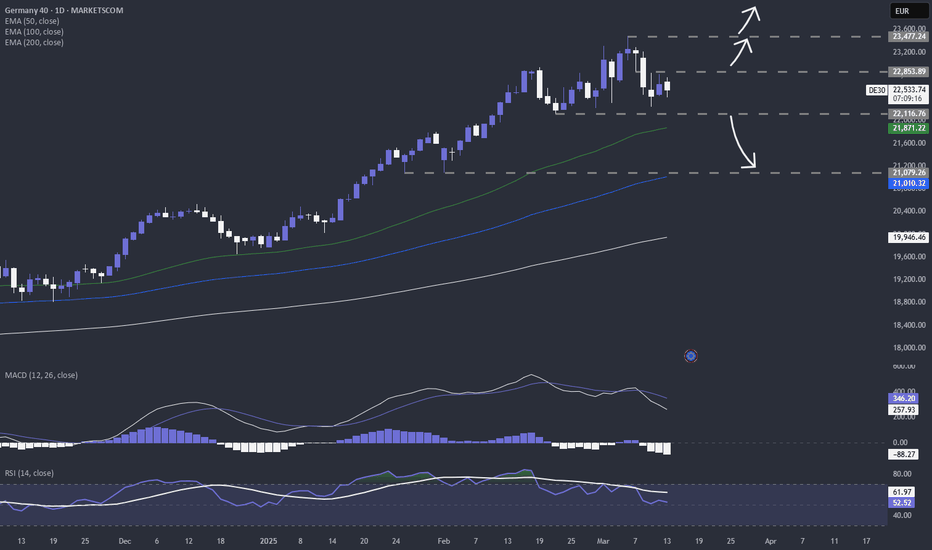

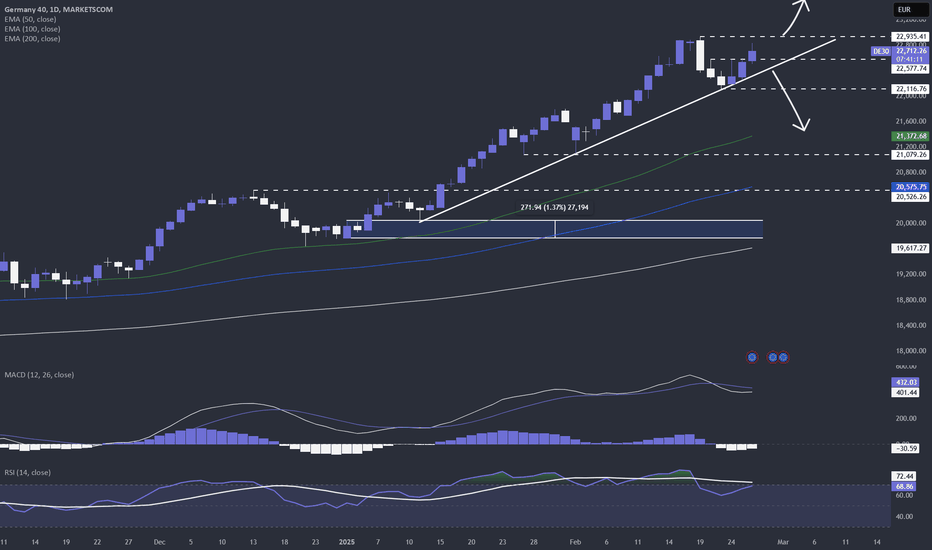

Now it's time for US and EU to have their public tariff battle. Given that wine, champagne and beer are a huge part of EU export into the US, there might be some pain felt among the MARKETSCOM:DE30 bulls. Let's dig in. XETR:DAX Let us know what you think in the comments below. Thank you. 74.2% of retail investor accounts lose money when trading CFDs with...

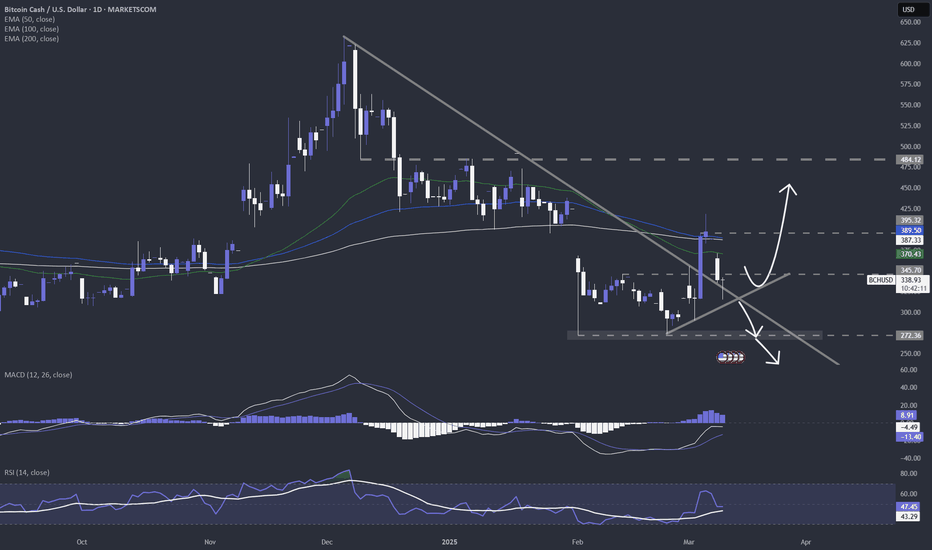

Bitcoin Cash MARKETSCOM:BCHUSD is currently resisting to go for lower lows. Instead, the crypto is forming higher lows. If this remains like this, there might see some buying interest coming through. Let's dig in. CRYPTO:BCHUSD Let us know what you think in the comments below. Thank you. 74.2% of retail investor accounts lose money when trading CFDs with...

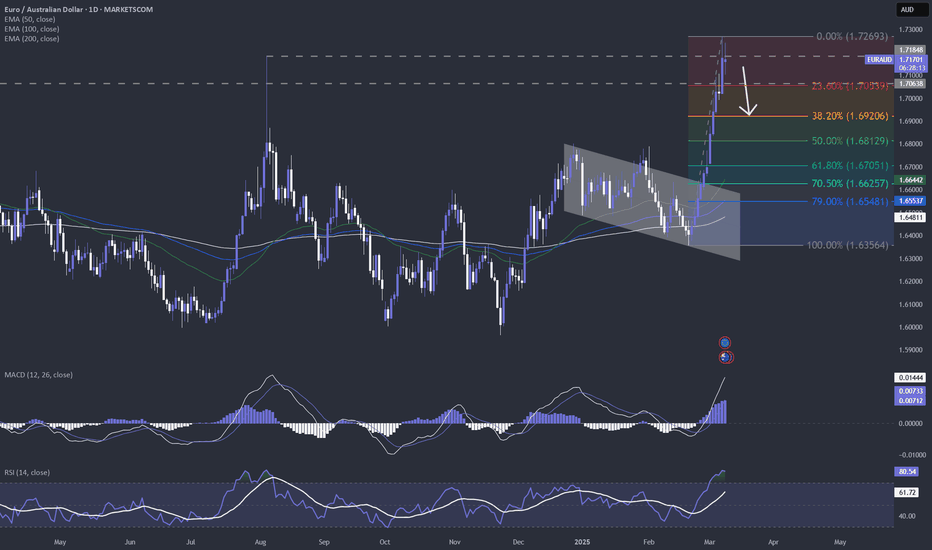

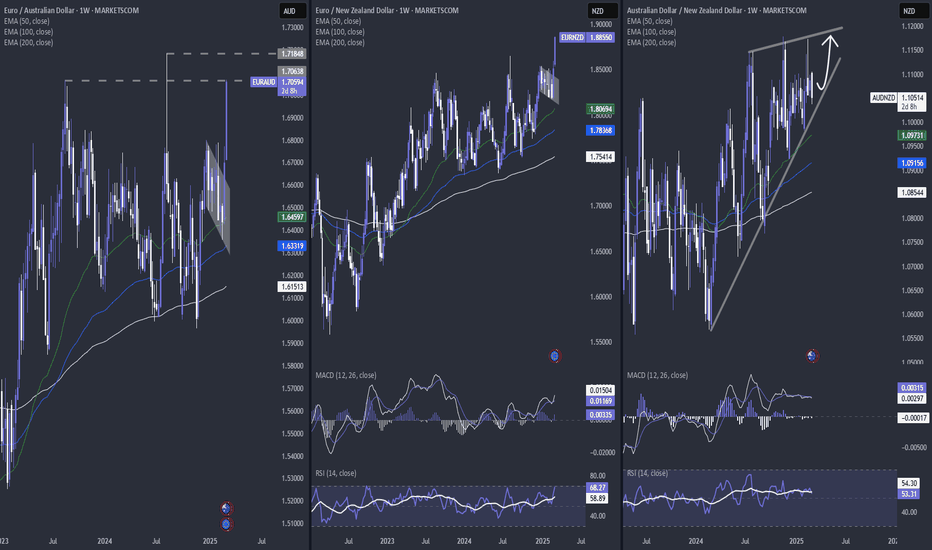

We mentioned this pair last week and told you to keep an eye on the highest point of 2024. And there we are, MARKETSCOM:EURAUD is flirting with that area. If we continue to see the rate struggling to remain above that hurdle, there might be a chance for a slight retracement. What do you think? Let's dig in! FX_IDC:EURAUD Let us know what you think in the...

The numbers are out and, so far, the market is reacting logically. Let's dig in! NASDAQ:AMD NASDAQ:AVGO NASDAQ:NVDA MARKETSCOM:GOLD MARKETSCOM:EURUSD MARKETSCOM:DOLLARINDEX MARKETSCOM:USDCAD Let us know what you think in the comments below. Thank you. 74.2% of retail investor accounts lose money when trading CFDs with this provider....

We are seeing strong move in the euro just before the ECB rate decision on Thursday. However, let's not forget that we will get some action from the RBA and RBNZ in the first days of April. MARKETSCOM:EURAUD and MARKETSCOM:EURNZD are at key resistance areas, which could be interesting for the sellers. That said, we have not received any reversal signal yet, so...

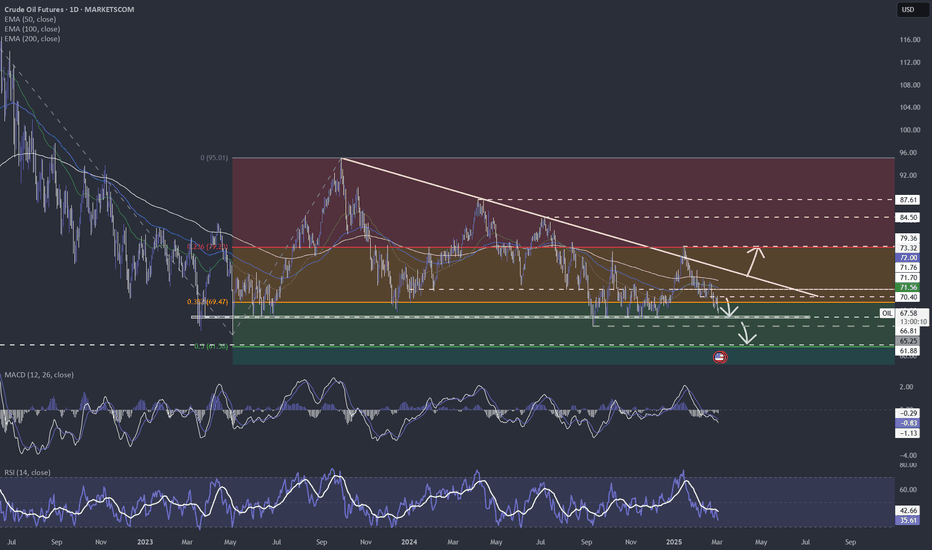

So far, the our stance is unchanged, we remain somewhat bearish on the price of MARKETSCOM:OIL in the near-term. That said, certain criteria still need to be met for us to get comfortable with further declines, especially from the technical side. Let's dig in! TVC:USOIL Let us know what you think in the comments below. Thank you. 74.2% of retail...

Trump's planned tariffs on imports from Mexico and Canada, set to take effect on March 4, along with an additional 10% levy on Chinese products, have heightened concerns about potential countermeasures and escalating trade tensions. As a result, during Monday’s Asian trading session, gold prices surged, as these policies strengthened demand for gold, which is...

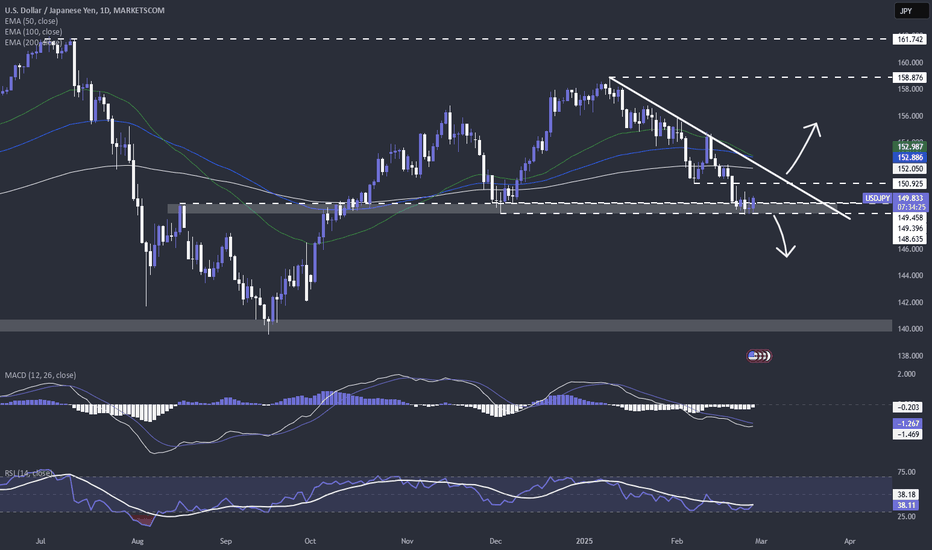

MARKETSCOM:USDJPY is currently flirting with the area around the 149.00 hurdle. In order to shift our attention to some lower areas, a drop below the lowest point of December 2024 is needed. But what about the US PCEs? Let's dig in... FX_IDC:USDJPY What are your thoughts on this? 74.2% of retail investor accounts lose money when trading CFDs with this...

It seems that geopolitics are the key driving force of the MARKETSCOM:DE30 bulls. The current news on a possible end of the war in Ukraine is helping boost trader morale. Let's dig in! XETR:DAX What are your thoughts on this? 74.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how...

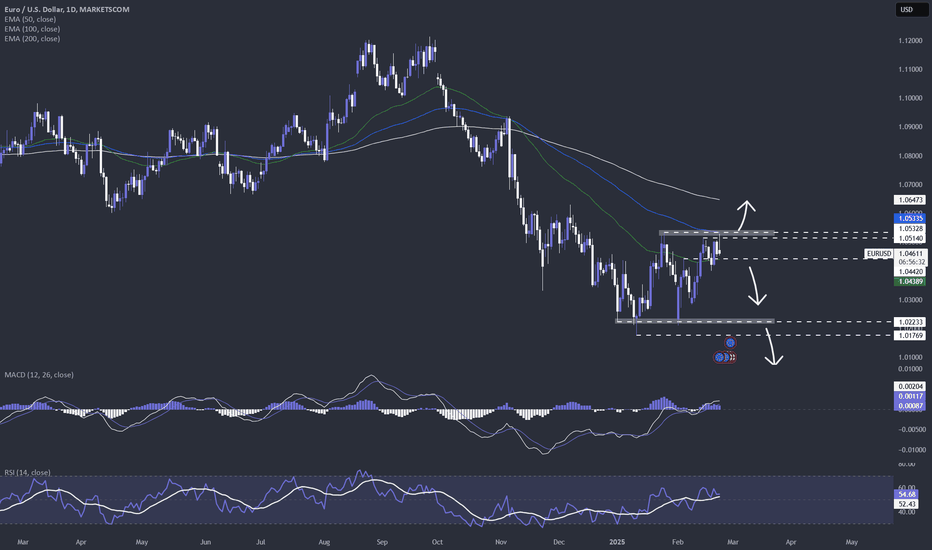

At the moment, we are seeing that the bulls are fighting hard to keep MARKETSCOM:EURUSD elevated. But they are struggling to overcome some key resistance barriers. But the upside doesn't look very promising, due to the upcoming US PCE numbers and the ECB rate decision. Let's dig into the possible near-term outcome scenarios for the $FX_IDC:EURUSD. What are...

On Thursday, the Japanese Yen soared to a two-month high as investors increased their bets, that the Bank of Japan would raise interest rates again later in the year. Meanwhile, the market remains jittery over concerns surrounding new tariff threats from U.S President Donald Trump. BOJ Governor Kazuo Ueda mentioned that he had a routine meeting with Japanese...

The recent performance of TVC:GOLD has been spectacular. It seems, the precious metal can't find a ceiling. MARKETSCOM:GOLD has a good chance of travelling towards the psychological 3000 mark. Let's dig in! 74.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether...

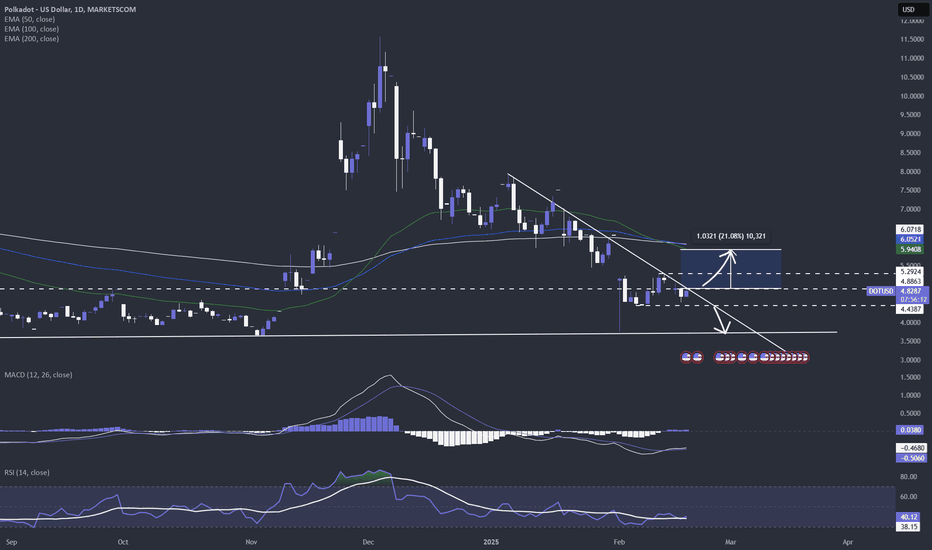

MARKETSCOM:DOTUSD Polkadot is flirting with its short-term downside resistance line drawn from the high of 6th of January. In order to shift our attention to some higher areas, a break of that trendline is required. But even then we will not get too comfortable with higher areas, as the rate might find resistance near our EMAs. Let's dig in! CRYPTO:DOTUSD ...