Market analysis from OANDA

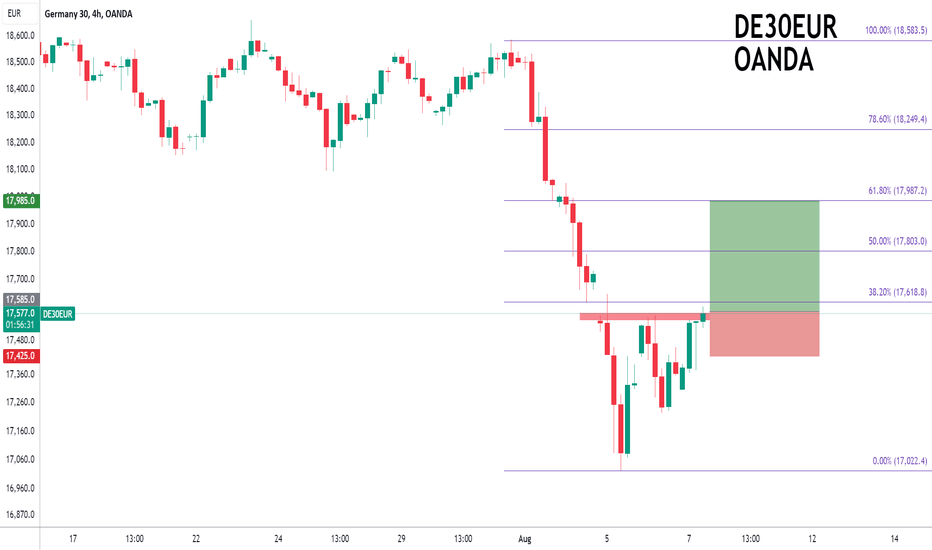

GER40 - 24h expiry Bullish divergence is expected to support prices. The bullish engulfing candle on the 4 hour chart the positive for sentiment. We are trading at oversold extremes. A higher correction is expected. The bias is to break to the upside. A break of the recent high at 17565 should result in a further move higher. We look to Buy a break of 17585...

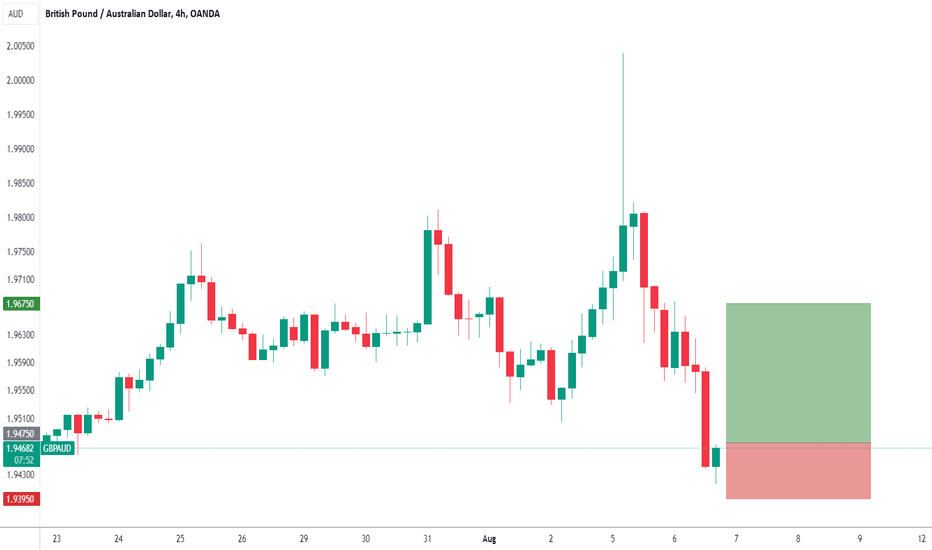

GBPAUD - 24h expiry The primary trend remains bullish. A lower correction is expected. Price action has formed an expanding wedge formation. Preferred trade is to buy on dips. Bespoke support is located at 1.9475. We look to Buy at 1.9475 (stop at 1.9395) Our profit targets will be 1.9675 and 1.9715 Resistance: 1.9625 / 1.9690 / 1.9760 Support: 1.9475 /...

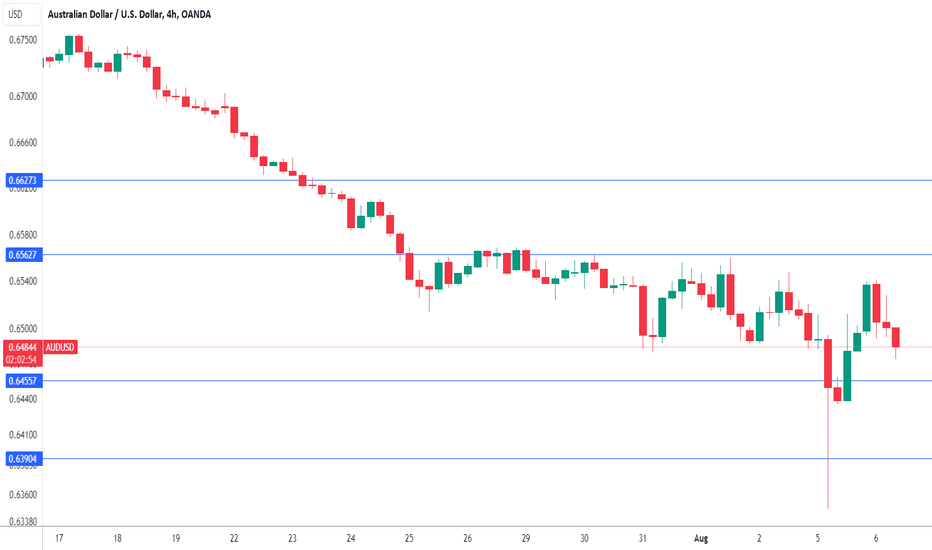

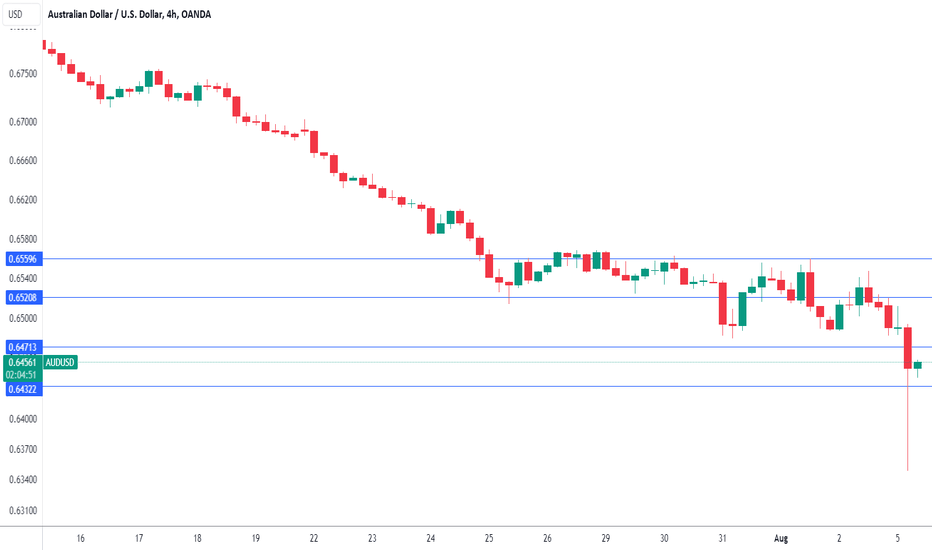

The Australian dollar gained ground earlier but has reversed directions and has edged lower. In the European session, AUD/USD is trading at 0.6778, down 0.24% at the time of writing. The Reserve Bank of Australia held the cash rate at 4.35% for a seventh straight time today. The markets had fully priced in this move and the Australian dollar’s reaction has been...

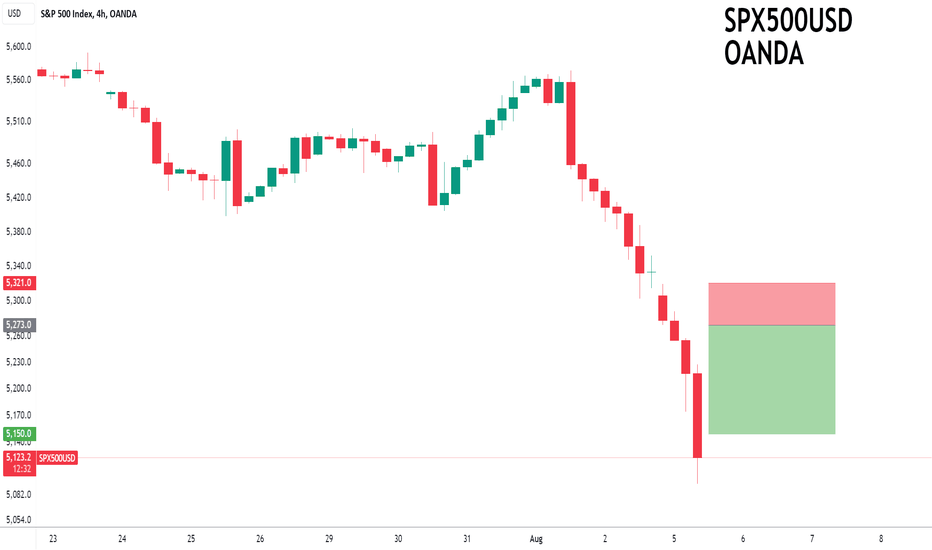

US500 - 24H expiry Traded to the lowest level in 12 weeks. We have a 78.6% Fibonacci pullback level of 5136 from 4930 to 5680. There is no clear indication that the downward move is coming to an end. The sequence for trading is lower lows and highs. We look to set shorts at our bespoke indicator level (5273). We look to Sell at 5273 (stop at 5321) Our...

The Australian dollar has taken a nasty spill to start off the trading week. AUD/USD dropped as much has 2.5% in the Asian session and fell to its lowest levels since November 2023. The Aussie has pared those losses and is down 0.96% at the time of writing, trading at 0.6448. The Reserve Bank of Australia meets early Tuesday and it’s a virtual certainty that the...

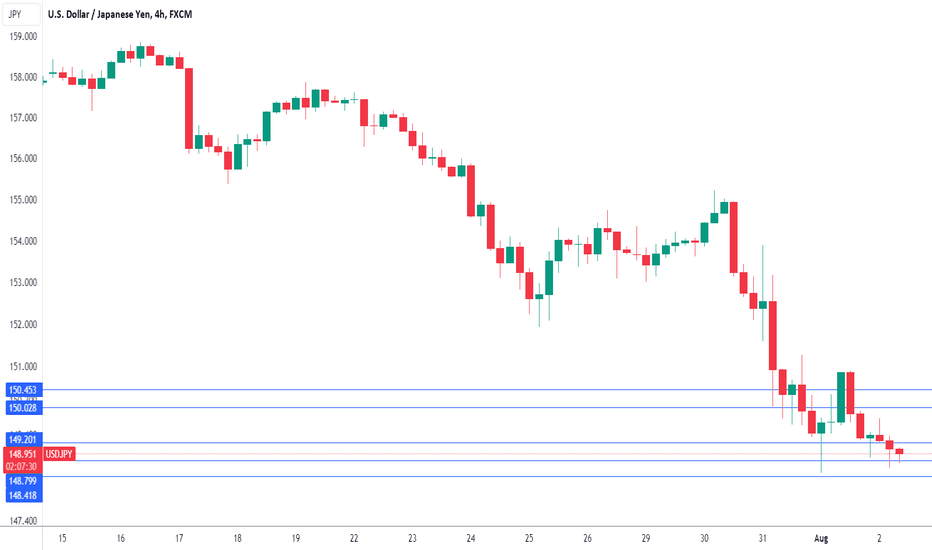

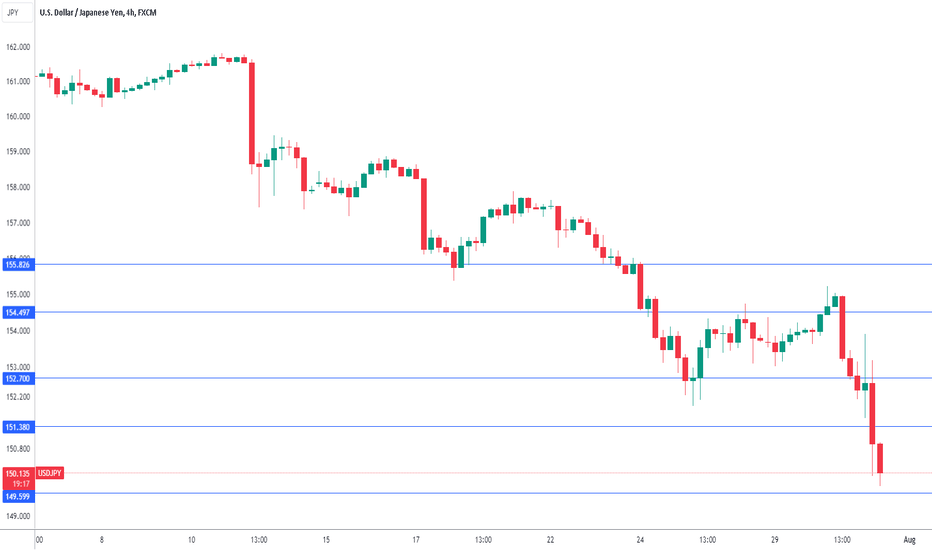

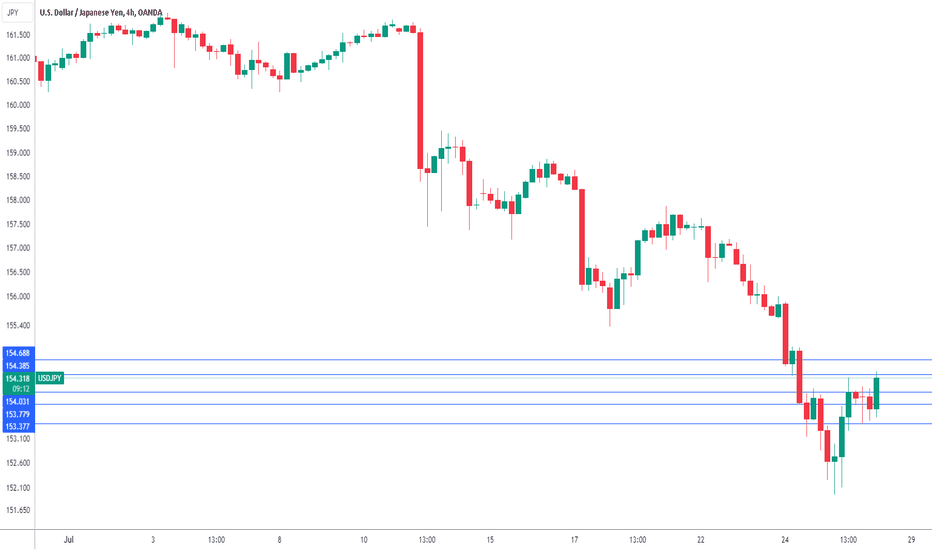

The Japanese yen continues to rally. USD/JPY is trading at 148.86 in the European session, down 0.31% on the day at the time of writing. On Thursday, the yen strengthened as much as 148.50, its best showing since May 11. Only three weeks ago, the yen looked dead in the water. USD/JPY was trading just shy of 162, its highest level in almost four decades. Since...

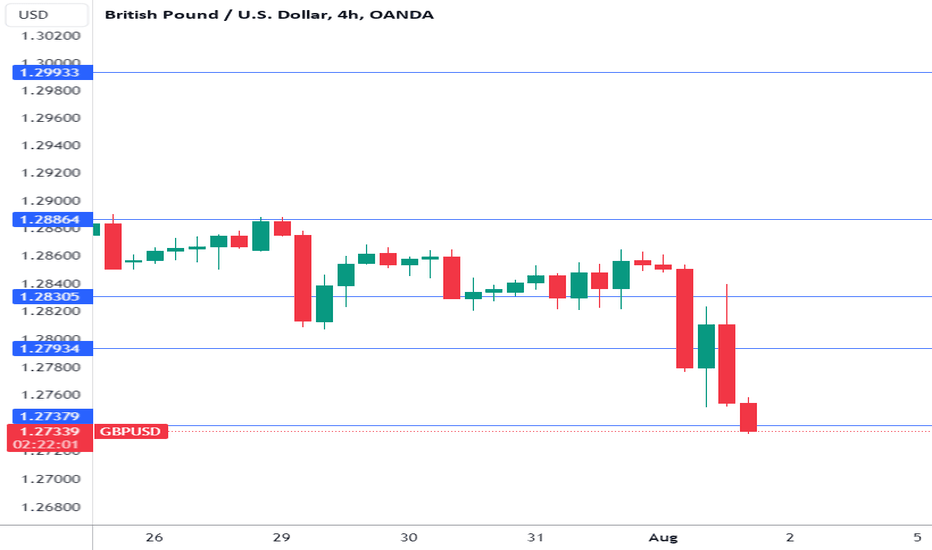

The British pound has fallen sharply on Thursday. GBP/USD is trading at 1.2774 in the North American session, down 0.63% on the day. Earlier, GBP/USD fell to 1.2750, its lowest level in a month. For those readers who like to follow the central banks (as the writer does), it has been a very interesting week. The Bank of Japan raised interest rates, the Federal...

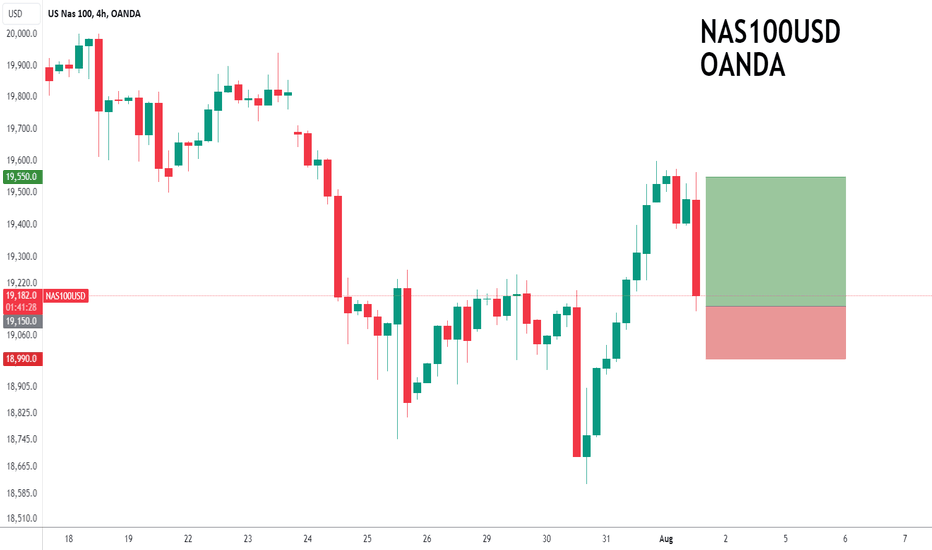

US100 - 24h expiry Previous resistance level of 19262 broken. Short term bias is mildly bullish. A lower correction is expected. We look to buy dips. Further upside is expected although we prefer to buy into dips close to the 19200 level. We look to Buy at 19200 (stop at 18990) Our profit targets will be 19550 and 19650 Resistance: 19895 / 20790 /...

The Japanese yen continues to sparkle. USD/JPY is trading at 150.27 in the European session, down 1.62% on the day at the time of writing. Earlier, the yen strengthened to 150.04, its highest level against the dollar since March 19. The Bank of Japan showed an aggressive side rarely seen at today’s meeting. The BoJ raised the benchmark rate to around 0.25%, up...

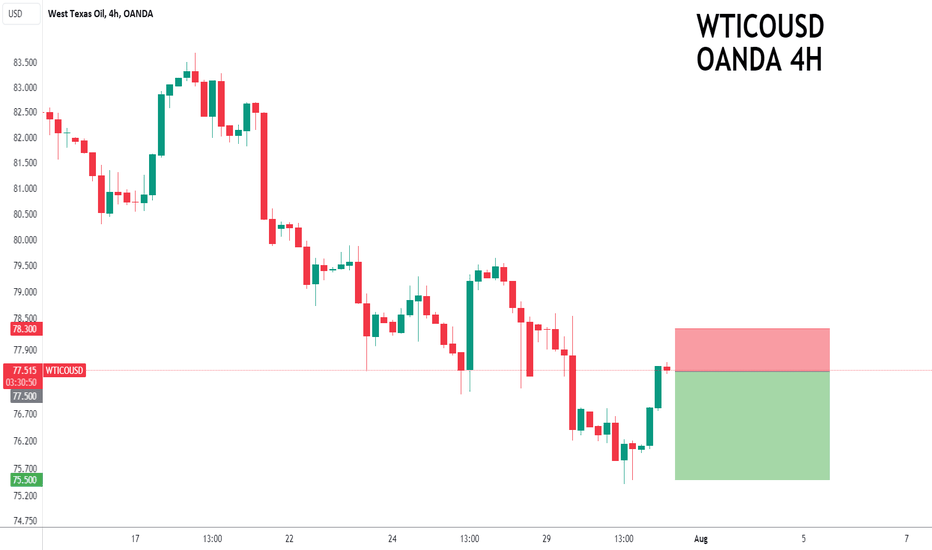

WTI - 24h expiry Our short term bias remains negative. Our bespoke support of 77.06 has been clearly broken. Previous support at 77.50 now becomes resistance. We look for a temporary move higher. We look for losses to be extended today. We look to Sell at 77.50 (stop at 78.30) Our profit targets will be 75.50 and 75.15 Resistance: 77.13 / 77.50 /...

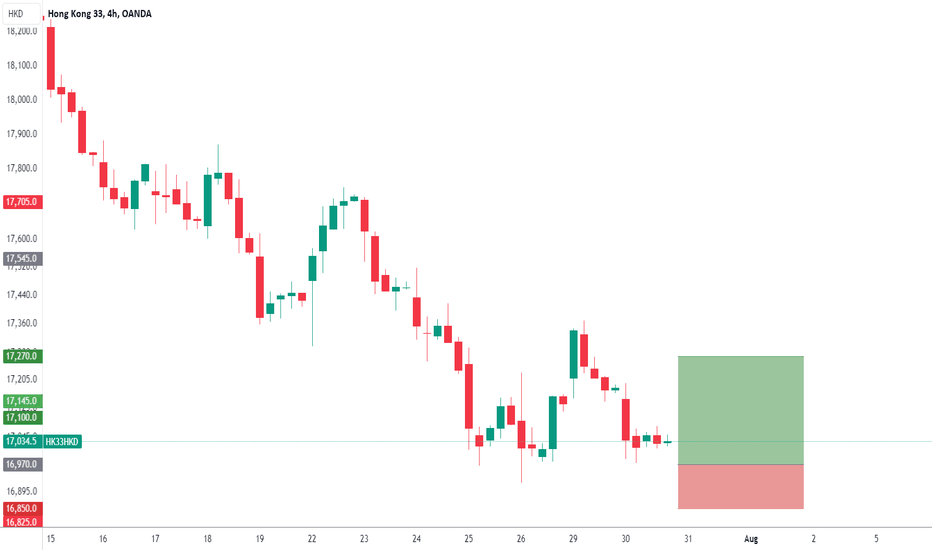

HS50 - 24h expiry Price action has continued to trend strongly lower and has stalled at the previous support near 16917. Price action looks to be forming a bottom. A Doji style candle has been posted from the base. This is positive for short term sentiment and we look to set longs at good risk/reward levels for a further correction higher. Although the...

NZDUSD - 24h expiry There is no clear indication that the downward move is coming to an end. Although we remain bearish overall, a correction is possible without impacting the trend lower. Risk/Reward would be poor to call a sell from current levels. A move through 0.5865 will confirm the bearish momentum. The measured move target is 0.5835. We look to Sell...

The Japanese yen continues to show volatility but has closed right where it started over the past few sessions. USD/JPY is trading at 153.65 in the European session, up 0.04% on the day. The yen is coming off an excellent week, surging 2.3% against the US dollar. We’re unlikely to see much movement from the yen today, as there are no US releases on the calendar...

The Japanese yen has hit the brakes on this week’s impressive rally. USD/JPY is trading at 154.34 in the European session, up 0.30% on the day. On Thursday, the yen climbed as much as 1.3% but gave up all of those gains after the strong US GDP report. Still, the yen is up 1.9% this week. Tokyo Core CPI rose to 2.2% y/y in July, a notch higher than the 2.1% gain...

The Canadian dollar is almost unchanged on Wednesday, after the Bank of Canada cut rates at today’s meeting. In the North American session, USD/CAD is trading at 1.3778, up 0.05% on the day at the time of writing. The Bank of Canada lowered rates by 25 basis points, bringing the key interest rate to 4.50%. The markets had priced in a rate cut at close to 90%, so...

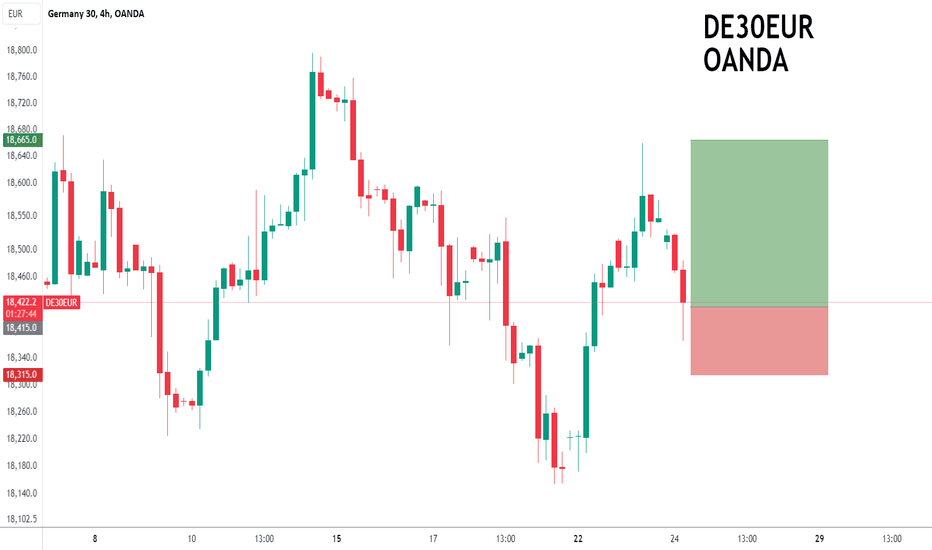

GER40 - 24h expiry A Morning Doji Star formation has been posted at the low. A Doji style candle has been posted from the base. The primary trend remains bullish. Daily signals are bullish. Yesterday's Marabuzo is located at 18415. We look to buy dips. We look to Buy at 18415 (stop at 18315) Our profit targets will be 18665 and 18725 Resistance: 18509 /...

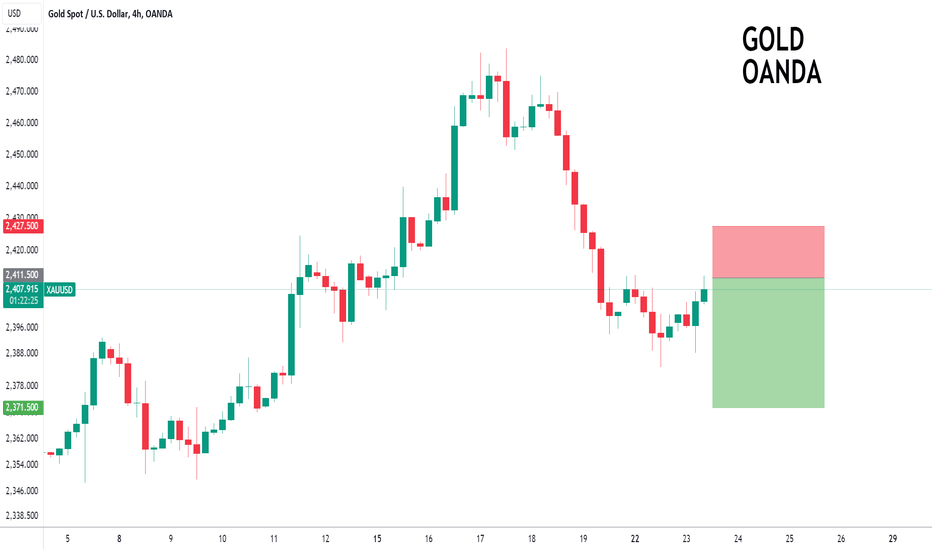

Gold - 24h expiry Posted a Double Top formation. Short term bias has turned negative. 5 negative daily performances in succession. 20 4hour EMA is at 2411.5. We look for a temporary move higher. We look to Sell at 2411.5 (stop at 2427.5) Our profit targets will be 2371.5 and 2361.5 Resistance: 2404.0 / 2412.2 / 2420.0 Support: 2383.9 / 2370.0 /...

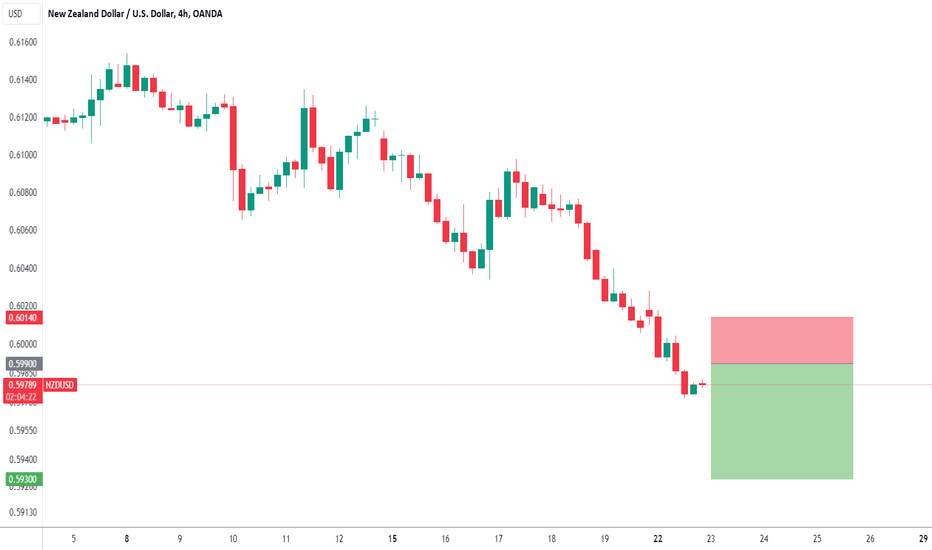

NZDUSD - 24h expiry There is no indication that the selloff is coming to an end. Although we remain bearish overall, a correction is possible without impacting the trend lower. Risk/Reward would be poor to call a sell from current levels. A move through 0.5975 will confirm the bearish momentum. The measured move target is 0.5950. We look to Sell at 0.5990...