Market analysis from OANDA

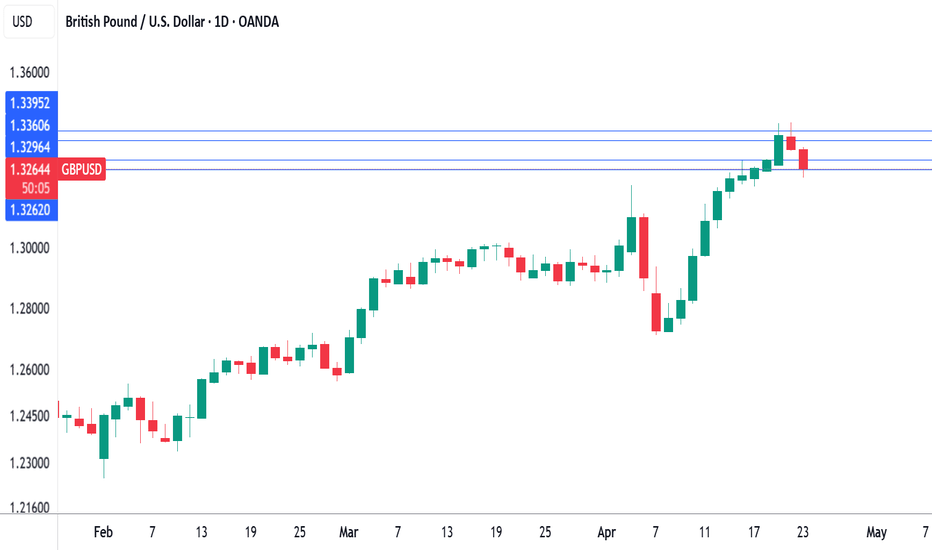

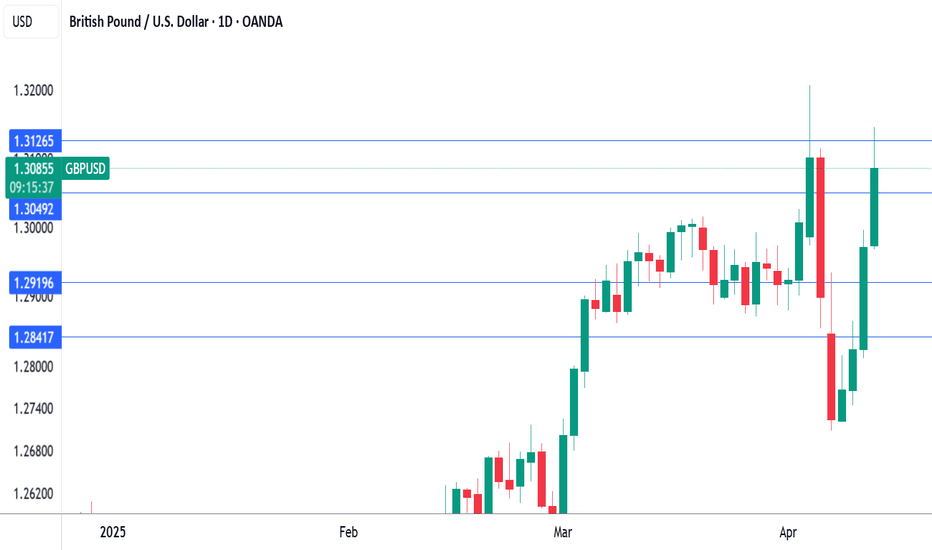

The British pound dropped as much as 0.7% earlier today and is under pressure. In the North American session, GBP/USD is trading at 1.3265, down 0.45% on the day. The pound has taken advantage of broad US dollar weakness recently, rising 3% in the month of April. On Tuesday, the pound climbed as high as 1.3423, its highest level since September 2024. UK PMIs...

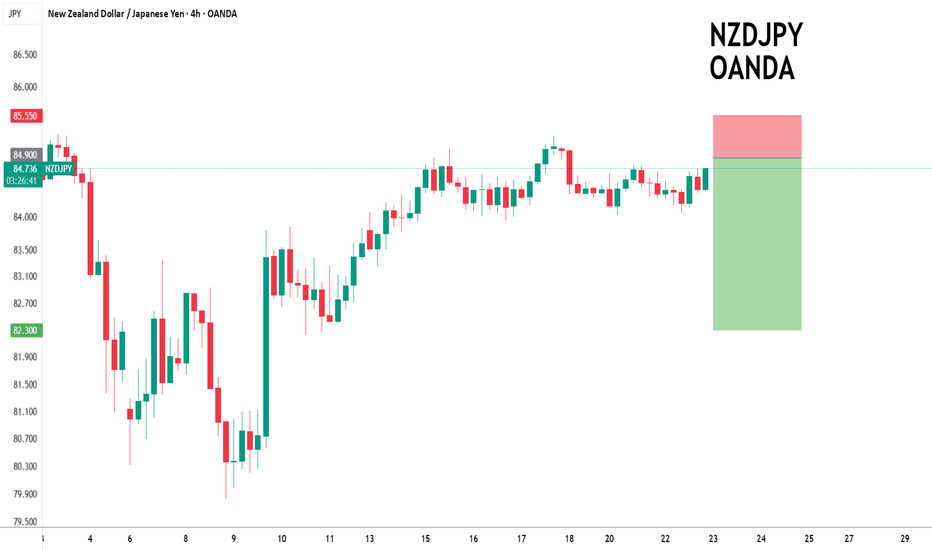

NZDJPY - 24h expiry The primary trend remains bearish. The rally is close to a correction count on the daily chart. We look for a temporary move higher. Preferred trade is to sell into rallies. Bespoke resistance is located at 84.90. We look to Sell at 84.90 (stop at 85.55) Our profit targets will be 82.30 and 82.00 Resistance: 84.75 / 85.50 /...

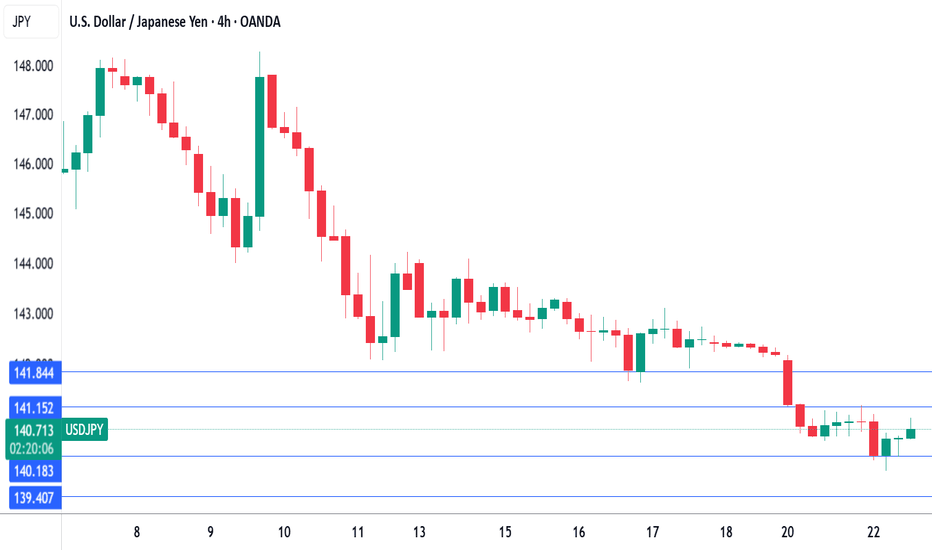

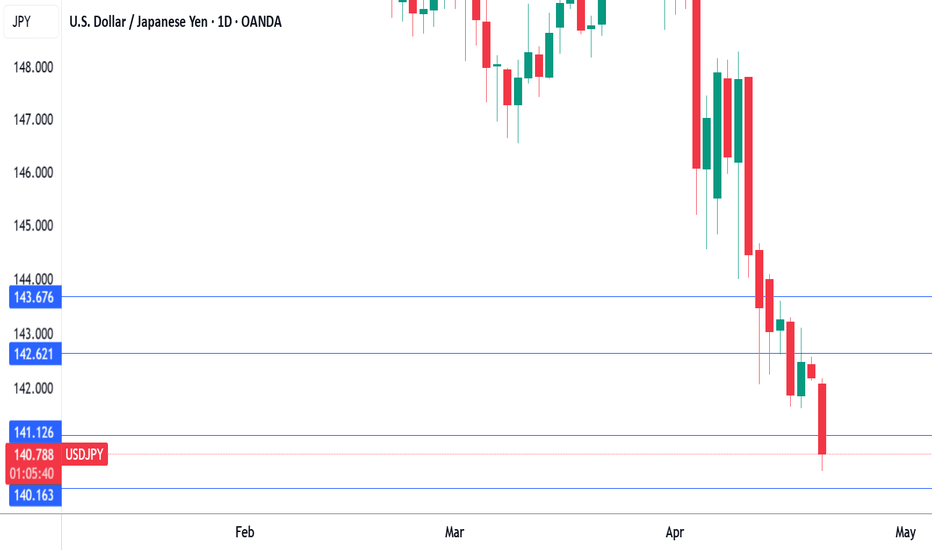

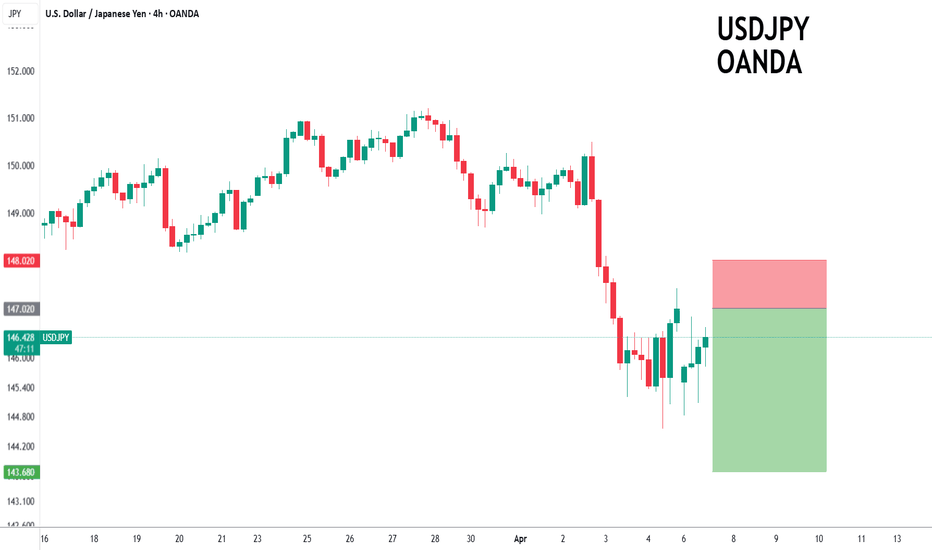

The Japanese yen has rallied for a third straight day. In the European session, USD/JPY is trading at 140.38, down 0.33% on the day. The yen has climbed 1.3% since Thursday, as the US dollar is under pressure against the major currencies. BoJ Core CPI, a key inflation indicator, remained at 2.2% for a third consecutive month in March, shy of the forecast of 2.4%....

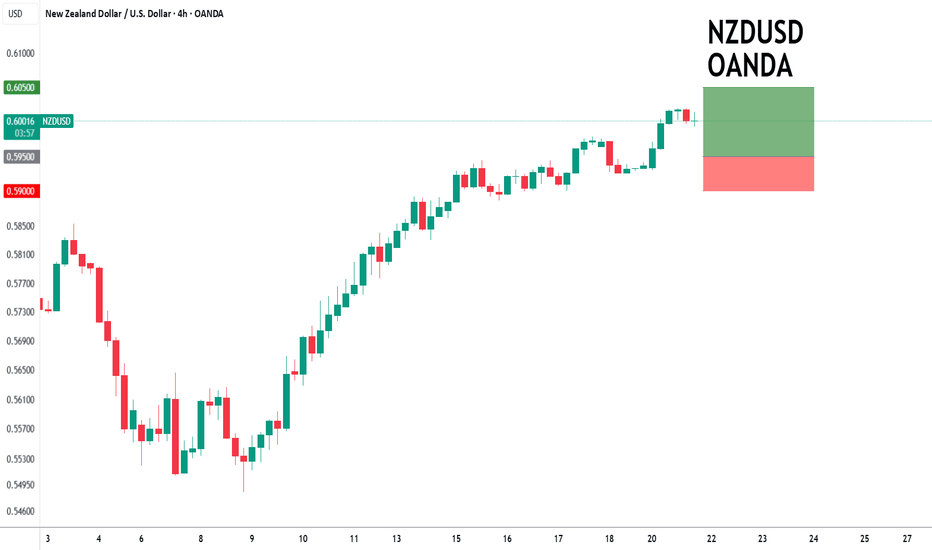

NZDUSD - 24h expiry There is no indication that the rally is coming to an end. Although we remain bullish overall, a correction is possible with plenty of room to move lower without impacting the trend higher. Risk/Reward would be poor to call a buy from current levels. A move through 0.6025 will confirm the bullish momentum. The measured move target is...

The Japanese yen came flying out of the gates on Monday. In the European session, USD/JPY is trading at 141.00, down 0.79%. Earlier the yen strengthened to 140.47, its strongest level since Sep. 2024. The US dollar has posted losses against the major currencies on Monday, including against the yen. Investors gave the US dollar a thumbs down after President...

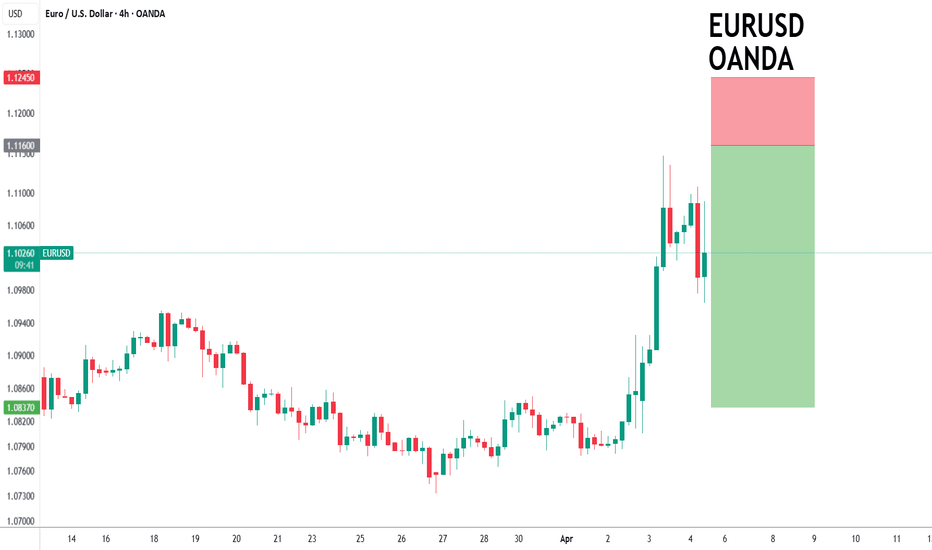

The euro is showing little movement on Friday. In the European session, EUR/USD is trading at 1.1369, up 0.09% on the day. The ECB lowered its deposit facility rate on Thursday by a quarter-point, bring the rate to 2.25%. This marked the seventh rate cut since the ECB started its easing cycle in June 2024 and interest rates are now at their lowest since December...

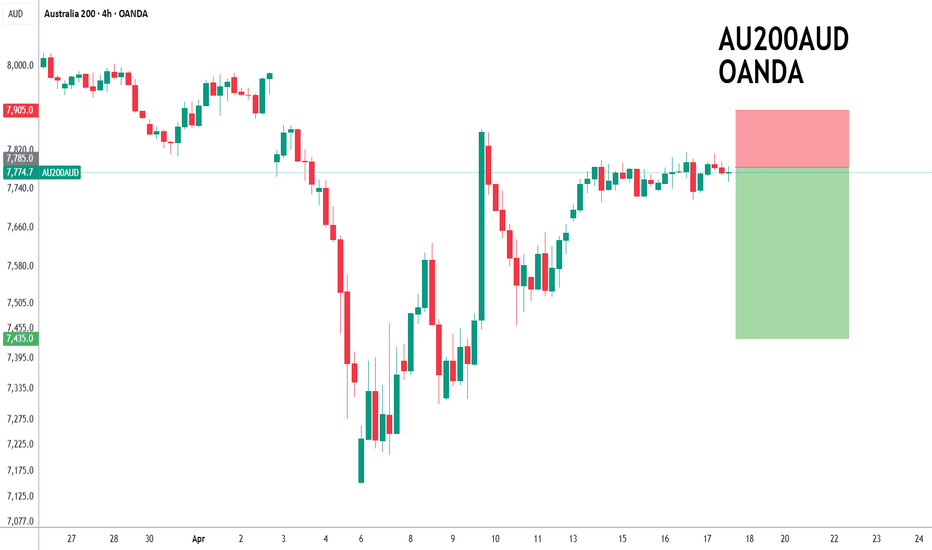

ASX200 - 24h expiry Daily signals are bearish. Daily signals for sentiment are at oversold extremes. The lack of interest is a concern for bulls. Offers ample risk/reward to sell at the market. 20 1day EMA is at 7766. We look to Sell at 7785 (stop at 7905) Our profit targets will be 7435 and 7365 Resistance: 7817 / 7865 / 7987 Support: 7716 / 7600 /...

NZDJPY - 24h expiry The primary trend remains bearish. The rally is close to a correction count on the daily chart. The RSI is trending lower. Bearish divergence is expected to cap gains. Bespoke resistance is located at 84.50. Preferred trade is to sell into rallies. We look to Sell at 84.50 (stop at 85.15) Our profit targets will be 81.90 and 81.50...

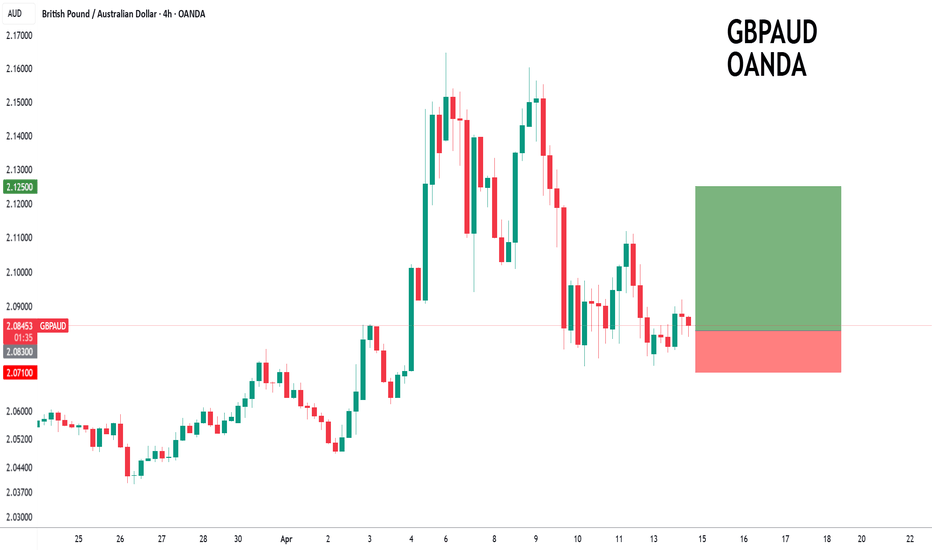

GBPAUD - 24h expiry The primary trend remains bullish. Bullish divergence is expected to support prices. The RSI is trending higher. Preferred trade is to buy on dips. Bespoke support is located at 2.0830. We look to Buy at 2.0830 (stop at 2.0710) Our profit targets will be 2.1250 and 2.1320 Resistance: 2.1000 / 2.1200 / 2.1250 Support: 2.0730 / 2.0620...

The British pound is up sharply on Friday, extending its rally for a fourth straight day. In the European session, GBP/USD is trading at 1.3088, up 0.94% on the day. The pound has surged 2.9% since Monday. UK GDP higher than expected February with a gain of 0.5% m/m. This followed a revised 0% reading in January and beat the market estimate of 0.1%. This was the...

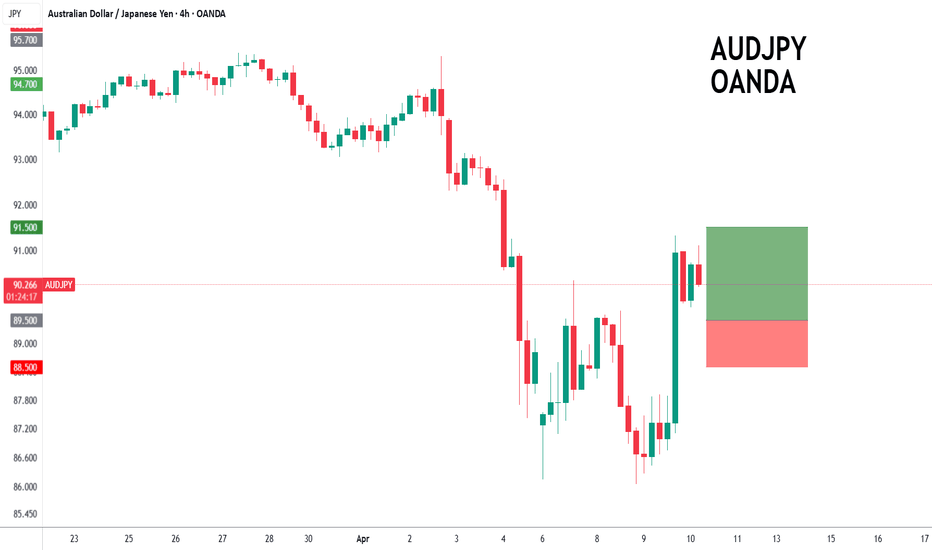

AUDJPY - 24h expiry There is no indication that the rally is coming to an end. Further upside is expected. Risk/Reward would be poor to call a buy from current levels. A move through 91.00 will confirm the bullish momentum. The measured move target is 92.00. We look to Buy at 89.50 (stop at 88.50) Our profit targets will be 91.50 and 92.00 Resistance:...

The Japanese yen continues to make inroads against the US dollar. In the North American session, USD/JPY is up 1.1% on Wednesday, trading at 144.60. Earlier, the yen strengthened to 143.98, its strongest level since Sept. 2024. Bank of Japan Governor Kazuo Ueda said on Wednesday that the central bank will have to determine the impact of US trade policy on growth...

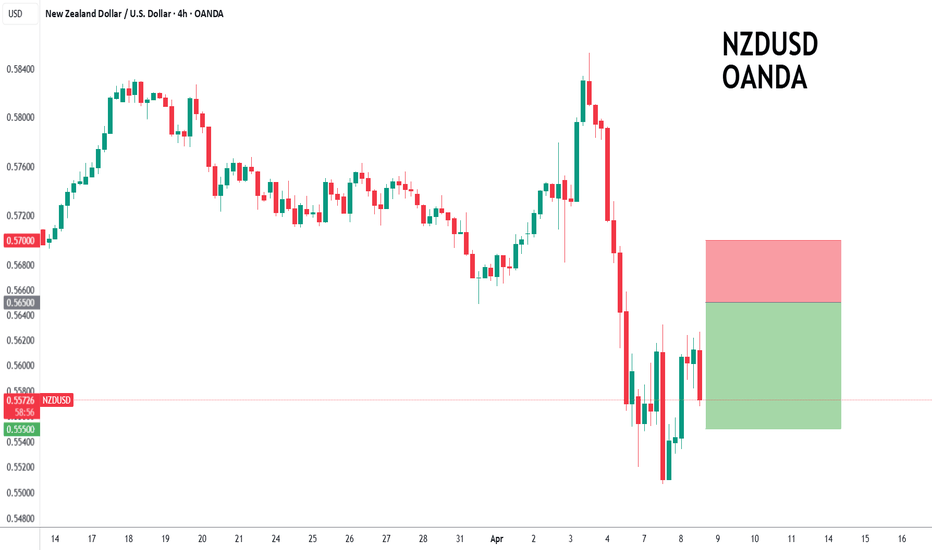

NZDUSD - 24h expiry There is no indication that the selloff is coming to an end. A higher correction is expected. Risk/Reward would be poor to call a sell from current levels. A move through 0.5600 will confirm the bearish momentum. The measured move target is 0.5525. We look to Sell at 0.5650 (stop at 0.5700) Our profit targets will be 0.5550 and 0.5525...

The New Zealand dollar has rebounded on Tuesday. NZD/USD is trading at 0.5615, up 1.3% on the day. This follows a 5% plunge over the past two days. The Reserve Bank of New Zealand is widely expected to lower interest rates by a quarter-point at its rate meeting on Wednesday. The markets have priced in a quarter-point cut at 75% and a jumbo half-point cut at 25%....

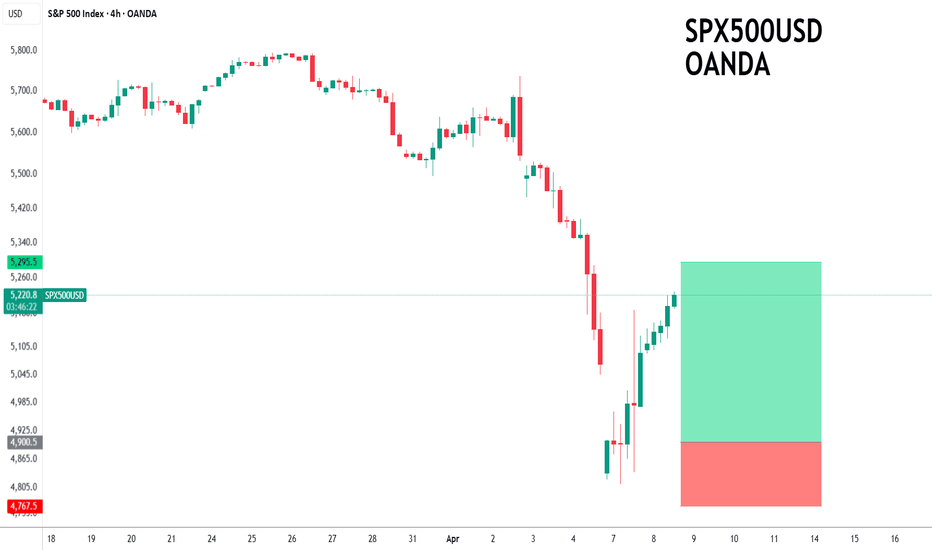

SPX500USD - 24h expiry Price action looks to be forming a bottom. A Doji style candle has been posted from the base. Setbacks should be limited to yesterday's low. We look to buy dips. Risk/Reward would be poor to call a buy from current levels. We look to Buy at 4900.5 (stop at 4767.5) Our profit targets will be 5295.5 and 5365.5 Resistance: 5219.6 /...

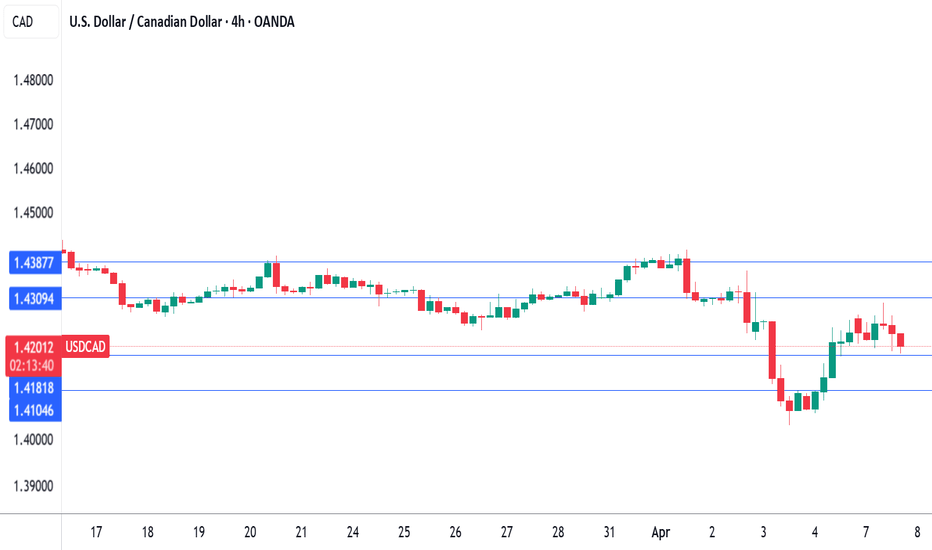

The Canadian dollar has stabilized on Monday after declining close to 1% on Friday. In the North American session, USD/CAD is trading at 1.4225, up 0.23% on the day. It has been a roller-coaster for the Canadian dollar, which jumped 1.1% on Thursday but gave up almost all of the gains a day later. Canada's economy shed 32.6 thousand jobs in March, the biggest...

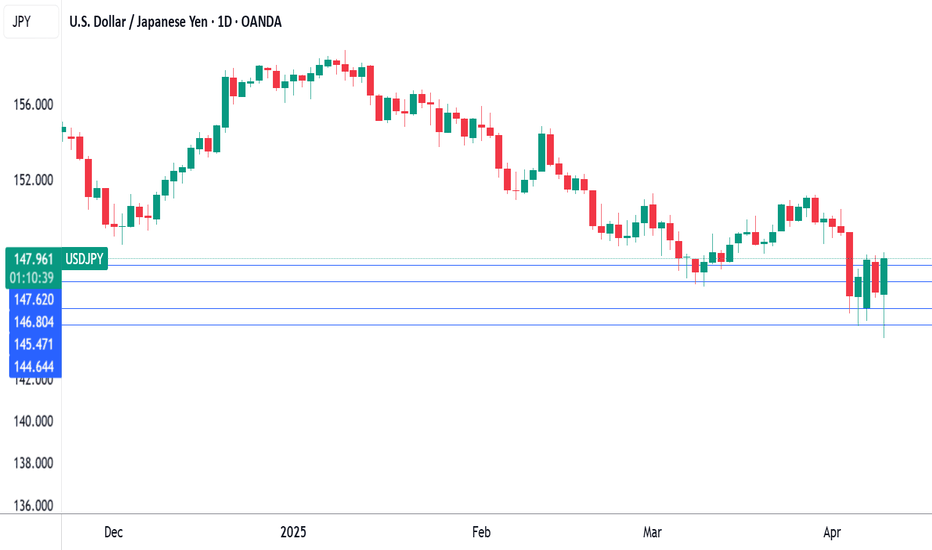

USDJPY - 24h expiry The rally was sold and the dip bought resulting in mild net gains yesterday. Selling posted in Asia. We have a Gap open at 147.02 from 04.04 to 06.04. The medium term bias remains bearish. A Fibonacci confluence area is located at 143.68. Preferred trade is to sell into rallies. We look to Sell at 147.02 (stop at 148.02) Our profit...

EURUSD - Intraday Continued upward momentum from 1.0778 resulted in the pair posting net daily gains yesterday. Trades at the highest level in 6 months. A Fibonacci confluence area is located at 1.1105. Our medium term bias is bearish below 1.1014 towards 1.0700. There is scope for mild buying at the open but gains should be limited. We look to Sell at...