Market analysis from OANDA

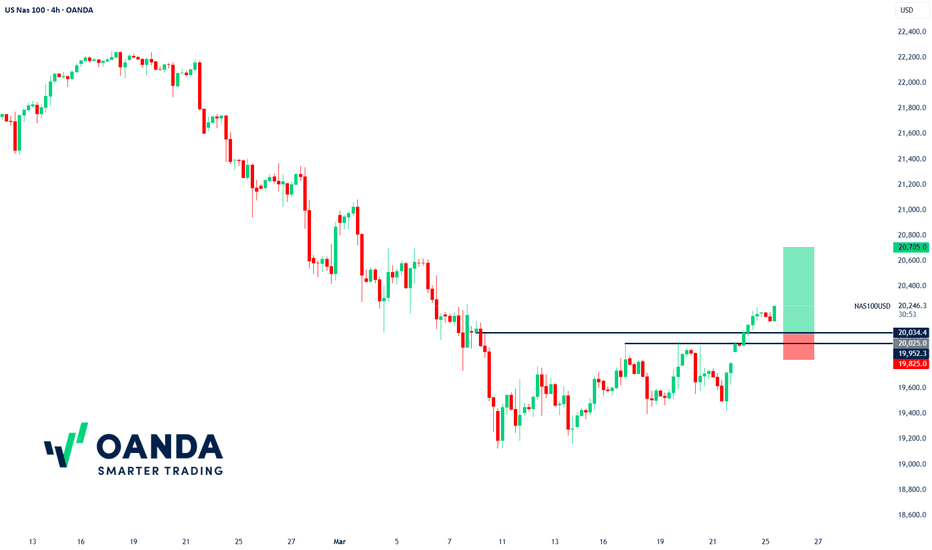

🚀 OANDA:NAS100USD Buy Idea: Bullish Momentum Targets 20705 💹 - 24h expiry OANDA:NAS100USD - We look to Buy at 20025 Stop Loss: 19825 Target 1: 20705 Target 2: 20730 Resistance: 20234, 20705, 20730 Support: 20025, 19423, 19125 Technical Setup: 📈 Continued upward momentum from 19424 resulted in the pair posting net daily gains...

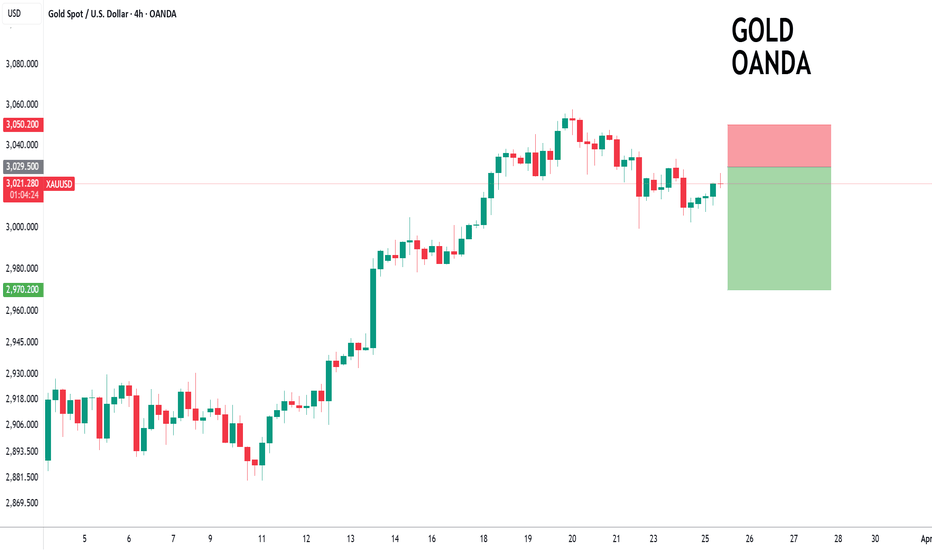

XAUUSD - 24h expiry Previous support at 3030 now becomes resistance. Although the bulls are in control, the stalling positive momentum indicates a turnaround is possible. Posted a Bearish Inverted Hammer Bottom on the Daily chart. A higher correction is expected. The RSI is trending lower. We look to Sell at 3029.5 (stop at 3050.2) Our profit targets will...

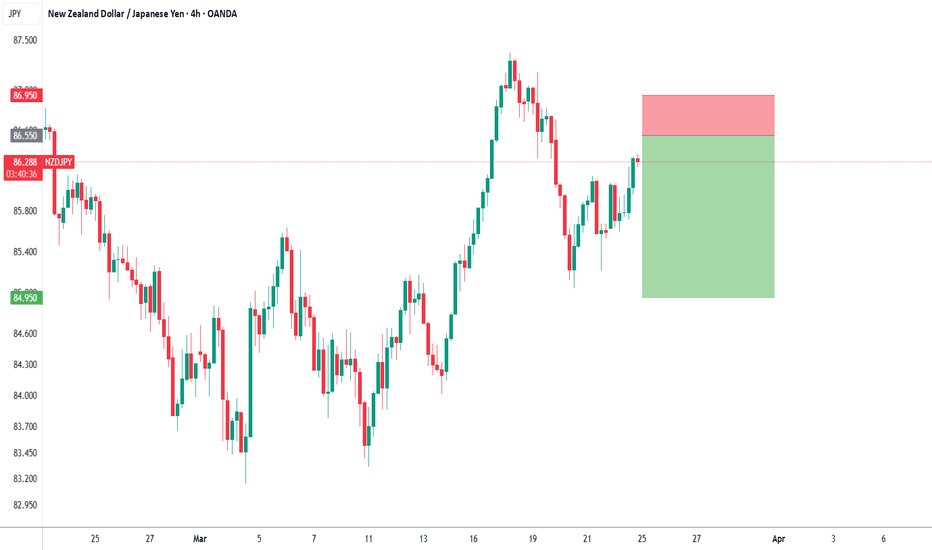

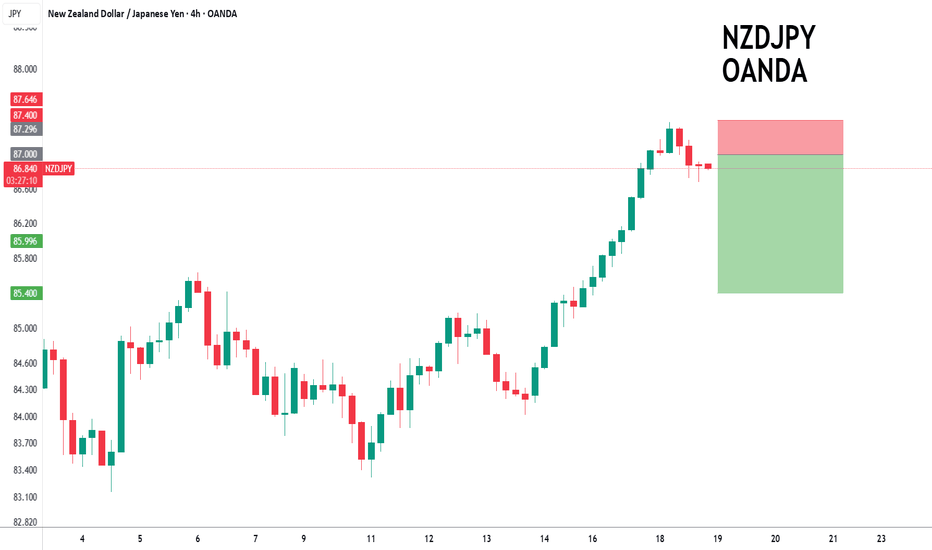

NZDJPY - 24h expiry The primary trend remains bearish. We look for a temporary move higher. Preferred trade is to sell into rallies. The RSI is trending higher. Bespoke resistance is located at 86.55. We look to Sell at 86.55 (stop at 86.95) Our profit targets will be 84.95 and 84.70 Resistance: 86.70 / 87.15 / 87.65 Support: 85.20 / 84.75 / 84.40 Risk...

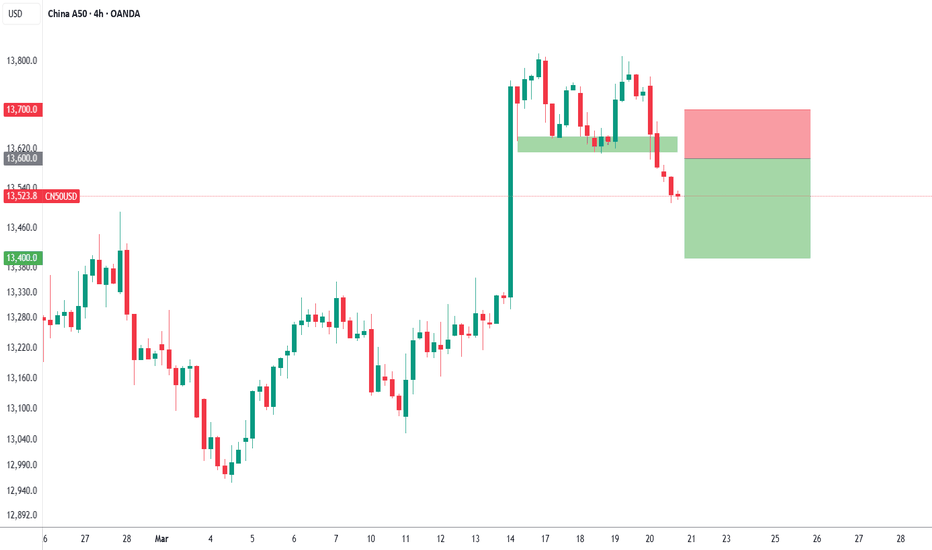

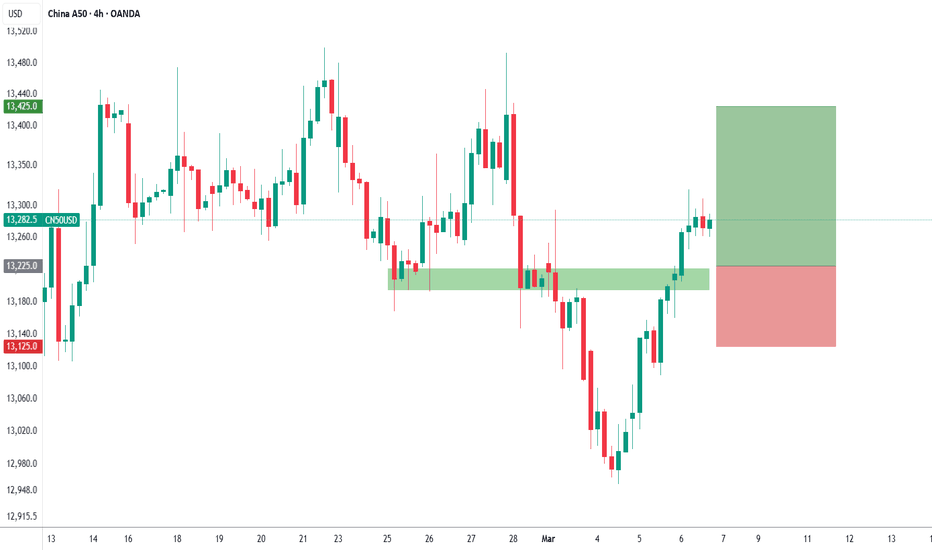

CHN50 - 24h expiry Price action looks to be forming a top. There is no clear indication that the downward move is coming to an end. Risk/Reward would be poor to call a sell from current levels. A move through 13500 will confirm the bearish momentum. The measured move target is 13350. We look to Sell at 13600 (stop at 13700) Our profit targets will be 13400...

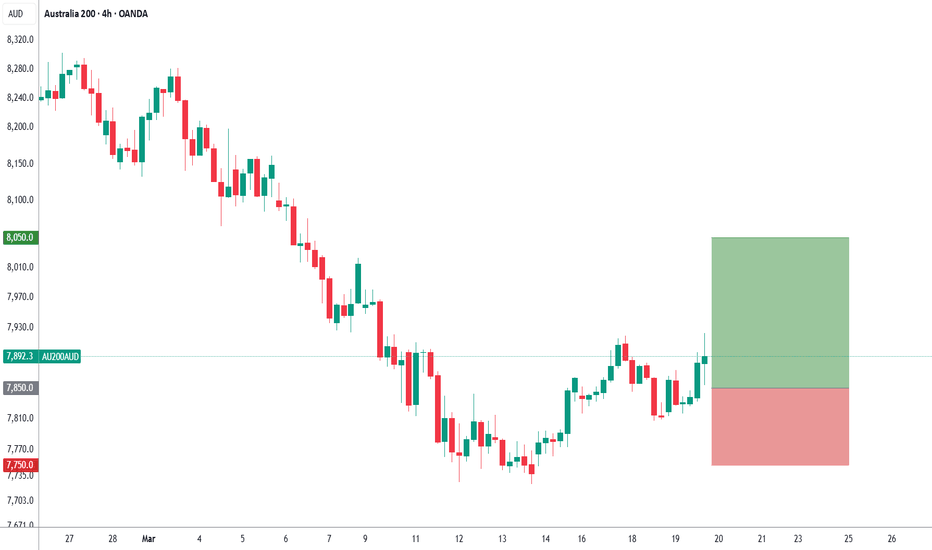

AU200AUD - 24H EXPIRY Price action has continued to trend strongly lower and has stalled at the previous support near 7750. Price action looks to be forming a bottom. Further upside is expected. Risk/Reward would be poor to call a buy from current levels. A move through 7900 will confirm the bullish momentum. The measured move target is 8100. We look to...

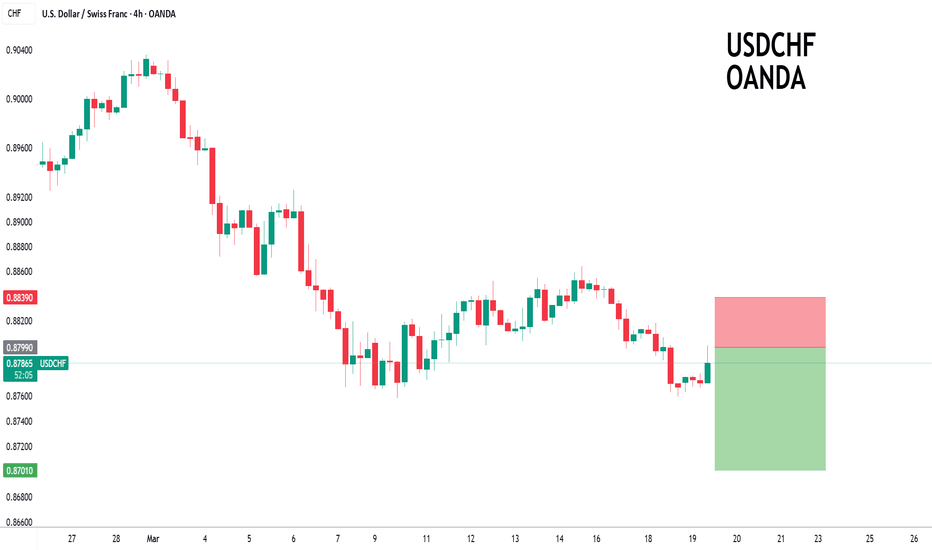

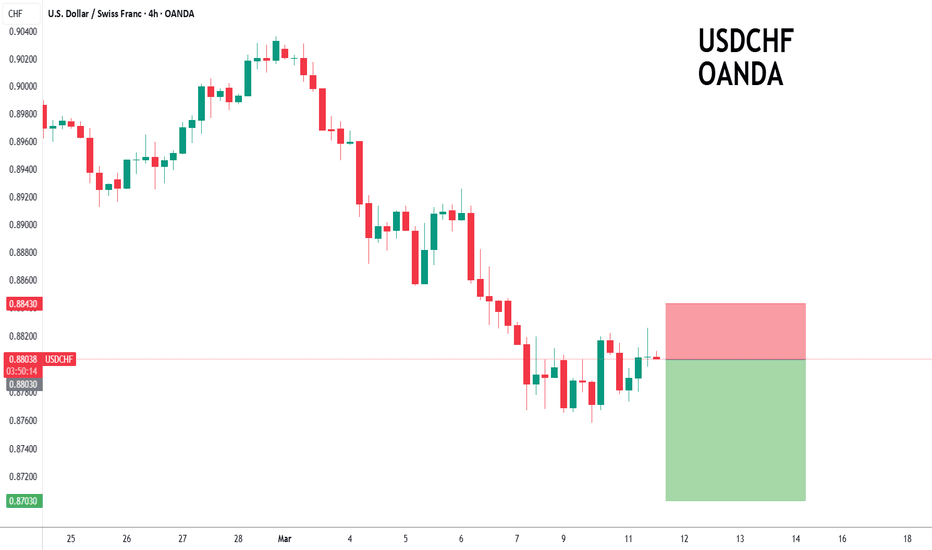

USDCHF - 24h expiry Broken out of the channel formation to the downside. Our short term bias remains negative. Offers ample risk/reward to sell at the market. The weaker US dollar has boosted performance. 20 4hour EMA is at 0.8801. We look to Sell at 0.8799 (stop at 0.8839) Our profit targets will be 0.8701 and 0.8681 Resistance: 0.8777 / 0.8800 /...

NZDJPY - 24h expiry The primary trend remains bearish. Bearish divergence is expected to cap gains. Preferred trade is to sell into rallies. Rallies should be capped by yesterday's high. Bespoke resistance is located at 87.00. We look to Sell at 87.00 (stop at 87.40) Our profit targets will be 85.40 and 85.10 Resistance: 87.30 / 87.70 / 88.00 Support:...

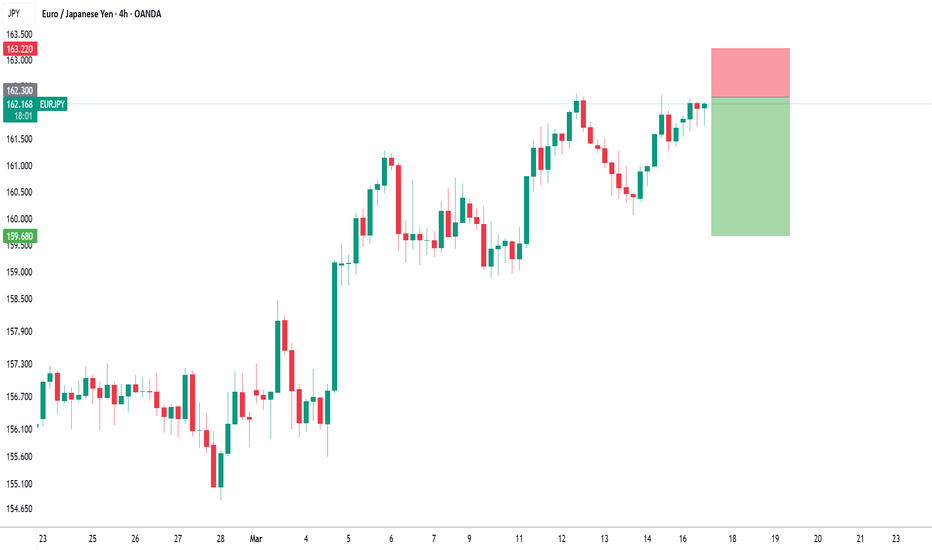

EURJPY - 24h expiry Although the bulls are in control, the stalling positive momentum indicates a turnaround is possible. There is no sign that this bullish momentum is faltering but the pair has stalled close to a previous swing high of 162.36. This is negative for short term sentiment and we look to set shorts at good risk/reward levels for a further...

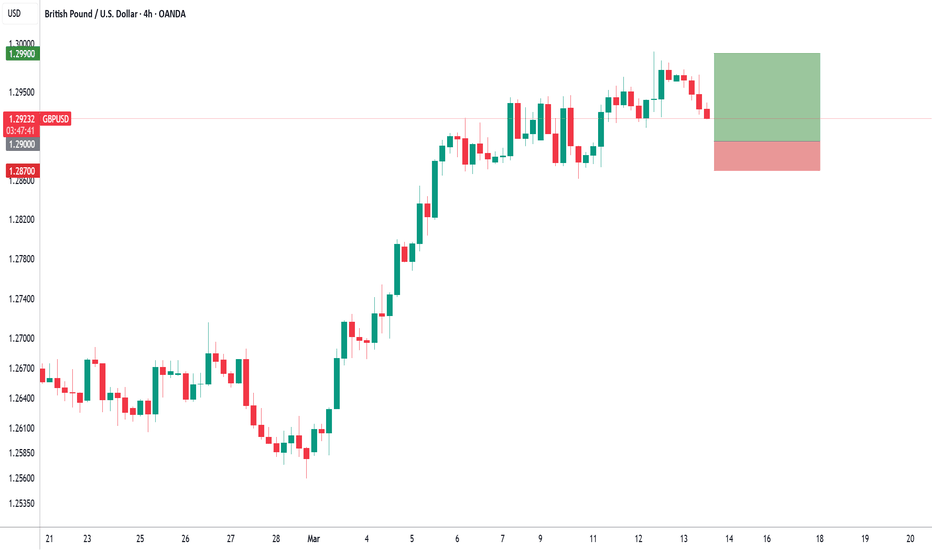

he British pound has edged lower against the US dollar on Friday. GBP/USD is trading at 1.2928 in the European session, down 0.13% on the day. The UK economy barely registered any growth in the second half of 2024, rising 0.1% in the third quarter and flatlining in the third quarter. The New Year hasn't seen any improvement, as GDP contracted 0.1% m/m in...

GBPUSD - 24h expiry The medium term bias remains bullish. Bearish divergence is expected to cap gains. A lower correction is expected. We look to buy dips. Bespoke support is located at 1.2900. We look to Buy at 1.2900 (stop at 1.2870) Our profit targets will be 1.2990 and 1.3020 Resistance: 1.2970 / 1.2990 / 1.3020 Support: 1.2915 / 1.2860 /...

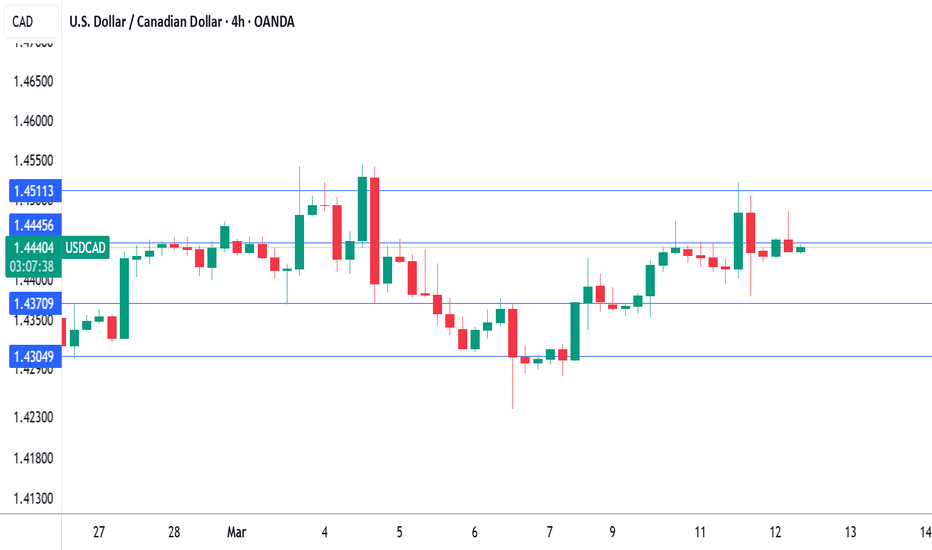

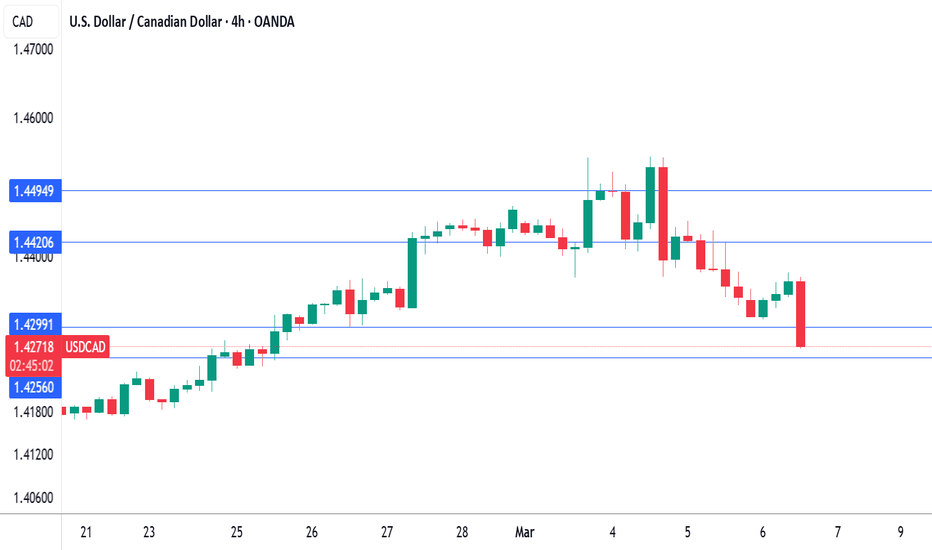

The Canadian dollar posted gains earlier but couldn't consolidate. In the European session, USD/CAD is trading at 1.4439, up 0.03% on the day. It's decision day at the Bank of Canada, which is widely expected to lower rates by 25 basis points. This would lower the cash rate to 2.75%, its lowest level since July 2022. The BoC has been aggressive and has lowered...

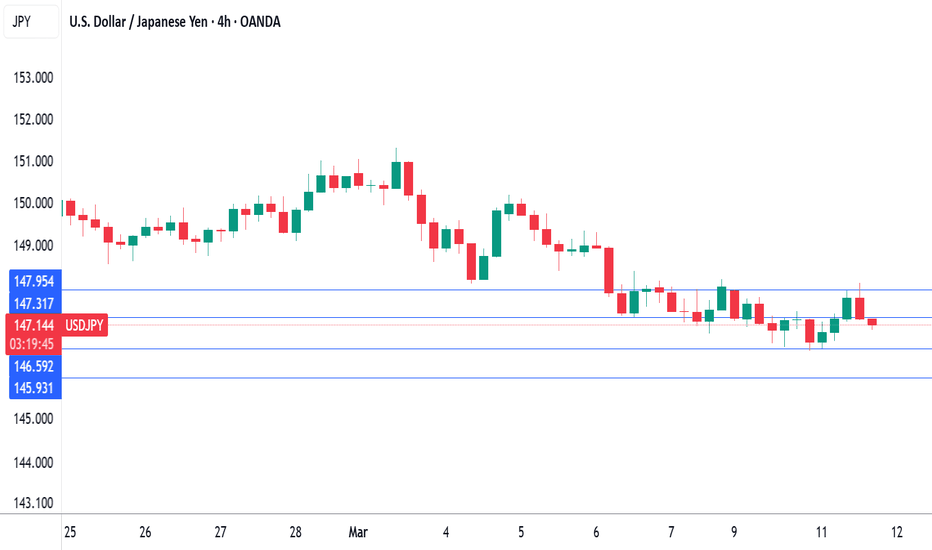

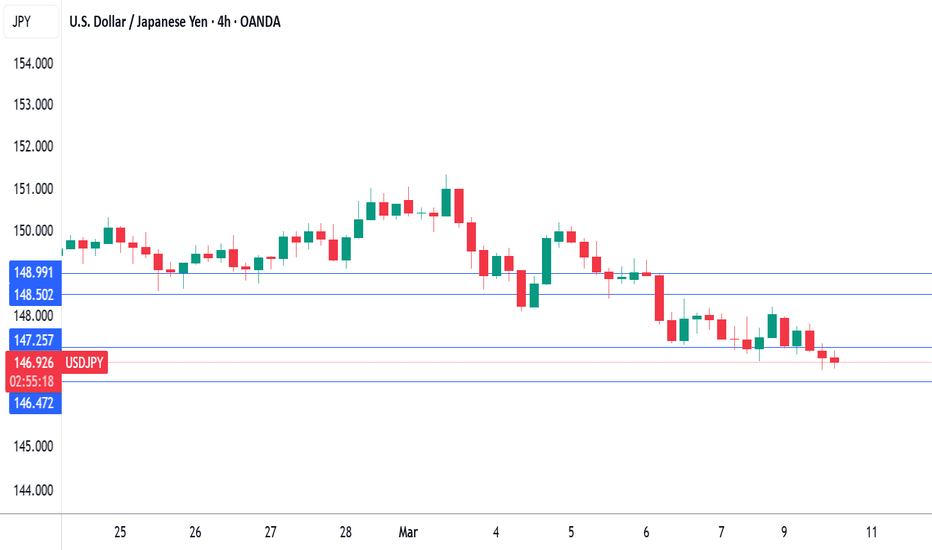

The Japanese yen is showing movement in both directions today. In the North American session, USD/JPY is trading at 147.37, down 0.03% on the day. Japan's GDP expanded 2.2% y/y in the fourth quarter of 2024, lower than the initial estimate of 2.8%. The revision was expected to stay largely unchanged but was pushed lower due to a decrease in inventories and...

USDCHF - 24h expiry There is no clear indication that the downward move is coming to an end. 20 4hour EMA is at 0.8816. Bespoke resistance is located at 0.8800. Our outlook is bearish. The weaker US dollar has boosted performance. We look to Sell at 0.8803 (stop at 0.8843) Our profit targets will be 0.8703 and 0.8683 Resistance: 0.8811 / 0.8830 /...

The Japanese yen has started the week with strong gains. In the European session, USD/JPY is trading at 147.07, down 0.766 on the day. Earlier, the yen strengthened to 146.72, its best level since Oct. 4, 2024. Japan's wage data for January was mixed. Base pay for Japanese workers jumped by 3.1% y/y but more importantly, inflation-adjusted real wages declined by...

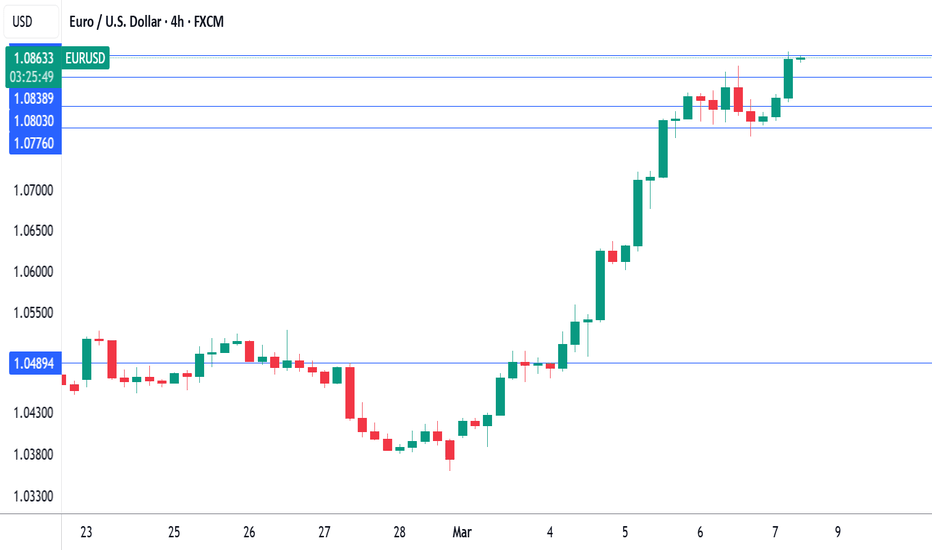

The euro has posted strong gains on Friday after taking a pause a day earlier. EUR/USD is trading at 1.0858 in the European session, up 0.69% on the day. It's been a remarkable week for the euro, which has soared 4.7% against the US dollar. The ECB lowered rates by 25 basis points on Thursday in a widely-expected decision. This brings the deposit rate to 2.5%,...

CHN50 - 24h expiry There is no clear indication that the upward move is coming to an end. Although we remain bullish overall, a correction is possible with plenty of room to move lower without impacting the trend higher. Short term RSI has turned positive. Risk/Reward would be poor to call a buy from current levels. A move through 13150 will confirm the...

The Canadian dollar is steady on Thursday after gaining around 1% over the past two days. In the European session, USD/CAD is trading at 1.4351, up 0.07% on the day. We could see some volatility from the Canadian dollar over the next two days, with the release of the Ivey PMI today and the employment report on Friday. The Trump tariff saga took a twist on...

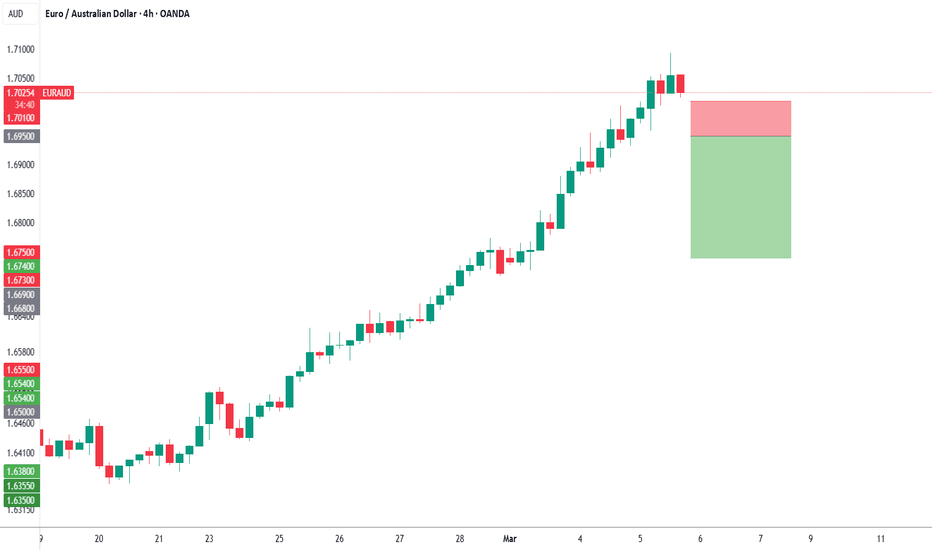

EURAUD - 24h expiry We are trading at overbought extremes. Bearish divergence is expected to cap gains. The rally is close to a correction count on the daily chart. We look to Sell a break of 1.6950. A lower correction is expected. We look to Sell a break of 1.6950 (stop at 1.7010) Our profit targets will be 1.6740 and 1.6710 Resistance: 1.7070 / 1.7100...