Market analysis from Swissquote

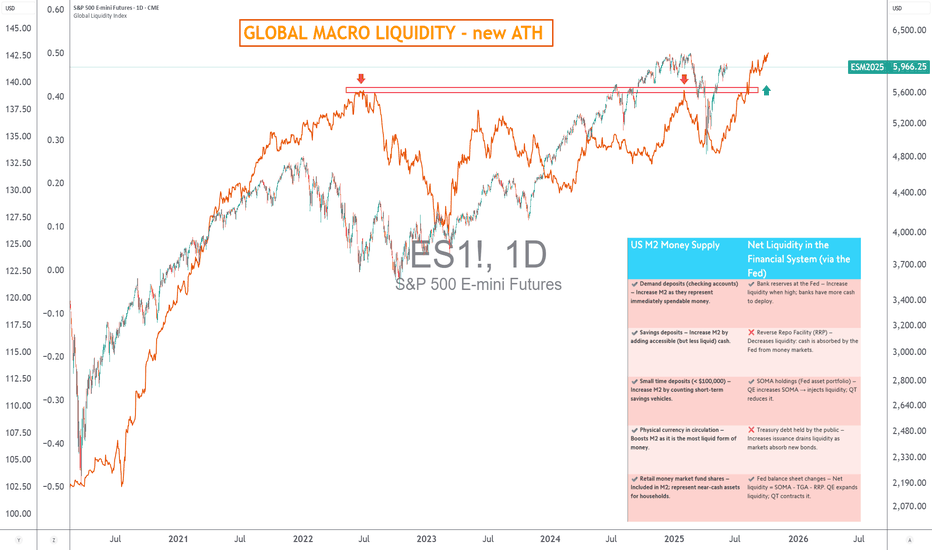

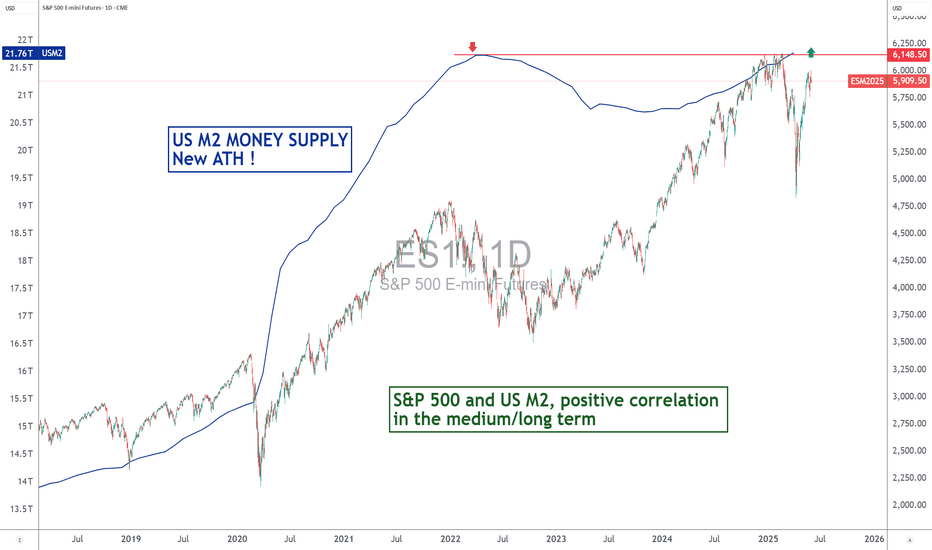

Liquidity is a key factor in market finance. Without it, risky assets in the stock market, equities and cryptocurrencies lose their fuel. Over the cycles, one thing has become clear: the direction of financial markets is strongly correlated with that of global liquidity. But liquidity is not a single indicator: it is organized into three complementary layers....

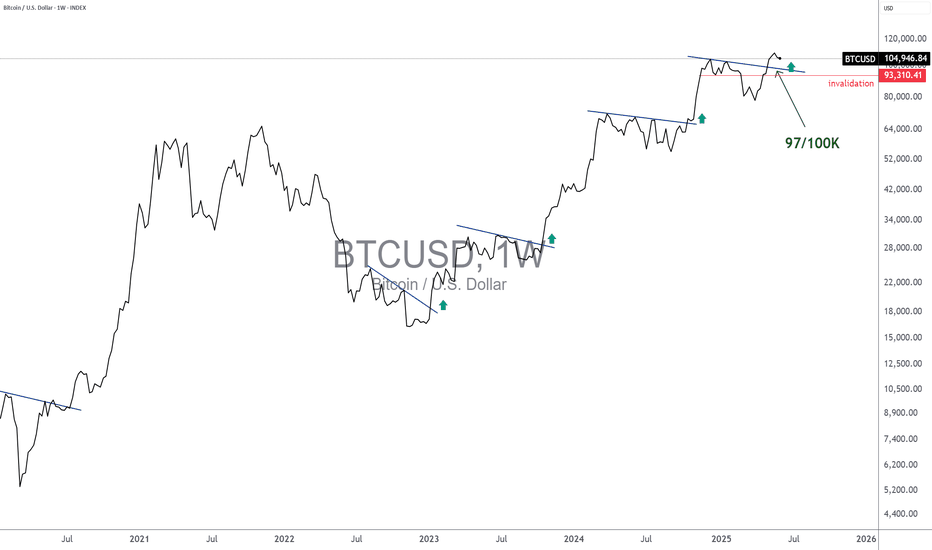

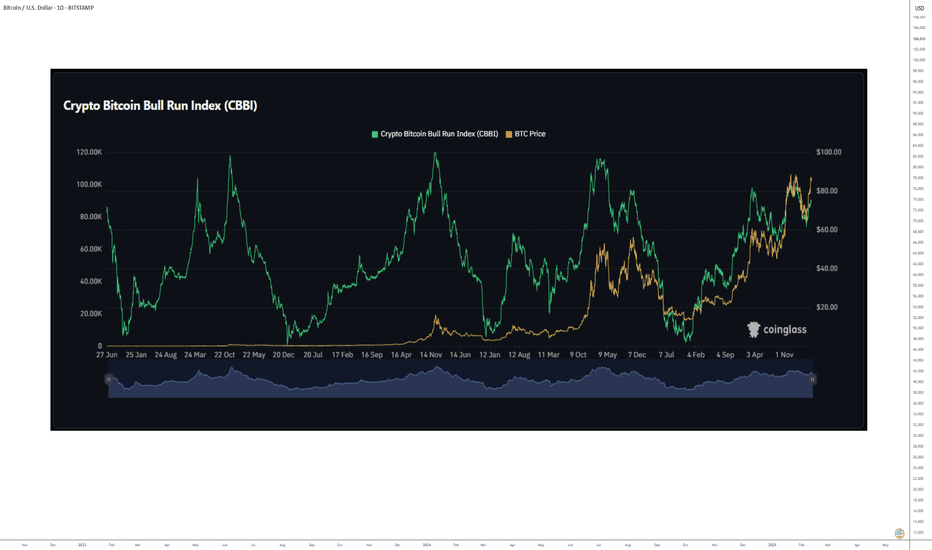

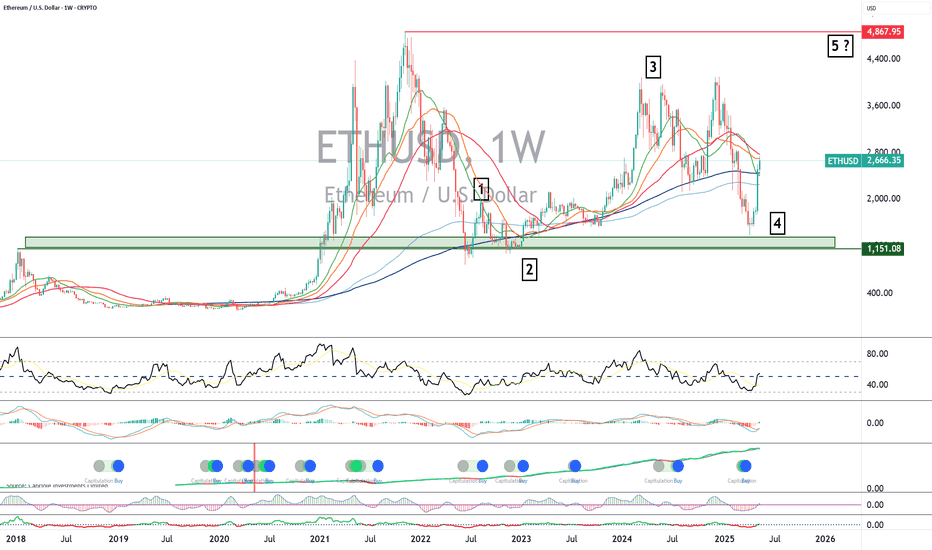

1) The bitcoin cycle linked to the Spring 2024 halving ends at the end of 2025 The bitcoin price reached 11,900 US dollars on Thursday May 22, and many investors are wondering whether the bullish cycle linked to the Spring 2024 halving is already over. In terms of bitcoin's time cycle, the answer is negative, as all past cycles have ended at the end of the year...

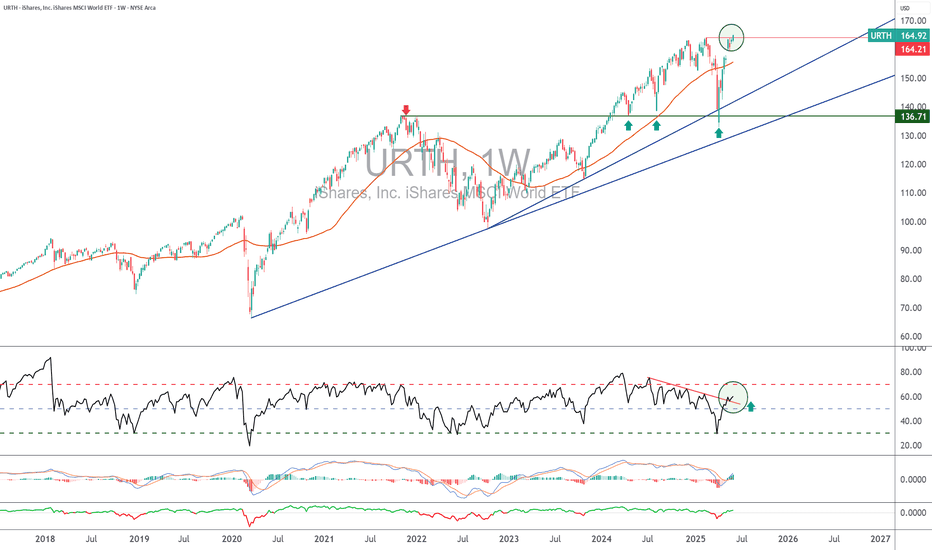

The MSCI World stock market index set a new all-time record during the trading session of Monday June 2, wiping out the entire stock market shock of February/March, which saw the global equity market lose 20%. This technical signal still needs to be confirmed at the end of the week at the next weekly technical close. If this bullish technical break were to be...

The European Central Bank (ECB) unveils a new monetary policy decision this Thursday, June 5, and the consensus is for further cuts in all three ECB interest rates. The ECB's key rate (the main rate at which banks refinance with the ECB) currently stands at 2.40% and should be cut to 2.15% according to the analyst consensus, in other words, a return of the ECB's...

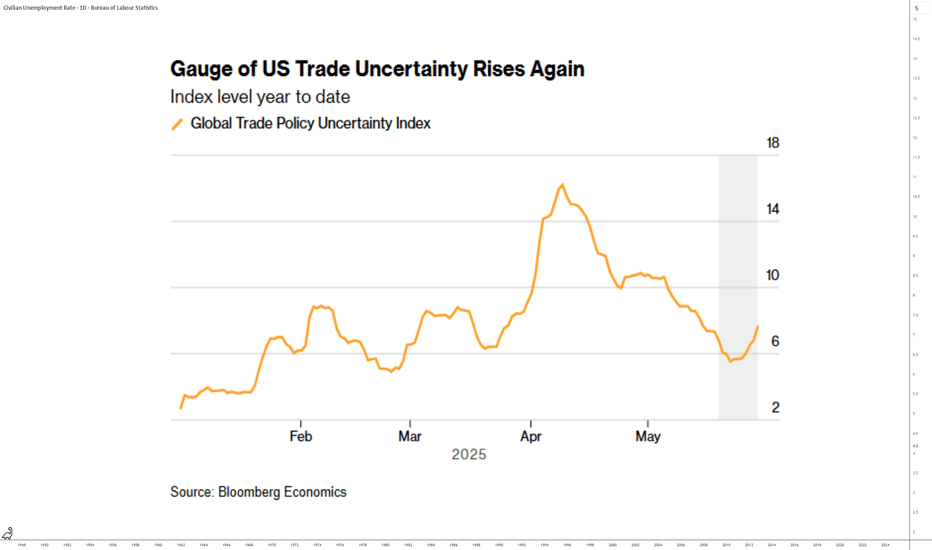

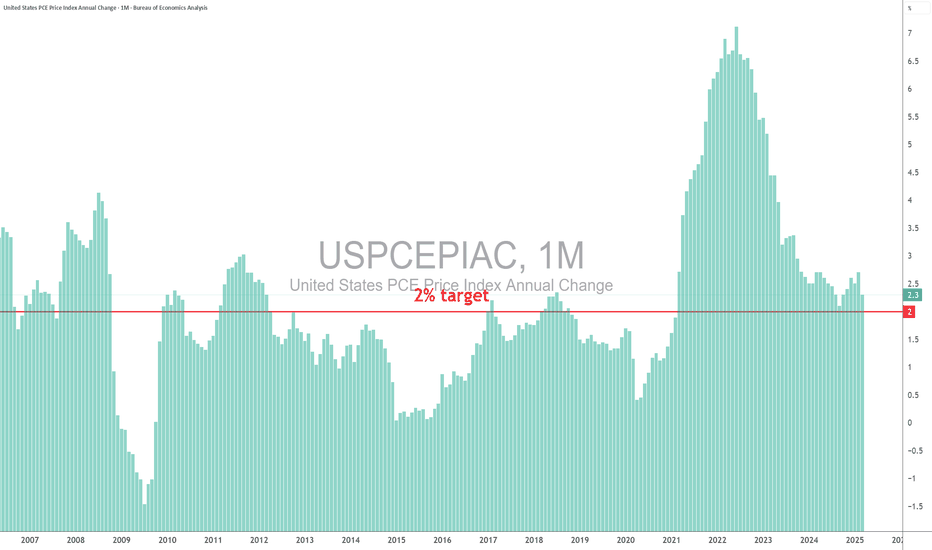

Several fundamental factors will have a strong impact on financial markets in this first week of June, as uncertainty surrounding the trade war remains high. However, there was some good news last Friday, with US PCE inflation continuing to move towards the Fed's target despite tariffs. This week, two fundamental factors are under close scrutiny: US labor market...

1) Money supply at an all-time high: an apparent paradox given that the Fed is no longer lowering interest rates The M2 money supply in the United States has just reached a new all-time high, even though the Federal Reserve has not lowered its key interest rate since December 2024. This may come as a surprise: how is such an influx of liquidity possible...

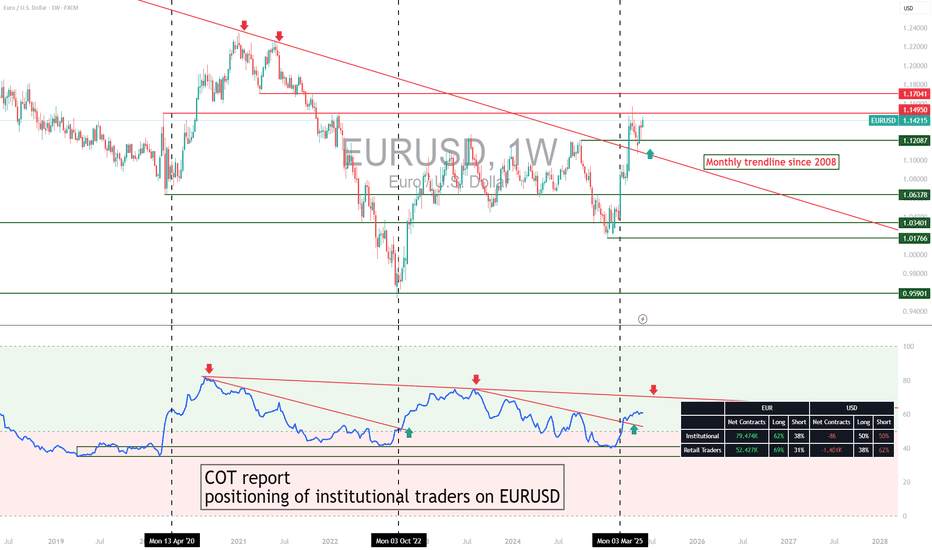

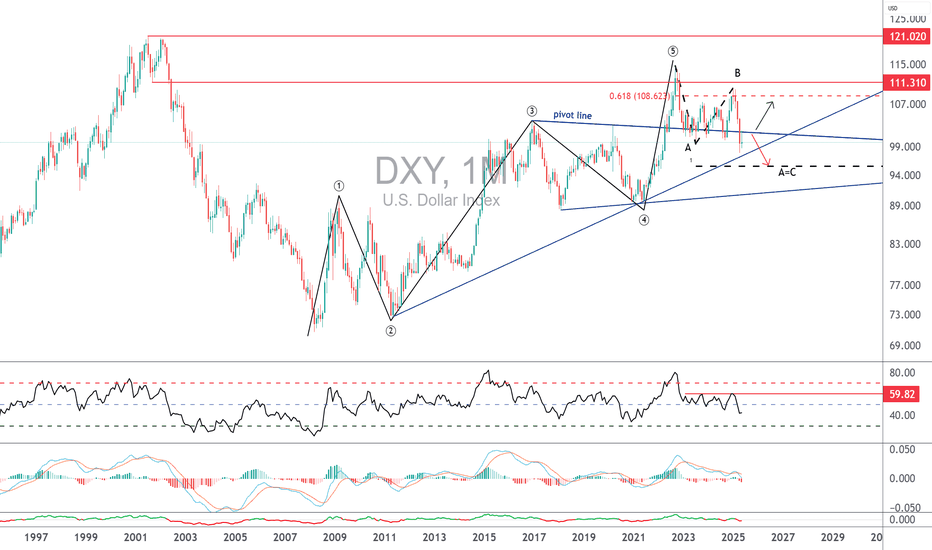

1) The US Dollar remains the weakest major Forex currency in 2025 The US dollar has had a difficult year on the foreign exchange market (Forex), recording a decline of over 9% against the world's major currencies, despite the Federal Reserve's continuing rigid monetary policy. Technically speaking, the DXY index has reached several theoretical bearish targets,...

The bitcoin price has been on a solid uptrend since the beginning of April, a move we've been deciphering here on a regular basis. You can follow our Swissquote account to make sure you don't miss our next analytical updates on BTC and altcoins. The new question we're asking is simple: with the bitcoin price having just set a new all-time high, is this bullish...

The financial markets are currently under the influence of a conjunction of themes of fundamental concern, the most important of which are : - the trade war and the current phase of trade diplomacy - the current phase of disinflation in the West, which could be threatened by tariffs - the intransigence of the Federal Reserve (FED) which, unlike the European...

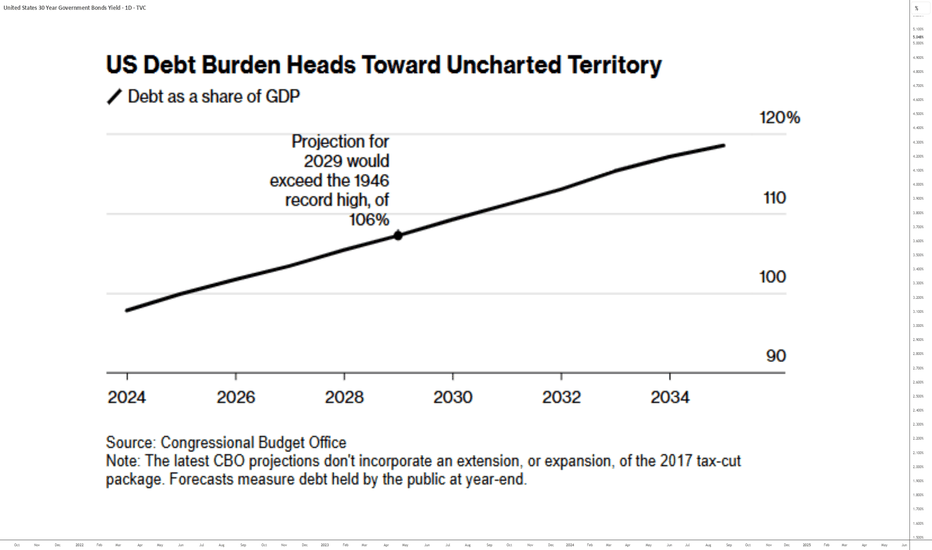

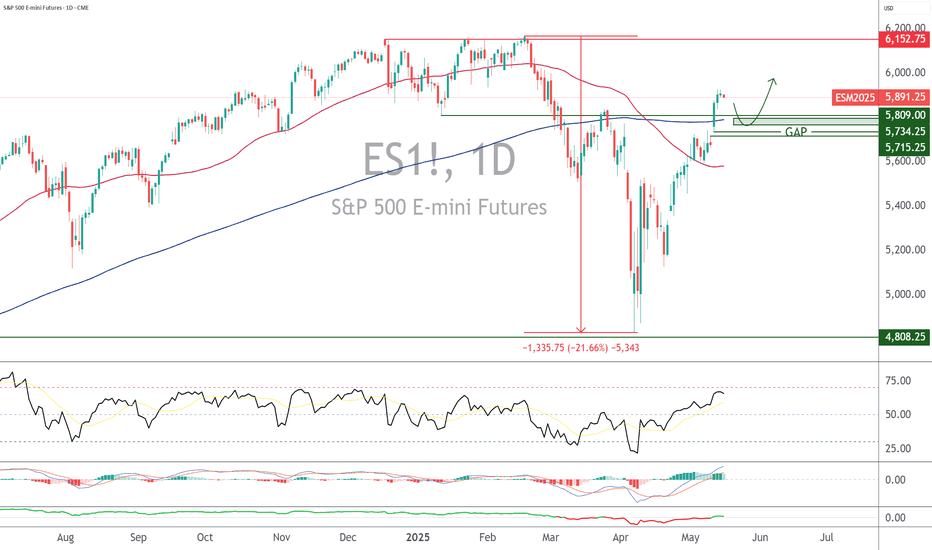

Introduction: The equity market is marking time in the short term after a vertical uptrend since the beginning of April. There are many issues of fundamental concern, but one is currently front and center: the sustainability of US sovereign debt. Of course, it's far too early to talk about a US public debt crisis, but the new tax bill championed by the Trump...

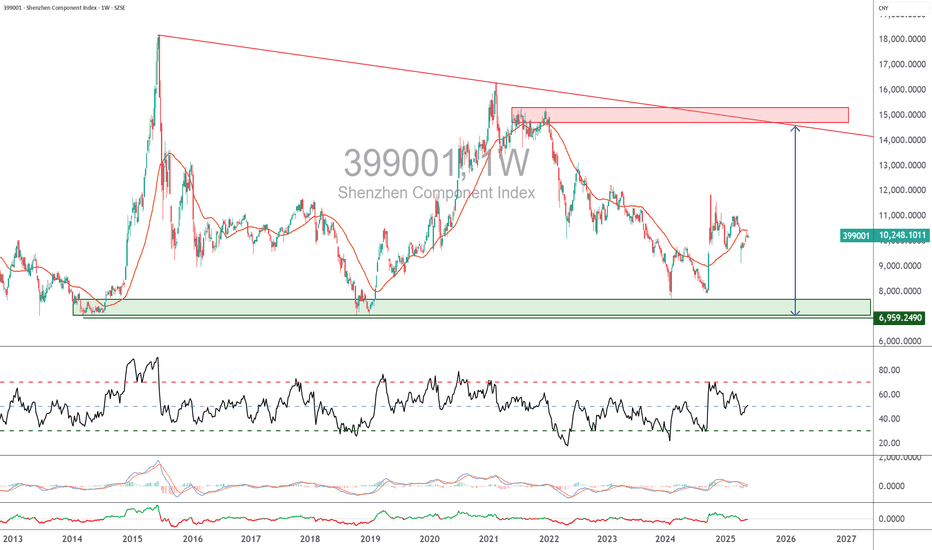

Introduction: While the US equity market has rallied vertically since the beginning of April on the back of trade diplomacy, the S&P 500 is now not far from its all-time high and is once again expensive in terms of market valuation. From a diversification point of view, the Chinese equity market may appear to offer some advantages at present, both technically and...

Introduction: The bitcoin price has rebounded by over 40% since the beginning of April, following a successful pull-back from its previous all-time high. This successful chartist pull-back (see the first chart below, which shows Japanese candlesticks in weekly BTC/USD data) is part of bitcoin's bullish cycle linked to the last Halving, in April 2024. Remember...

Introduction: After a marked uptrend which saw gold reach $3500 at the end of April, with an annual rise of almost 30% since the beginning of the year and $1500 up since the bullish breakout of February 2024 (bullish breakout of the former all-time high of $2075 at the time), the message from technical analysis is as follows: now is not the time to initiate an...

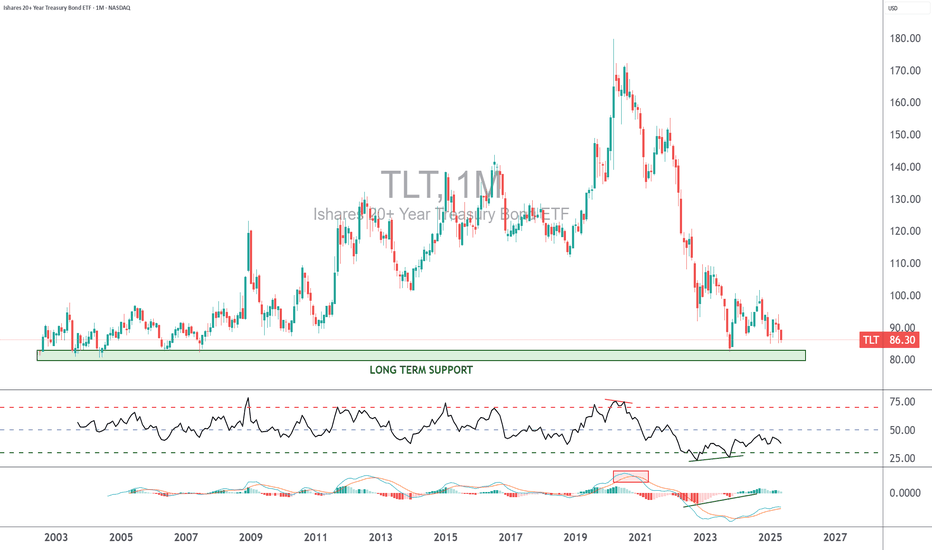

Introduction: should we finally go back to buying bonds? While the equity market has rebounded vertically since mid-April and the start of a period of trade diplomacy between the USA and its main trading partners, bond prices have remained at a low level. Although both realized and implied volatility have fallen sharply in recent weeks (see our bearish analysis...

Introduction: The bitcoin price is a highly cyclical market structured around the halving event that takes place every 4 years. BTC's last halving took place in April 2024, and it is around this event that our current cycle is structured, which should end at the end of 2025 if and only if the cycle repetition still applies (Bitcoin's famous 4-year cycle). To find...

Introduction: The equity market has been on a bullish upswing since mid-April (we invite you to reread our bearish analysis of the VIX at the end of April), against a backdrop of trade diplomacy, particularly between China and the USA. Now that the S&P 500 index has returned to equilibrium since the start of the year (i.e., its annual performance is no longer...

Introduction: In our previous TradingView analyses, we defended the bullish recovery of the crypto market since the beginning of April, particularly for the bitcoin price. The latter seems to be positively correlated with the global liquidity trend (you can reread all our latest crypto analyses in our analysis history directly from the main page of our...

Introduction: The euro dollar is the best-performing major Forex pair this year (2025), up over 8%. But since the beginning of May, major resistance at $1.15 and an overbought technical environment have halted the rise, while trade negotiations between the USA and China are well underway. Although the rise in the EUR/USD rate has been underpinned by structural...