Market analysis from Tickmill

Title : NASDAQ ( NQ1! ) , H4 potential for bearish dip Type: Bearish Dip Resistance: 13979 Pivot: 13791.25 Support: 13110.5 Preferred case: On the H4 chart, price is near pivot level of 13791.25 in line with 50% Fibonacci retracement . Price can potentially dip to the take profit level of 13110.5 in line with 61.8% Fibonacci projection . Our bearish bias is...

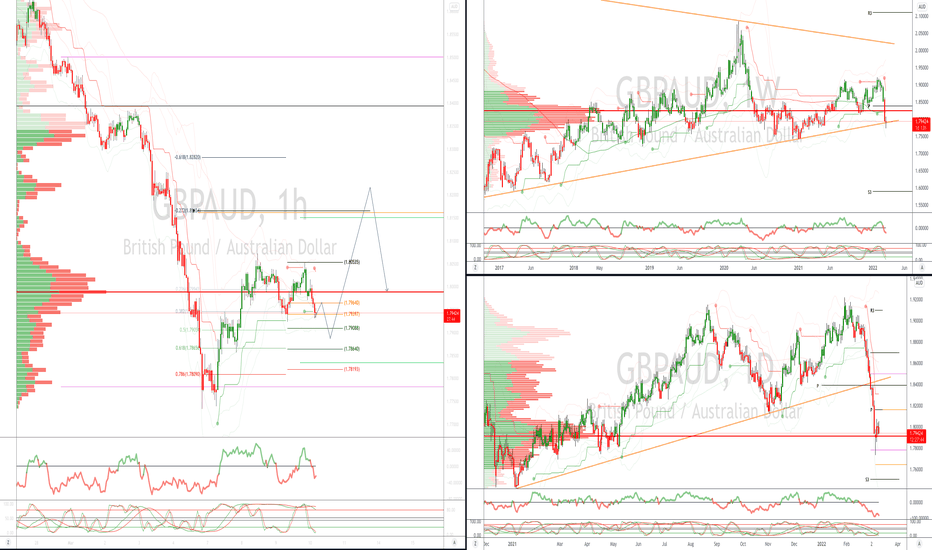

In this update we review the recent price action in GBPAUD and identify the next high probability trading opportunity and price objectives to target.

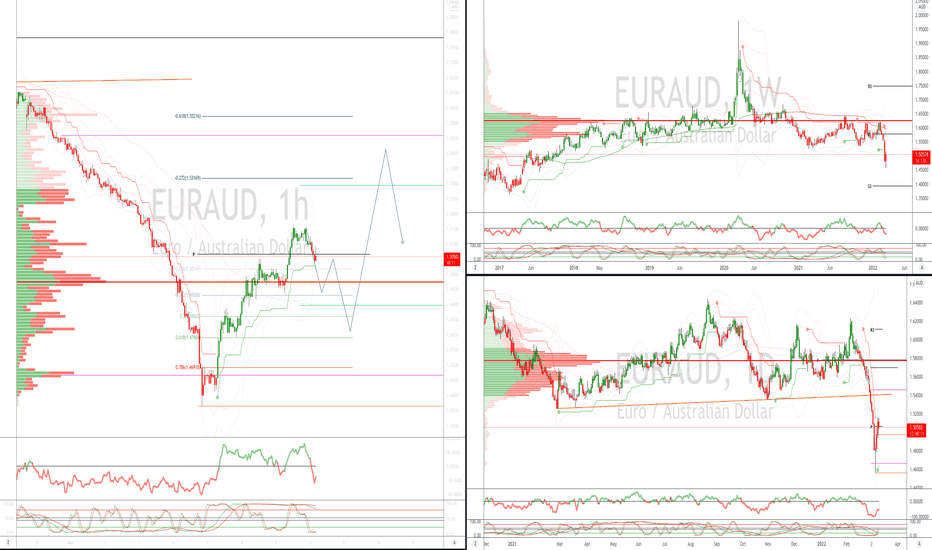

In this update we review the recent price action in EURAUD and identify the next high probability trading opportunity and price objectives to target.

Type : Bullish bounce Resistance : 1751'4 Pivot: 1639'6 Support :1581'4 Preferred case: With price moving above the ichimoku cloud , we see the potential for a bounce from our Pivot at 1694'2 in line with 38.2% Fibonacci retracement towards our 1st resistance at 1757'4 in line with horizontal swing high resistance. Alternative scenario: Alternatively, price can...

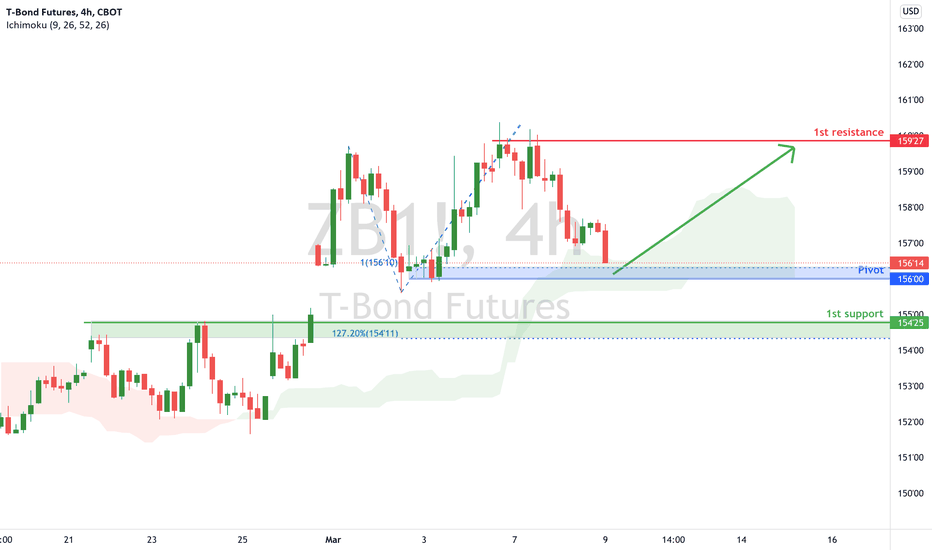

Type: Bullish continuation Resistance: 163'18 Support: 157'24 Pivot: 159'16 Preferred case: With price moving above the ichimoku cloud , we have a bias that price will rise from our pivot of 156'00 in line with the 100% Fibonacci projection to our 1st resistance of 159'27 which is also the graphical swing high resistance. Alternative Scenario : Price may dip to...

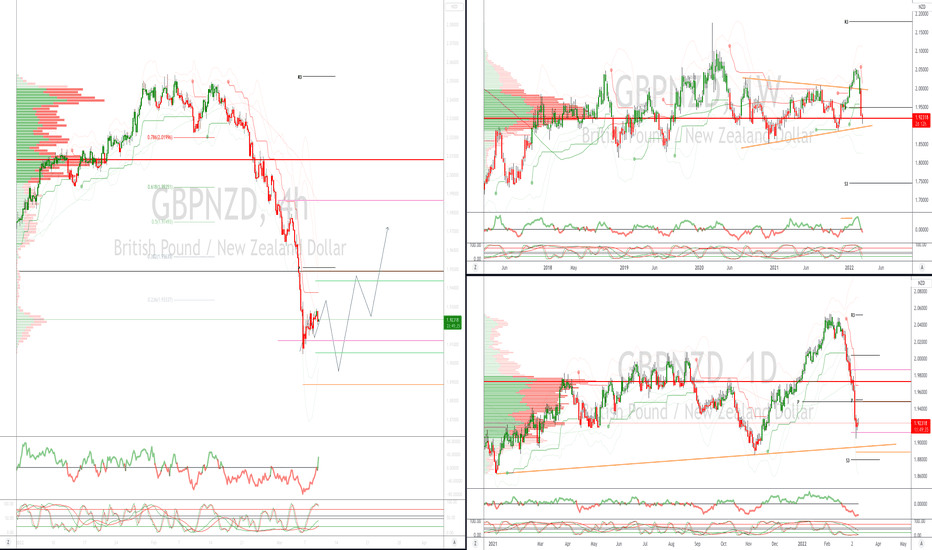

In this update we review the recent price action in GBPNZD and identify the next high probability trading opportunities and price objectives to target.

In this update we review the short trade in GBPCHF and update the trade management protocol.

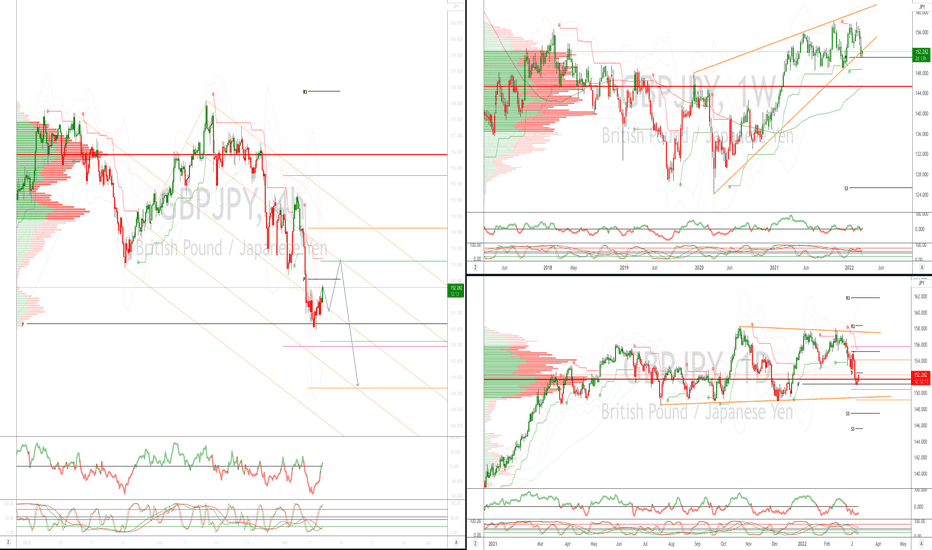

In this update we review the recent price action in GBPJPY and identify a high probability trading pattern and price objectives to target.

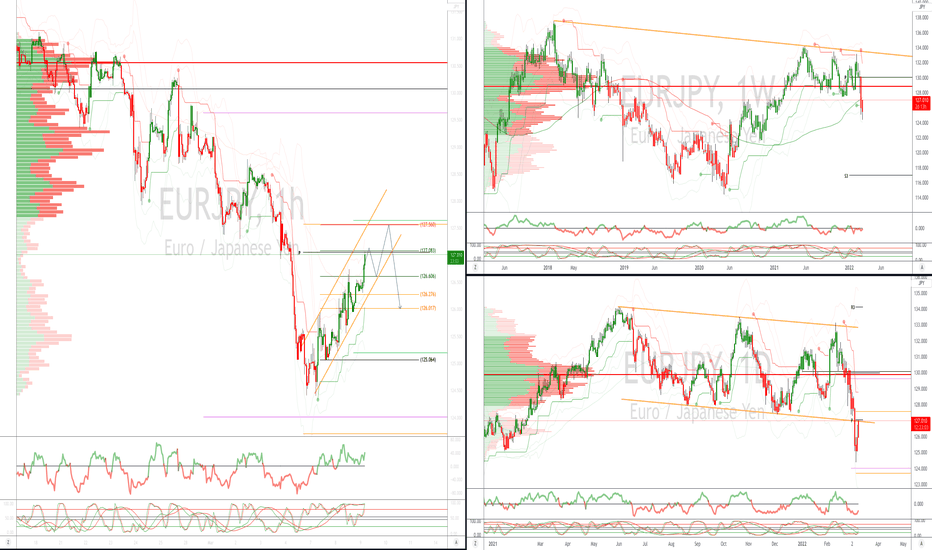

In this update we review the recent intraday price action in the EURJPY and identify a high probability trade location and price objectives to target.

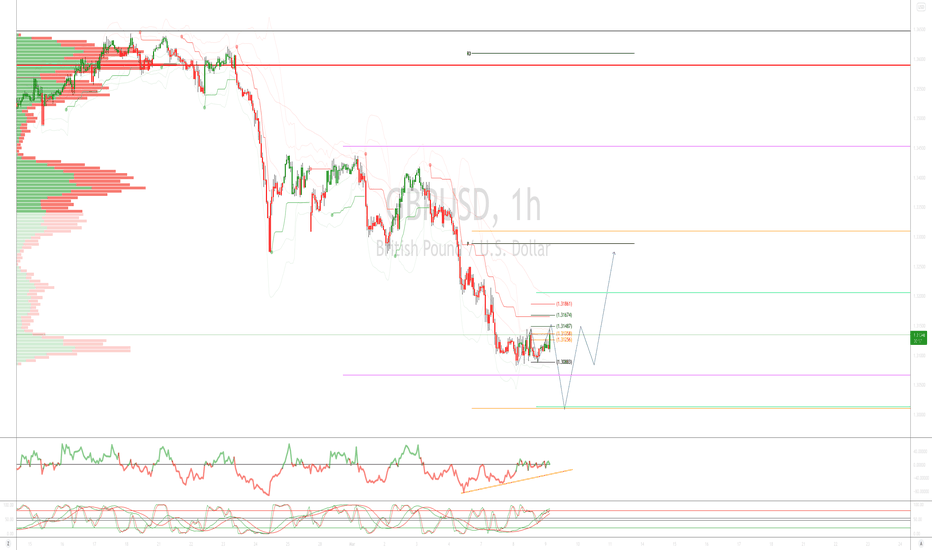

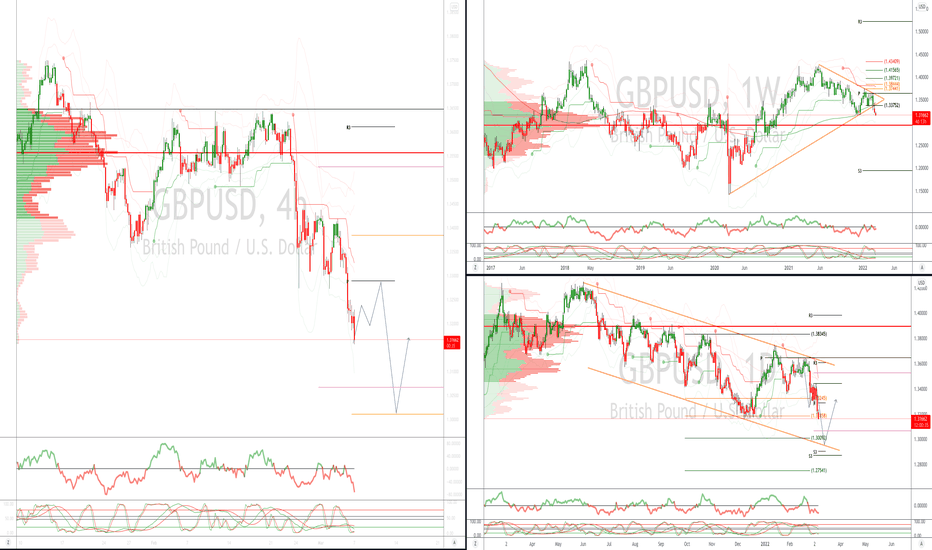

In this update we review the intraday price action in GBPUSD and identify some high probability trading patterns and price objectives to target.

In this update we review the recent price action in Gold (futures contract) and identify the next high probability trading pattern and the price objectives to target.

In this update we review the recent price action in the Nasdaq (futures contract) and identify the next high probability trading pattern and price objectives to target.

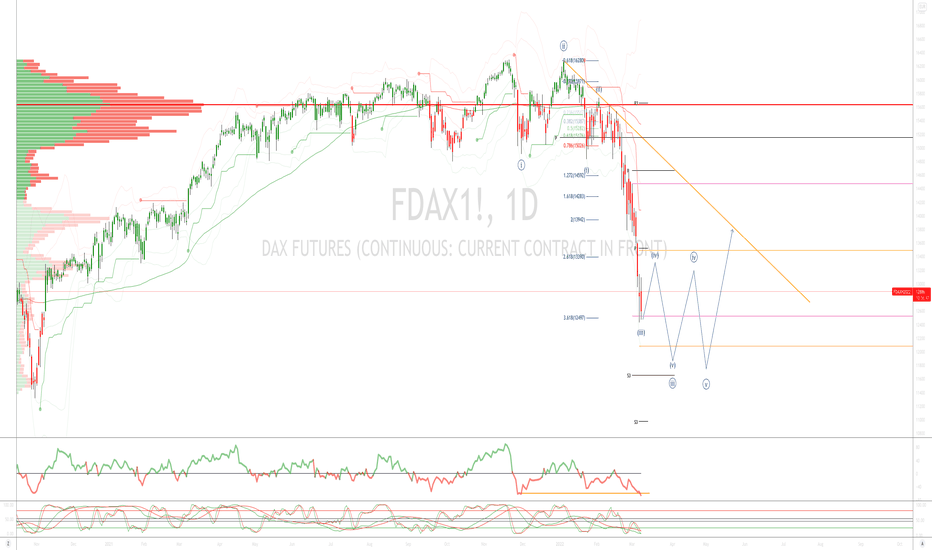

In this update we review the recent price action in the German Dax (futures contract) and identify the next high probability trading opportunity and price objectives to target.

In this update we review the recent price action in the sp500 (futures contract) and identify a high probability trading pattern and price objectives to target.

In this update we review the recent price action in AUDUSD and identify the next high probability trading opportunity and price objectives to target.

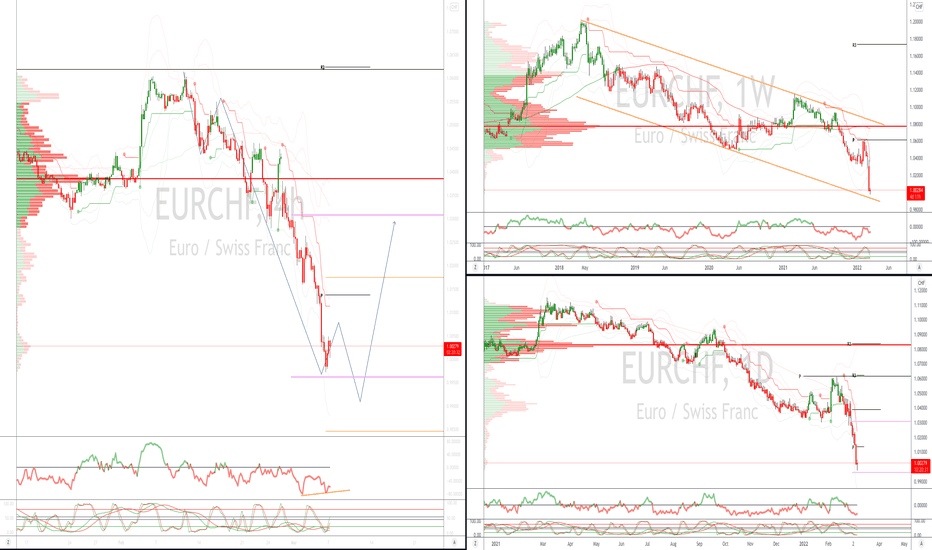

In this update we review the recent price action in EURCHF and identify the next high probability trading pattern and price objectives to target.

In this update we review the recent price action in the Dollar Index and identify the next high probability trading pattern and price objectives to target.

In this update we review the recent price action in GBPUSD and identify the next high probability trade locations and price objectives to target.