Market analysis from Trade Nation

Data Highlights: China Foreign Reserves (June): China's FX reserves data will be closely watched for signs of capital outflows or PBoC intervention, especially amid ongoing yuan stability efforts and recent volatility in global markets. Japan Labor Cash Earnings & Economic Indices (May): Labor cash earnings are a key wage inflation indicator. Any upside surprise...

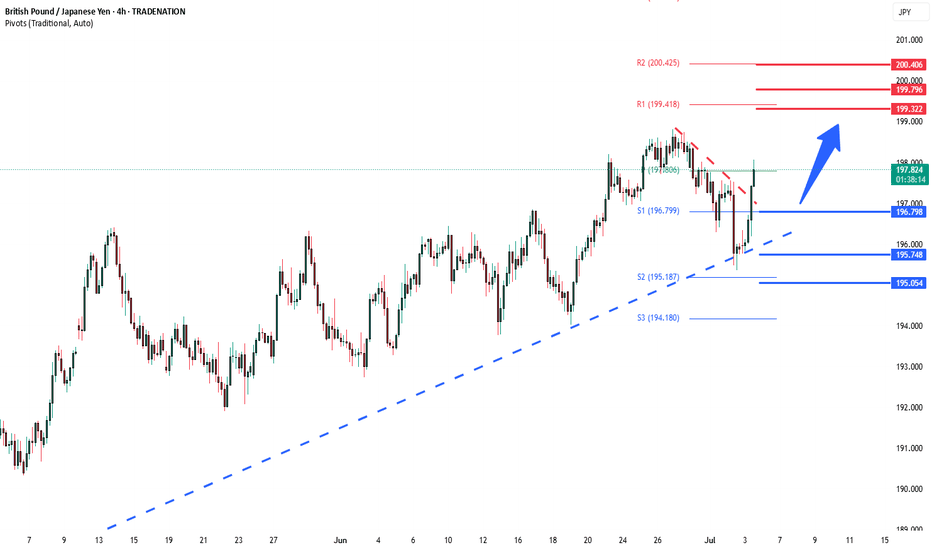

Key Support: 196.75 This level marks the prior consolidation zone and serves as a critical pivot. A corrective pullback toward 196.75 followed by a bullish reversal would validate the uptrend, with upside targets at: 199.20 – Initial resistance and short-term target 199.70 – Minor resistance zone 200.40 – Longer-term breakout objective However, a daily close...

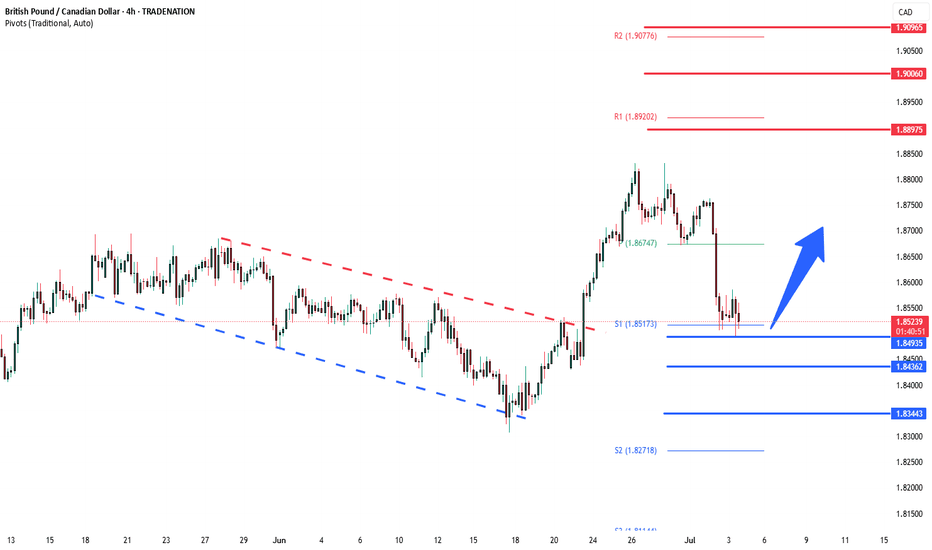

The GBPCAD currency pair price action sentiment appears Bullish, supported by the current rising trend. The recent intraday price action seems to be a sideways consolidation breakout. The key trading level is at the 1.8500 level, the previous consolidation price range. A corrective pullback from the current levels and a bullish bounce back from the 1.8500 level...

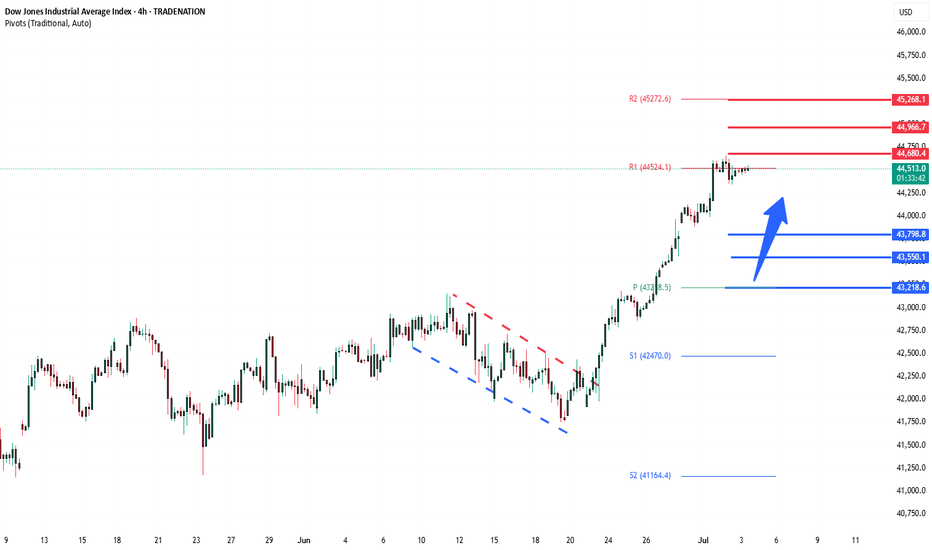

Key Support and Resistance Levels Resistance Level 1: 44680 Resistance Level 2: 44670 Resistance Level 3: 45270 Support Level 1: 43800 Support Level 2: 43550 Support Level 3: 43220 This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is...

House Republicans moved Trump’s major tax and spending bill closer to a final vote, which could happen before his July 4 deadline. The package includes tax cuts, immigration funding, and the rollback of green energy incentives. Gamblers are raising concerns about a tax increase in the bill that could affect them. In trade news, the US eased export rules on chip...

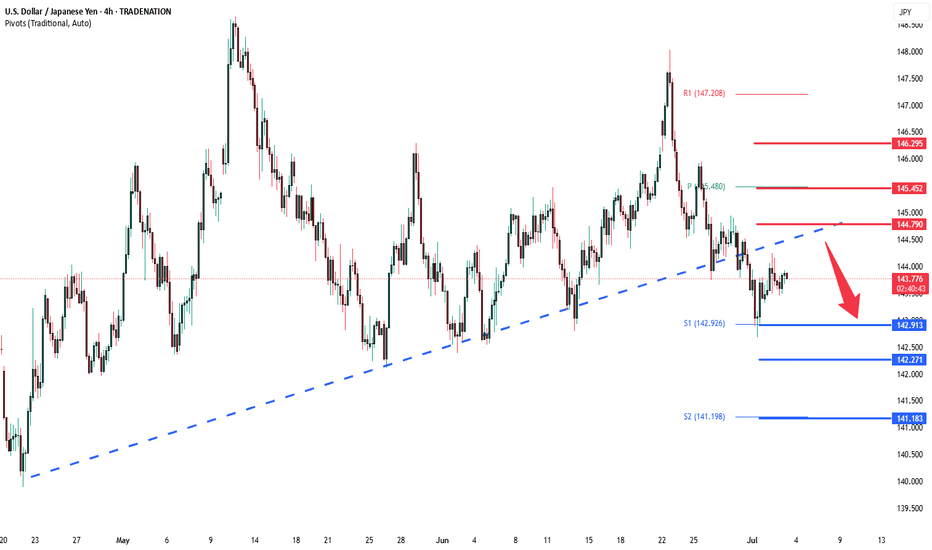

The USDJPY pair is currently trading with a bearish bias, aligned with the broader downward trend. Recent price action shows a retest of the resistance zone, suggesting a temporary relief rally within the downtrend. Key resistance is located at 144.80, a prior consolidation zone. This level will be critical in determining the next directional move. A bearish...

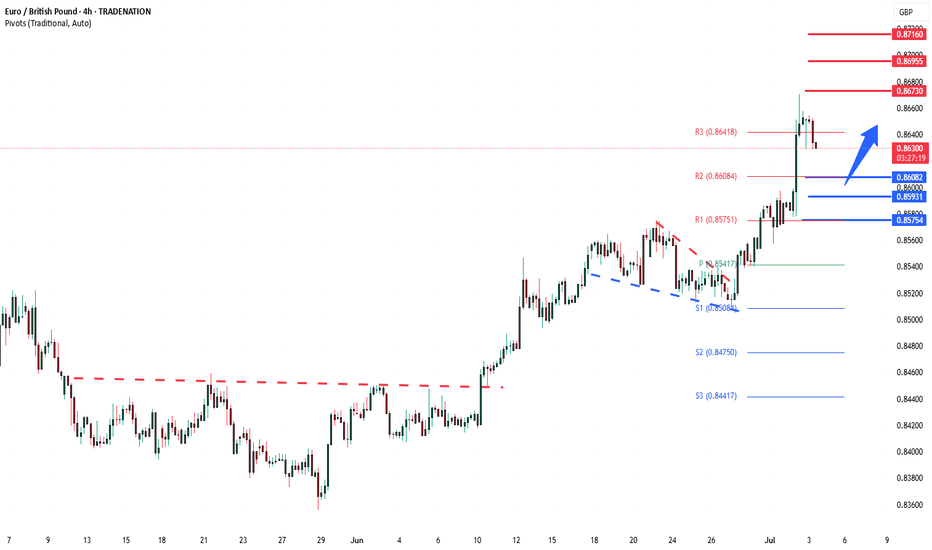

The EURGBP remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend. Support Zone: 0.8600 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 0.8600 would confirm ongoing upside momentum, with potential targets at: 0.8670 – initial...

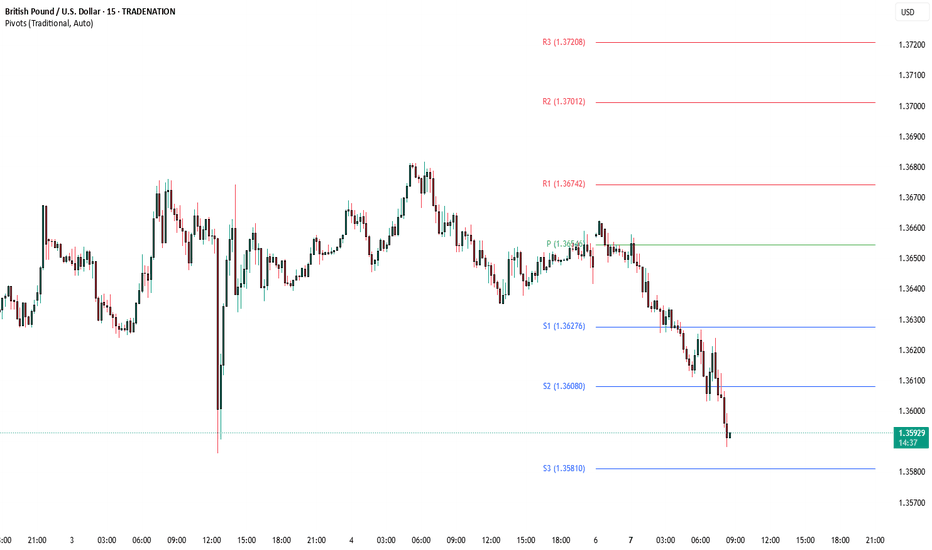

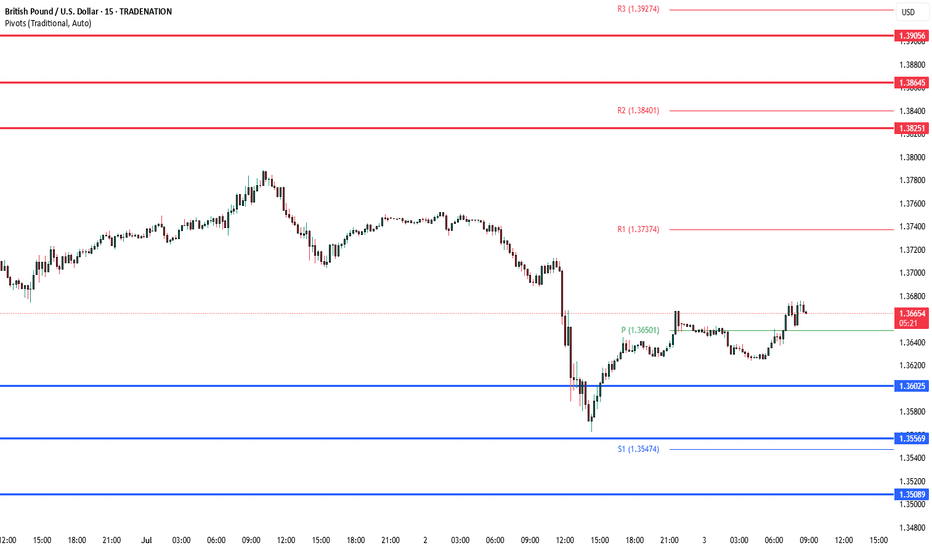

The GBPUSD currency pair continues to exhibit a bullish price action bias, supported by a sustained rising trend. Recent intraday movement reflects a sideways consolidation breakout, suggesting potential continuation of the broader uptrend. Key Technical Level: 1.3600 This level marks the prior consolidation range and now acts as pivotal support. A corrective...

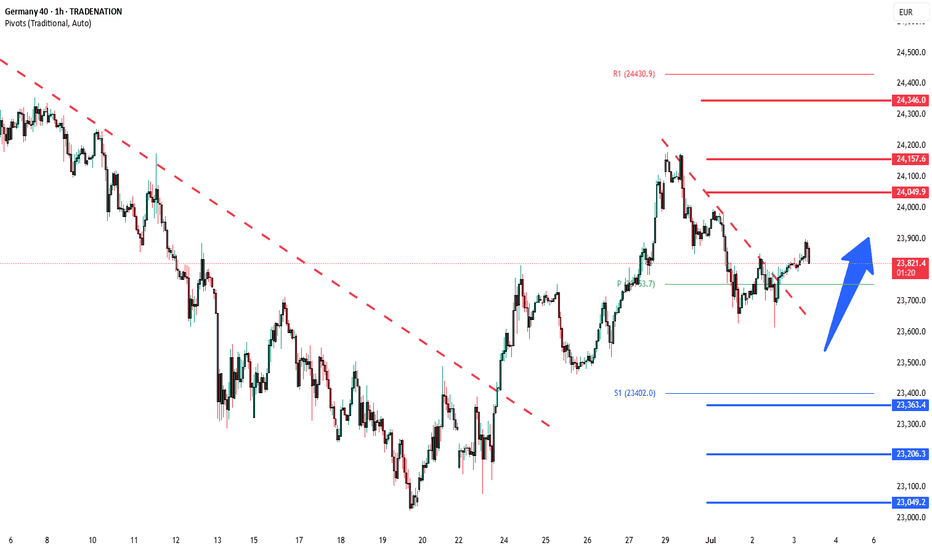

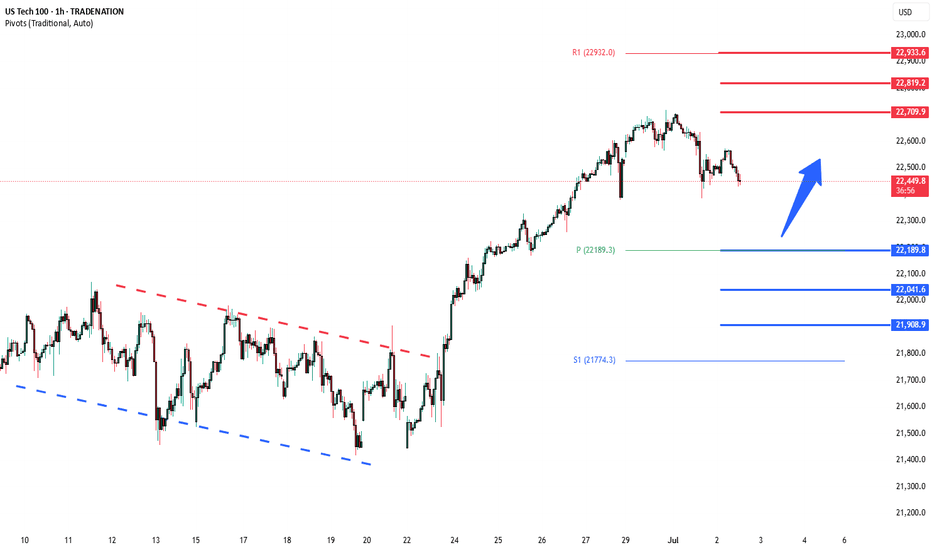

Trend Overview: The DAX index maintains a bullish overall sentiment, supported by a sustained rising trend on the higher timeframes. However, recent intraday price action suggests a corrective pullback and consolidation phase, likely part of a broader continuation pattern. Key Support and Resistance Levels: Support: Initial support: 23,330 – a key previous...

Thursday, July 3 – Market Focus Key Economic Data: US: June Jobs Report – Crucial for gauging labor market momentum and Fed rate expectations. ISM Services PMI (June) – Offers insight into the largest sector of the economy. May Trade Balance, Factory Orders, Initial Jobless Claims – Together provide a fuller picture of external demand, industrial health, and...

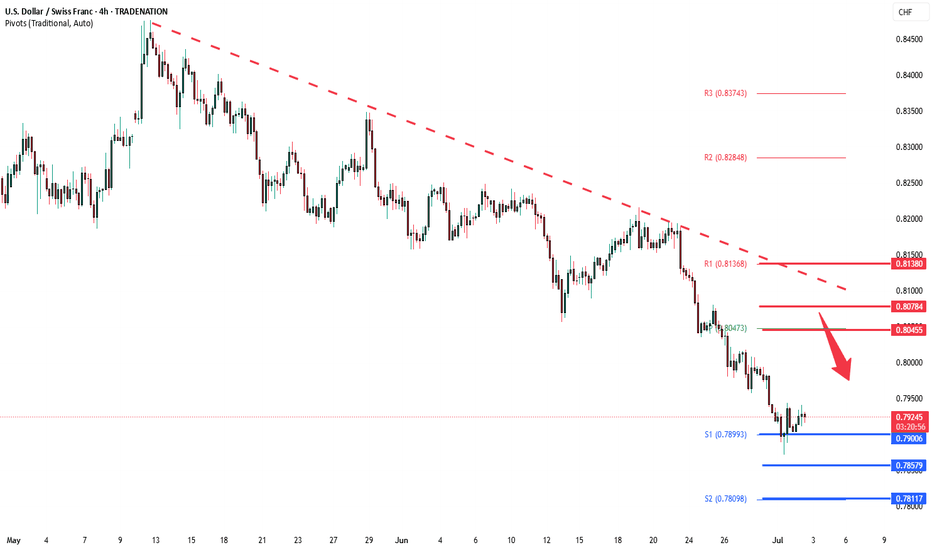

The USD/CHF pair is currently trading with a bearish bias, aligned with the broader downward trend. Recent price action shows a retest of the falling resistance, suggesting a temporary relief rally within the downtrend. Key resistance is located at 0.8045, a prior consolidation zone. This level will be critical in determining the next directional move. A bearish...

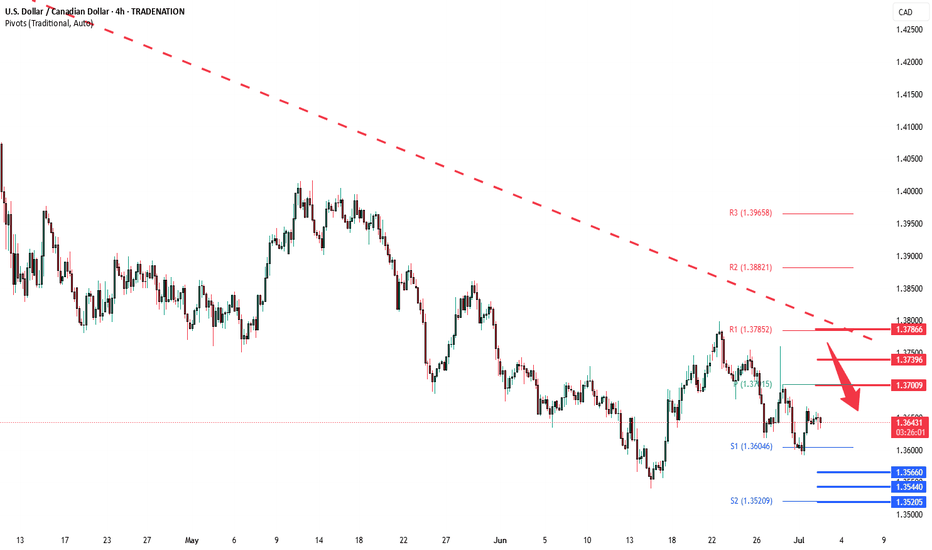

The USDCAD currency pair remains in a bearish technical structure, consistent with the prevailing downtrend. Recent price action suggests sideways consolidation, indicating indecision as the pair pauses before its next directional move. Key Technical Levels: Resistance: 1.3700 – Key pivot zone; previously acted as intraday resistance. 1.3740 – Minor...

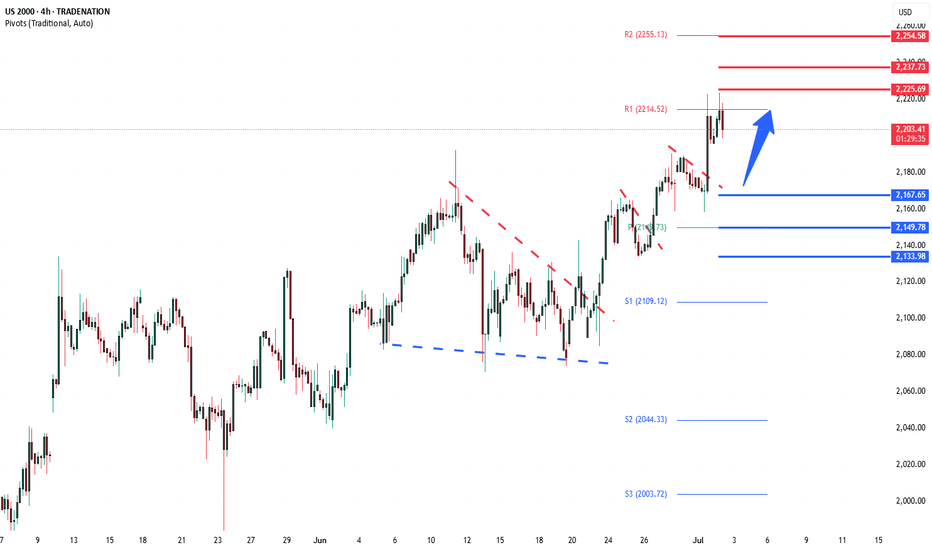

Key Support and Resistance Levels Resistance Level 1: 2225 Resistance Level 2: 2240 Resistance Level 3: 2255 Support Level 1: 2167 Support Level 2: 2150 Support Level 3: 2134 This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not...

Trump Trade Tensions: Donald Trump reaffirmed his July 9 deadline for higher tariffs, intensifying criticism of Japan, particularly over auto sector issues. While Japan insists talks are in good faith, market fears of a breakdown are rising. US Tax Policy in Focus: Trump’s “Big Beautiful” tax and spending bill faces potential resistance in the House despite...

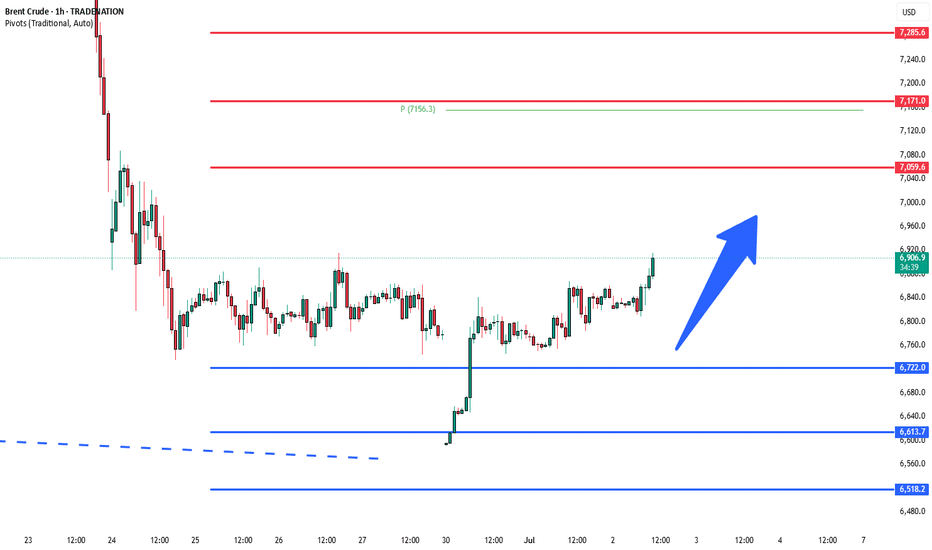

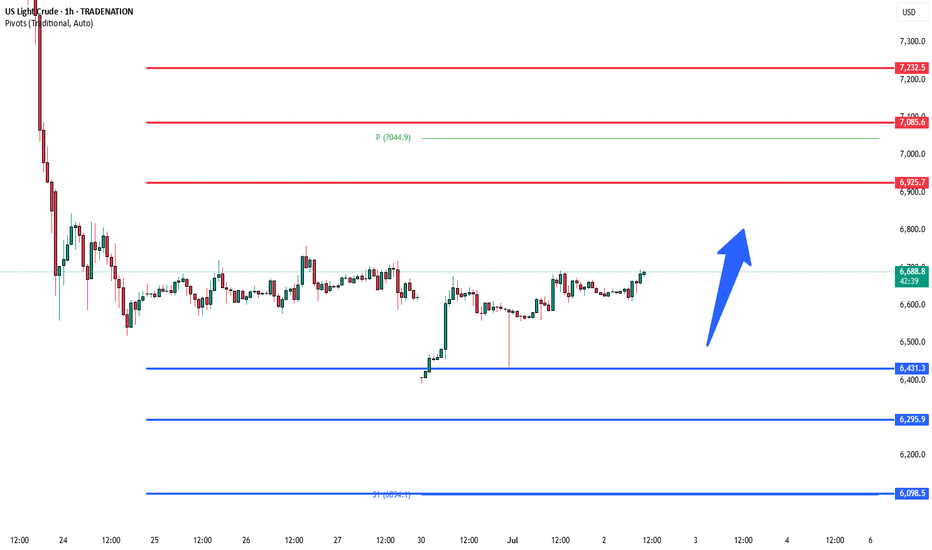

Key Support and Resistance Levels Resistance Level 1: 7060 Resistance Level 2: 7170 Resistance Level 3: 7280 Support Level 1: 6720 Support Level 2: 6610 Support Level 3: 6520 This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not...

Crude oil prices remain under pressure as easing geopolitical tensions between Iran and Israel reduce fears of supply disruptions in the Middle East. Adding to the bearish tone, the anticipated output increase by OPEC+—expected to raise August production by 411,000 bpd—acts as a supply-side headwind. Meanwhile, a modest rebound in the US Dollar from multi-year...

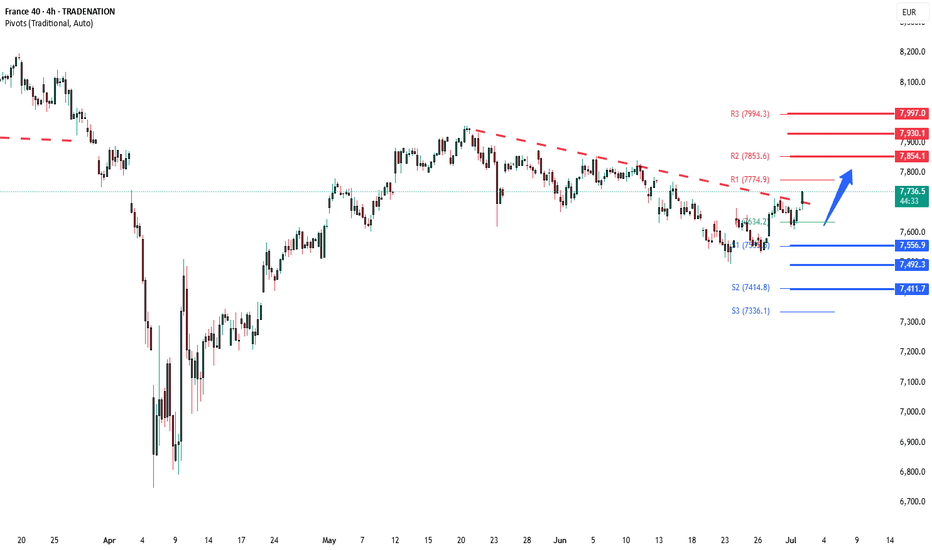

Key Support and Resistance Levels Resistance Level 1: 7850 Resistance Level 2: 7930 Resistance Level 3: 7995 Support Level 1: 7560 Support Level 2: 7490 Support Level 3: 7410 This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not...

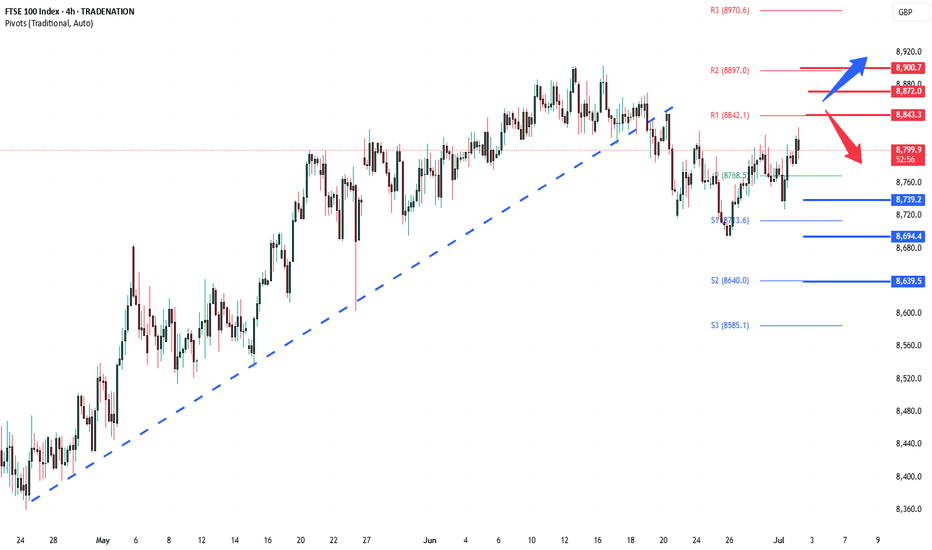

The FTSE remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend. Support Zone: 8740 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 8740 would confirm ongoing upside momentum, with potential targets at: 8840 – initial...