Market analysis from Trade Nation

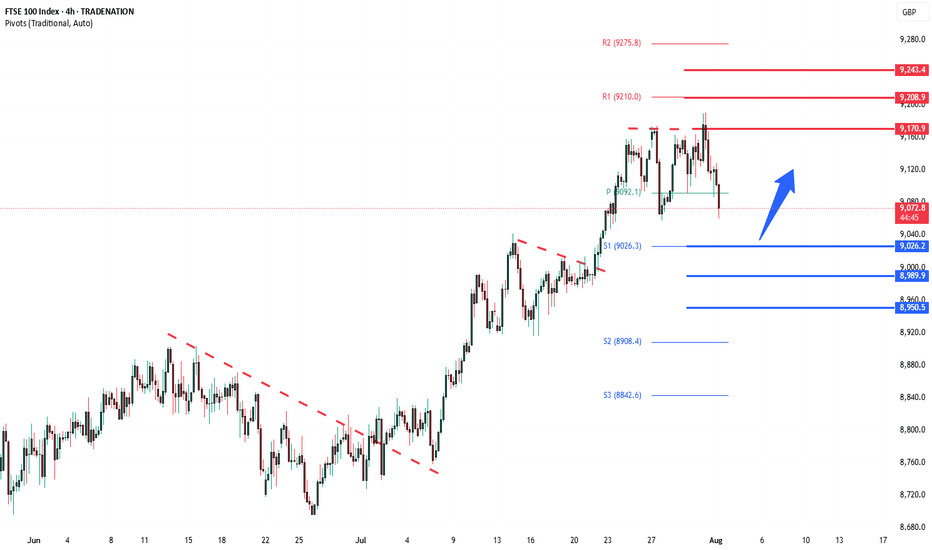

The FTSE remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend. Support Zone: 9026 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 9026 would confirm ongoing upside momentum, with potential targets at: 9170 – initial...

Weekly Summary – Key Data & Earnings (Week Ending August 2, 2025): Economic Data: US Jobs Report: Job growth slowed slightly; unemployment ticked up. Supports Fed holding rates steady. US Manufacturing (ISM): Sector still shrinking, showing weakness. US Car Sales & Construction: Car sales rose; construction spending up, led by infrastructure. China...

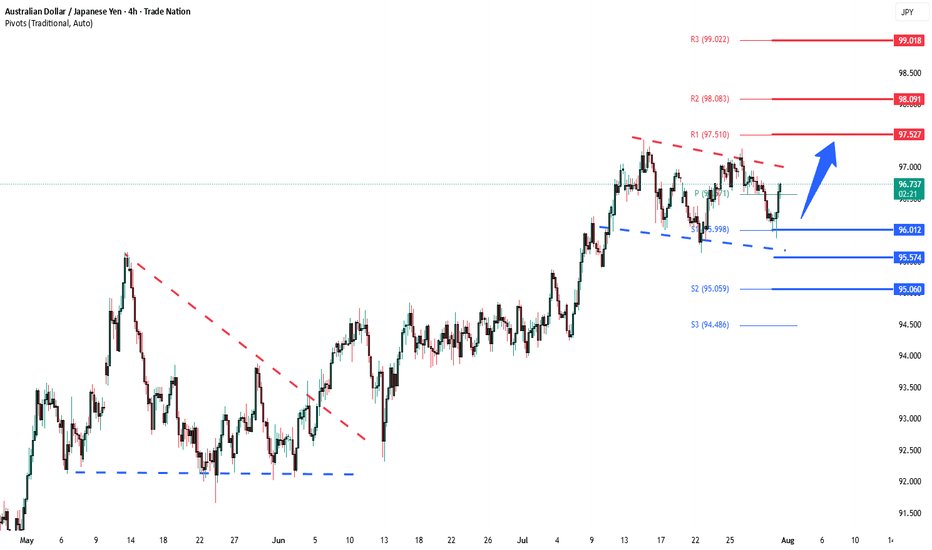

Key Support and Resistance Levels Resistance Level 1: 97.527 Resistance Level 2: 98.091 Resistance Level 3: 99.00 Support Level 1: 96.00 Support Level 2: 95.574 Support Level 3: 95.060 This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It...

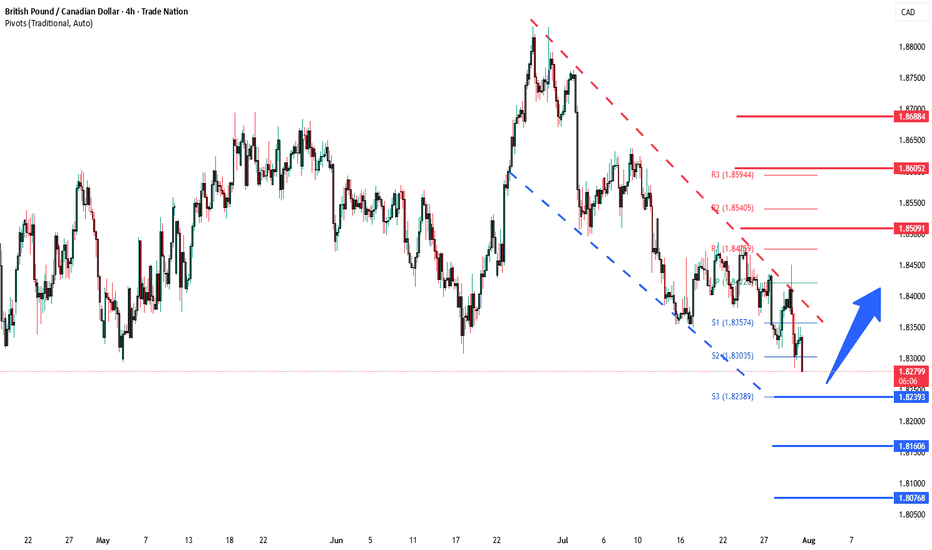

The GBPCAD remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend. Support Zone: 1.8240 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 1.8240 would confirm ongoing upside momentum, with potential targets at: 1.8510 – initial...

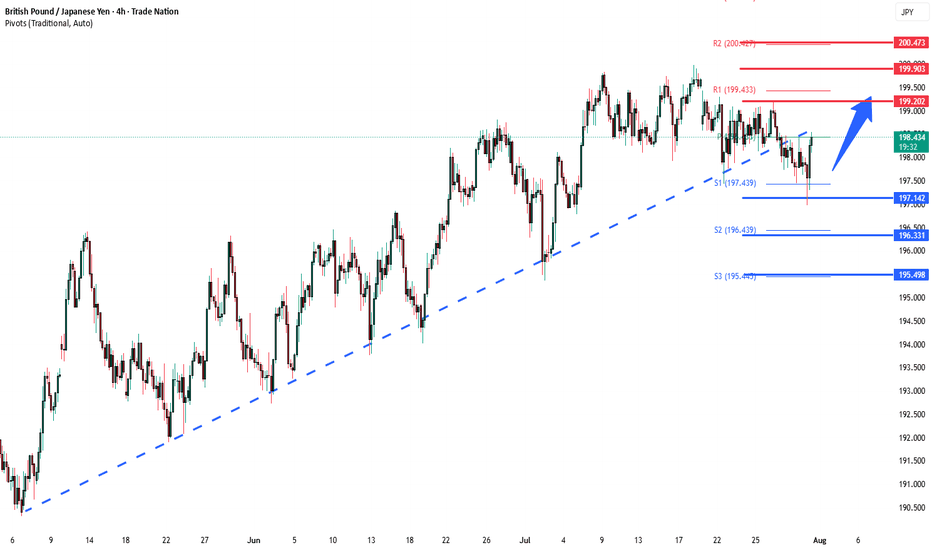

Key Support: 196.75 This level marks the prior consolidation zone and serves as a critical pivot. A corrective pullback toward 196.75 followed by a bullish reversal would validate the uptrend, with upside targets at: 199.20 – Initial resistance and short-term target 199.70 – Minor resistance zone 200.40 – Longer-term breakout objective However, a daily close...

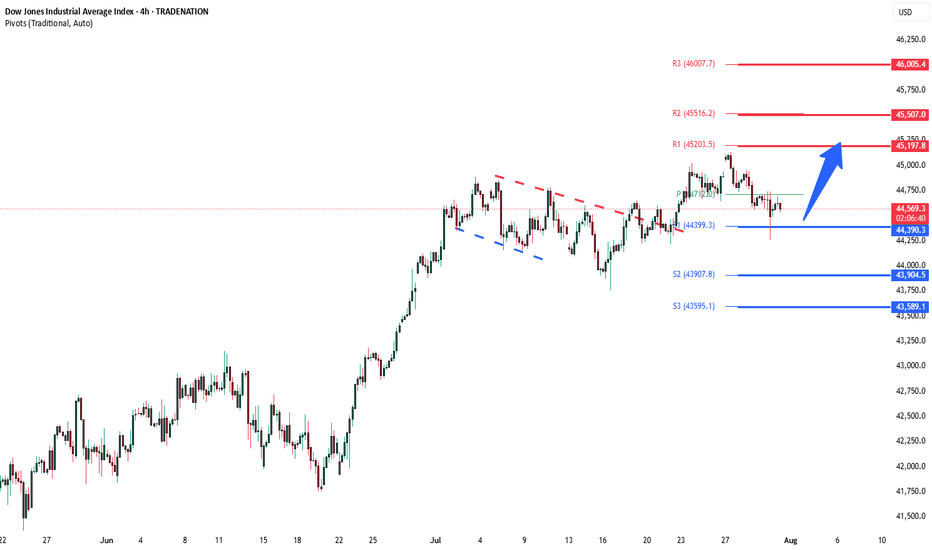

Key Support and Resistance Levels Resistance Level 1: 45197 Resistance Level 2: 45500 Resistance Level 3: 46000 Support Level 1: 44390 Support Level 2: 43900 Support Level 3: 43590 This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is...

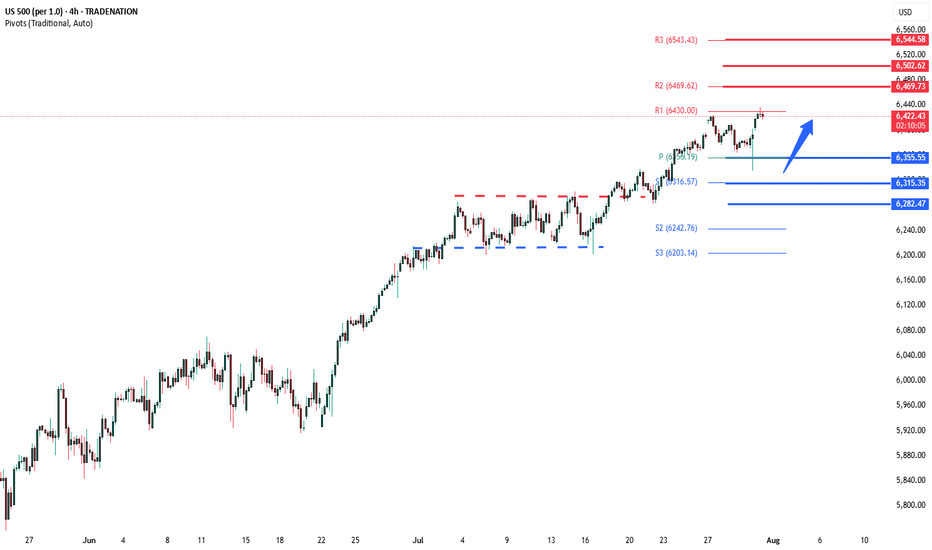

The S&P 500 slipped -0.12% after initially rising +0.3%, as Fed Chair Powell’s cautious “wait-and-see” stance on rate cuts dampened sentiment. The metals and mining sector dragged the index lower, falling nearly -4% after the U.S. announced surprise copper tariff details—excluding refined metal until 2027—leading to a sharp -20% drop in COMEX copper...

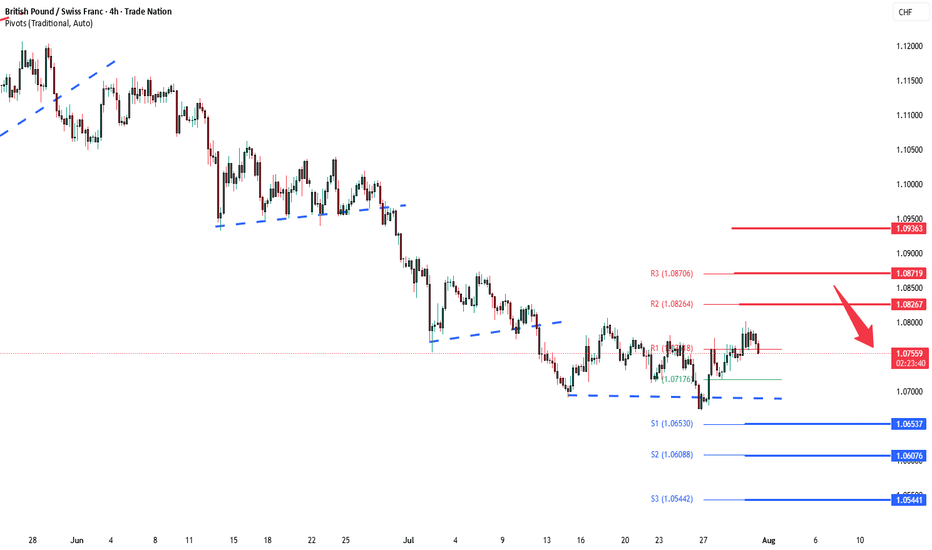

The GBPCHF pair is currently trading with a bearish bias, aligned with the broader downward trend. Recent price action shows a retest of the falling resistance, suggesting a temporary relief rally within the downtrend. Key resistance is located at 1.0826, a prior consolidation zone. This level will be critical in determining the next directional move. A bearish...

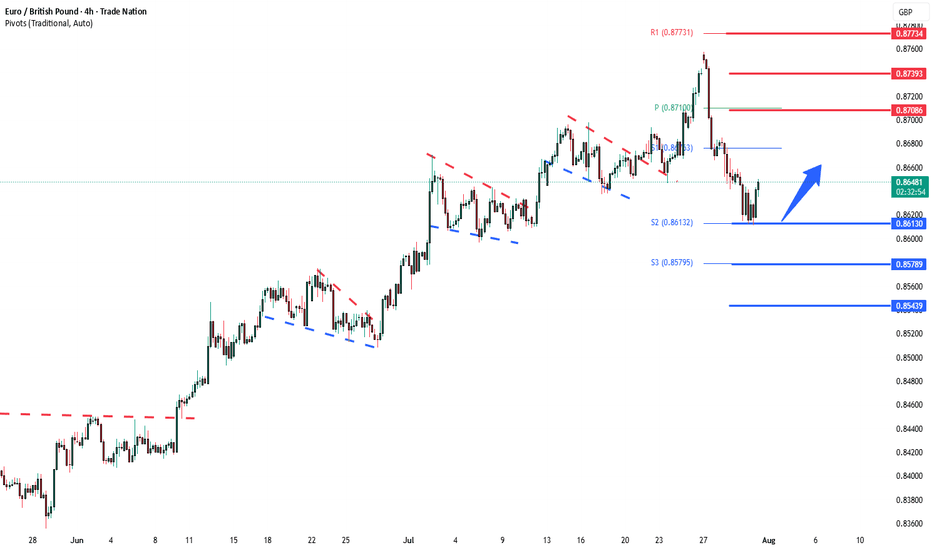

The EURGBP remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend. Support Zone: 0.8613 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 0.8613 would confirm ongoing upside momentum, with potential targets at: 0.8708 – initial...

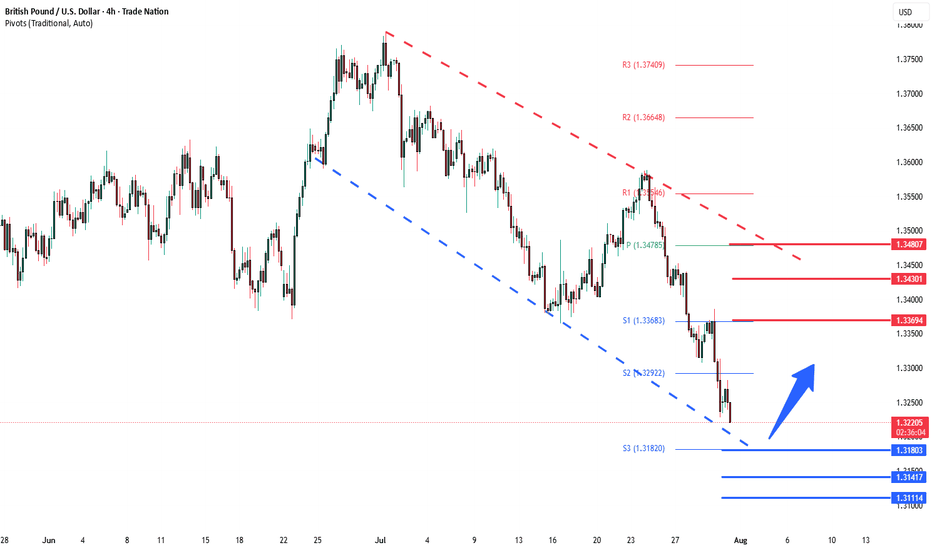

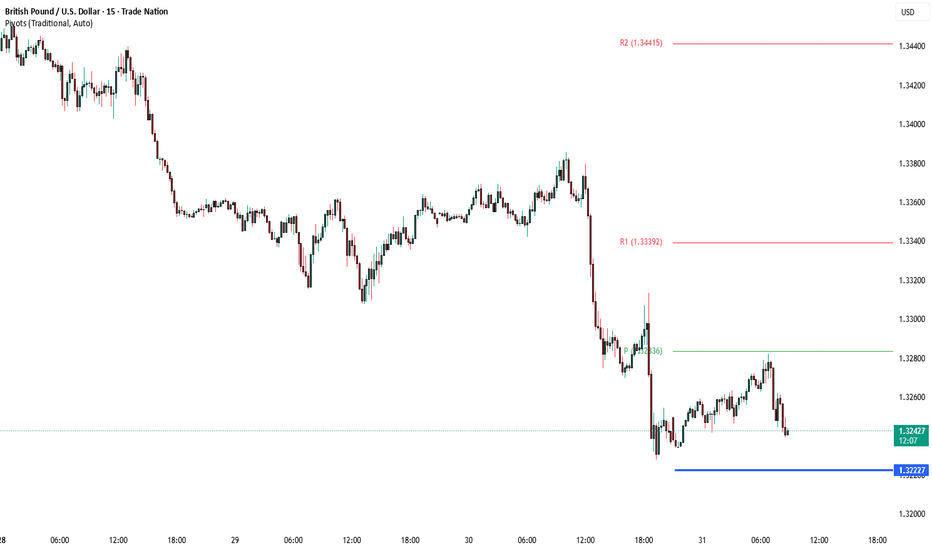

The GBPUSD remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend. Support Zone: 1.3180 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 1.3180 would confirm ongoing upside momentum, with potential targets at: 1.3370 – initial...

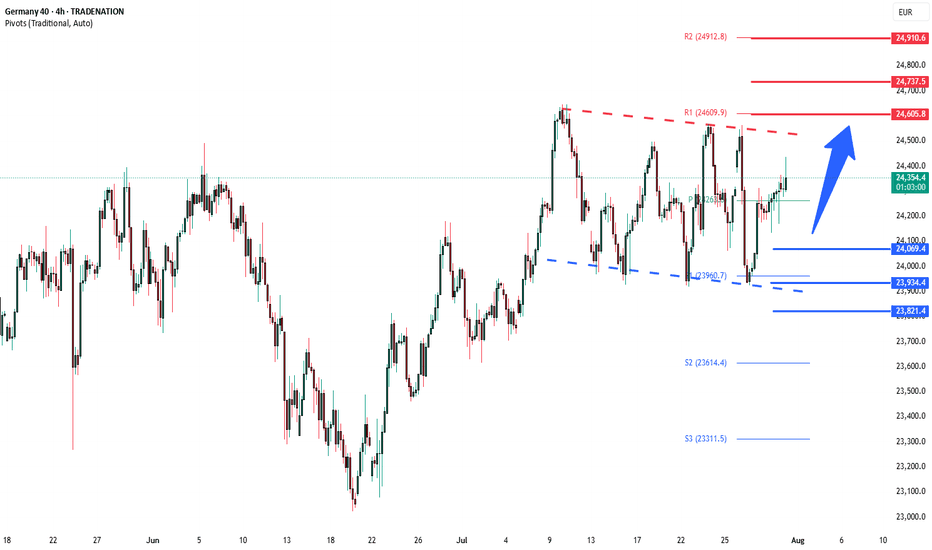

The DAX remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend. Support Zone: 24070 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 24070 would confirm ongoing upside momentum, with potential targets at: 24605 – initial...

Thursday July 31 - Market Summary United States: June personal income rose by 0.2 percent. June personal spending increased by 0.3 percent. Core PCE inflation was up 0.2 percent, showing steady disinflation. The Federal Reserve is likely to stay cautious; no immediate rate cuts expected. Japan: The Bank of Japan kept its interest rate at 0.5...

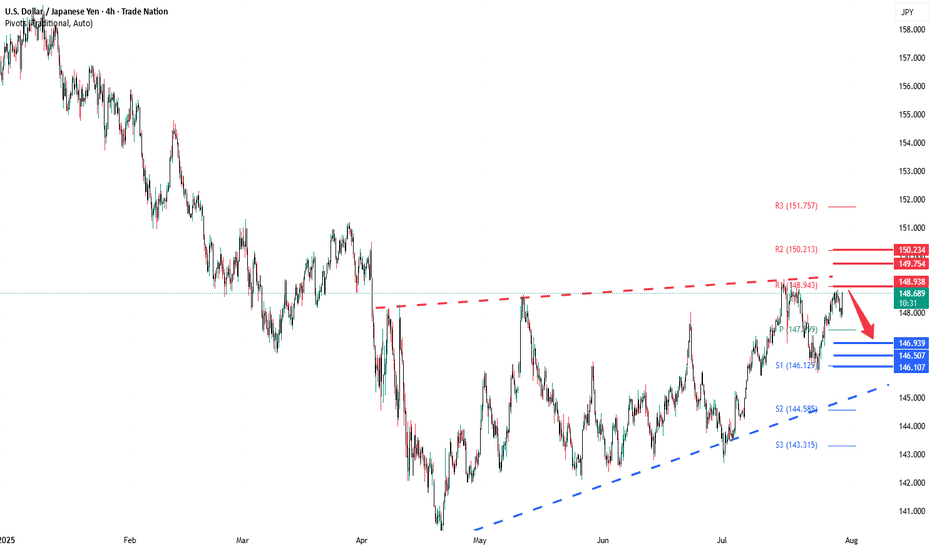

The USDJPY pair is currently trading with a bearish bias, aligned with the broader downward trend. Recent price action shows a retest of the falling resistance, suggesting a temporary relief rally within the downtrend. Key resistance is located at 149.90, a prior consolidation zone. This level will be critical in determining the next directional move. A bearish...

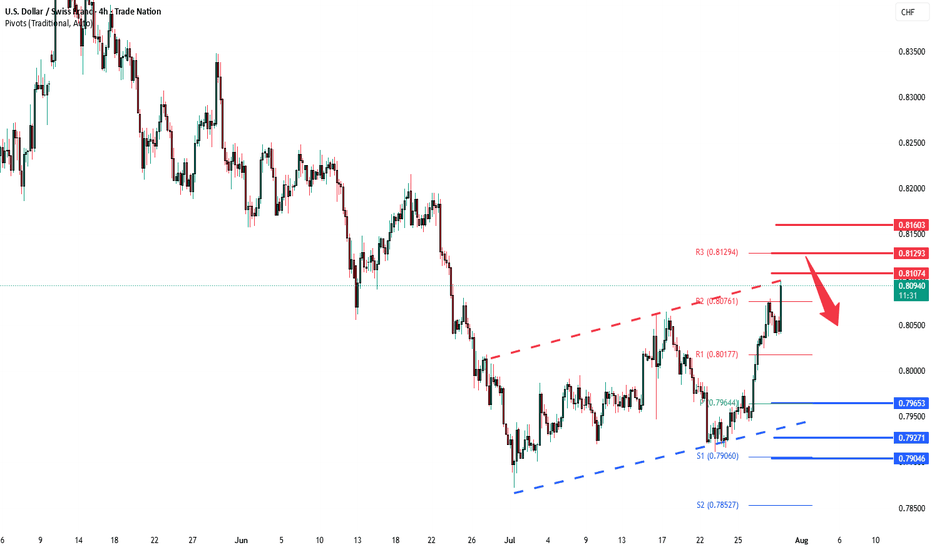

The USD/CHF pair is currently trading with a bearish bias, aligned with the broader downward trend. Recent price action shows a retest of the falling resistance, suggesting a temporary relief rally within the downtrend. Key resistance is located at 0.8107, a prior consolidation zone. This level will be critical in determining the next directional move. A bearish...

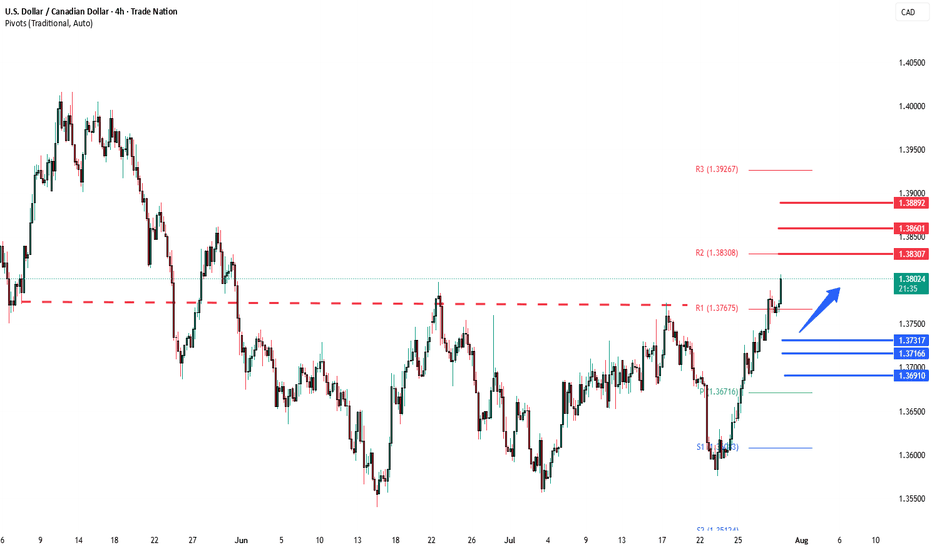

The USDCAD remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend. Support Zone: 1.3730 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 1.3730 would confirm ongoing upside momentum, with potential targets at: 1.3830 – initial...

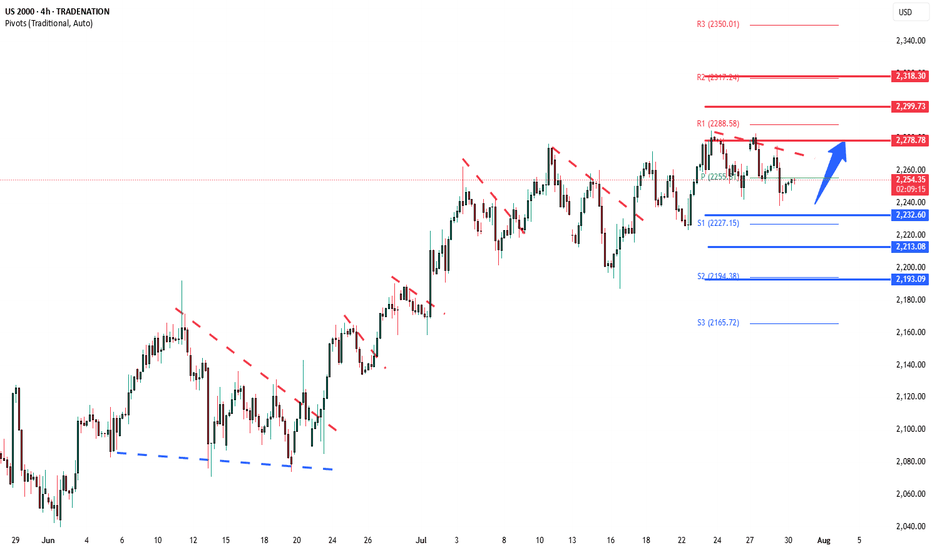

Key Support and Resistance Levels Resistance Level 1: 2278 Resistance Level 2: 2300 Resistance Level 3: 2318 Support Level 1: 2232 Support Level 2: 2213 Support Level 3: 2193 This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not...

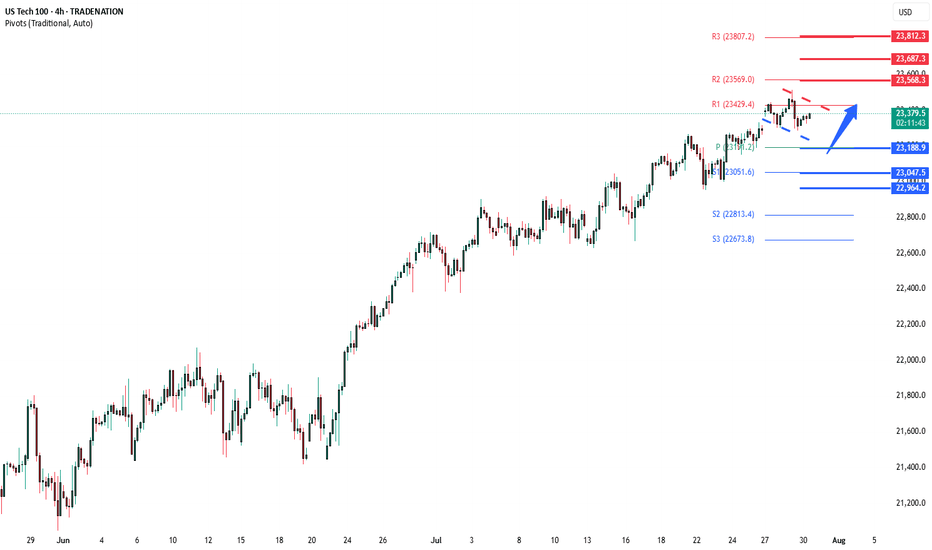

US equities pulled back, breaking a six-day winning streak for the S&P 500 (-0.30%) as sentiment cooled ahead of key earnings and the Federal Reserve’s rate decision. The Nasdaq 100 (NDX) was weighed down by weakness in megacap tech stocks—the Mag-7 fell -0.68%, with Meta declining -2.46% and Microsoft earnings due after the close. Post-earnings disappointments...

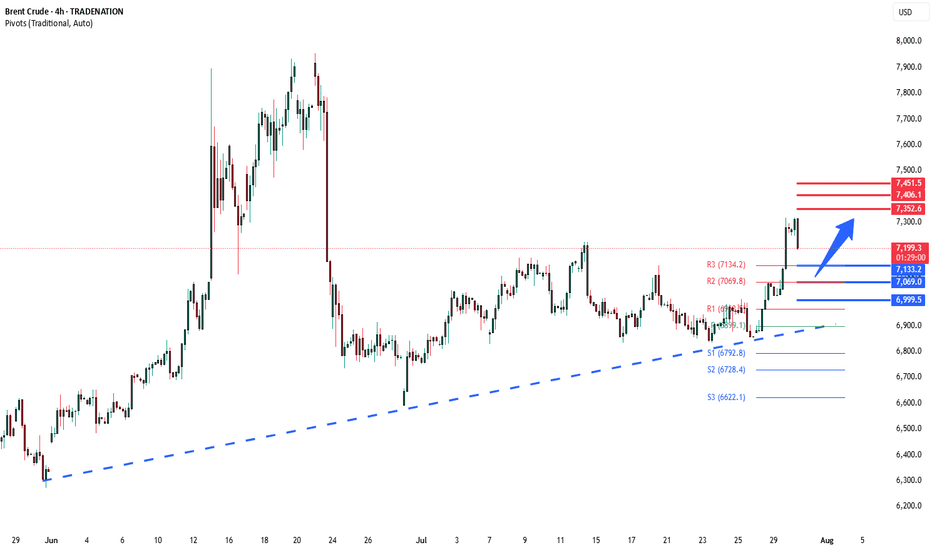

The Brent Crude remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend. Support Zone: 7133 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 7133 would confirm ongoing upside momentum, with potential targets at: 7352 – initial...