Market analysis from Trade Nation

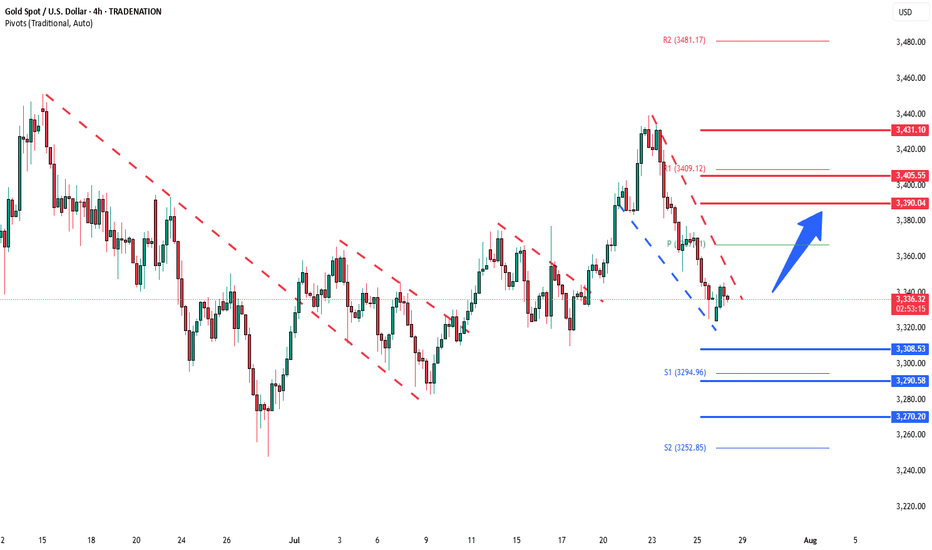

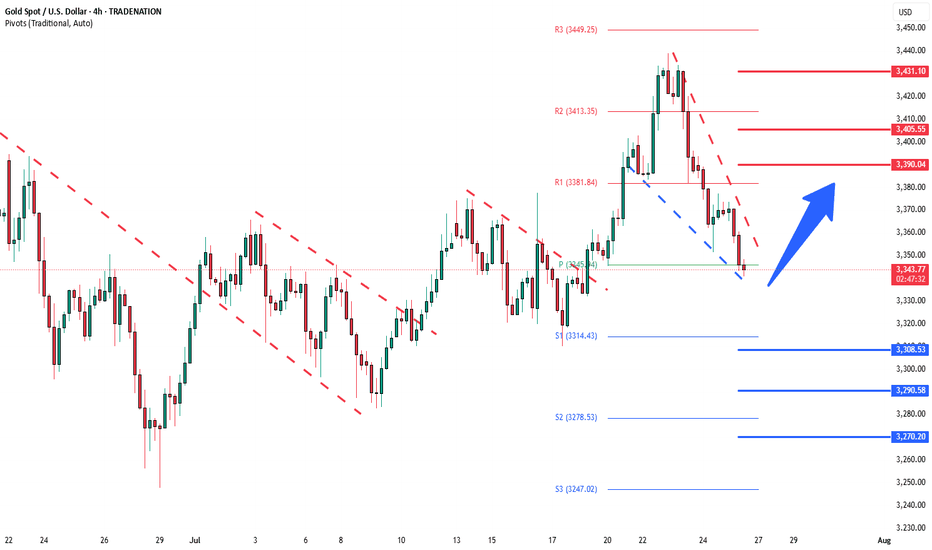

The Gold remains in a bullish trend, with recent price action showing signs of a continuation breakout within the broader uptrend. Support Zone: 3308 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 3308 would confirm ongoing upside momentum, with potential targets at: 3387 – initial...

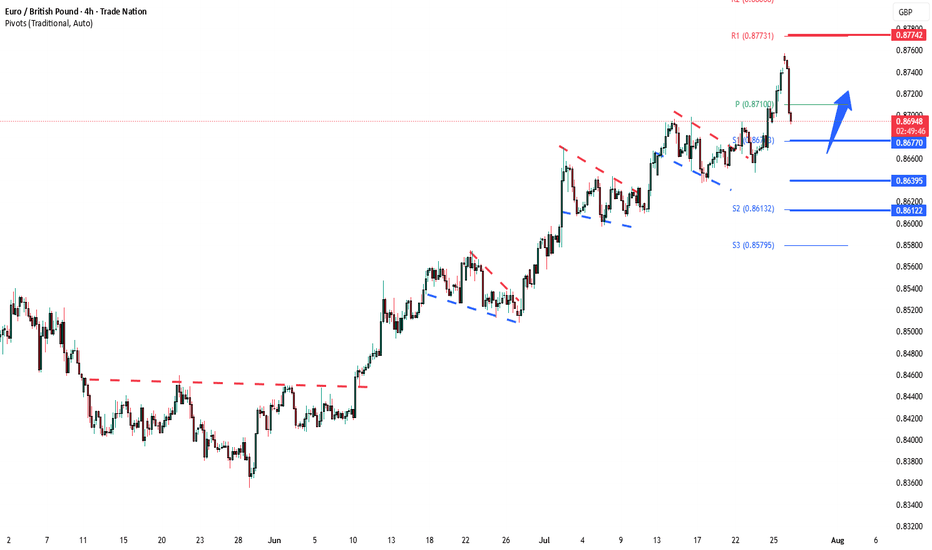

The EURGBP remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend. Support Zone: 0.8677 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 0.8677 would confirm ongoing upside momentum, with potential targets at: 0.8775 – initial...

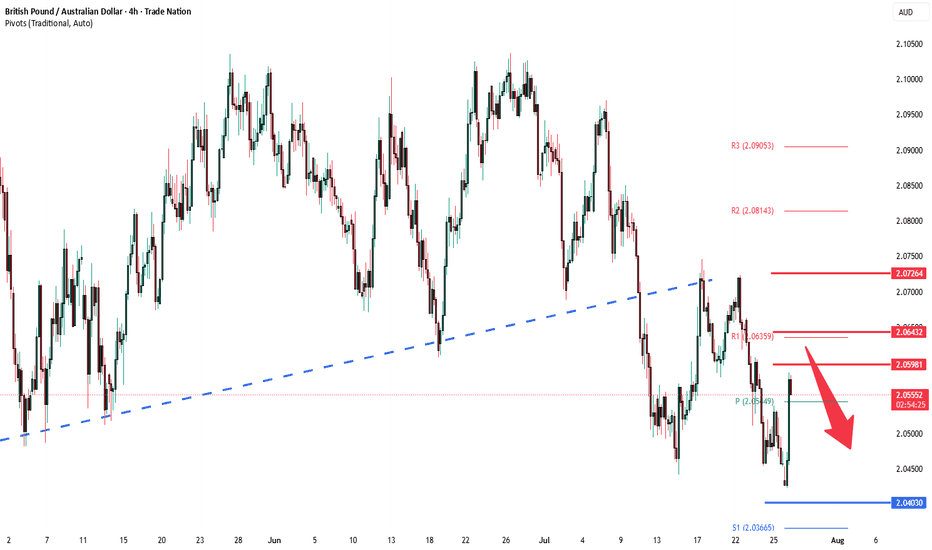

The GBPAUD pair is currently trading with a bearish bias, aligned with the broader downward trend. Recent price action shows a retest of the resistance, suggesting a temporary relief rally within the downtrend. Key resistance is located at 2.0600, a prior consolidation zone. This level will be critical in determining the next directional move. A bearish...

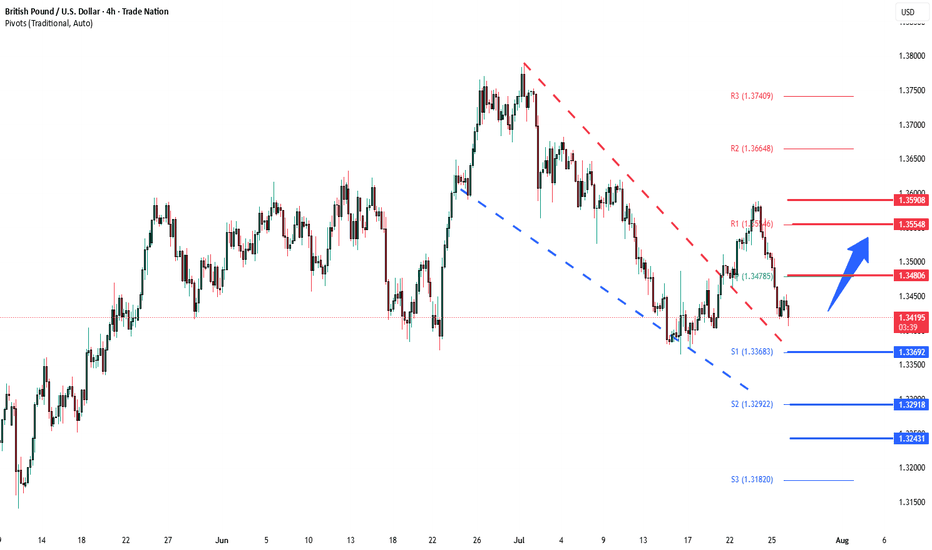

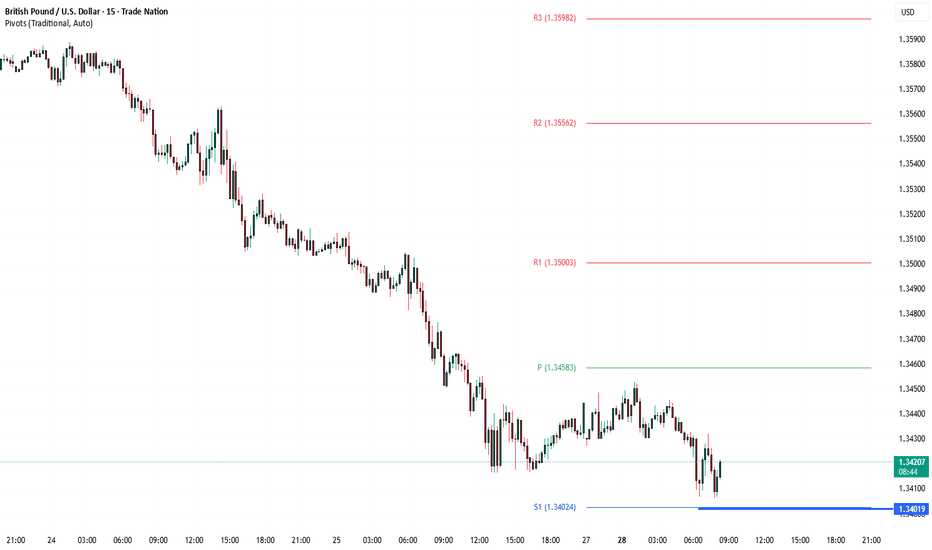

The GBPUSD remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend. Support Zone: 1.3370 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 1.3370 would confirm ongoing upside momentum, with potential targets at: 1.3480 – initial...

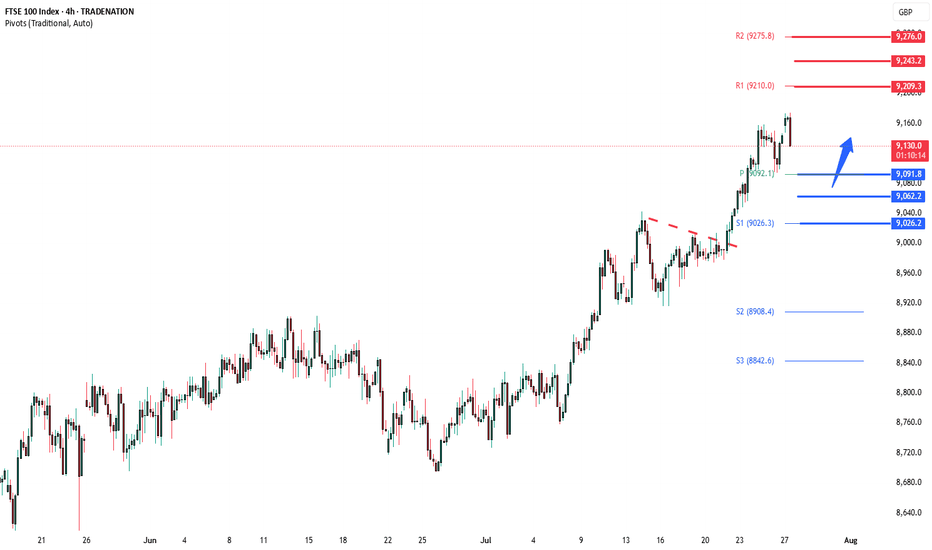

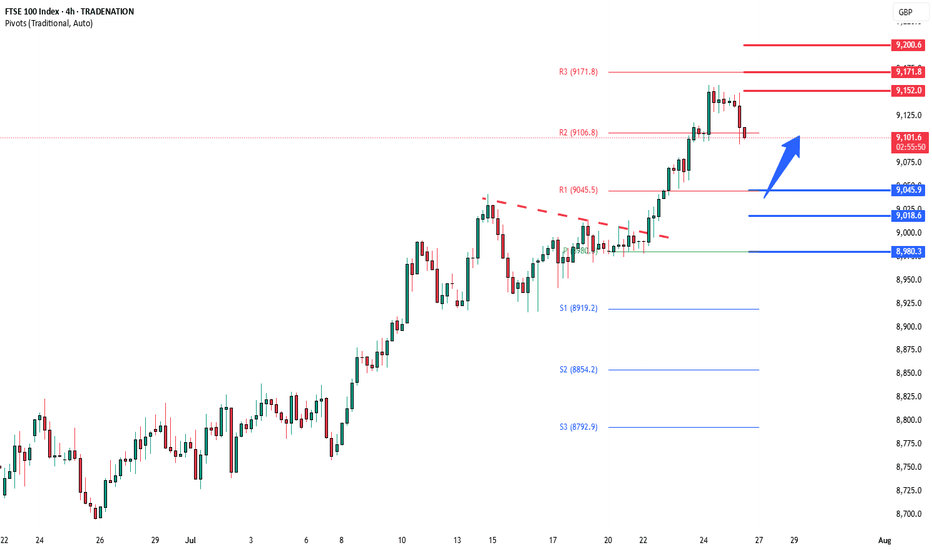

The FTSE remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend. Support Zone: 9092 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 9092 would confirm ongoing upside momentum, with potential targets at: 9210 – initial...

Market Summary – Monday, July 28: Data: The Dallas Fed manufacturing index is expected to stay weak, highlighting ongoing softness in US regional manufacturing. Earnings: EssilorLuxottica – Consumer strength and China demand in focus. Cadence Design Systems – Insight into AI and semiconductor R&D spending. Heineken – Signals on global consumer demand and...

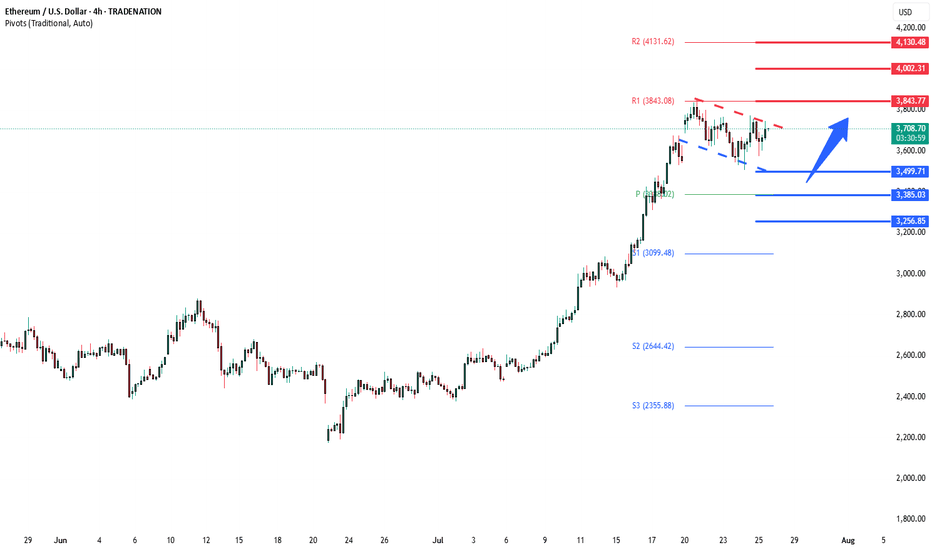

The ETHUSD remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend. Support Zone: 3500 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 3500 would confirm ongoing upside momentum, with potential targets at: 3842 – initial...

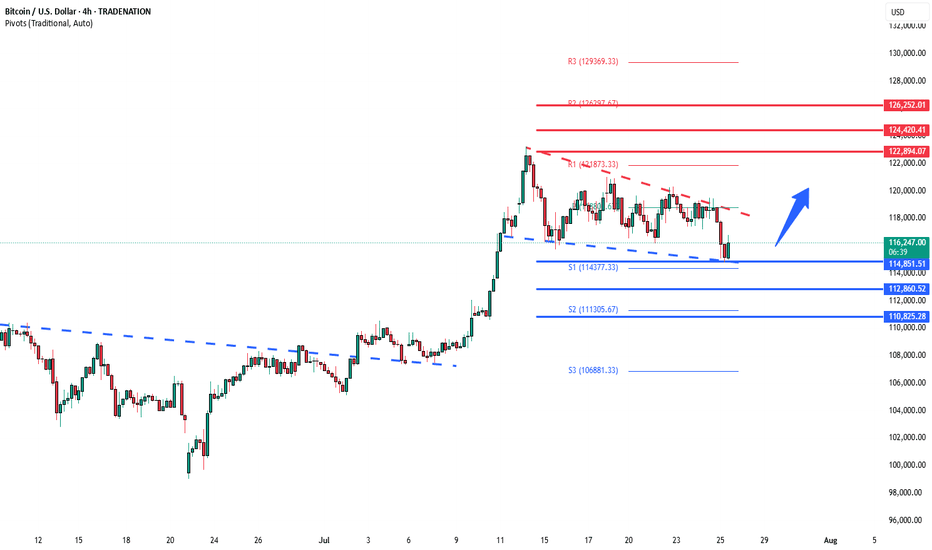

The BTCUSD remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend. Support Zone: 114,850 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 114,850 would confirm ongoing upside momentum, with potential targets at: 122,900 –...

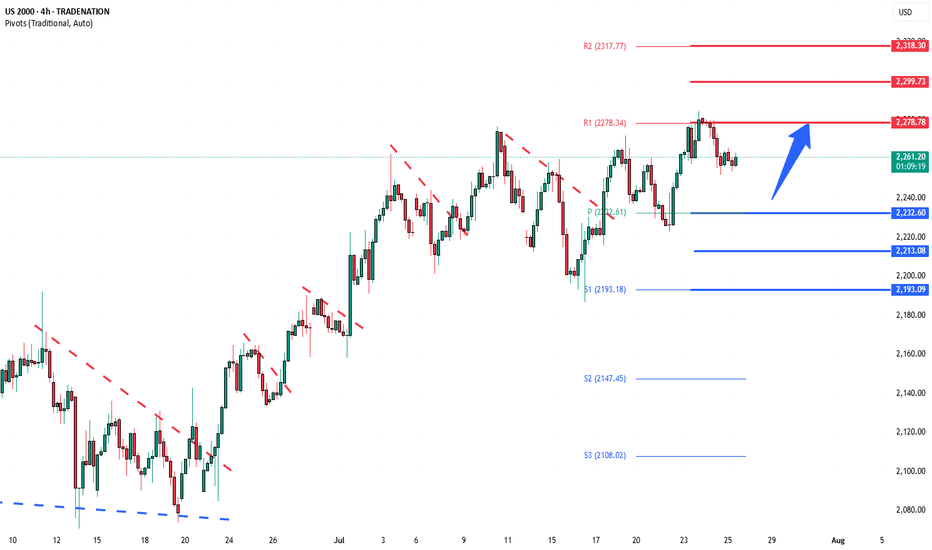

Key Support and Resistance Levels Resistance Level 1: 2278.80 Resistance Level 2: 2299.70 Resistance Level 3: 2318.30 Support Level 1: 2232.60 Support Level 2: 2213.00 Support Level 3: 2193.00 This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment...

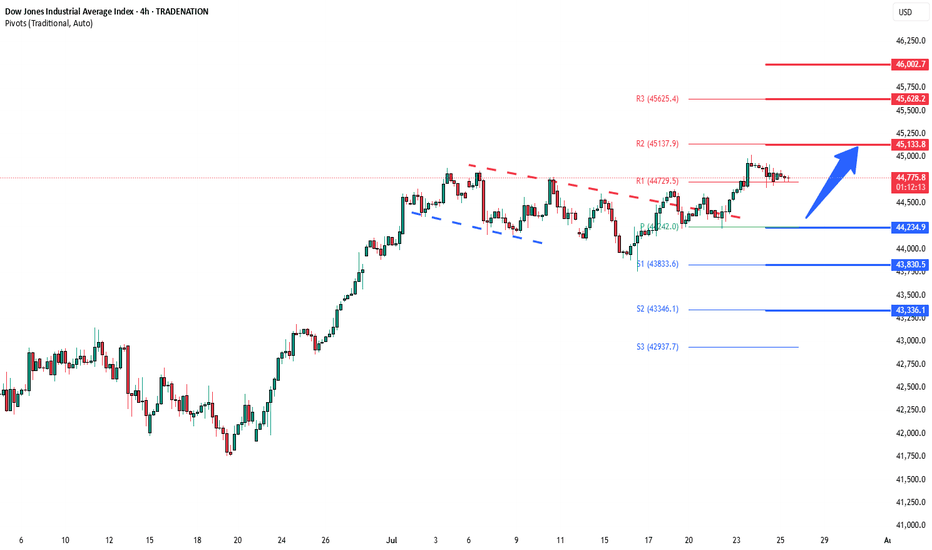

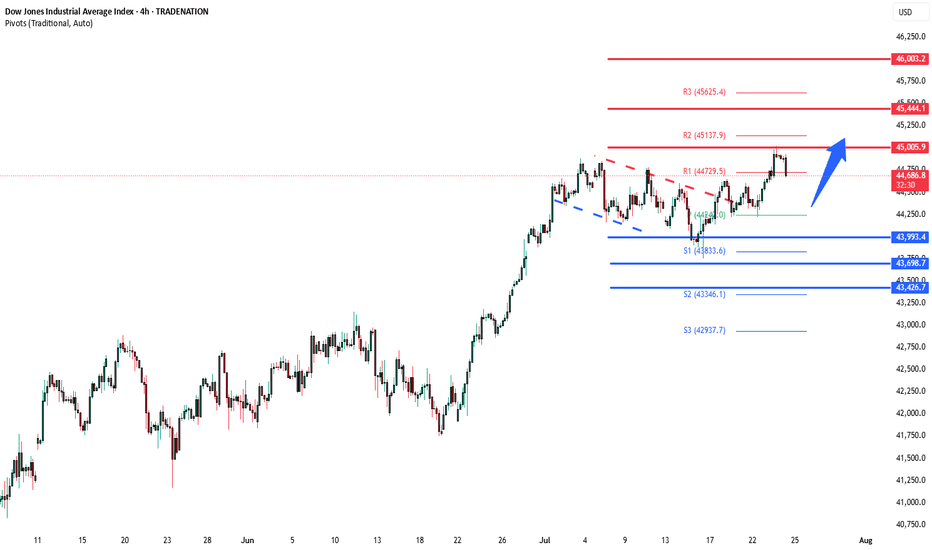

Key Support and Resistance Levels Resistance Level 1: 45135 Resistance Level 2: 45630 Resistance Level 3: 46000 Support Level 1: 44240 Support Level 2: 43830 Support Level 3: 43340 This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is...

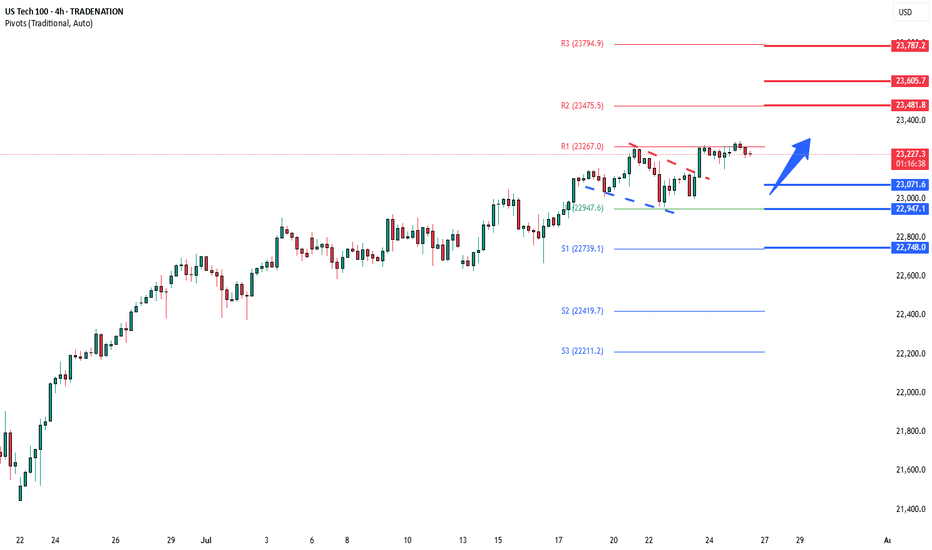

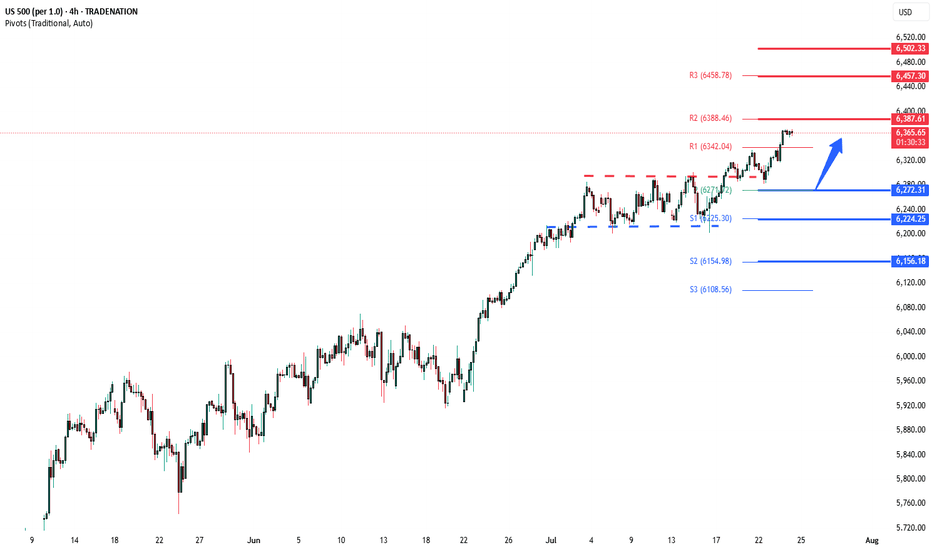

Thursday was a slightly positive session for equities, with the NASDAQ 100 rising +0.18% to close at a fresh record high, driven by strong economic data. However, overall market action was subdued, with the S&P 500’s trading range the narrowest since February (0.35%). Notably, the equal-weighted S&P 500 fell -0.33%, highlighting underlying weakness outside...

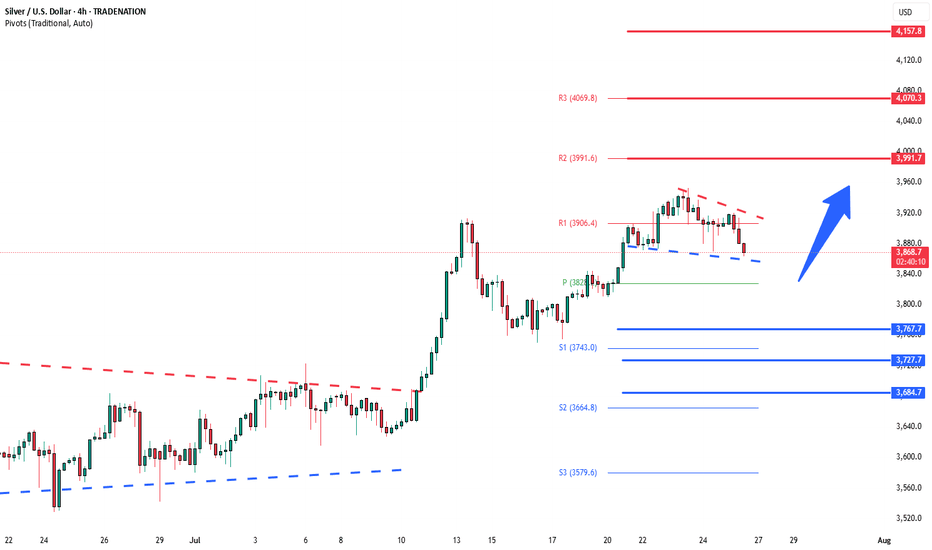

The Silver remains in a bullish trend, with recent price action showing signs of a continuation breakout within the broader uptrend. Support Zone: 3686 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 3686 would confirm ongoing upside momentum, with potential targets at: 3814 – initial...

The Gold remains in a bullish trend, with recent price action showing signs of a continuation breakout within the broader uptrend. Support Zone: 3308 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 3308 would confirm ongoing upside momentum, with potential targets at: 3387 – initial...

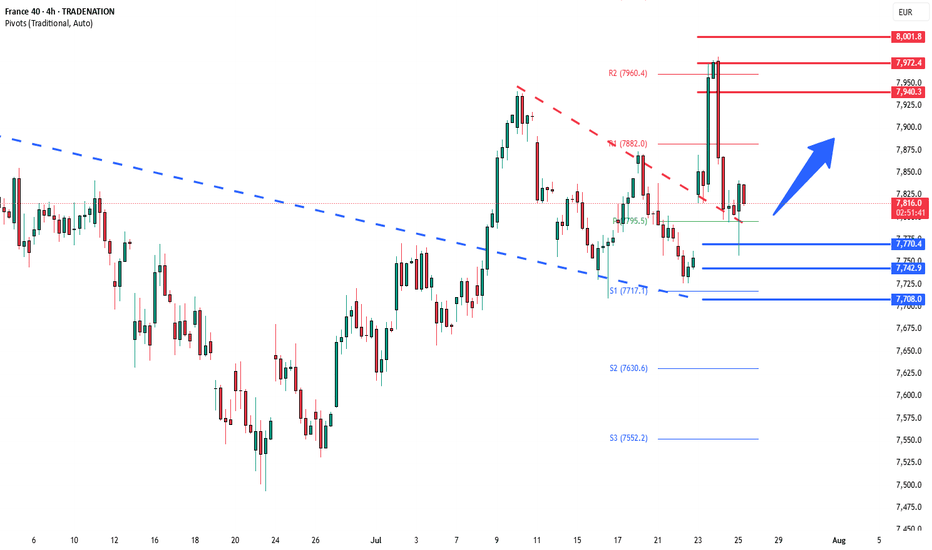

The CAC 40 index continues to display a bullish bias, underpinned by a well-established rising trend. Recent intraday price action indicates a breakout from consolidation, suggesting renewed upward momentum. Key Technical Levels: Support: 7770 – This level marks the prior consolidation zone and now serves as critical support. 7740 – Secondary support, guarding...

The FTSE remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend. Support Zone: 9045 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 9045 would confirm ongoing upside momentum, with potential targets at: 9150 – initial...

Friday, July 25 – Financial Market Summary (Trading Focus) Key Data Releases: US June Durable Goods Orders: A leading indicator of manufacturing activity. Strong growth may boost USD and treasury yields; weak numbers could fuel rate-cut bets. July Kansas City Fed Services Activity: Gauges regional service sector performance, often a directional cue for...

Key Support and Resistance Levels Resistance Level 1: 45000 Resistance Level 2: 45444 Resistance Level 3: 46000 Support Level 1: 43990 Support Level 2: 43700 Support Level 3: 43426 This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is...

Key Developments: AI Drives Earnings Momentum Alphabet reported strong results, but flagged surging AI infrastructure costs, signaling increased capex ahead. SK Hynix posted record earnings and committed to expanding AI-related investments, reinforcing the sector’s critical growth role. Investor sentiment remains AI-positive, with capital rotation favoring tech...