Market analysis from Trade Nation

Economic Data US June Existing Home Sales (10:00 ET): Will gauge housing demand resilience amid high mortgage rates. A weaker print may support rate cut expectations. Eurozone July Consumer Confidence (Flash): Important for sentiment around ECB rate policy. Any downside surprise could weigh on the euro. Central Banks BoJ’s Uchida Speaks: Watch for any shift in...

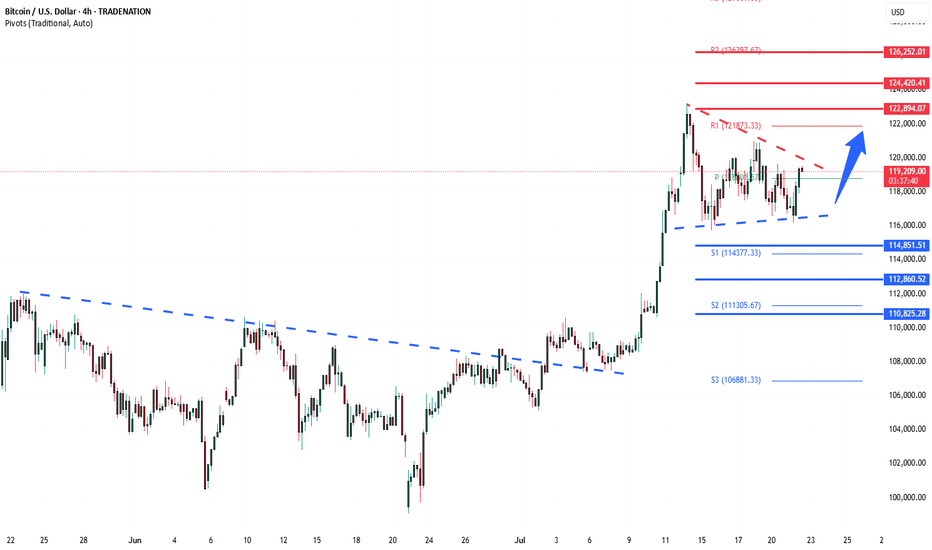

The BTCUSD remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend. Support Zone: 114,850 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 114,850 would confirm ongoing upside momentum, with potential targets at: 122,900 –...

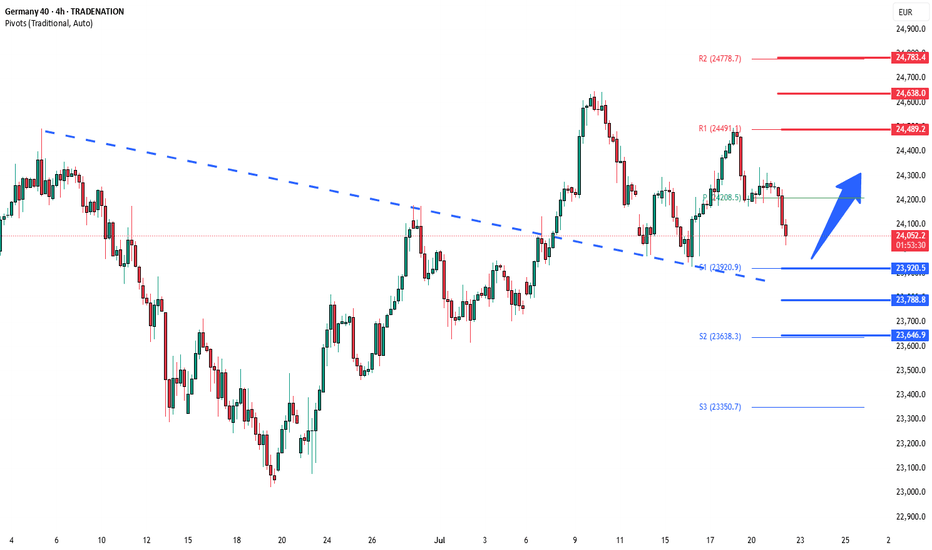

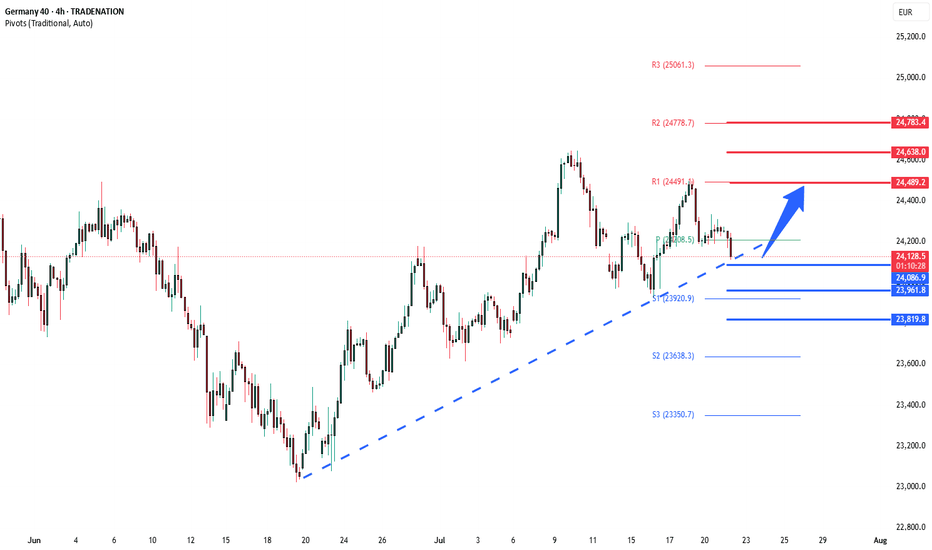

Key Support and Resistance Levels Resistance Level 1: 24490 Resistance Level 2: 24640 Resistance Level 3: 24780 Support Level 1: 23920 Support Level 2: 23790 Support Level 3: 23646 This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is...

Key Developments: Fed Politics: Treasury Secretary Scott Bessent called for a review of the Fed’s $2.5B HQ renovation, continuing political pressure on Jerome Powell. This adds to the uncertainty around Fed independence and rate path. Meme Stock Surge: Opendoor soared 121% amid a retail-driven frenzy. Major institutional investors are also chasing the rally,...

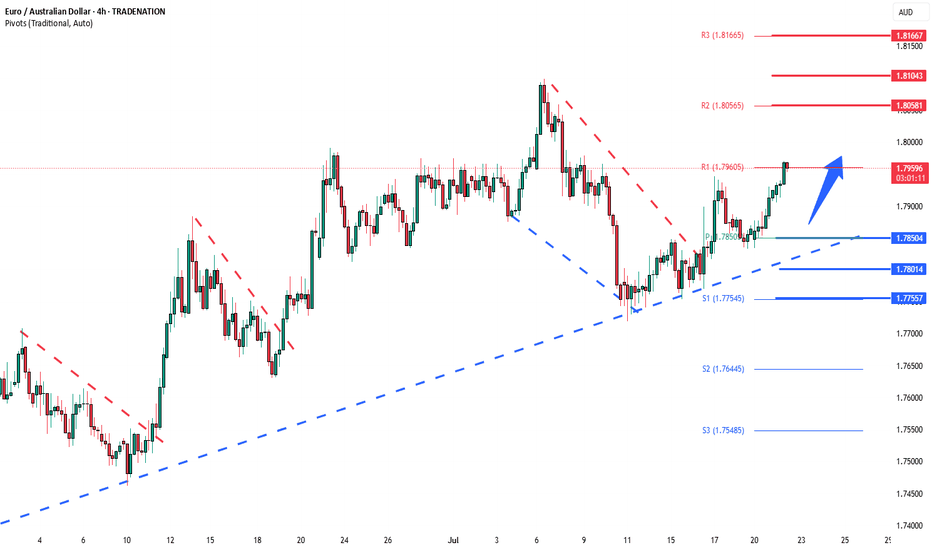

The EURAUD remains in a bullish trend, with recent price action indicating a continuation breakout within the broader uptrend. Support Zone: 1.7850 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 1.7850 would confirm ongoing upside momentum, with potential targets at: 1.8060 – initial...

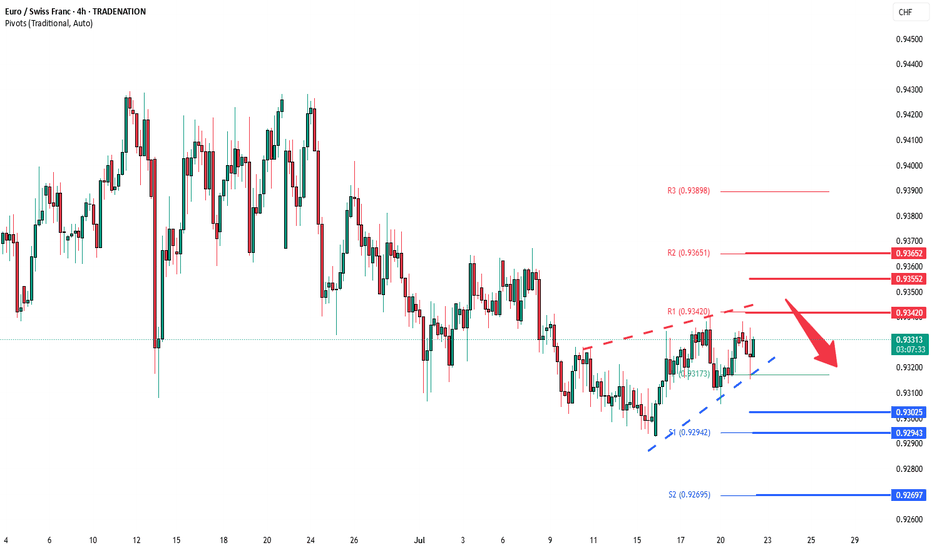

The EURCHF pair is currently trading with a bearish bias, aligned with the broader downward trend. Recent price action shows a retest of the falling resistance, suggesting a temporary relief rally within the downtrend. Key resistance is located at 0.9340, a prior consolidation zone. This level will be critical in determining the next directional move. A bearish...

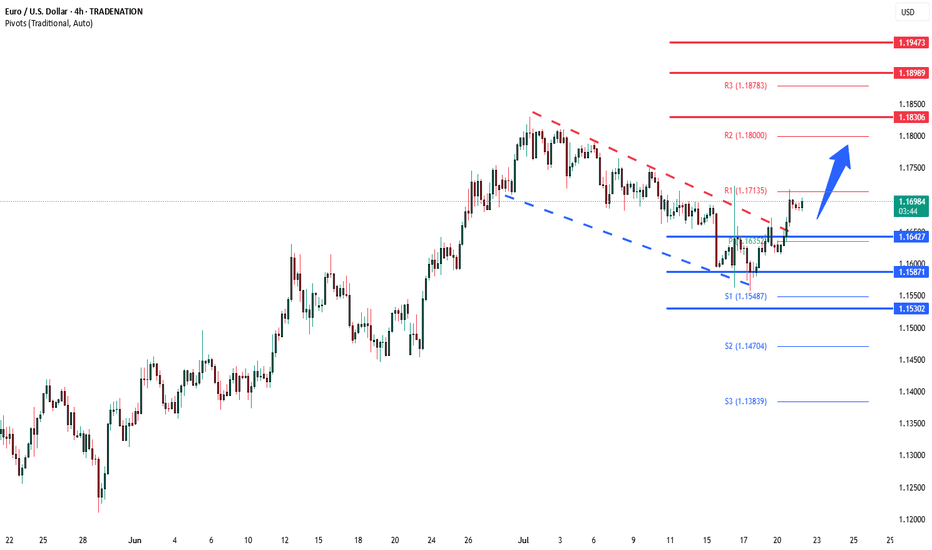

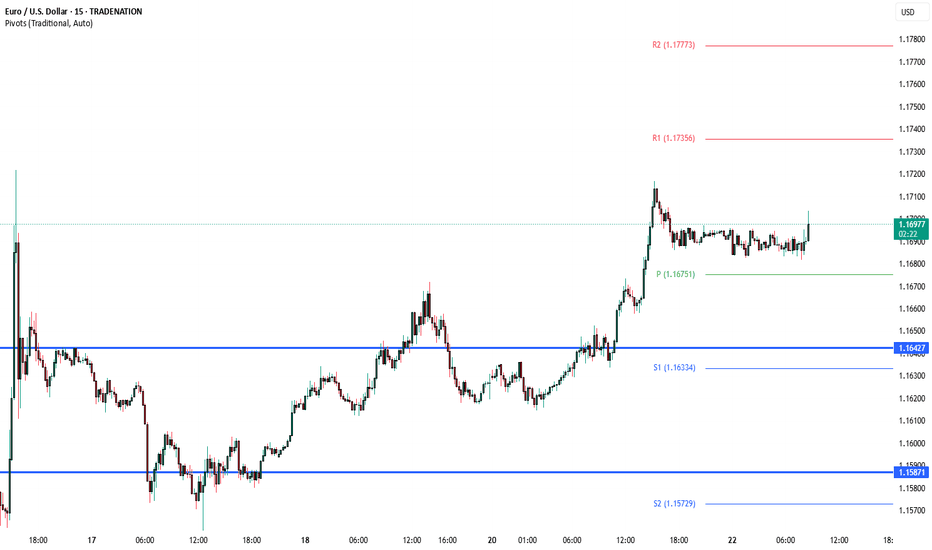

The EURUSD currency pair continues to exhibit a bullish price action bias, supported by a sustained rising trend. Recent intraday movement reflects a sideways consolidation breakout, suggesting potential continuation of the broader uptrend. Key Technical Level: 1.1640 This level marks the prior consolidation range and now acts as pivotal support. A corrective...

The DAX remains in a bullish trend, with recent price action showing signs of a resistance breakout within the broader uptrend. Support Zone: 24085 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 24085 would confirm ongoing upside momentum, with potential targets at: 24490 – initial...

Key Data Releases: US: Philadelphia Fed non-manufacturing activity – A pulse-check on services sector strength. Positive surprise could boost USD and Treasury yields. Richmond Fed manufacturing & business conditions – Insight into regional factory health; any contraction signals broader economic weakness. UK: June Public Finances – Higher borrowing may raise...

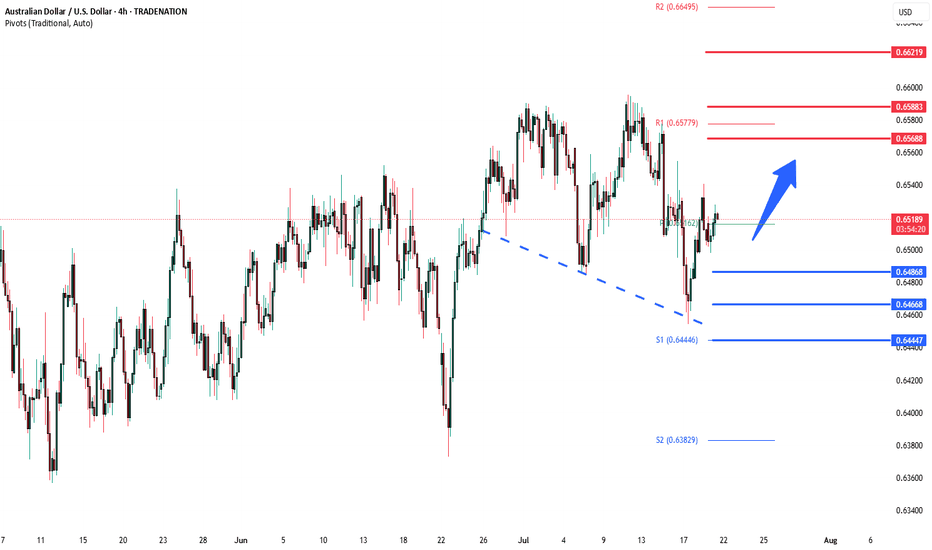

Trend Overview: The AUDUSD currency price remains in a bullish trend, characterised by higher highs and higher lows. The recent intraday price action is forming a continuation consolidation pattern, suggesting a potential pause before a renewed move higher. Key Technical Levels: Support: 0.6465 (primary pivot), followed by 0.6445 and 0.6400 Resistance: 0.6570...

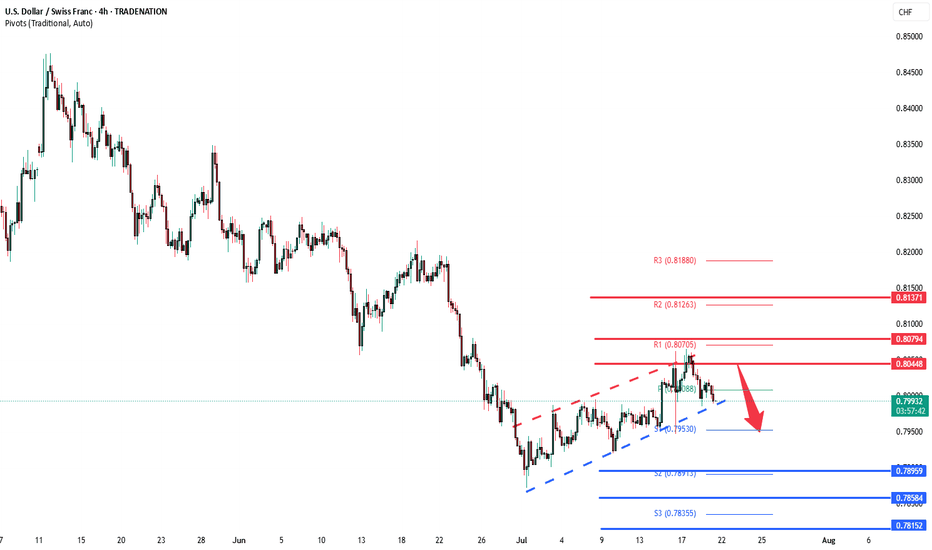

The USD/CHF pair is currently trading with a bearish bias, aligned with the broader downward trend. Recent price action shows a retest of the falling resistance, suggesting a temporary relief rally within the downtrend. Key resistance is located at 0.8045, a prior consolidation zone. This level will be critical in determining the next directional move. A bearish...

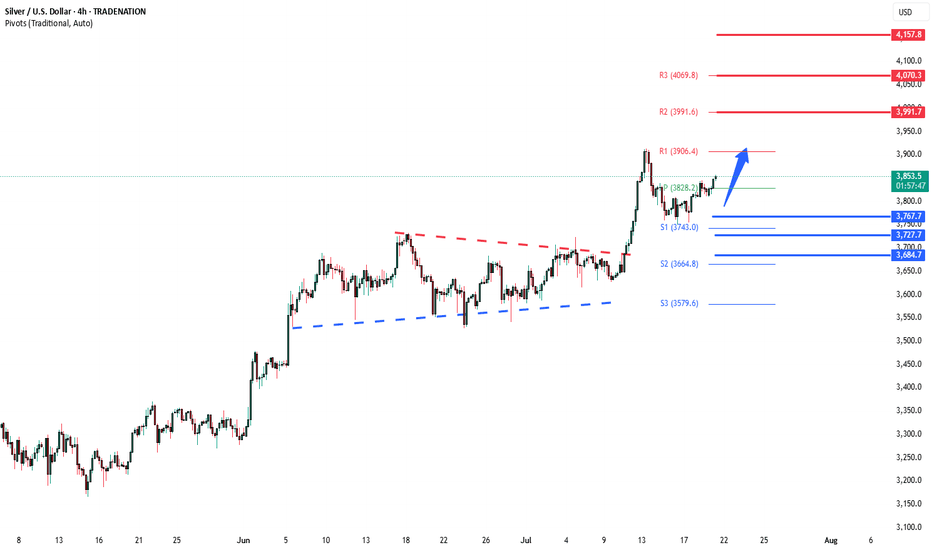

The Silver remains in a bullish trend, with recent price action showing signs of a continuation breakout within the broader uptrend. Support Zone: 3686 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 3686 would confirm ongoing upside momentum, with potential targets at: 3814 – initial...

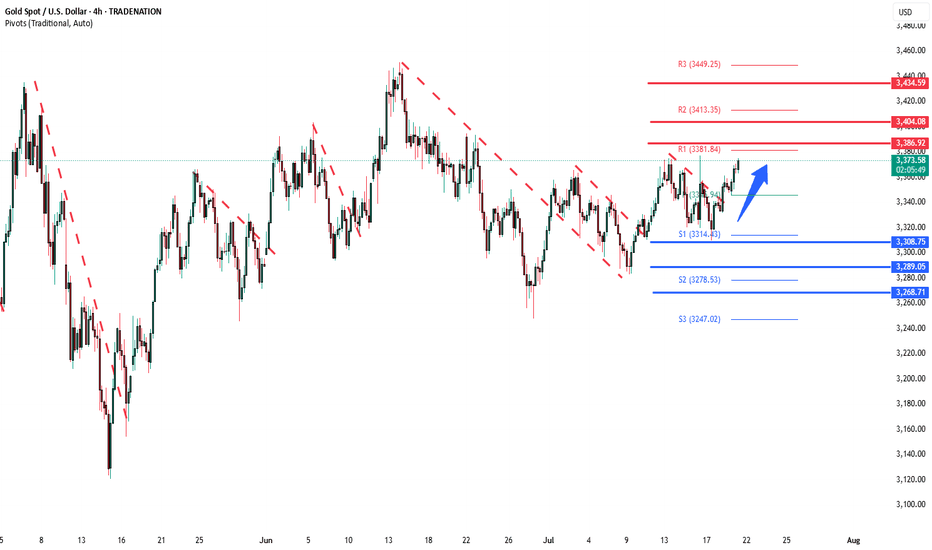

The Gold remains in a bullish trend, with recent price action showing signs of a continuation breakout within the broader uptrend. Support Zone: 3308 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 3308 would confirm ongoing upside momentum, with potential targets at: 3387 – initial...

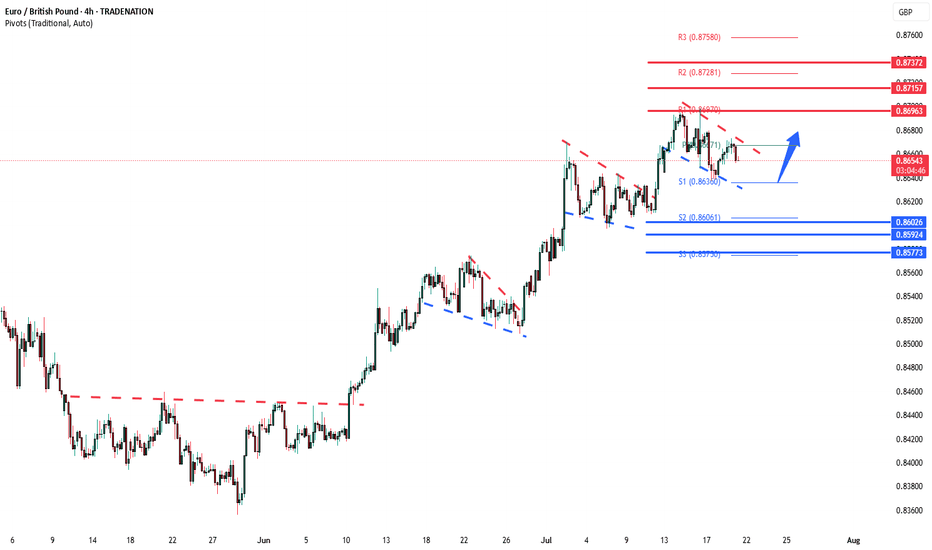

The EURGBP remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend. Support Zone: 0.8620 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 0.8620 would confirm ongoing upside momentum, with potential targets at: 0.8700 – initial...

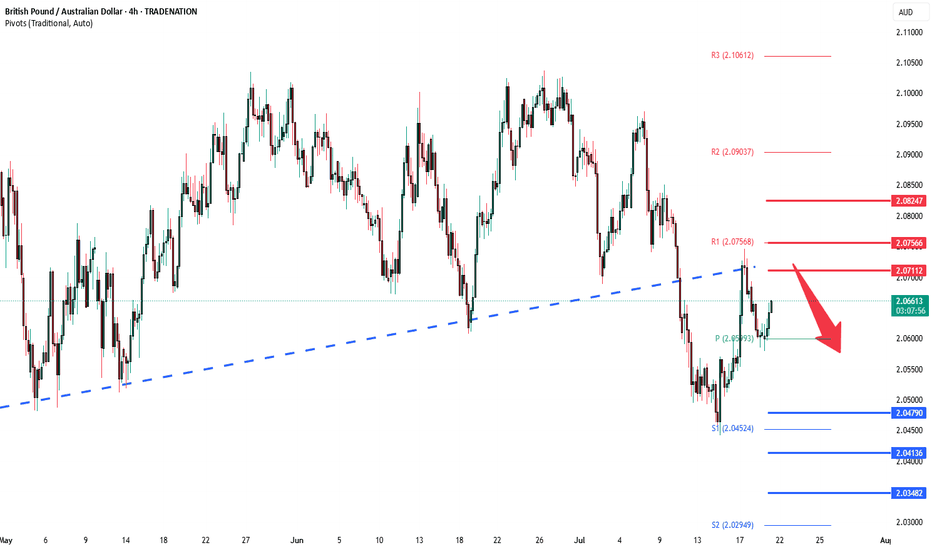

The GBPAUD pair is currently trading with a bearish bias, aligned with the broader downward trend. Recent price action shows a retest of the previous support zone, suggesting a temporary relief rally within the downtrend. Key resistance is located at 2.0660, a prior consolidation zone. This level will be critical in determining the next directional move. A...

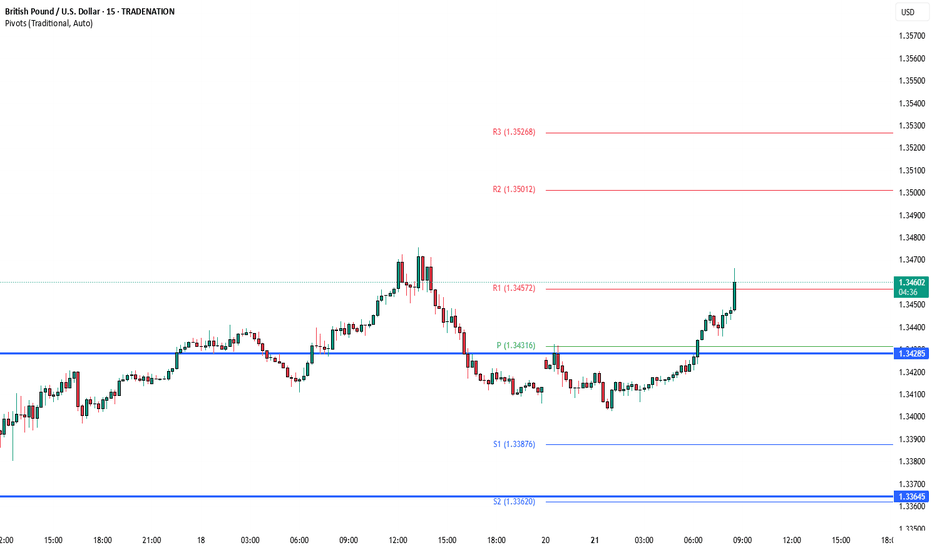

The GBPUSD remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend. Support Zone: 1.3430 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 1.3430 would confirm ongoing upside momentum, with potential targets at: 1.3600 – initial...

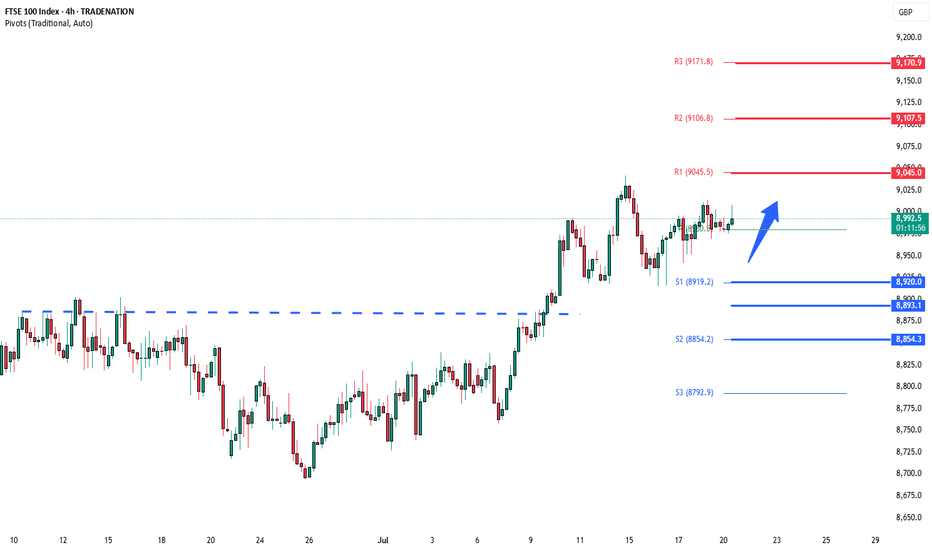

The FTSE remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend. Support Zone: 8020 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 8920 would confirm ongoing upside momentum, with potential targets at: 9045 – initial...

Economic Data & Central Bank Updates US Leading Economic Index (June) Fell by 0.1%, pointing to ongoing weakness in manufacturing, jobs, and housing. Markets may view this as a soft growth signal, potentially influencing rate cut expectations. China Loan Prime Rates (LPR) No change: 1-year at 3.0%, 5-year at 3.5%. This steady stance follows slightly better Q2...