Market analysis from Trade Nation

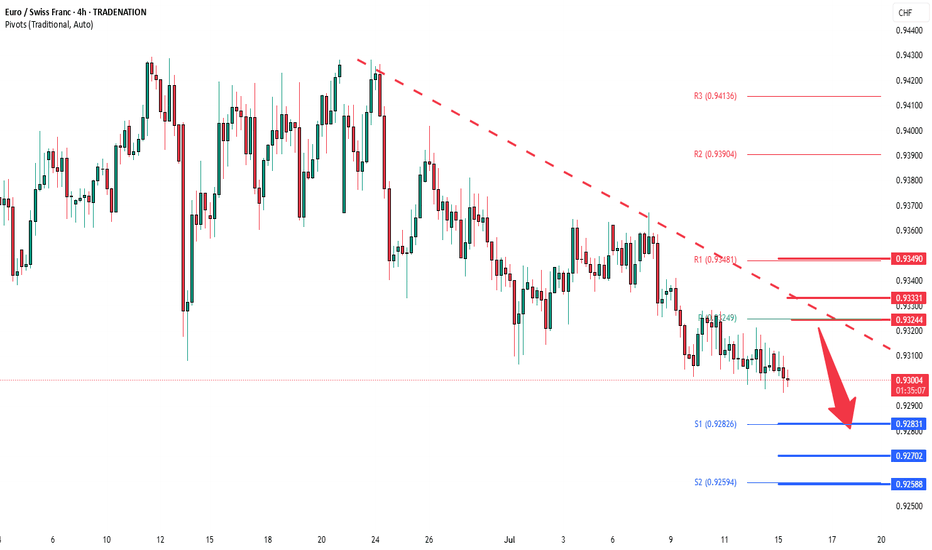

The EURCHF pair is currently trading with a bearish bias, aligned with the broader downward trend. Recent price action shows a retest of the previous support zone, suggesting a temporary sideways consolidation within the downtrend. Key resistance is located at 0.9320, a prior consolidation zone. This level will be critical in determining the next directional...

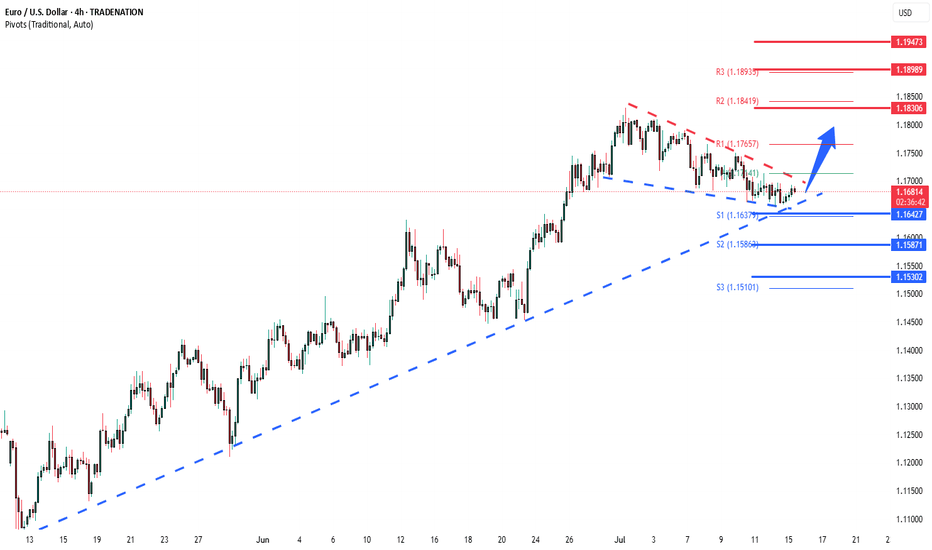

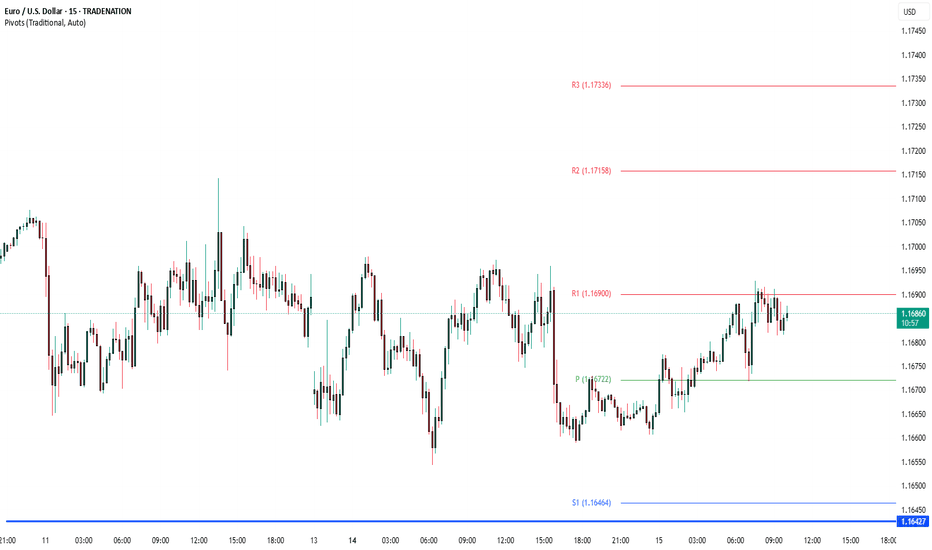

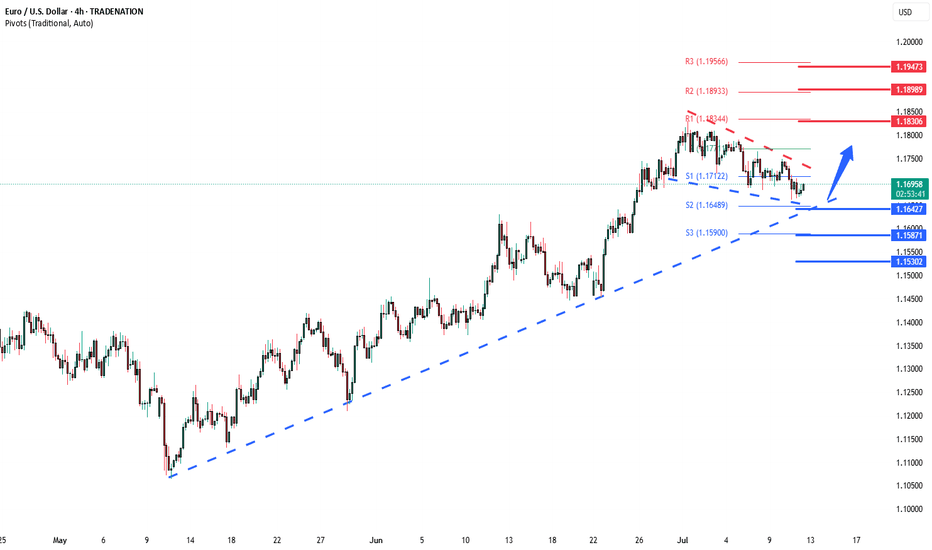

The EURUSD currency pair continues to exhibit a bullish price action bias, supported by a sustained rising trend. Recent intraday movement reflects a sideways consolidation breakout, suggesting potential continuation of the broader uptrend. Key Technical Level: 1.1640 This level marks the prior consolidation range and now acts as pivotal support. A corrective...

The DAX remains in a bullish trend, with recent price action showing signs of a resistance breakout within the broader uptrend. Support Zone: 24085 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 24085 would confirm ongoing upside momentum, with potential targets at: 24650 – initial...

Macro Data Highlights United States June CPI – Crucial inflation gauge; likely to shape Fed rate expectations. Empire Manufacturing Index (July) – Regional economic activity snapshot. China Q2 GDP – Key read on the health of the world’s second-largest economy. June Retail Sales / Industrial Production / Home Prices – Important for tracking domestic demand and...

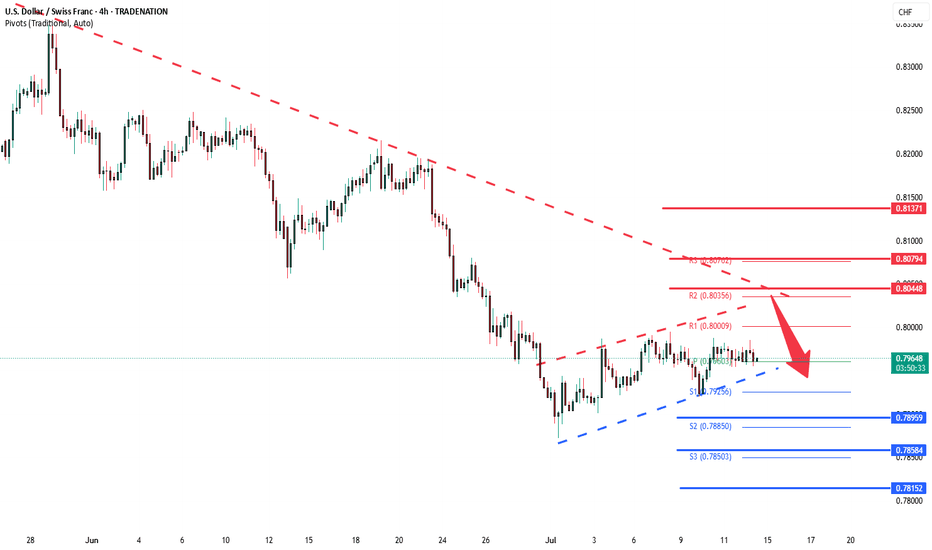

The USD/CHF pair is currently trading with a bearish bias, aligned with the broader downward trend. Recent price action shows a retest of the falling resistance, suggesting a temporary relief rally within the downtrend. Key resistance is located at 0.8045, a prior consolidation zone. This level will be critical in determining the next directional move. A bearish...

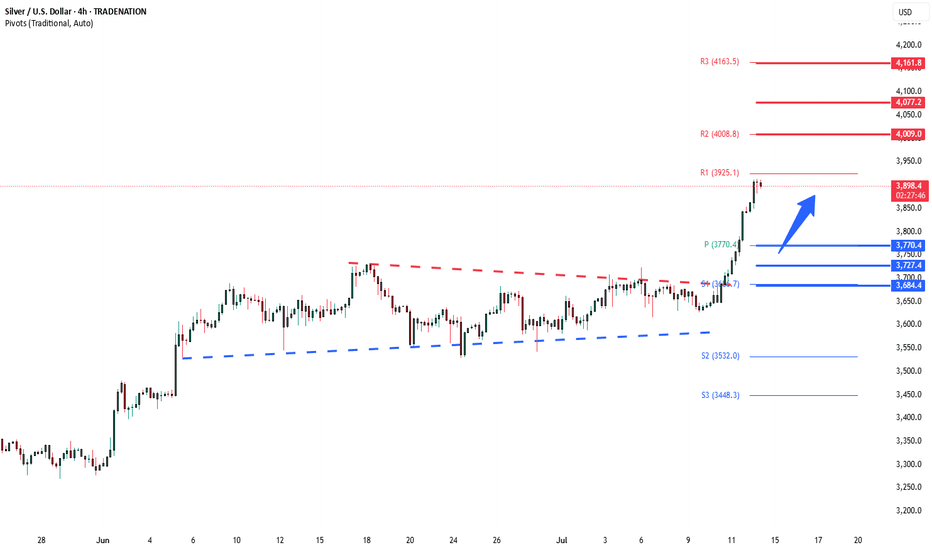

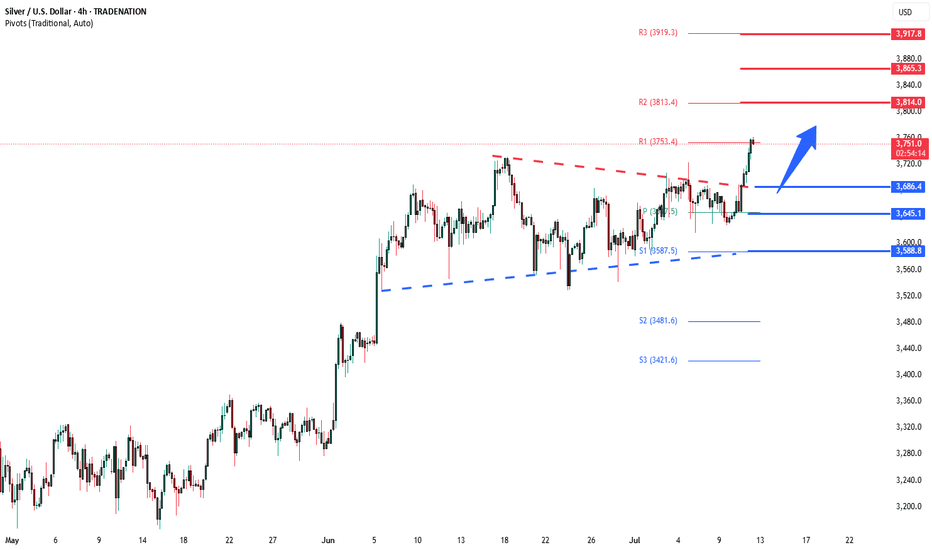

The Silver remains in a bullish trend, with recent price action showing signs of a continuation breakout within the broader uptrend. Support Zone: 3770 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 3770 would confirm ongoing upside momentum, with potential targets at: 4000 – initial...

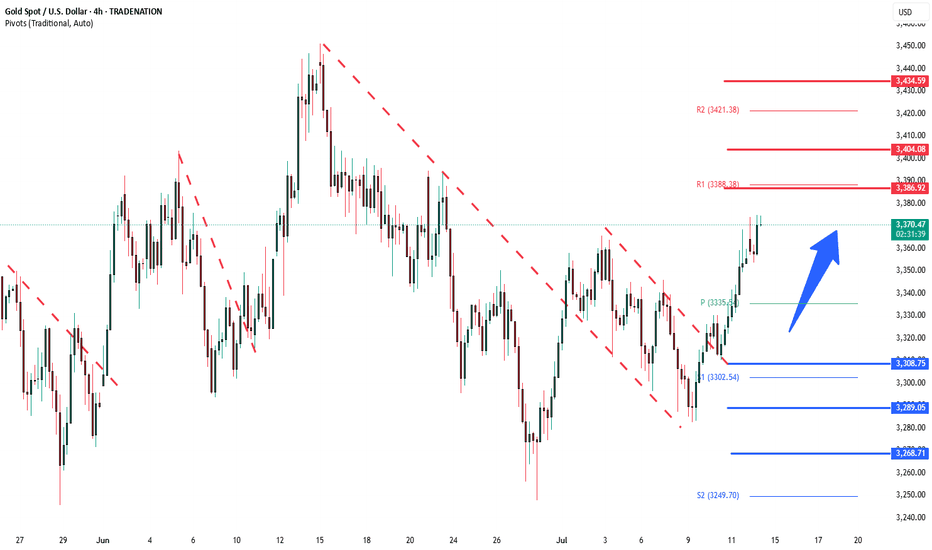

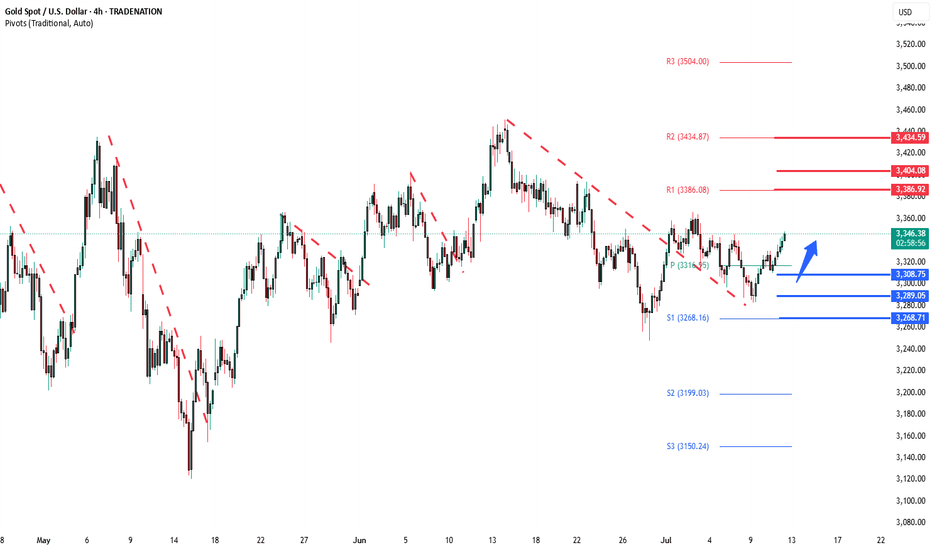

The Gold remains in a bullish trend, with recent price action showing signs of a continuation breakout within the broader uptrend. Support Zone: 3308 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 3308 would confirm ongoing upside momentum, with potential targets at: 3387 – initial...

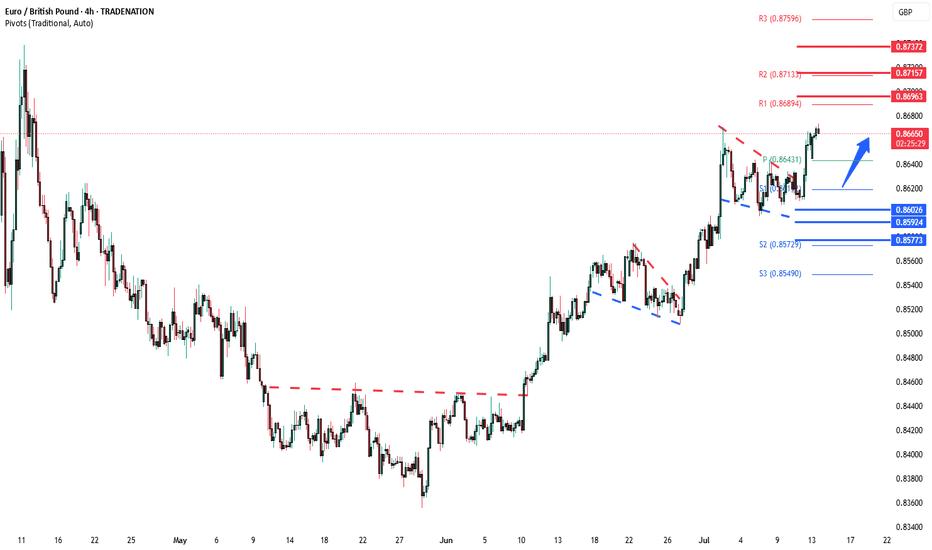

The EURGBP remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend. Support Zone: 0.8620 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 0.8620 would confirm ongoing upside momentum, with potential targets at: 0.8700 – initial...

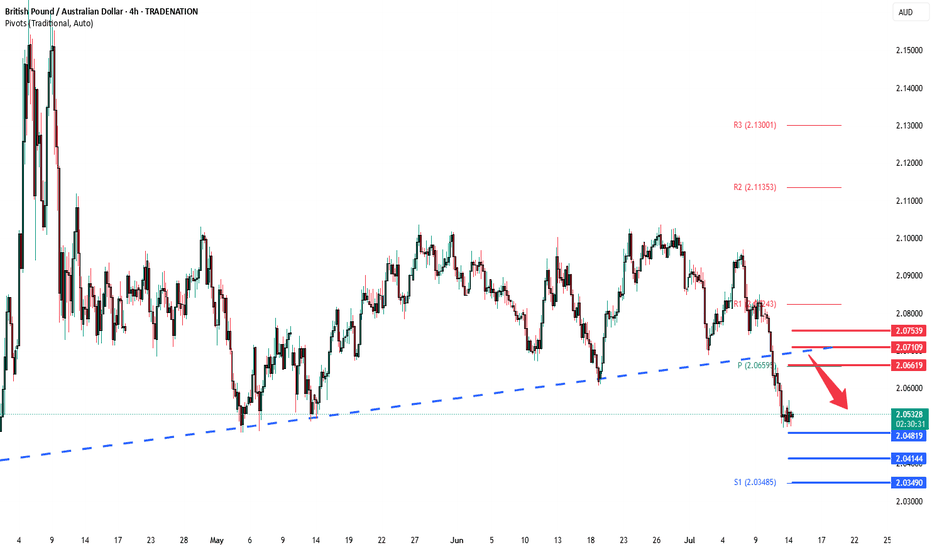

The GBPAUD pair is currently trading with a bearish bias, aligned with the broader downward trend. Recent price action shows a retest of the previous support zone, suggesting a temporary relief rally within the downtrend. Key resistance is located at 2.0660, a prior consolidation zone. This level will be critical in determining the next directional move. A...

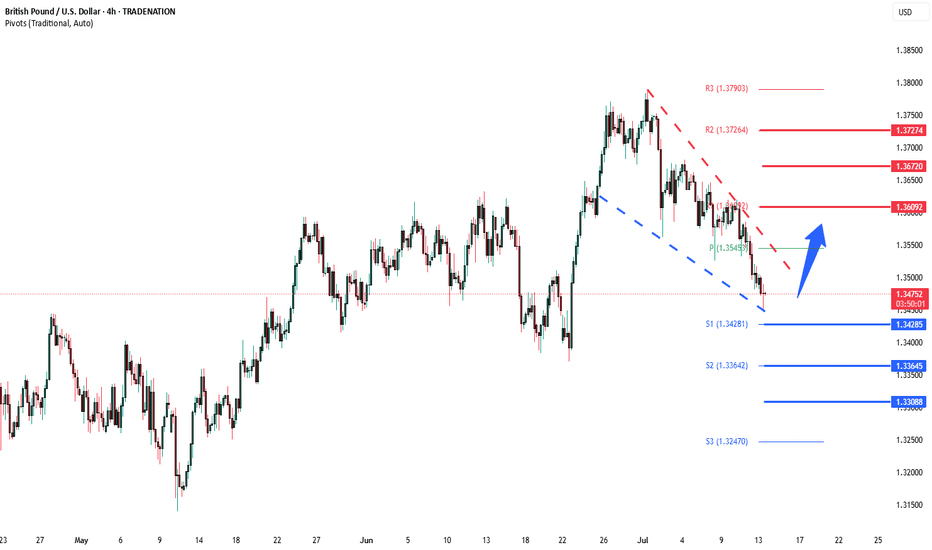

The GBPUSD remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend. Support Zone: 1.3430 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 1.3430 would confirm ongoing upside momentum, with potential targets at: 1.3600 – initial...

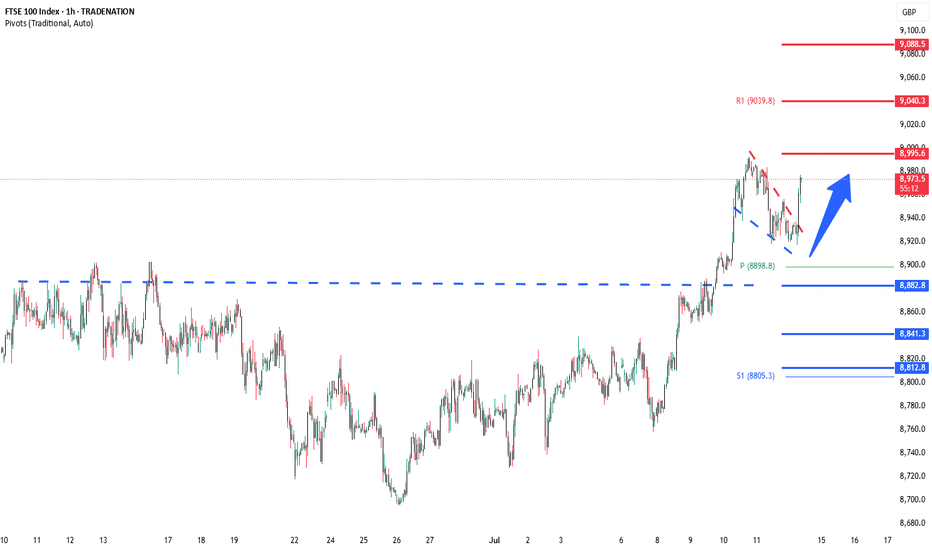

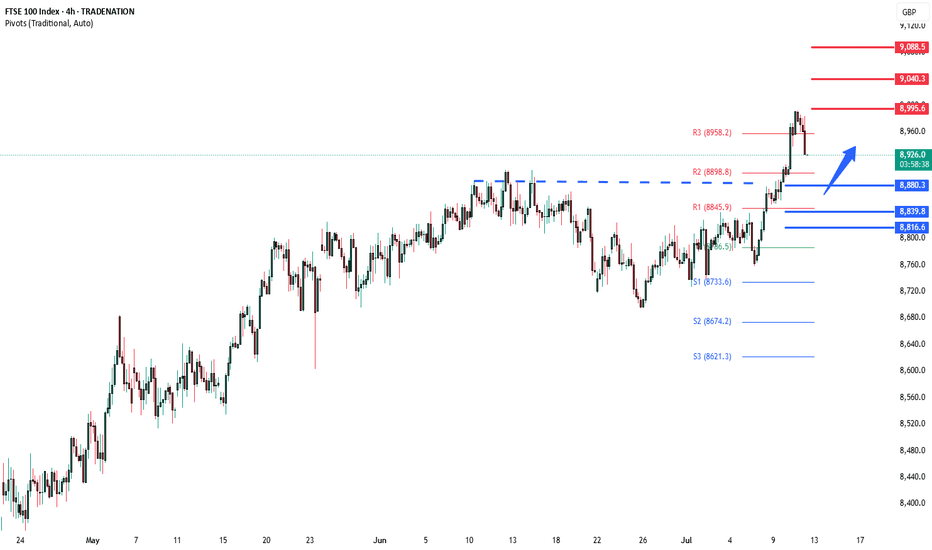

The FTSE remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend. Support Zone: 8880 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 8880 would confirm ongoing upside momentum, with potential targets at: 8900 – initial...

China – June Trade Balance Exports rose 5.8% year-on-year, beating expectations, as exporters rushed to ship goods before new U.S. tariffs. Imports increased 1.1% year-on-year, recovering slightly from a previous drop. Trade surplus expanded to $114.7 billion from $103.2 billion in May. Takeaway: Export strength is driven by temporary factors. Weak imports still...

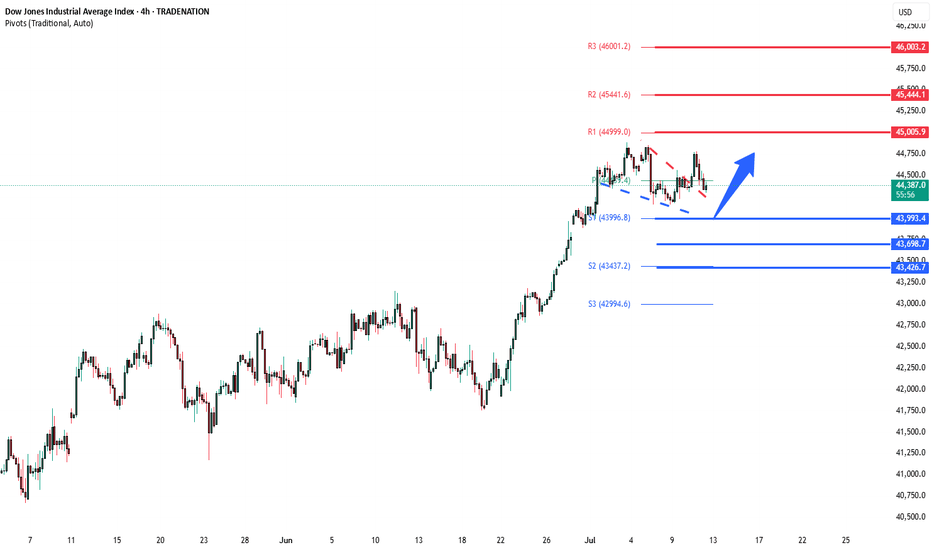

Key Support and Resistance Levels Resistance Level 1: 45000 Resistance Level 2: 45445 Resistance Level 3: 46000 Support Level 1: 44000 Support Level 2: 43700 Support Level 3: 43430 This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is...

Donald Trump escalated trade tensions again, threatening a 35% tariff on Canadian goods shortly after reopening trade talks, and floated doubling global tariffs to 20%. This reinforces his aggressive protectionist stance and puts renewed pressure on allies like Canada and Vietnam, the latter blindsided by a 20% levy. Meanwhile, US-China relations may be entering a...

The Silver remains in a bullish trend, with recent price action showing signs of a continuation breakout within the broader uptrend. Support Zone: 3686 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 3686 would confirm ongoing upside momentum, with potential targets at: 3814 – initial...

The Gold remains in a bullish trend, with recent price action showing signs of a continuation breakout within the broader uptrend. Support Zone: 3308 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 3308 would confirm ongoing upside momentum, with potential targets at: 3387 – initial...

The EURUSD currency pair continues to exhibit a bullish price action bias, supported by a sustained rising trend. Recent intraday movement reflects a sideways consolidation breakout, suggesting potential continuation of the broader uptrend. Key Technical Level: 1.1640 This level marks the prior consolidation range and now acts as pivotal support. A corrective...

The FTSE remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend. Support Zone: 8880 – a key level from previous consolidation. Price is currently testing or approaching this level. A bullish rebound from 8880 would confirm ongoing upside momentum, with potential targets at: 8900 – initial...