Market analysis from TradeStation

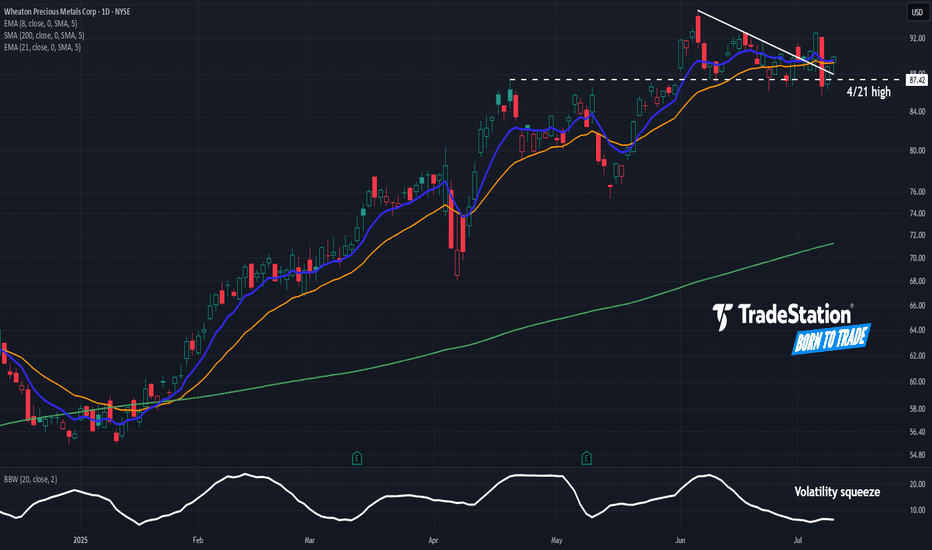

Wheaton Precious Metals has consolidated for more than a month, and some traders may think it’s poised to continue higher. The first pattern on today’s chart is the April 21 high of $87.42. The silver company stayed below that level through June 2. It then shot above it and held the same price over the following month. That could suggest old resistance has become...

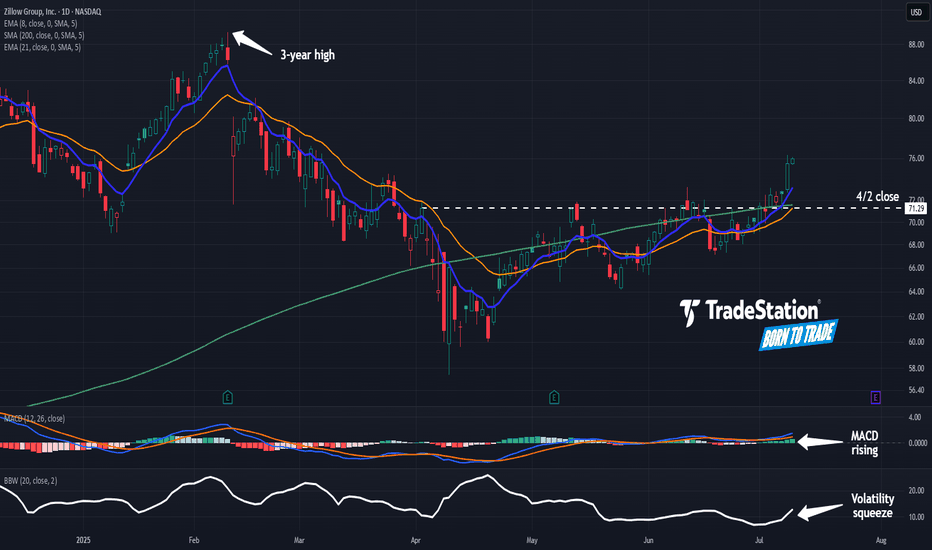

Zillow has been in a tight range for months, but now it may be coming to life. The first pattern on today’s chart is the April 2 close of $71.29. Z closed above it last week and is extending the move, which may confirm a breakout. Second, prices pushed above the rising 200-day simple moving average. That may reflect a bullish long-term trend in the housing tech...

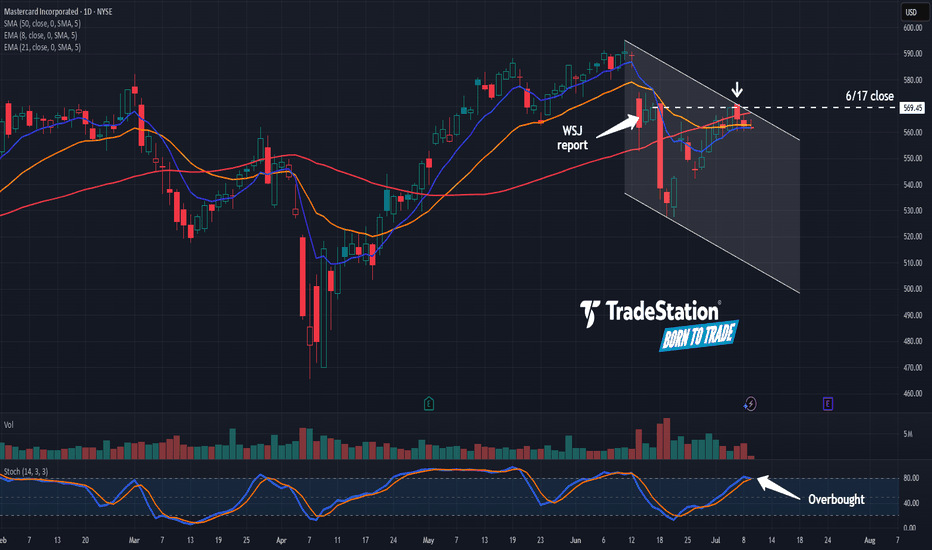

Mastercard fell hard in June on the threat of stablecoin competition. Now, after a rebound, some traders may expect another push to the downside. The first pattern on today’s chart is the selloff that began on June 13 when the Wall Street Journal reported that major retailers were considering stablecoins as an alternative to credit-card payment systems. Another...

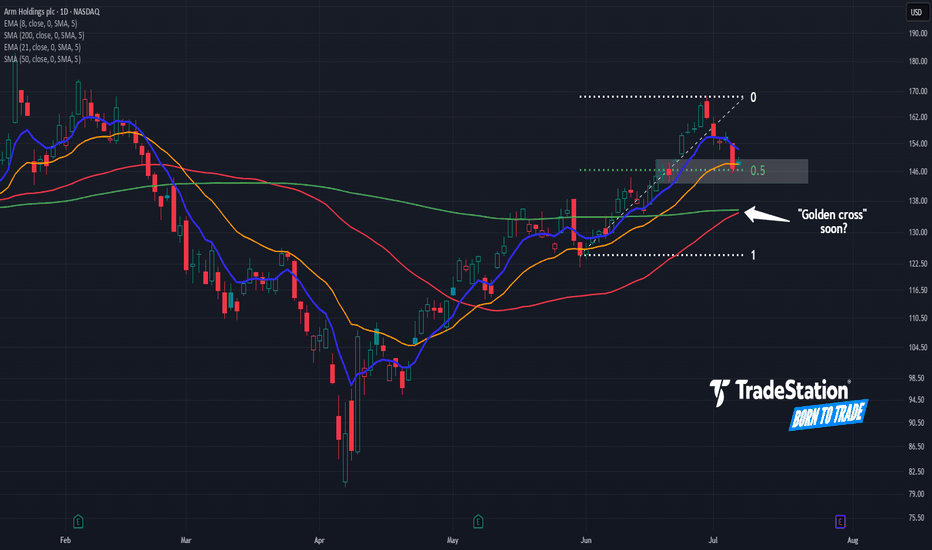

Arm Holdings rallied sharply last month, and now the AI chip stock has pulled back. The first pattern on today’s chart is the advance from May 30 through June 30. ARM retraced half that move and is trying to bounce, which may confirm its upward direction. Second, prices have retested their rising 21-day exponential moving average (EMA). The 8-day EMA is also...

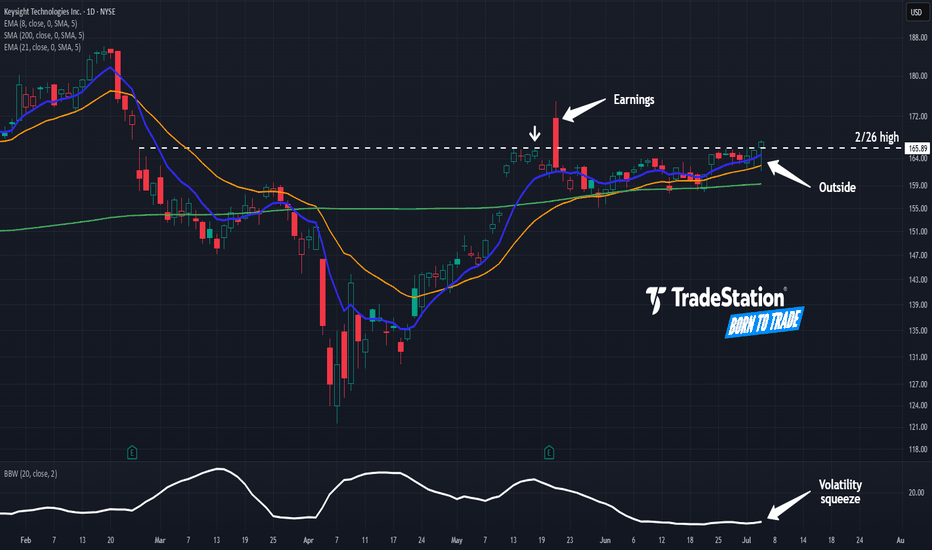

Keysight Technologies has been stuck in a range, but some traders may think a breakout is coming. The first pattern on today’s chart is the $165.89 level. It was the intraday high on February 26 as the broader market began a slide to the downside. The technology stock stalled near the same level in late May, even after a strong quarterly report. KEYS ended...

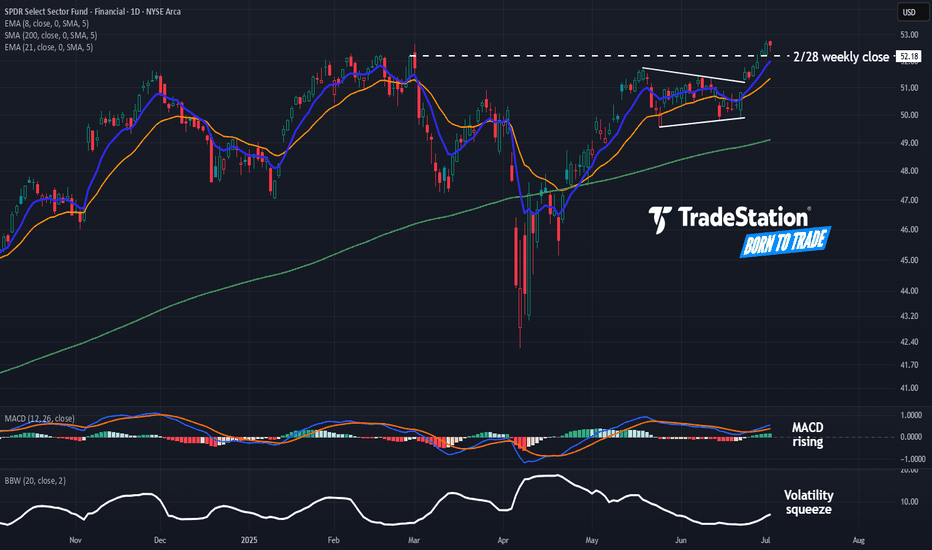

Financials could be attempting a breakout, two weeks before the sector kicks off earnings season. The first pattern on today’s chart of the SPDR Select Sector Financial ETF is the price level around $52. XLF stalled at that zone in February after peaking about 1 percent below it in November. February 28’s final price of $52.18 could be especially important...

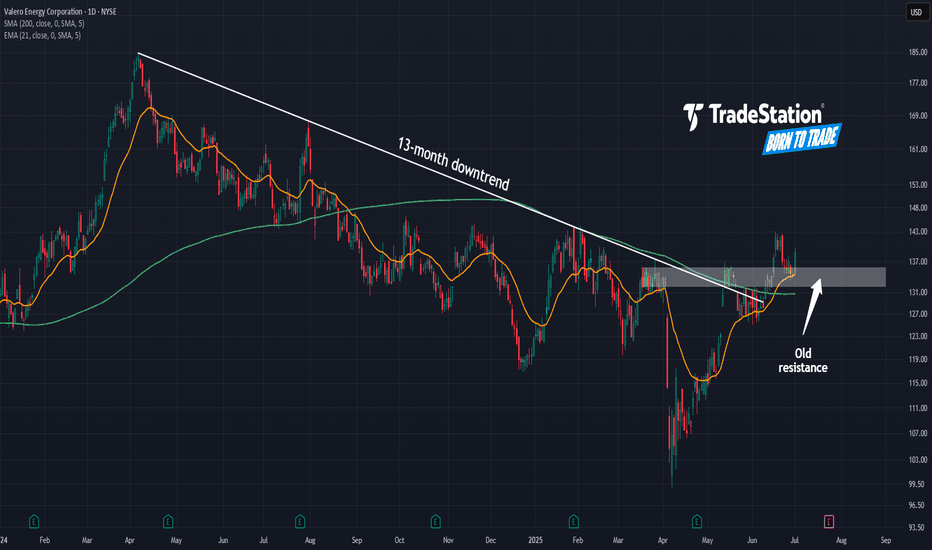

Valero Energy spent more than a year in a downtrend, but some traders may think conditions have changed. The first pattern on today’s chart is the series of lower highs between April 2024 and May 2025. VLO pushed above that falling trendline last month and has remained there since. That may suggest its longer-term direction is turning higher. Second is the price...

Monster Beverage broke out to a new all-time high in May, and now it’s pulled back. The first pattern on today’s chart is the March 2024 high of $61.23. The maker of energy drinks hesitated at that level in early May but pulled back to hold it last week. Has old resistance become new support? Second, MNST is trying to stabilize at its rising 50-day simple moving...

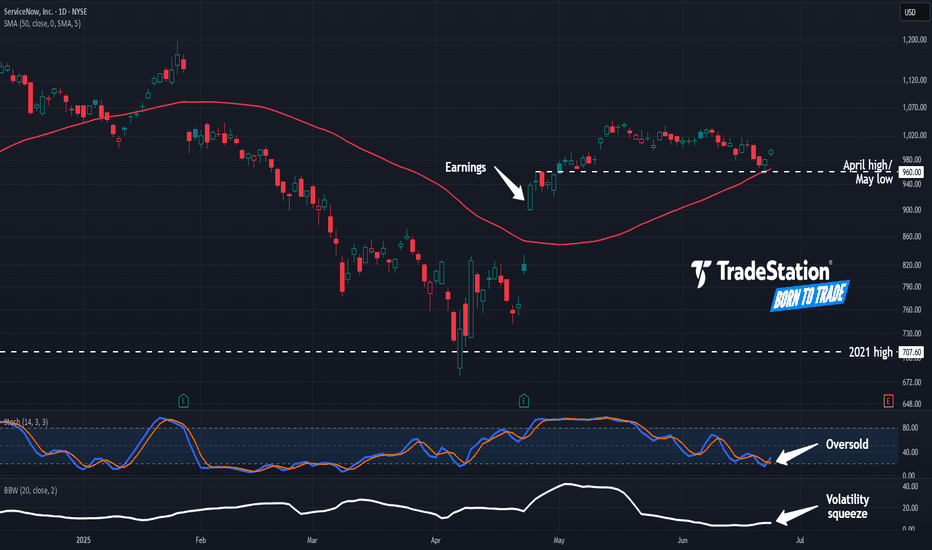

ServiceNow has been resting for months, and now some traders may think the software company is ready to move again. The first pattern on today’s chart is the price area around $960. It was the peak in late April and the low early last month. NOW pulled back to hold that level yesterday and bounced. Second, the 50-day simple moving average swung up to visit the...

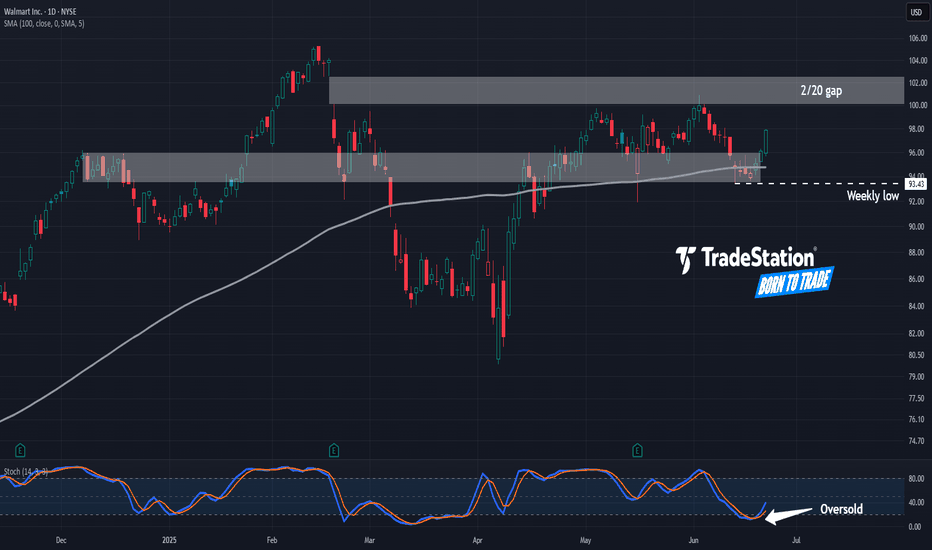

Walmart has snoozed for months, but some traders may think it’s waking up. The first pattern on today’s chart is the price range on either side of roughly $95. The retail giant peaked at that level in early December and is back near the same location more than six months later. That indicates a period of consolidation has occurred. Second, a weekly low of $93.43...

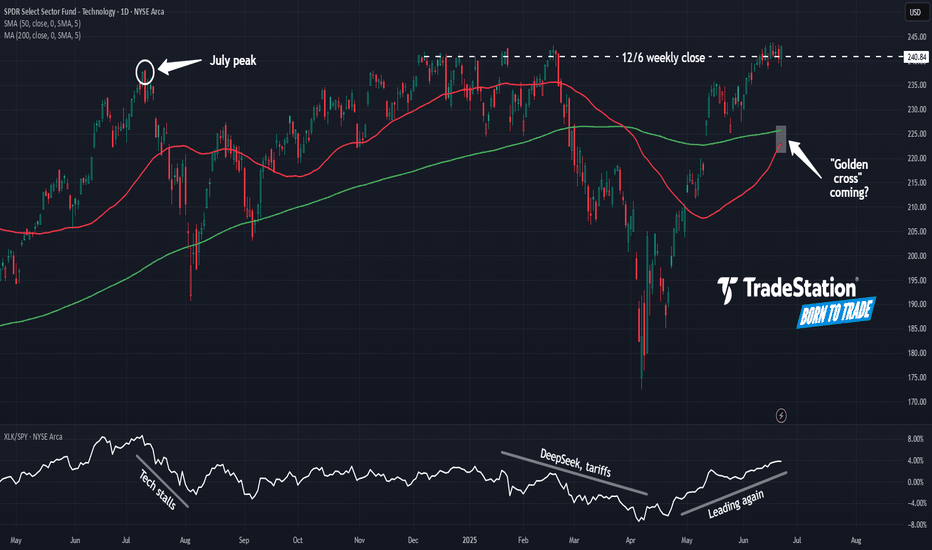

Technology stocks have been coming to life recently, and some traders may expect new highs soon. The first pattern on today’s chart of the SPDR Select Sector Technology Fund is last July’s peak around $238. As the fund retreated from that level, it began a period of underperformance. (See ratio chart in the lower study.) The weakness continued through April, when...

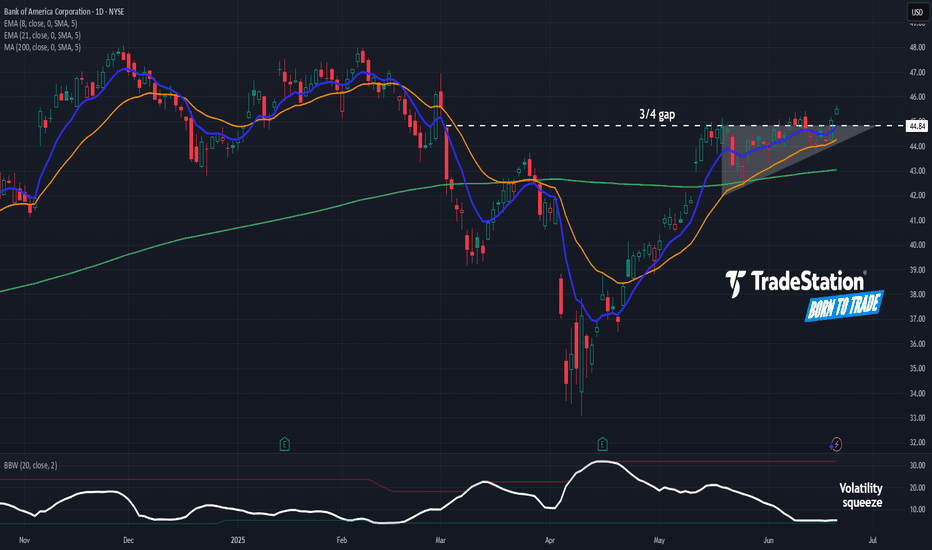

Bank of America squeezed into a range, and now it may be breaking out. The first pattern on today’s chart is $44.84, the high on March 4 as the megabank gapped lower. It spent more than a month pushing against that level while making higher lows. The resulting ascending triangle is a potentially bullish continuation pattern. Second, BAC closed above the...

GE Aerospace has been rallying, and now it’s pulled back. The first pattern on today’s chart is the steady advance in April and May that established GE at its highest levels since 2001. Is an accumulation phase underway? Second is the May 23 close of $232.79. The industrial stock tested and held it yesterday after lingering above it all last week. That could...

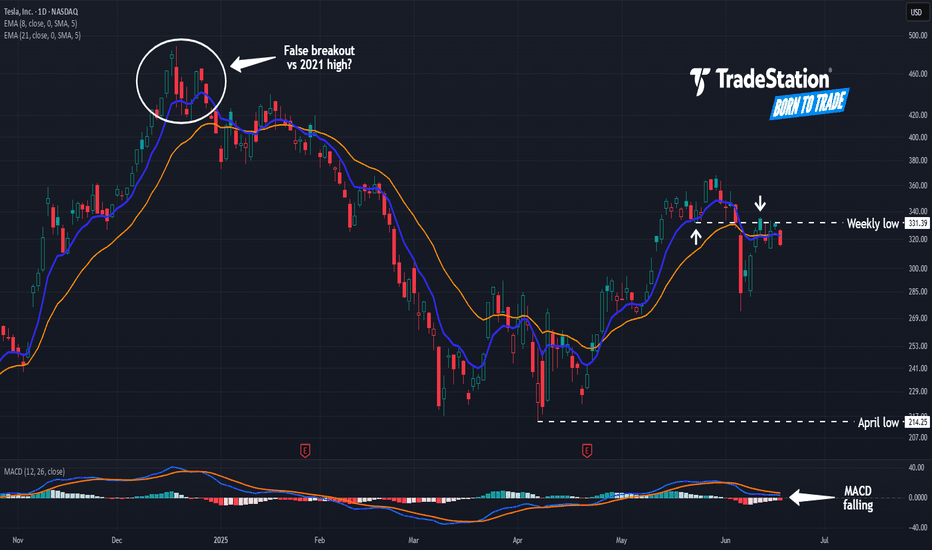

Tesla bounced between early April and late May, but now it may be stalling. The first pattern on today’s chart is the weekly low of $331.39 from May 22. TSLA fell below that level two weeks ago and was rejected at the same price area last week. Has old support become new resistance? Second, the stock has fallen under its 8- and 21-day exponential moving averages...

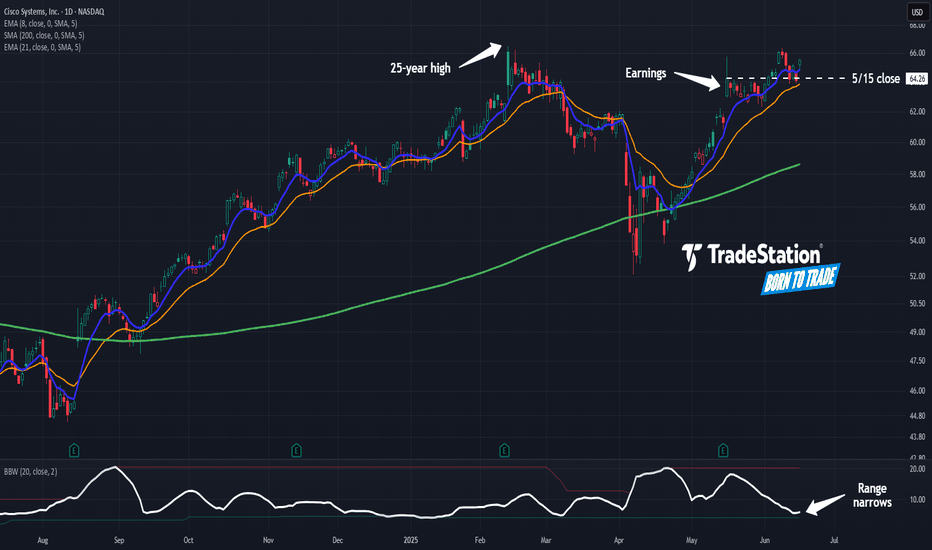

Cisco Systems has climbed as AI investment helps power growth, and some traders may think the move will continue. The first pattern on today’s chart is the February 13 peak of $66.50. It was the highest level since September 2000, when the dotcom bubble was deflating. The networking giant come within $0.14 of that level on June 9 and remains in close proximity....

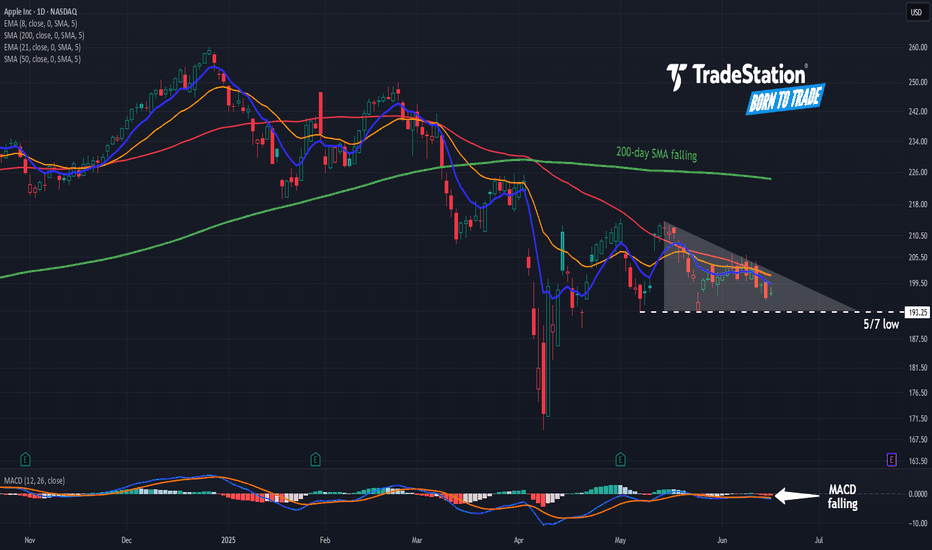

Apple has struggled all year, and evidence of a downtrend may be growing in the tech giant. The first pattern on today’s chart is this month’s lower high relative to mid-May. Combined with the May 7 low of $193.25, some traders may think a descending triangle is taking shape. That’s a potentially bearish formation. Second, TradeStation data shows that AAPL is...

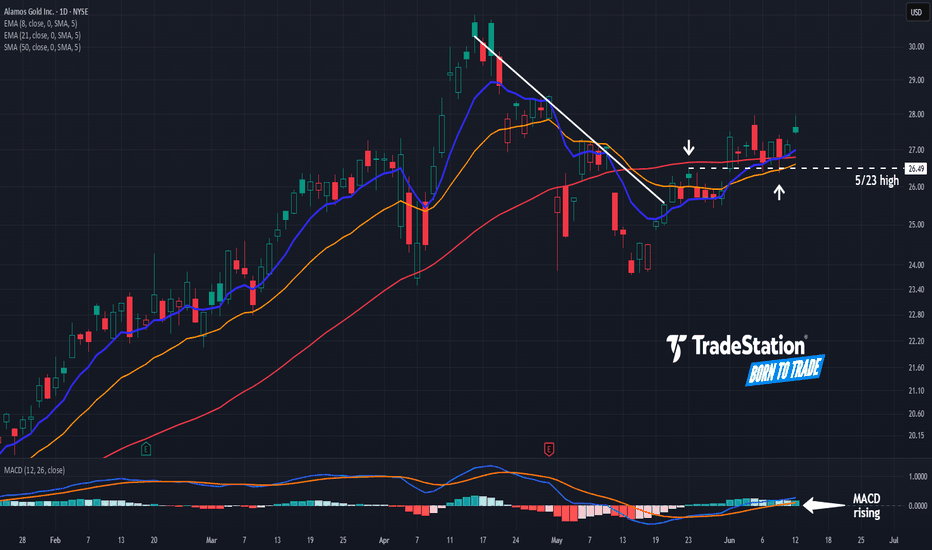

Alamos Gold has rallied sharply in the last 16 months, and some traders may see potential for further upside. The first pattern on today’s chart is the series of lower highs between mid-April and mid-May. The gold miner cleared that falling trendline about three weeks ago and has been grinding higher since. Such price action could suggest old resistance has been...

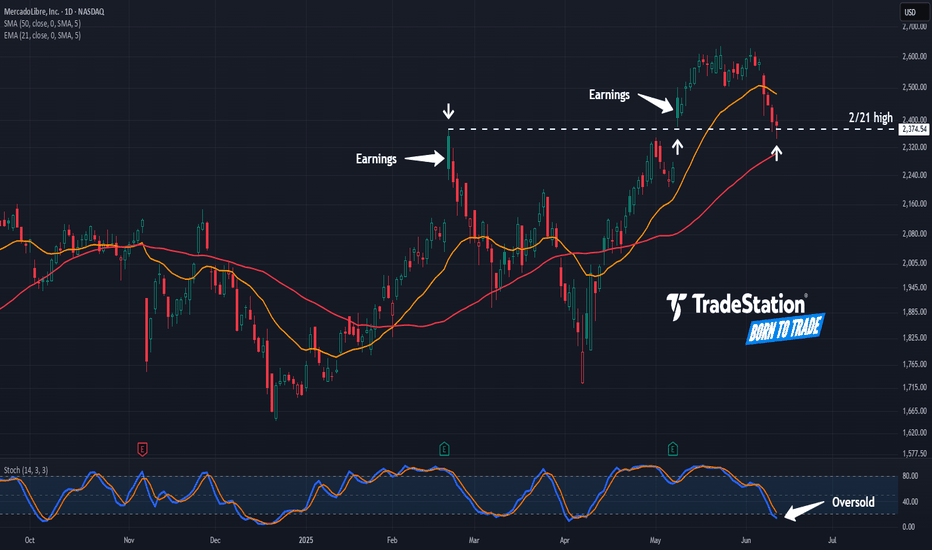

MercadoLibre rallied to new highs last month, and some traders may see an opportunity in its latest pullback. The first pattern on today’s chart is the $2,374.54 level. MELI first touched that price on February 21 after reporting strong earnings. The stock gapped above the level in May on another strong quarterly report and has now retested it. Will the old...