Market analysis from TradeStation

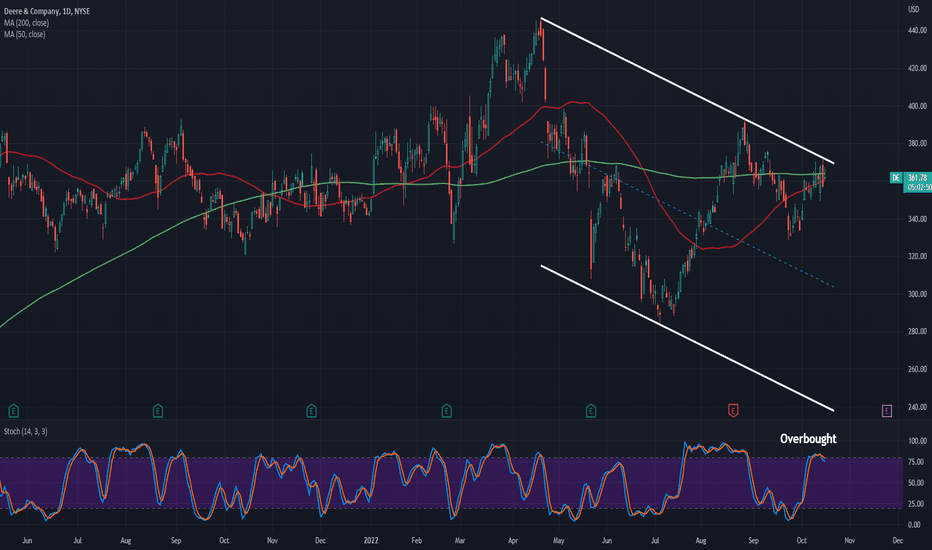

Deere has been one of the better-performing members of the S&P 500 since the summer, but now it could be hitting resistance. The main pattern on today’s chart is the falling parallel channel along the highs of April, August and October. The farm supplier probed that resistance on Friday before reversing along with the rest of the market. Could it now push lower...

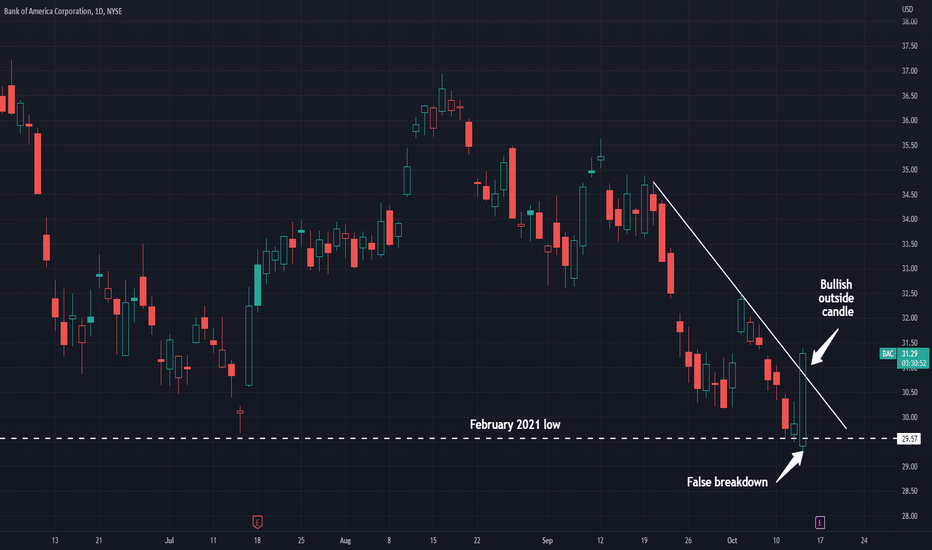

Bank of America lost more than 40 percent of its value between February's high and this morning’s low. Is the megabank now showing signs of a bounce? The first pattern on today’s chart is the early drop to $29.31. That was BAC’s lowest price since December 2020, but it lasted less than 30 minutes. Prices turned green by 10am ET and quickly surpassed the previous...

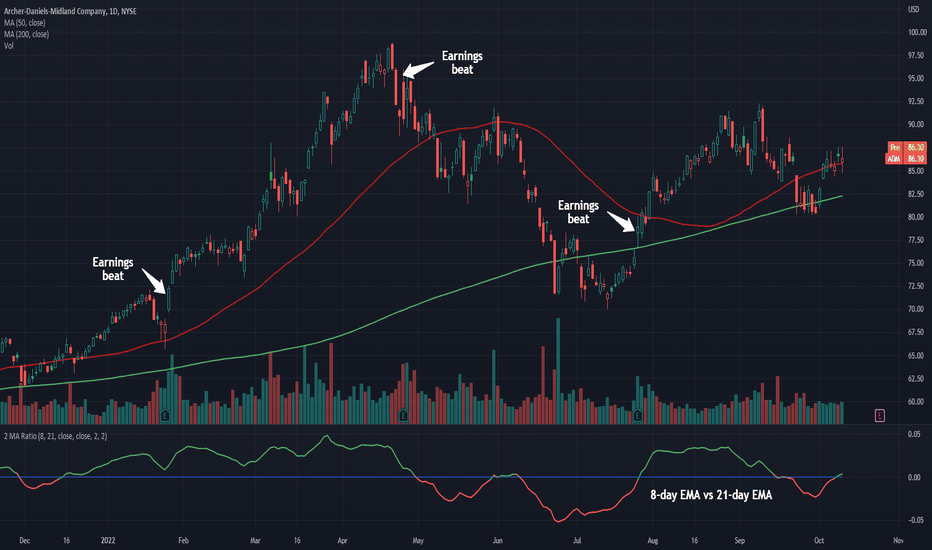

The S&P 500 and Nasdaq-100 have made new multiyear lows this week. That helps draw attention to the price action in today’s stock, which has been fighting higher all year: Archer Daniels Midland. The grain processor bottomed in mid-July, followed by a higher low in late September. It also managed to hold its 200-day simple moving average (SMA). (Did you know only...

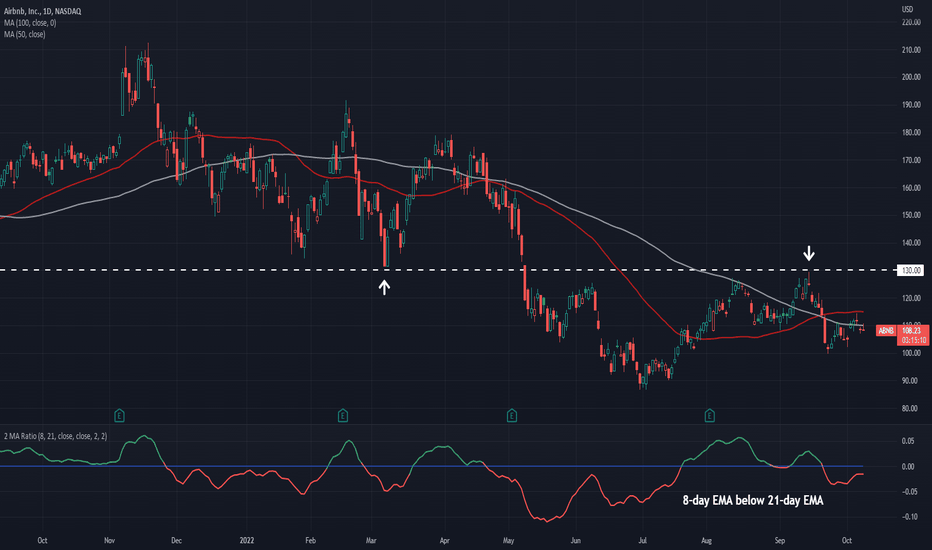

Airbnb has been trending lower since late 2021. Now, after a period of consolidation, some traders may expect the weakness to resume. The main pattern on today’s chart is the 100-day simple moving average (SMA), which has been steadily falling all year. ABNB is back under this line after unsuccessfully trying to reclaim it in August, September and earlier this...

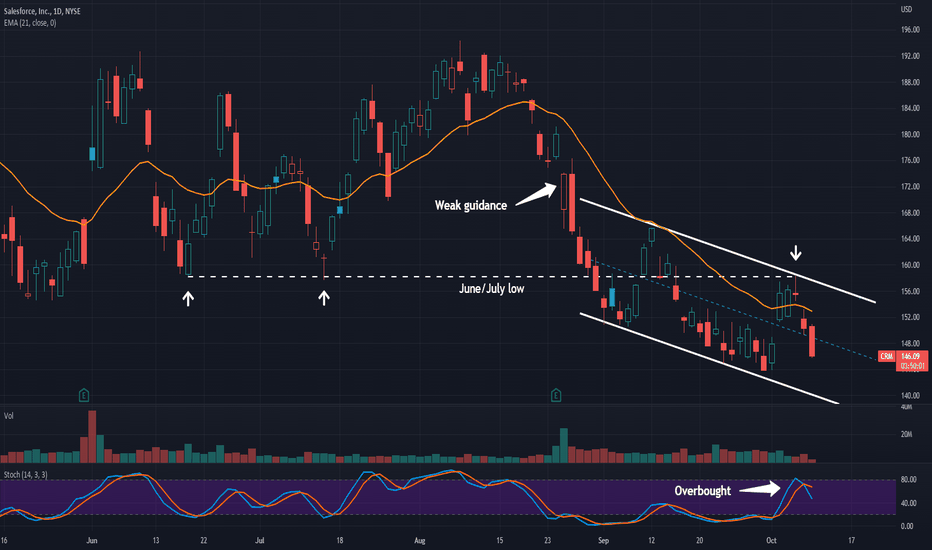

Software companies like Salesforce.com have struggled with rising interest rates and a strong U.S. dollar. Today we'll consider some potentially bearish patterns on the daily chart. First is CRM's inability to reclaim the monthly lows of June and July last week. (Both were around $158.) Second is the descending channel taking shape since the beginning of...

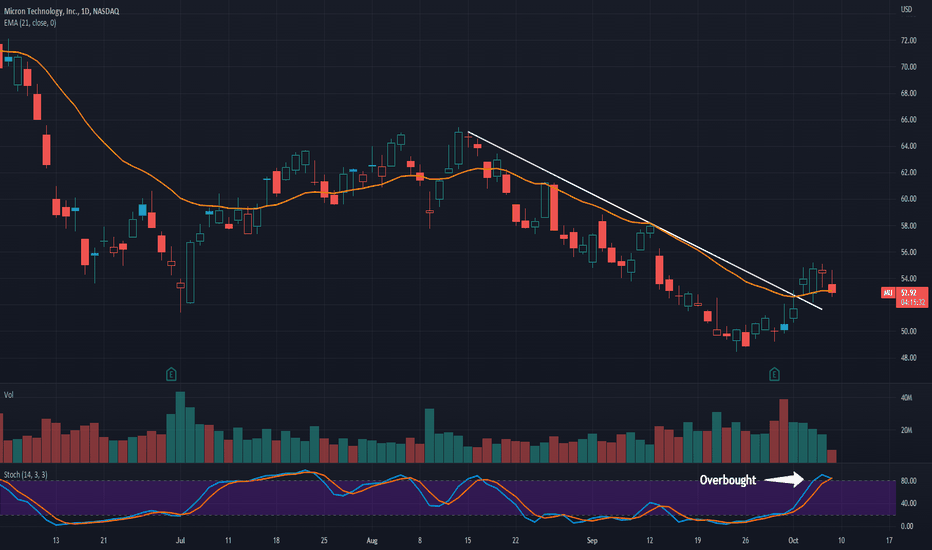

Micron Technology bounced along with the rest of the market over the last week. But now it may be showing signs of continuing lower. The main pattern on today’s chart is the falling trendline along the highs of August and September. While MU has fought above this resistance, trendline breakouts have generally not worked in the current bearish market. Fundamentals...

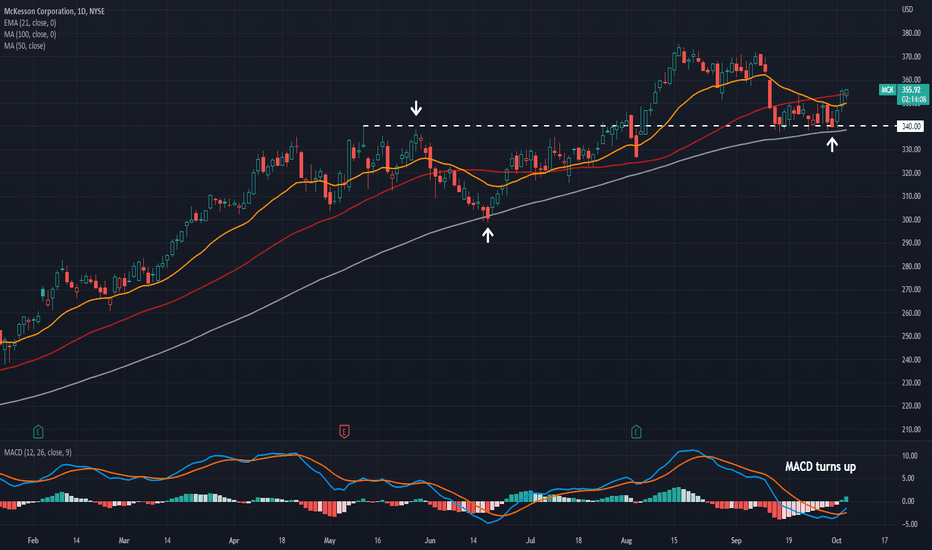

Drug distributor McKesson has been a surprising breakout stock in 2022 thanks to strong earnings. It’s the 14th-best performing member of the S&P 500 this year, according to TradeStation data. MCK is also the biggest gainer apart from inflationary plays like energy and fertilizers. Nonetheless, it’s been relatively quiet for several months as the earlier surge is...

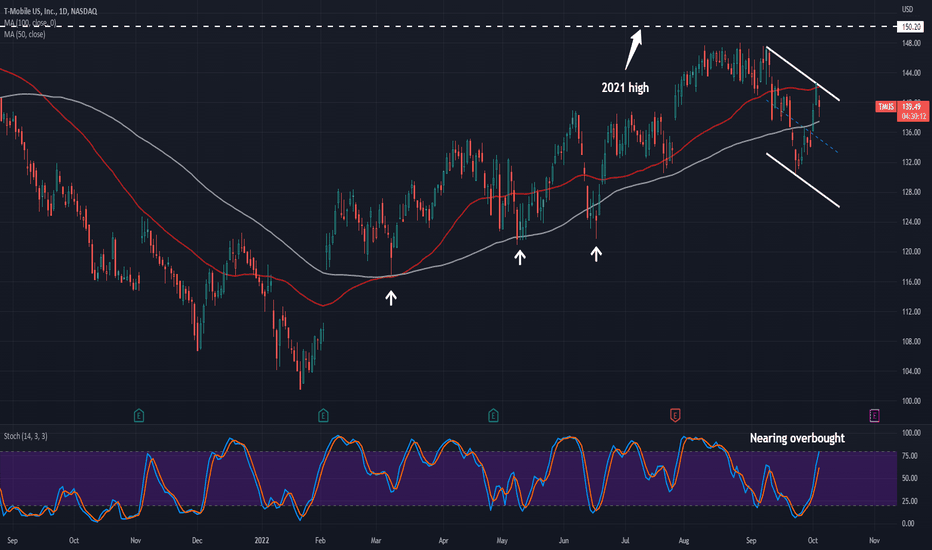

Telecom stocks have mostly fallen in recent months. One exception has been T-Mobile US. Could it soon follow its peers lower? The first pattern on today’s chart is TMUS’s break below its 100-day simple moving average (SMA) in late September. Price bounced there several times this year (see white arrows), but this time spent more than a week under it. That could...

Freyr Battery has been getting attention from Wall Street lately. A Goldman Sachs upgrade on August 25 triggered the first big jump. Morgan Stanley followed with positive commentary four weeks later. Those bullish calls have left some interesting patterns on the green-energy company’s chart. First, notice how FREY has muscled above April’s peak around...

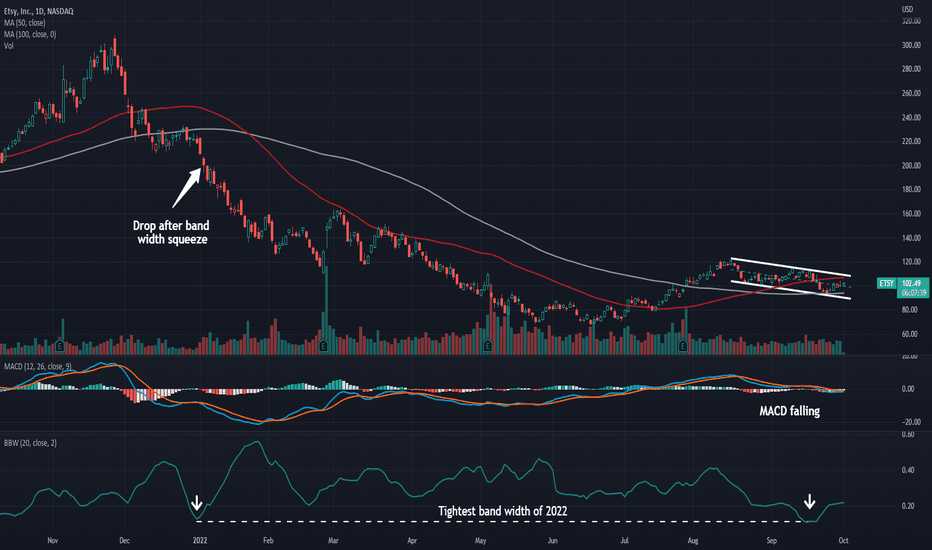

Many tech and e-commerce stocks have made new 52-week lows recently as the market slides. Etsy has been an exception, but will that remain the case? The first pattern on today’s chart is the relatively tight descending channel that’s formed since mid-August. ETSY now finds itself between the 50-day simple moving average (SMA) and 100-day SMA. Its failure to hold...

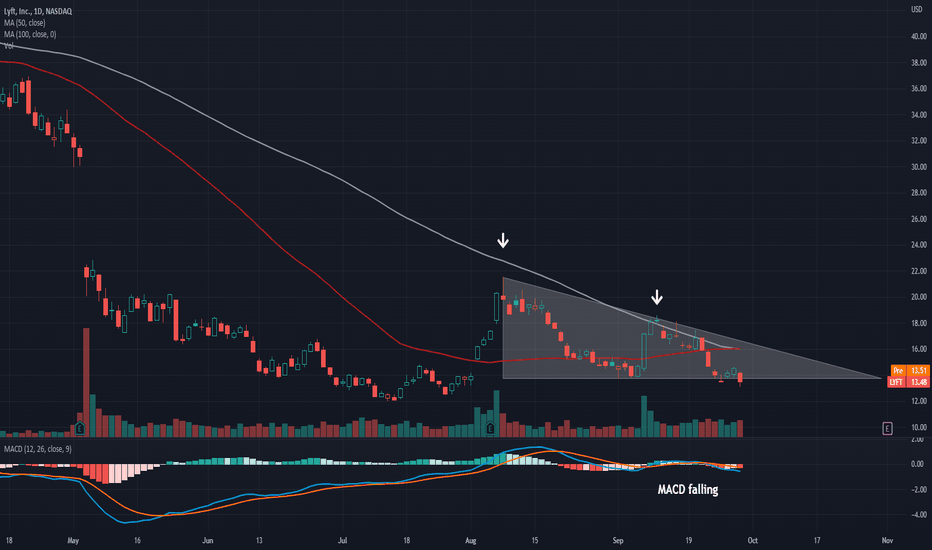

Ridesharing company Lyft has tried to hold a price range since the spring. Now, after a couple of fleeting bounces, a bearish continuation pattern could be materializing. Notice the high on August 8 near $20, followed by a pullback to $13.75. LYFT then bounced but couldn’t get above $19. That high and lower high have produced a descending triangle -- a...

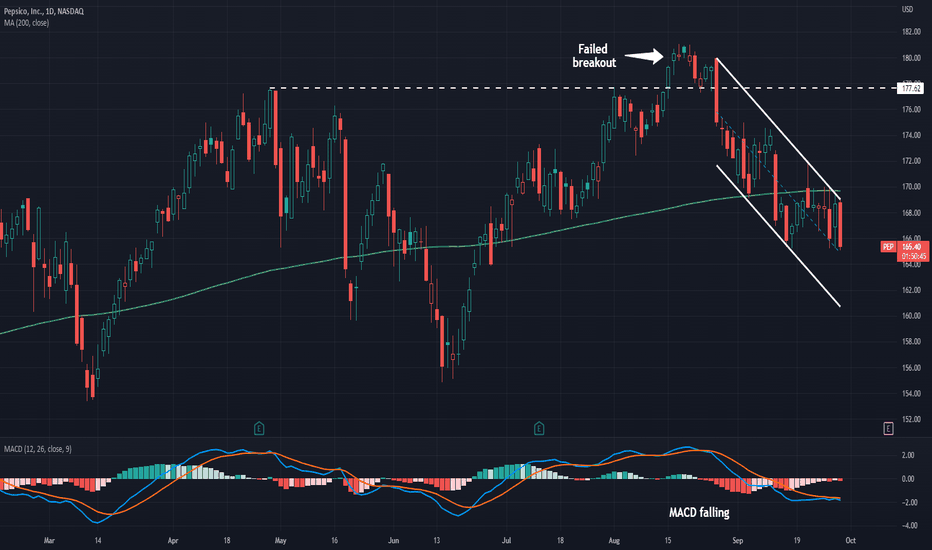

With the market under pressure, some investors have sought refuge in consumer staples. But some, like PepsiCo, have also struggled. The first pattern on today’s chart is the series of lower highs and lower lows since Jerome Powell’s hawkish Jackson Hole speech on August 26. These have produced something of a descending channel, with PEP ending yesterday’s session...

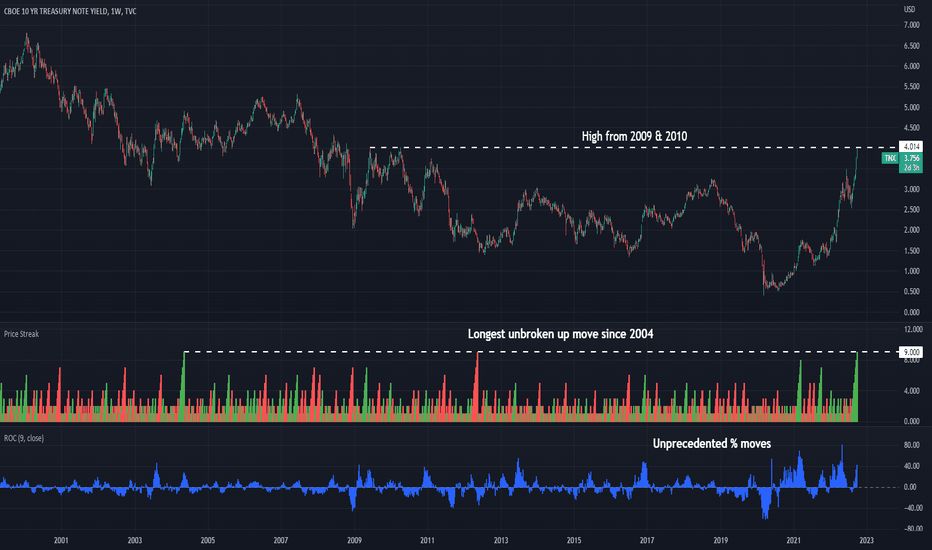

U.S. Treasuries have gone through a period of historic turmoil as the Federal Reserve starts shrinking its balance sheet. Today’s weekly chart considers just how dramatic the moves have been using the 10-year note’s yield index (TNX). The first thing that stands out is the accelerating rate of change since about March 2021. This chart shows ROC with a nine-week...

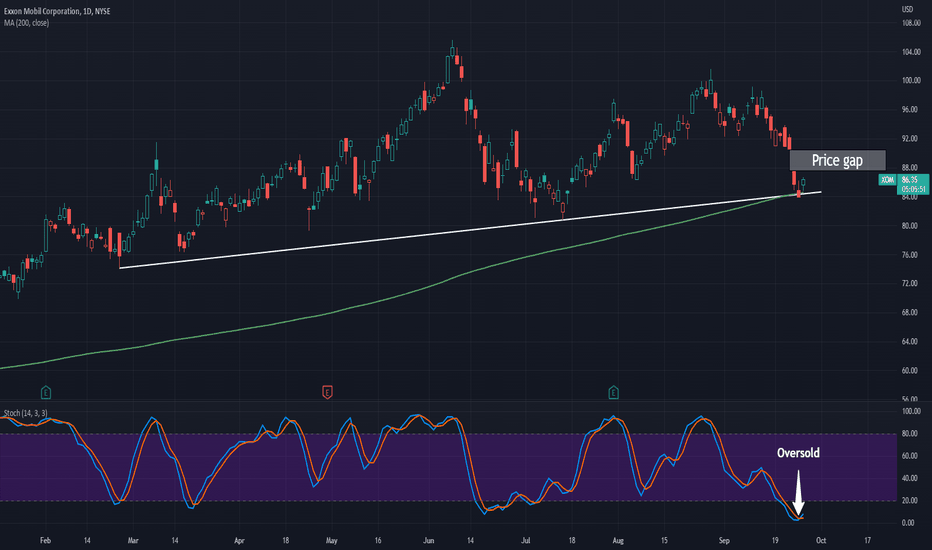

Exxon Mobil has been drifting since the late spring along with other energy stocks. But now it’s trying to do something it hasn’t done all year. The main pattern on today’s chart is the 200-day simple moving average (SMA), one of the most basic measures of long-term support. XOM tested that level yesterday for the first time since December, which could draw some...

Electric vehicles have been in focus since the Inflation Reduction Act boosted green-energy incentives. Let’s check out Rivian Automotive, the truck maker trying to stabilize after a big slide. The main pattern on today’s chart is a parallel channel forming between roughly $30.80 and $40. RIVN initially bounced at the low in mid-June before proceeding to a...

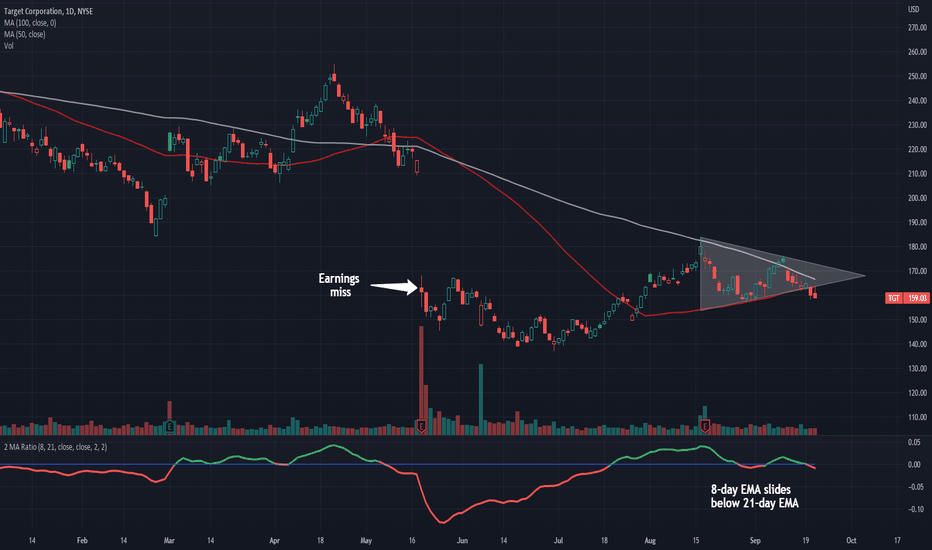

Target gapped lower on weak earnings four months ago. Now it may be showing signs of the bearish trend continuing. The main pattern on the retailer is a converging squeeze between the 50-day simple moving average (SMA) and the 100-day SMA. This has produced something of a triangle that TGT is now breaking to the downside. Today’s chart also features our 2 MA...

The Federal Reserve’s hawkish policies this year have punished megacap growth stocks, as most traders know. The resulting gloom has dragged two of the market’s four trillion-dollar companies to potentially important levels: Microsoft and Alphabet . Both hit new 52-week lows yesterday and are near levels where they bounced earlier in the year. MSFT slipped...

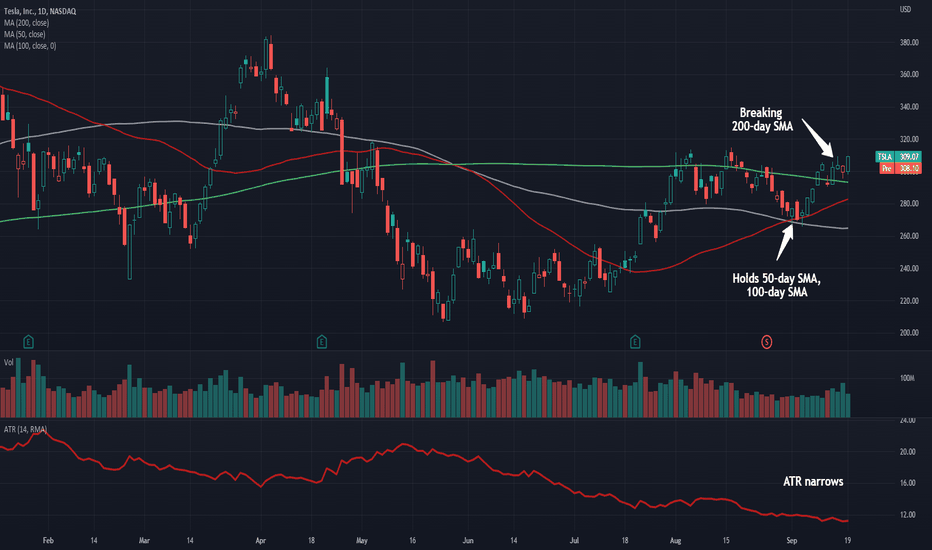

Lots of interesting things have been happening in the market lately. Today we’ll consider those, plus what isn’t happening in Tesla. First, the S&P 500 knifed below its 50-day simple moving average (SMA) in early September. TSLA, on the other hand, bounced at its 50-day SMA. Next, the bigger index saw its price ranges widen as volatility increased. TSLA’s, on...