Market analysis from TradeStation

Western Digital has skidded lower for months, but now the data-storage company seems to be fighting the bears. The main pattern on today’s chart is the double-bottom around $49.50. Sellers hammered WDC down to that level following the last two quarterly reports, and both times they quickly retreated. That area was also a high in June 2020 and a low in December...

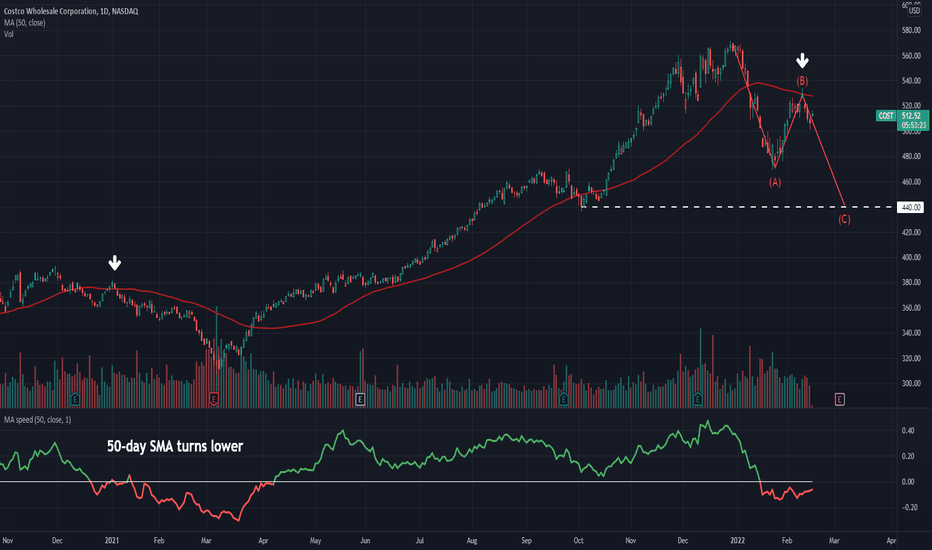

Costco ran to new highs in late December, but this year it’s been under pressure. The warehouse retailer slid 11 percent in January – its sharpest monthly drop since December 2018. It then retraced about half the decline to make a lower high last week. Notice how the high not only consisted of an abandoned shooting-star candlestick. It also occurred at the 50-day...

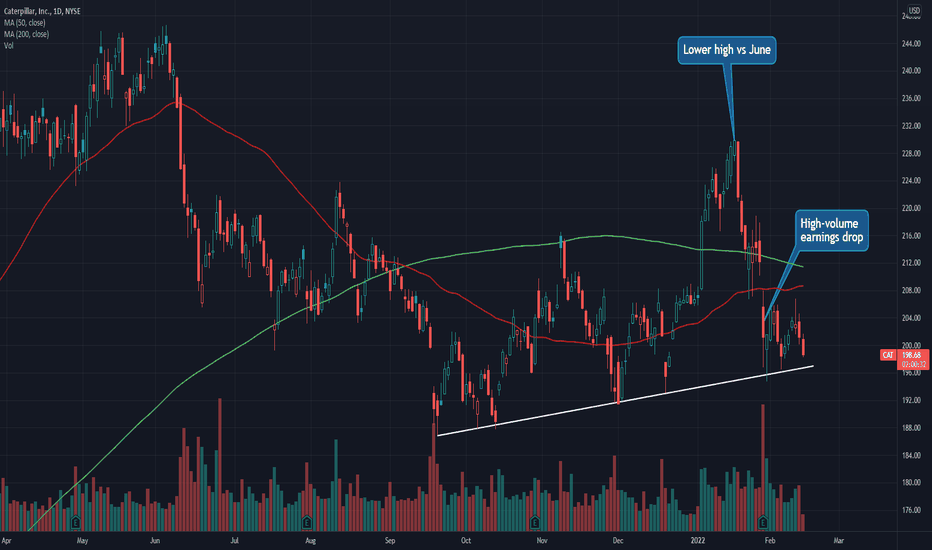

Caterpillar was one of the first big cyclicals to rally back from 2020’s crash. But it’s been showing signs of fatigue more recently. The first pattern on today’s chart is the lower high versus June. The broader S&P 500 and Dow Jones Industrial Average made new highs in early January, but CAT has gone more than six months without the same feat. Second is the...

Last week, we cited the potential breakout in the SPDR Gold ETF. Today’s chart shows a similar pattern in miner Barrick Gold. First, consider the series of lower highs since August 2020. Then notice how the price action Friday and today violated this downward trajectory. Second is the rounded bottom around $18, which took shape in the fourth quarter. This...

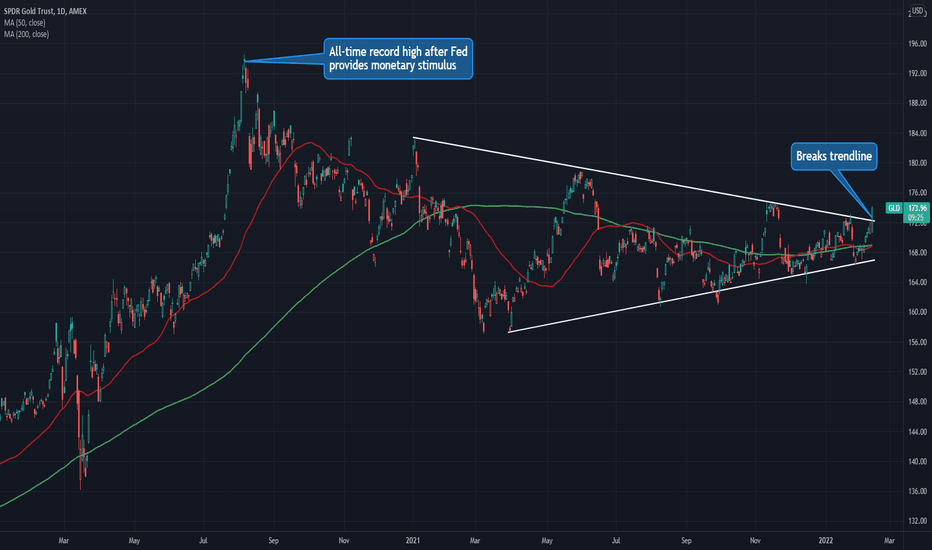

The SPDR Gold Trust ETF has squeezed into a tight range since rallying in mid-2020, and now it may be attempting a breakout. The main pattern on today’s chart is the pair of converging trendlines running along the highs and lows. GLD made a higher high today for the first time in over a year. Second, notice how the 200-day simple moving (SMA) turned higher in...

The Russell 2000 led markets to the downside in recent months . Now it may be leading the rebound. Notice how RUT made new February highs yesterday and today, while the S&P 500 and Nasdaq-100 are below their highs last week. Next, consider the price zone around 2,000. This is not only a “nice round number.” It’s also a level RUT broke on high volume early...

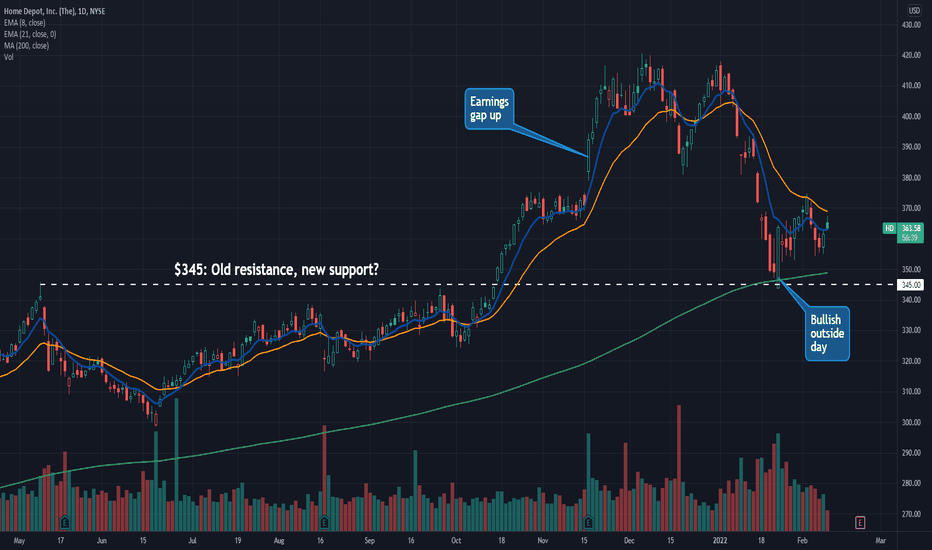

Home Depot jumped above $400 for the first time ever in late 2021. Now after a sharp pullback, value hunters may get interested. The first pattern on today’s chart is the level around $345. It was a peak in May, and last month it was the low. Is old resistance new support? The 200-day simple moving average (SMA) also rose from below. Next, consider the large,...

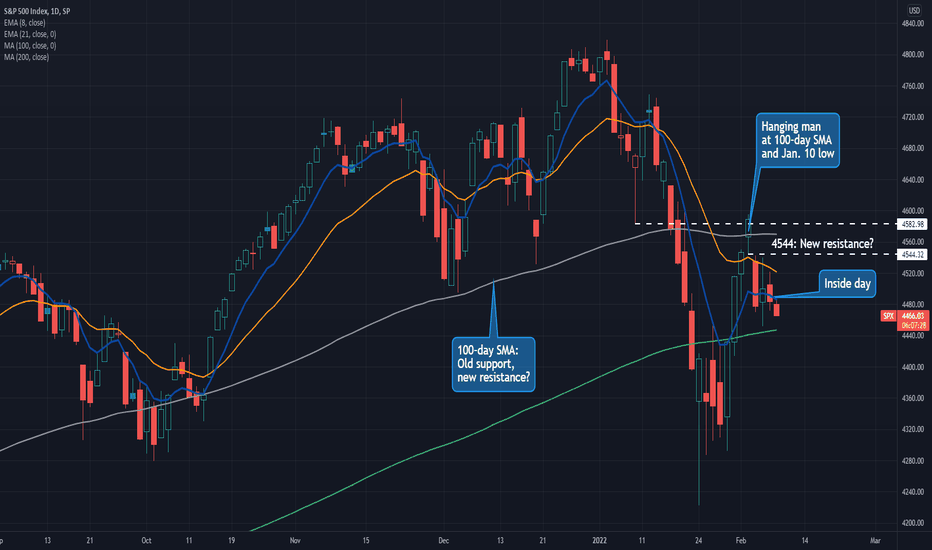

The S&P 500 has bounced from its January 24 low as investors focused on corporate earnings. But now it’s staggering as attention shifts back toward the Federal Reserve and inflation. First, consider the potential hanging man candle on February 2. Like January, was the high made early in the month? Second, that potential reversal pattern occurred at both the...

Amazon.com rallied sharply on some bullish news last week. But it may face some bearish patterns over the intermediate and longer terms. First, consider the level around $3,175. AMZN bounced there in the second, third and fourth quarters of last year before breaking it this quarter. That could make some traders think it will become resistance. Next is the...

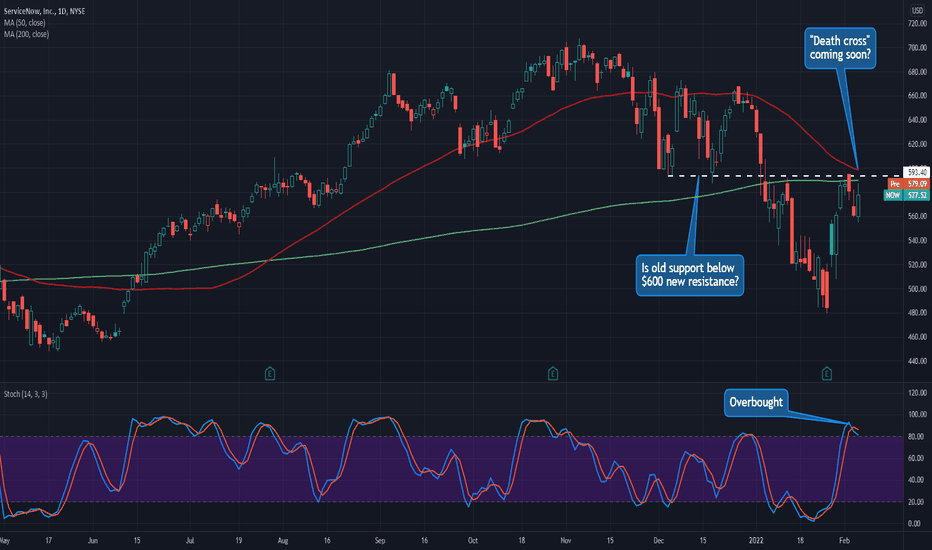

ServiceNow is exactly the type of cloud-computing growth stock that benefited from the pandemic. Is it now rolling over as the crisis fades? Consider the dive under $500 in January. NOW rebounded on strong quarterly results and an upgrade from Piper Sandler last week. Yet, prices failed to reclaim $600. That level could be important because it’s near two lows in...

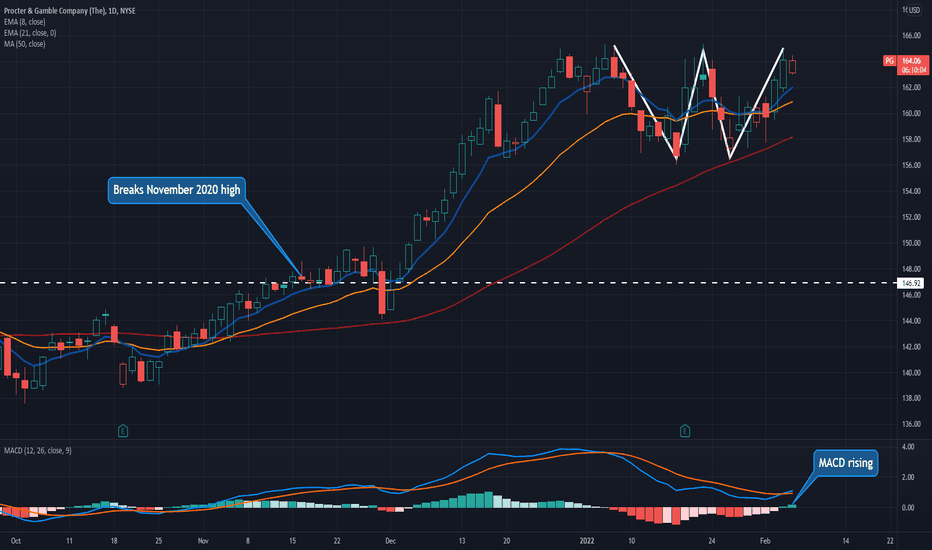

Procter & Gamble quietly broke out of a 12-month range in November and December. Now, after a period of consolidation, it may be ready to continue higher. The first feature on today’s chart is the W double-bottom pattern above $156. That potentially suggests new support has developed above its previous all-time highs. Second, 50-day simple moving average (SMA)...

The Nasdaq-100 has rebounded following a sharp drop. It’s a good time to consider where things stand with the tech-heavy index. First, Wednesday’s close represented almost exactly a 50 percent retracement of the decline from December 28 through January 24. Second, consider that it halted at the January 10 low. Will this old support become new...

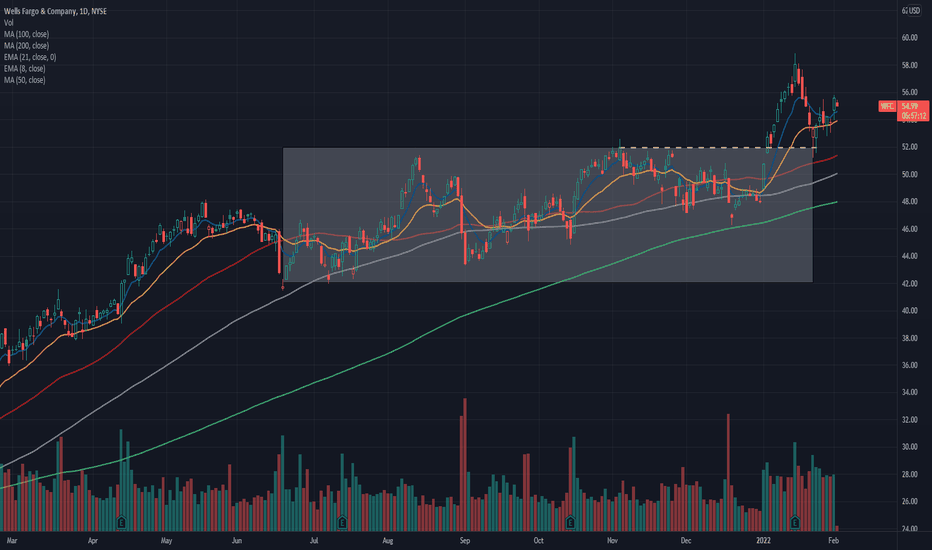

Wells Fargo began 2022 with a surge to new multiyear highs. Now after a pullback, the bank is showing signs of continuation to the upside. First, notice the consolidation between $42 and $52 in the second half of 2021. It made WFC’s January 4 jump above that range a potentially significant breakout. Second, consider the hammer candlesticks on January 24 and 25....

Growth stocks just had one of their worst months in years. But one high-multiple software company has held its ground better than most: cybersecurity provider Palo Alto Networks. Consider how stocks like Nvidia, Tesla and Microsoft crumbled under their 200-day simple moving averages (SMAs) at some point in January. Then notice how PANW remained firmly above that...

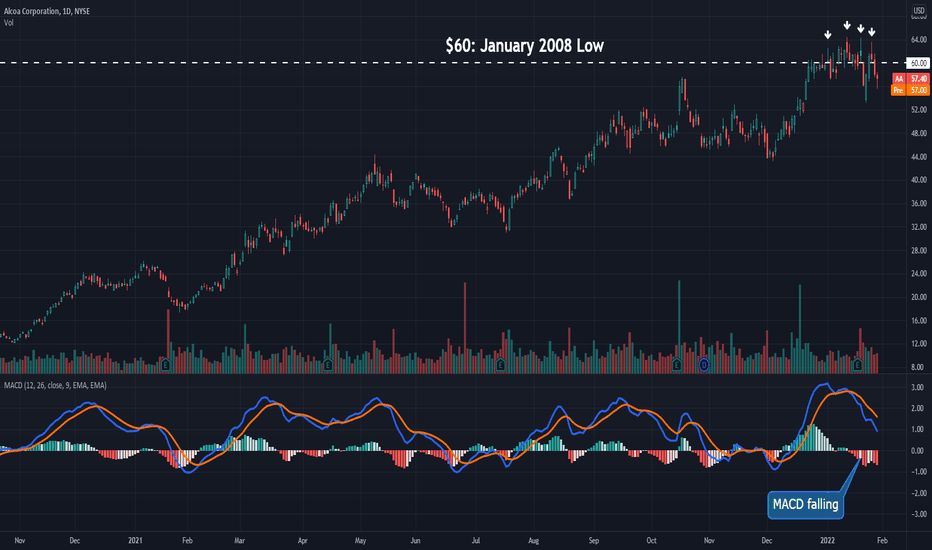

Material stocks have come under pressure as the Federal Reserve gets hawkish. Alcoa has held up better than many peers, but for how long? Notice the candles with long upper tails or solid bodies as the aluminum company chopped above $60. Those indicate selling pressure around that price. Looking further back, notice how that level matches a high from April 2018....

Tesla continues to bleed lower following its big fourth-quarter breakout. Now it may be crumbling through support. As we noted at the time , $900 was an important level on December 21. It had been a high from early 2021, and TSLA bounced sharply after turning the old resistance into new support. But what followed that rally? Prices shot back toward the November...

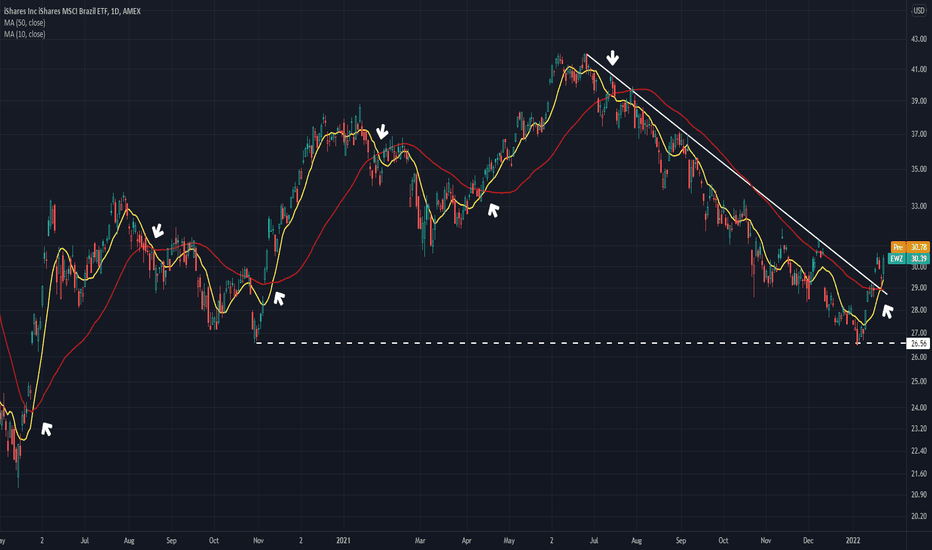

The iShares MSCI Brazil ETF has skidded lower since the summer, but now it may be reversing higher. The first pattern on today’s chart is the bearish trendline running along the highs of June, July and December. EWZ broke above that line last week and has remained there since – even as the S&P 500 crashed to a seven-month low. Next consider the 10- and 50-day...

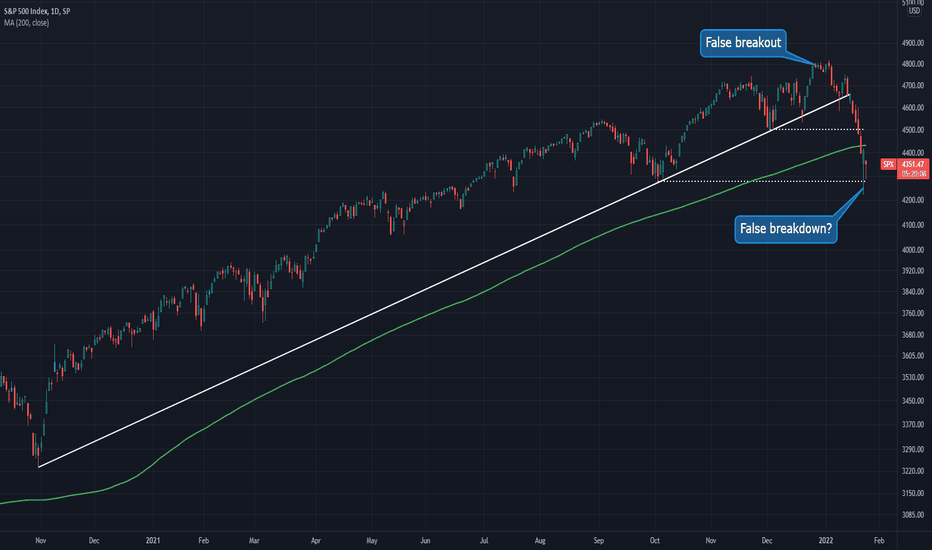

Early this year, we covered the false breakout in the S&P 500. Now the opposite may have taken place: a false breakdown. Notice how prices dipped yesterday to their lowest level since mid-June. They blitzed through support from early October and July, before reversing to close slightly positive. That kind of testing below support, followed by a quick rebound...