Market analysis from TradeStation

The S&P 500 had its biggest drop since March last week, bounced hard and now it’s dead in the water. What’s happening? Several things, it turns out. This chart shows how SPX has been trapped inside Tuesday’s candle for the last two sessions. But it’s holding the 8-day exponential moving average (EMA), which suggests the short-term trend is still positive. The...

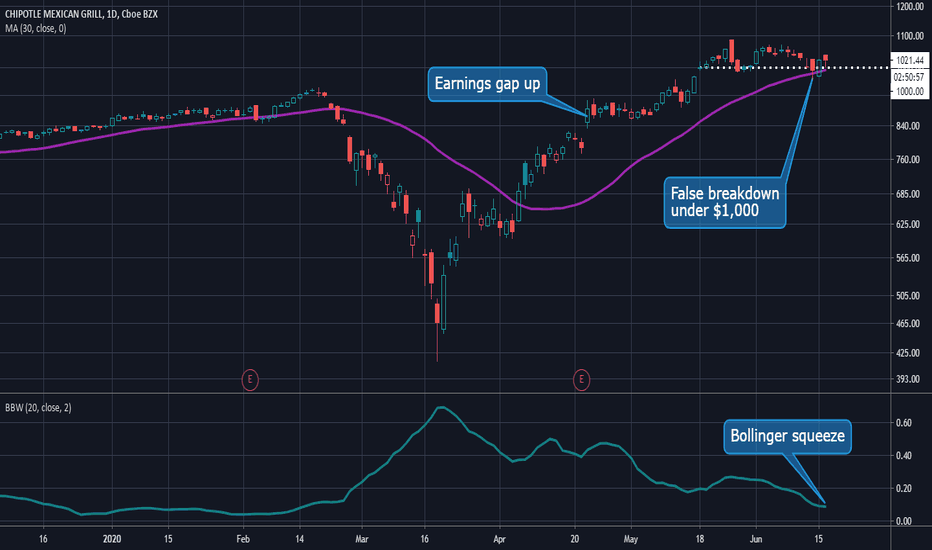

Chipotle Mexican Grill joined the 4-digit club a month ago, riding positive momentum from its strong results on April 21. Since then it’s squeezed into a very tight range as the economy reopens. Once or twice, prices tested and held that important $1,000 level, which suggests it’s building support up at these new highs. CMG took a stab lower on Friday, below...

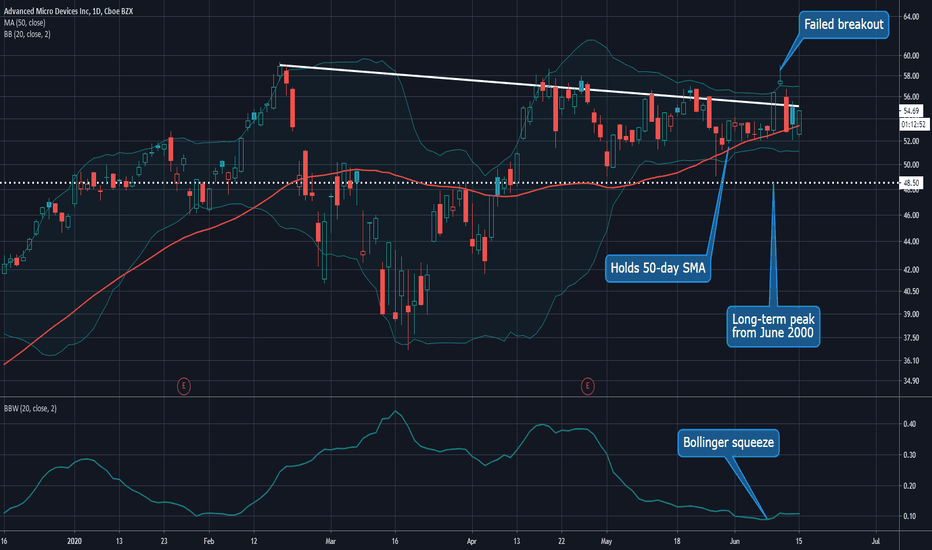

Advanced Micro Devices was the S&P 500’s top performer in both 2018 and 2019. It’s having another positive year, but remains trapped at a key resistance line that started in late February. AMD tried to break out last week after finding support at its 50-day simple moving average (SMA). It peaked out after the Fed meeting, along with the rest of the market and...

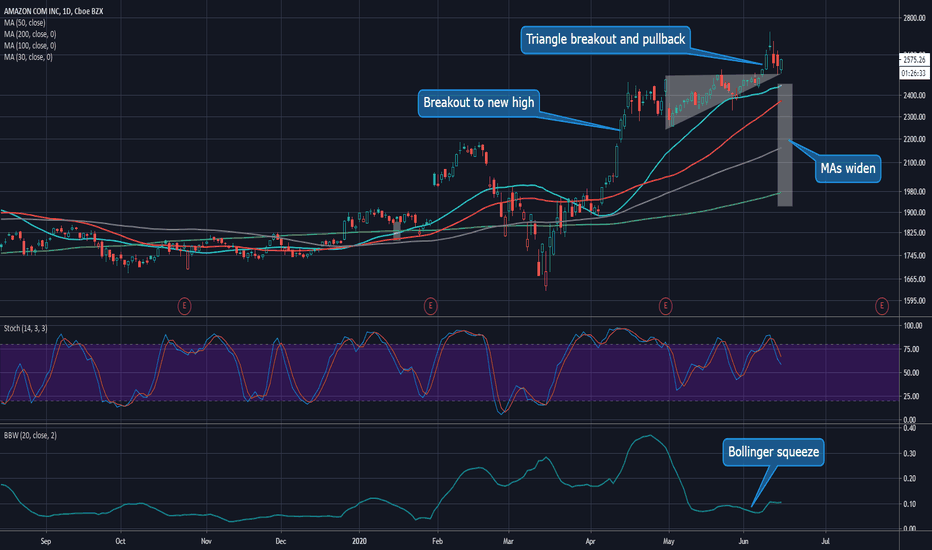

Amazon.com barely flinched when coronavirus slammed markets in February and March. Along with Netflix, it was one of the first major names to break out in April. And now it’s showing signs of continuation to the upside. Few stocks seem to have a stronger fundamental story than AMZN because coronavirus has boosted both halves of its business: e-commerce and cloud...

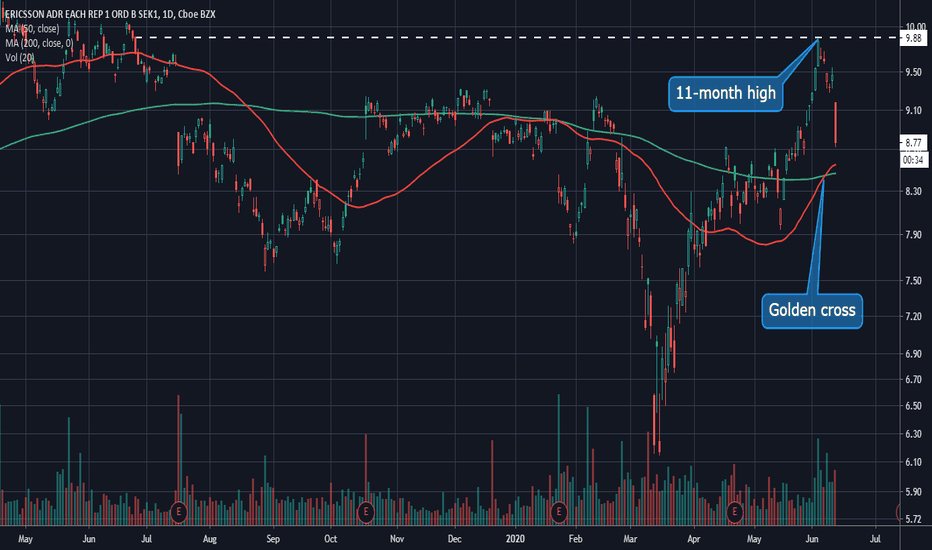

The S&P 500 is having its worst drop since mid-March. On days like today it can be useful to scan for stocks under accumulation before the selling hit. One of those is Ericsson. ERIC started running last month after President Trump moved against Huawei. Analysts see that helping the Swedish telecom supplier gain market share in U.S. 5G networks. ERIC was...

For several weeks, value stocks like airlines, energy , financials and industrials have outperformed. Coronavirus hammered these companies the most because they’re very sensitive to the economy, so it’s not a surprise that they enjoyed strong bounces as the social lockdowns ended. The Nasdaq-100 underperformed during the same time, but didn’t roll over. In...

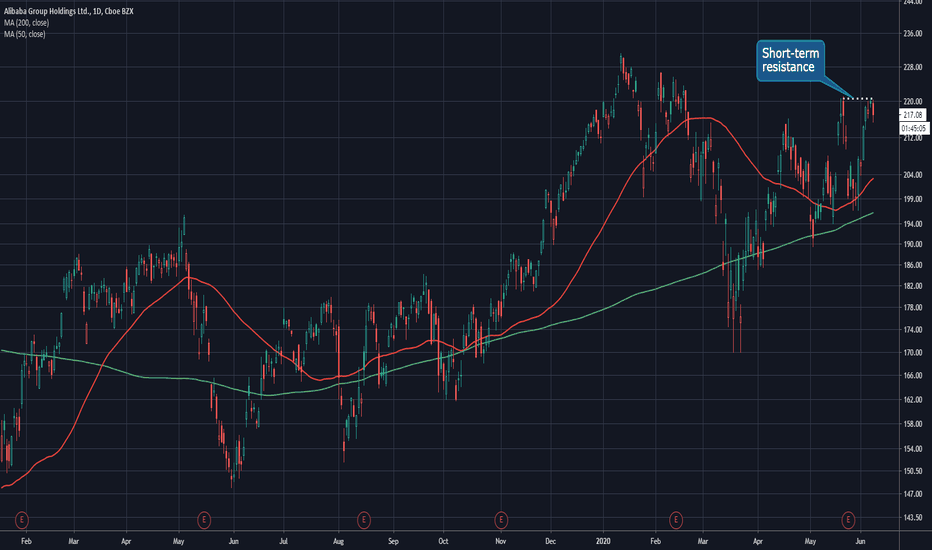

Recent weeks saw a brief flareup between the U.S. and China. But tensions haven’t escalated, and now Chinese stocks have exploded higher as things calm. The Nasdaq Golden Dragon Index is back to its highest levels since July 2018 and price action in the currency market may favor more gains in coming months. The U.S. dollar-Chinese Yuan pair seems to have...

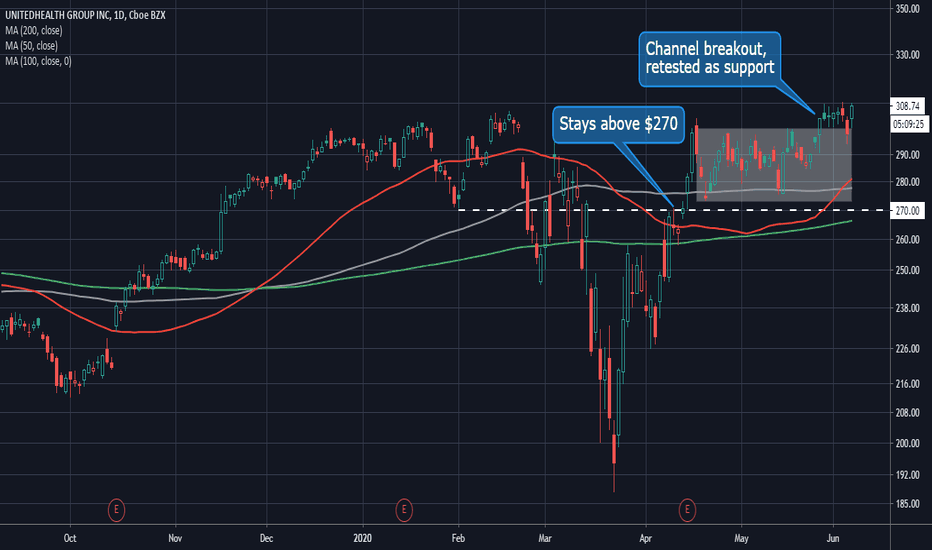

UnitedHealth rebounded from the coronavirus crash more quickly than most stocks. It was back above its 200-day simple moving average (SMA) in early April, 1-1/2 months before the broader S&P 500 . Then it stopped and waited, consolidating in a range and doing some important work technically. First, it established support above $270. This was a key pivot from...

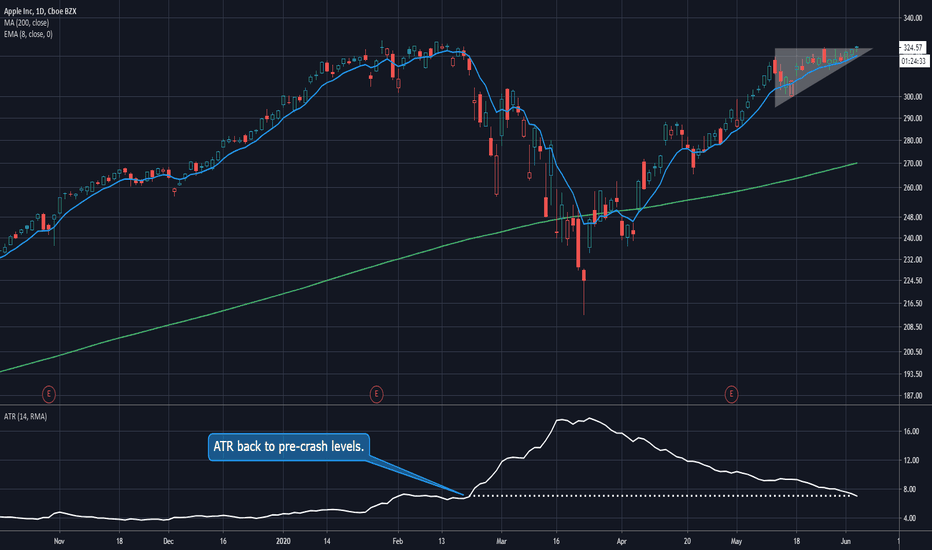

Investor sentiment has recently focused on beaten down cyclical stocks like banks and energy, distracting from megacap technology names. But traders shouldn’t forget about Apple. The iPhone giant is squeezing into a very tight range near its pre-Covid peaks. It’s also made higher lows while remaining trapped below $324, resulting in a bullish ascending...

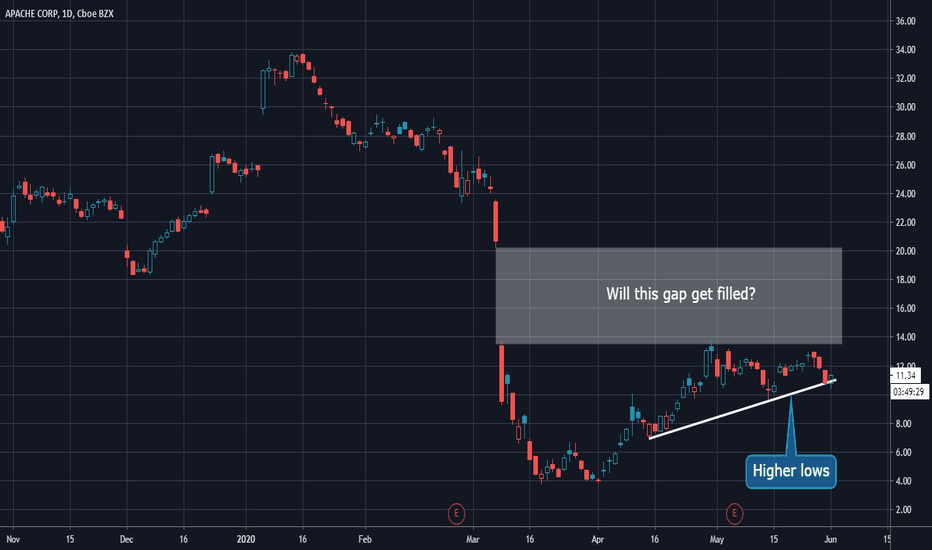

Oil driller Apache is the S&P 500’s top performing stock in the second quarter with a gain of more than 150 percent in the last two months. But it’s also down more than 60 percent from its 2020 high near $34. This may give it more upside potential as the economy reopens from coronavirus. The oil market is at an interesting crossroads because production is...

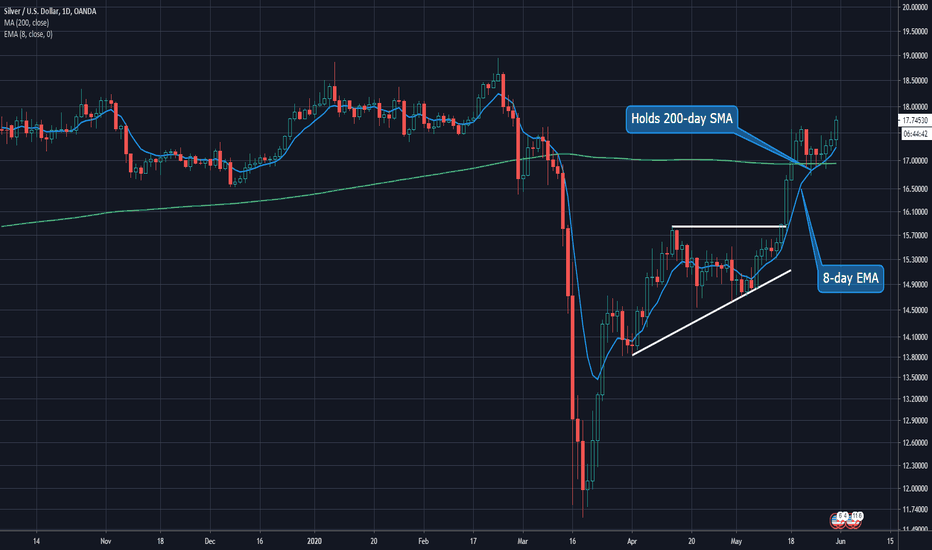

Precious metals have been the strongest corner of the market this year. It’s not a surprise when you consider the coronavirus pandemic, the resulting economic crash and now hefty monetary stimulus from central banks. Precious metals might not have controlled supply like Bitcoin , but it’s definitely MORE controlled than fiat currencies. Gold and silver both took...

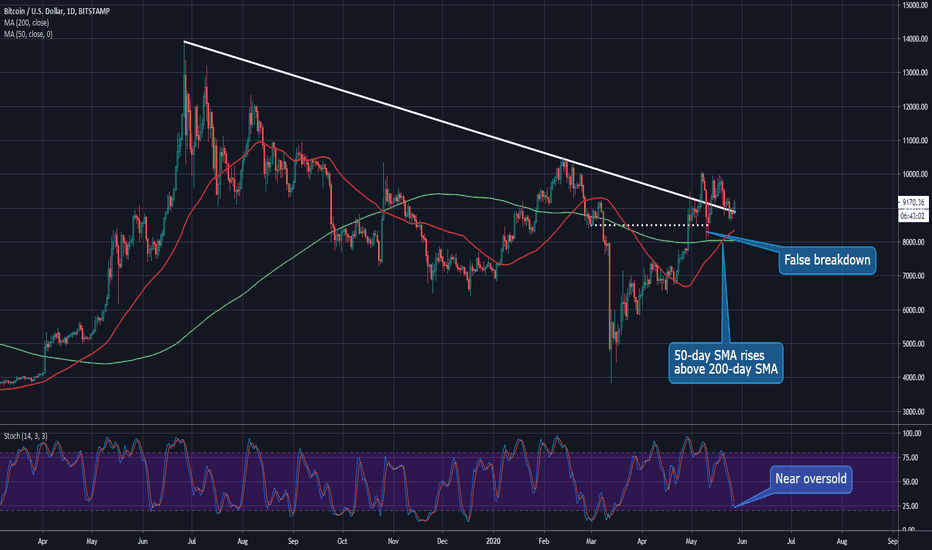

Bitcoin has been in a very tight range for the last month, despite halving on May 11. It might not be ready to rally immediately, but the bullish pressure seems to be growing. Today we’re focused on the downward-sloping trendline that’s formed in the last year. It’s been a clear negative for price that needs to be overcome before buyers can return with...

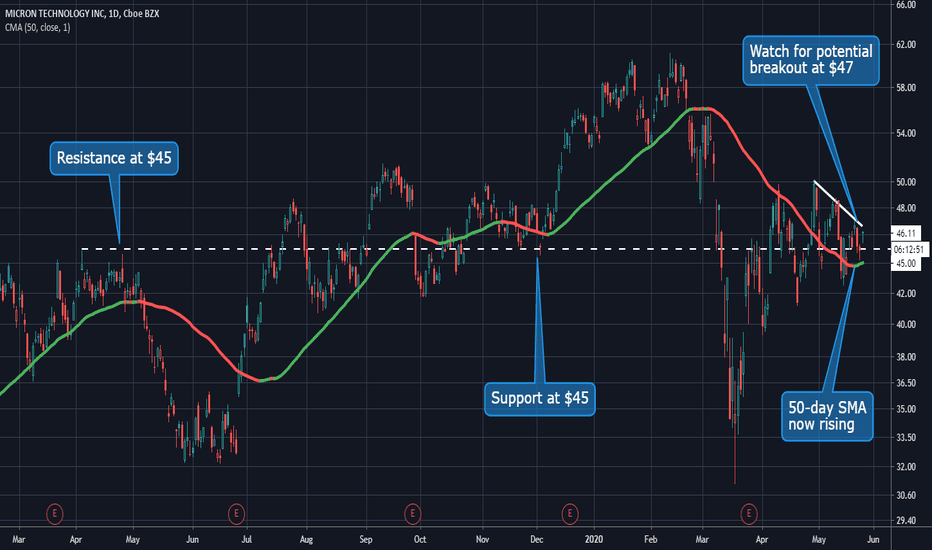

Micron Technology has staggered since the market crashed in February and March. The chip stock is very sensitive to the economy because of its reliance on the cyclical memory-chip market. If the global shutdowns continue, MU faces the risk of falling orders and prices. But if things recover, it controls a valuable corner of a strategically key industry. This...

We highlighted some levels on the S&P 500 earlier this month . Both of the index’s sharp bounces in May occurred after the 2820 line held. Now that it’s 100+ points higher, a channel seems to be emerging on the chart. Its top is in the 2950-2980 zone from late April and earlier this week. If the bulls run out of energy here, traders may want to look for a...

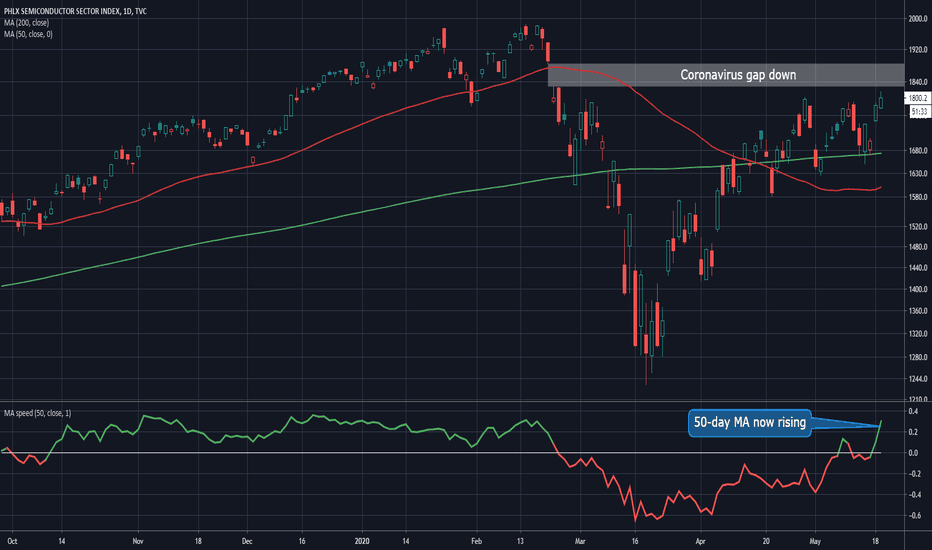

Chips have been one of the strongest industry groups in the last several years. The drivers are mobility, cloud computing, gaming and increased semiconductor use in general (including autos and industrial devices). 5G is another looming catalyst. Today the Philadelphia Semiconductor Index is on pace for its highest close since coronavirus first hammered the...

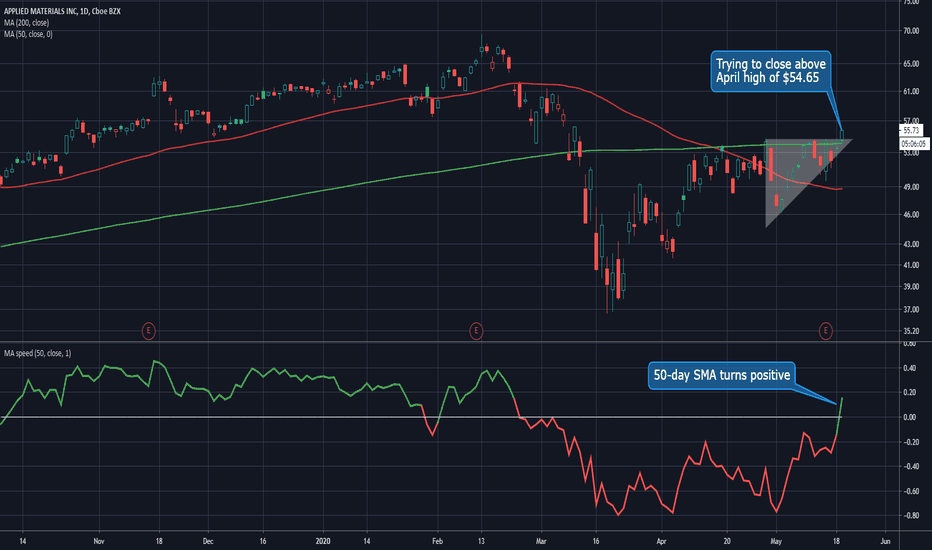

Several technology stocks have formed bullish triangles as they consolidate from the last few months’ of volatility. These include Microsoft , Salesforce.com and Mastercard – all playing out to the upside. Today another appears on the list: Semiconductor-equipment firm Applied Materials . AMAT has been trapped below its 200-day simple moving average (SMA)...

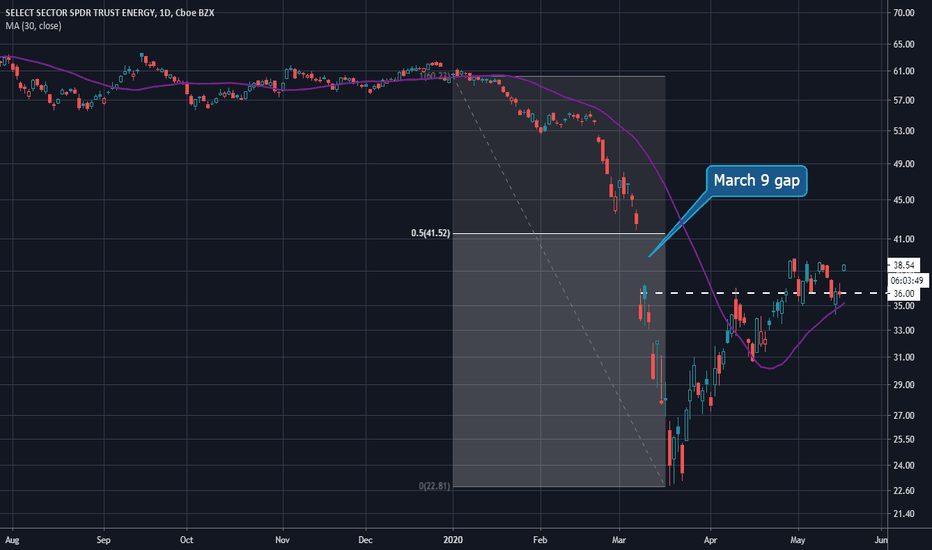

What a difference a month makes! At this time in April, crude oil was in negative territory as the market literally paid you to take barrels away. Now it's rebounded sharply as the economy reopens. On top of that, Memorial Day weekend is coming. Even if coronavirus hurts some travel demand, summer driving season is still around the corner. That brings us back to...

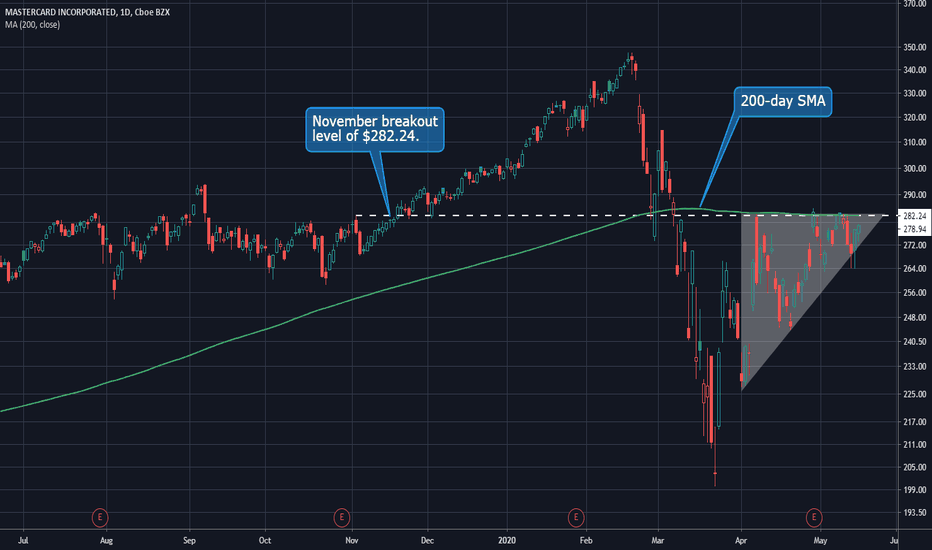

Sometimes people forget that the credit-card companies are members of the technology sector, but they are. We’ve already covered the bullish triangles in other tech names like Microsoft and Salesforce.com . And now Mastercard is showing a similar pattern. MA has faced resistance around $282, which closely matches its 200-day simple moving average (SMA)....