Market analysis from easyMarkets

Professional traders like to plan their trades, and then trade their plan. Are you trading like a pro? Our Crypto analyst provides 2 trading plans we can adopt and follow in this current market, and remember, FOMC this week, so anything can happen! Support/Resistance Levels: R1: 1475 S1: 1335 S2: 1230-1255 easyMarkets Account on TradingView allows you to...

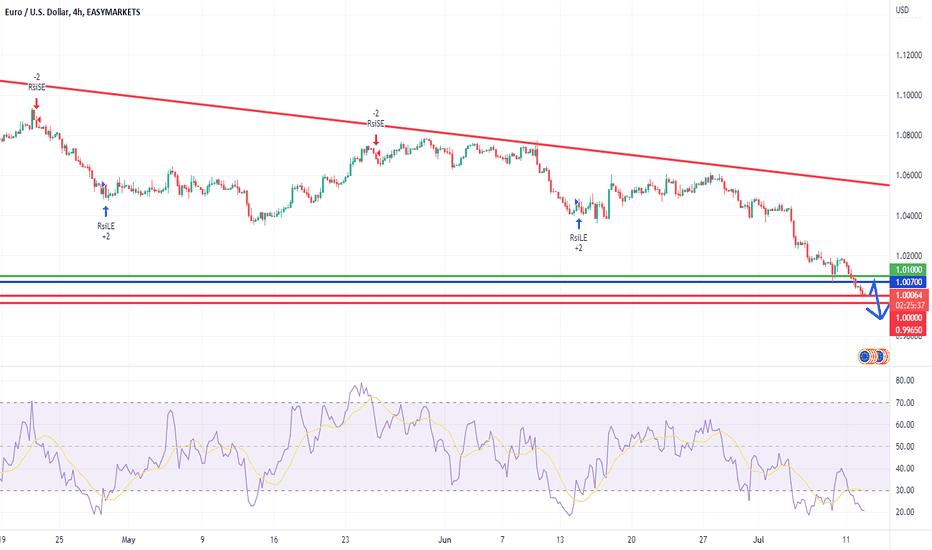

Dollar Index has broken through 108 level and is trading at 108.30 which is the highest level since 08/2002. Meanwhile, EUR/USD slides to parity level as the lowest since January 2003. US CPI is the key financial data of the week.

Dollar Index has broken through 108 level and is trading at 108.30 which is the highest level since 08/2002, as a result XAU/USD continues declining to an almost 10-month low @ $1723 per ounce. Meanwhile, EUR/USD slides to parity level as the lowest since January 2003. US CPI is the key financial data of the week.

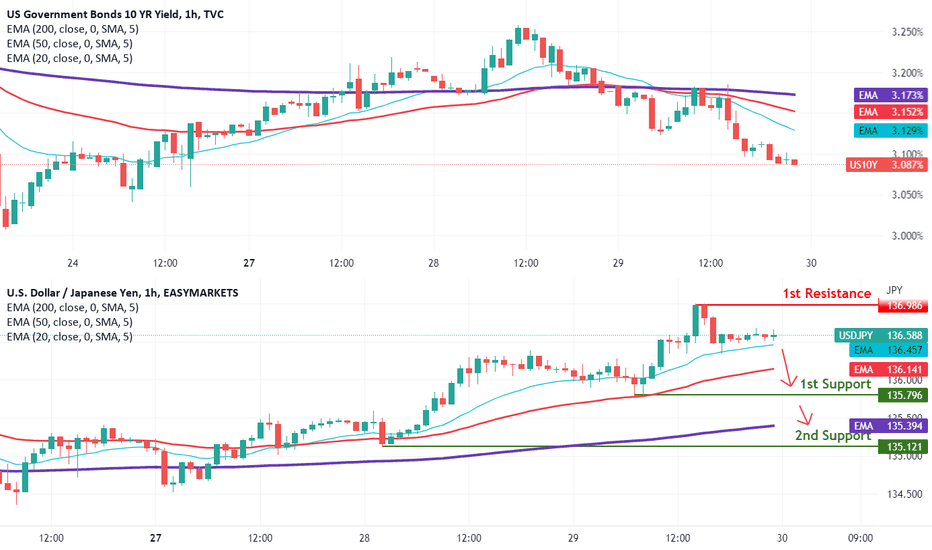

The USD/JPY rally has been driven by sharp increase in US interest rates and in particular is very sensitve to 10 year movements. What has happened since the FED rate hike is a high in yields has been put in short term and we are consolidating lower, this has not yet jumped across meaningfully to the USD/JPY which is rallying on Momentum and made fresh highs...

EUR/USD has been gently trying to rally in recent days with the USD peaking with US interest rate a week ago. SInce the US interest rates peaked the edging lower has allowed the EUR/USD to bounce and if we head into full blown recession, US rates have the most to give back whilst EURO rates have moved little in the biggest European bond market Germany. So the...

Is this the bottom? let the EMA's tell you ... in our latest stream, Crypto Analyst Danny runs you through critical, well-respected indicators and levels that can give you insight into whether or not Bitcoin will stop the bleeding anytime soon. Knife-catching/Scale-in zone: 18000-18650 Stop Losses below 16800 Conservative Long Entry (Short Term): Break of 50EMA...

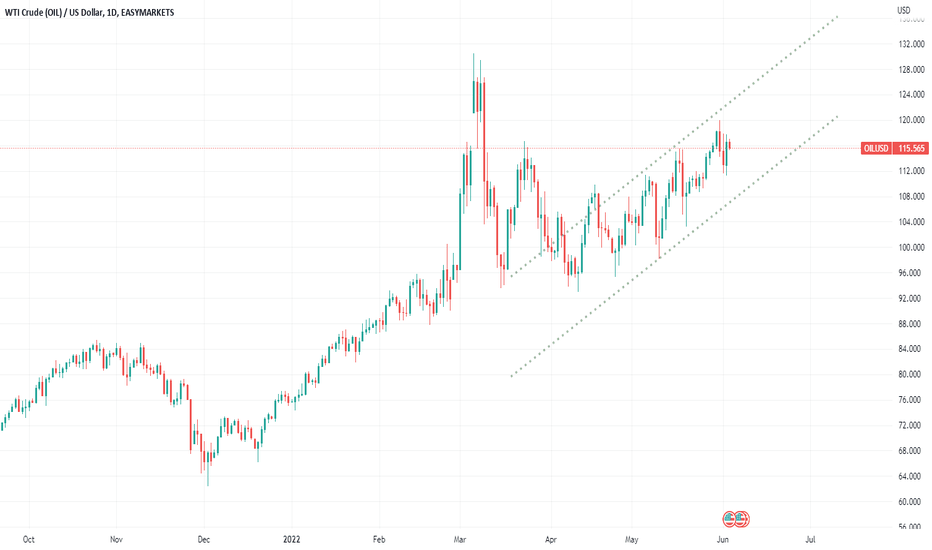

Bears have had not had so much fun and confidence since 2008 as the Inflation/recession combo and aggressive rate hikes keeps the bad news for stocks rolling in. Relief rallies will come from oversold conditions but also understanding the narratives driving the selling will help spot the reversal stories, we had one yesterday from large drop in Oil and inflation...

Looking for sellers to take profit and bargain hunters to squeeze this heavily sold Australia stock index into the close Friday or for Pop higher Morning if US stocks can Bounce. In large sell offs Friday are profit taking days for sellers and this naturally causing some buying as they close short positions and in the fallout there are some stocks that are bought...

BTC has been consecutively sold for 7 days straight and tends to be flirting with major support... from an analyst's perspective, we look at how we can more safely trade the volatility and scale in with minor positions. Support 1: weekly 200EMA (22,300) Support 2: 19,500 (Major Support) easyMarkets Account on TradingView allows you to combine easyMarkets...

US CPI is going to set the tone for US markets and the USD for the rest of the month ahead of the next FED meeting. A high inflation number will encourage the bond traders to push FED rate hike expectations higher and higher. US stocks would likely fall further under these conditions. A weaker inflation number 5.9% y/y is forecast and this may be enough to see...

200 EMA has perfectly rejected the last 3 bear market rallies and is now a huge level for bulls to break to ease the downside pressure, otherwise further bearish price action opens up retest of May lows near 25k. Key Pivot for this indicator is currently $31600 as of publishing. easyMarkets Account on TradingView allows you to combine easyMarkets industry...

RBA has announced the biggest single hike in the cash rate since 2000. Inflation in Australia has increased significantly and is expected to increase further. RBA wants to combat inflation before it gets out of control. RBA expects to take further steps in the process of normalizing monetary policies over the months ahead. ASX fell sharply, more than 1.5%...

Oil Volatility is driving multiple markets and in this video we explain the transmission mechanism of how Oil gets through to the markets you trade. We look through US Yields, USD/JPY and US stock market relationships with Oil and provide the correlations you need to watch to trade successfully. easyMarkets Account on TradingView allows you to combine...

As we scope out the technical support and resistance levels for ETH/USD, we also plan the potential pathways and stronger/risker entry points we can take from a neutral perspective. Along with some examples of confluent entry points for Long/Short positions. Support 1: 1790 Support 2: 1720 Support 3: 1580 Resistance 1: 1890 Resistance 2: 1940 Resistance 3:...

AUD/USD has led the relief rally but with inflation remaining high can stocks resume uptrend or are we just in a bear market bounce. We will soon find out as AUD and EUR/USD and US Stocks have all run into resistance at the normal sort of bounce levels and we have stalled now for 2 days. If we break down lower or higher here we have to respect the markets price...

EU Oil embargo on China and record German Inflation is a toxic mix that may short circuit the DAX short squeeze. Sellers are worried about inflation and the EU news has seen Oil push up to $118 overnight so if the market wants to worry it has more than enough reason especially if it goes higher above $120. Targets are 1-2 day down towards 14300-14200, a new high...

Historically, BTC blasted out of trend resistance following what seems to be a strong 'Bullish Divergence' on the RSI... presently, we are seeing a similar setup! Amidst all the negativity in the markets, if BTC were to break out here, it would most likely be a relief rally before the next leg down. We await the Core PCE Price Index announcement at 12:30 PM...

Alibaba Group Holding Limited is expected to report earnings on 05/26/2022 before market open. Analysts are expecting Alibaba to report adjusted income of $1.07 per share, down 33% comparing with the year-ago period $1.6per share, on revenue of $29.7 billion, up 3% for its fiscal fourth quarter. Alibaba is more than 72% off its record high set in October 2020....