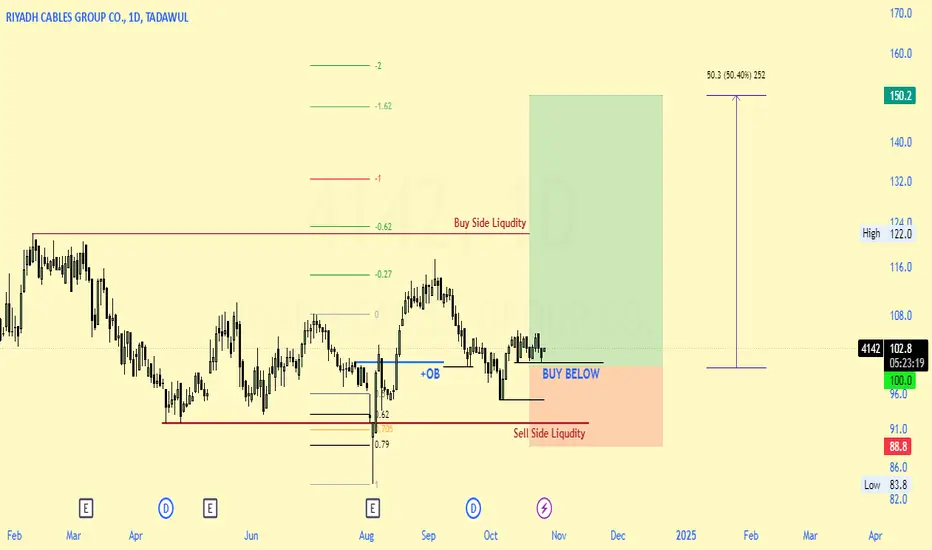

**Riyadh Cables Group (4142): A High-Growth Opportunity! 🚀**

Riyadh Cables Group (4142) is positioned for an impressive rally with a **50% upside target** projected in the coming weeks! As a market leader in cable manufacturing, Riyadh Cables stands strong amid rising demand in construction and infrastructure projects, making it a prime pick for growth-oriented investors.

**Why Buy Now?**

- 📈 **Strong Market Position**: The company leads with high-quality products and steady market expansion.

- 🏗️ **Sector Momentum**: Increased infrastructure investment is set to fuel demand.

- 💹 **High Upside Potential**: Forecasts indicate a promising 50% gain in the short term.

Take advantage of this promising opportunity, but remember to manage risk with appropriate stop-loss strategies. With strong fundamentals and market support, Riyadh Cables could deliver substantial rewards for savvy investors!

Riyadh Cables Group (4142) is positioned for an impressive rally with a **50% upside target** projected in the coming weeks! As a market leader in cable manufacturing, Riyadh Cables stands strong amid rising demand in construction and infrastructure projects, making it a prime pick for growth-oriented investors.

**Why Buy Now?**

- 📈 **Strong Market Position**: The company leads with high-quality products and steady market expansion.

- 🏗️ **Sector Momentum**: Increased infrastructure investment is set to fuel demand.

- 💹 **High Upside Potential**: Forecasts indicate a promising 50% gain in the short term.

Take advantage of this promising opportunity, but remember to manage risk with appropriate stop-loss strategies. With strong fundamentals and market support, Riyadh Cables could deliver substantial rewards for savvy investors!

I am an SMC & ICT Master, specializing in Market Structure, Liquidity, and Order Flow. With a razor-sharp focus on precision trading, I navigate the markets with strategy and discipline—turning probabilities into profitability!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

I am an SMC & ICT Master, specializing in Market Structure, Liquidity, and Order Flow. With a razor-sharp focus on precision trading, I navigate the markets with strategy and discipline—turning probabilities into profitability!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.