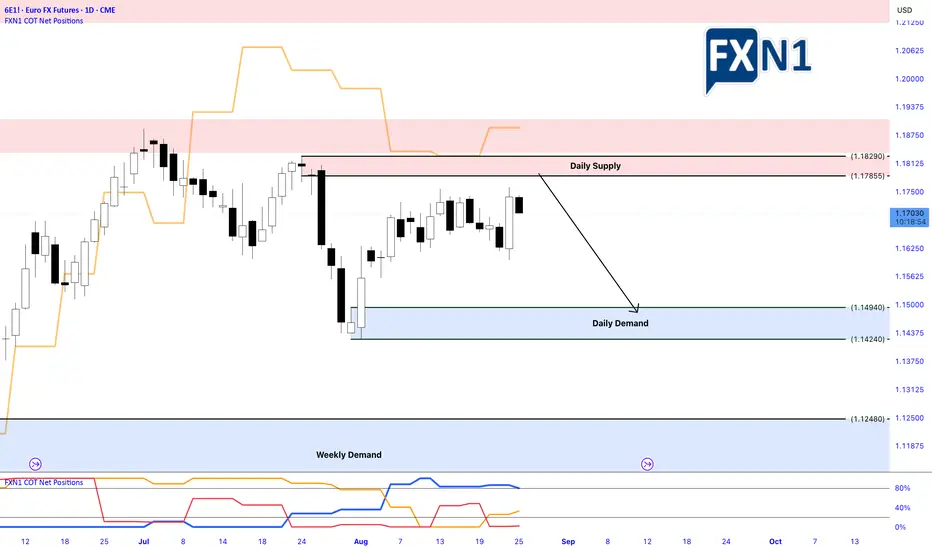

Last week, the 6E1! (Euro Futures / EUR/USD) closed with a solid bullish candle, successfully breaking through a key supply zone, signaling strong upward momentum. However, as the new week begins, the market has shifted to bearish pressure, indicating some uncertainty and potential consolidation.

The current situation across currency pairs against the USD remains ambiguous. The DXY dollar index shows mixed signals: on one hand, there is an increase in bullish positions among non-commercial traders, while on the other hand, there’s a decrease in bearish bets. Meanwhile, for the EUR and other currencies, non-commercial traders are increasing their bullish positions, suggesting a possible shift toward dollar weakness or euro strength. Despite these mixed signals, the major supply and demand zones highlighted on my charts remain unchanged.

Given the conflicting data and the current market volatility, I believe it’s prudent to wait until the end of August before making any significant trading decisions. The upcoming weeks should provide clearer insights into the market’s direction, especially as traders and institutions reassess their positions. For now, I will refrain from opening new trades or considering any currency pairs until the overall trend and the direction of the DXY dollar index become more evident. Patience and careful observation will be key in navigating the upcoming market movements.

✅ Please share your thoughts about EUR in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

The current situation across currency pairs against the USD remains ambiguous. The DXY dollar index shows mixed signals: on one hand, there is an increase in bullish positions among non-commercial traders, while on the other hand, there’s a decrease in bearish bets. Meanwhile, for the EUR and other currencies, non-commercial traders are increasing their bullish positions, suggesting a possible shift toward dollar weakness or euro strength. Despite these mixed signals, the major supply and demand zones highlighted on my charts remain unchanged.

Given the conflicting data and the current market volatility, I believe it’s prudent to wait until the end of August before making any significant trading decisions. The upcoming weeks should provide clearer insights into the market’s direction, especially as traders and institutions reassess their positions. For now, I will refrain from opening new trades or considering any currency pairs until the overall trend and the direction of the DXY dollar index become more evident. Patience and careful observation will be key in navigating the upcoming market movements.

✅ Please share your thoughts about EUR in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

✅ TELEGRAM CHANNEL: t.me/+VECQWxY0YXKRXLod

🔥 USA ZERO SPREAD BROKER: forexn1.com/usa/

🔥 UP to 4000$ BONUS: forexn1.com/broker/

🟪 Instagram: instagram.com/forexn1_com/

🔥 USA ZERO SPREAD BROKER: forexn1.com/usa/

🔥 UP to 4000$ BONUS: forexn1.com/broker/

🟪 Instagram: instagram.com/forexn1_com/

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

✅ TELEGRAM CHANNEL: t.me/+VECQWxY0YXKRXLod

🔥 USA ZERO SPREAD BROKER: forexn1.com/usa/

🔥 UP to 4000$ BONUS: forexn1.com/broker/

🟪 Instagram: instagram.com/forexn1_com/

🔥 USA ZERO SPREAD BROKER: forexn1.com/usa/

🔥 UP to 4000$ BONUS: forexn1.com/broker/

🟪 Instagram: instagram.com/forexn1_com/

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.