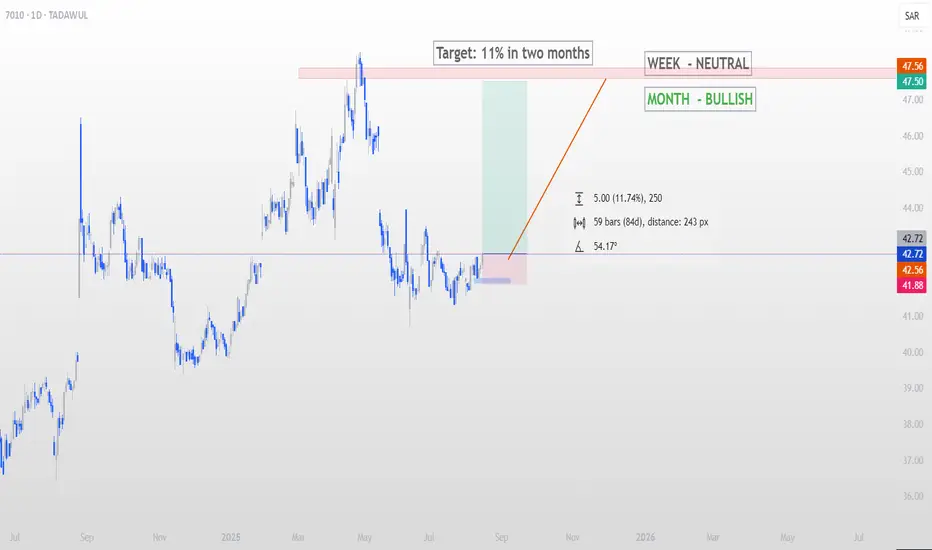

Today, I’m sharing a potential swing setup on Saudi Telecom Co. (7010) with a Risk/Reward Ratio of 5.69 and an upside potential of 11.74% over the next two months.

Weekly Bias: Neutral

Monthly Bias: Bullish

Target: SAR 47.56 (approx. +11.74%)

Stop Loss: SAR 41.88 (approx. -1.97%)

Entry Zone: Marked on chart

Timeframe: Daily

The key zones have been carefully marked on the chart for both entry and target areas. The trade setup allows a tight stop compared to the target, giving us a favorable R:R profile.

📌 Chart Highlights:

Price path projection shows approx. 59 days to target if momentum holds.

Our primary objective in the stock market is to grow our capital by 35–40% annually. To achieve this, we diversify our portfolio into 5–10 different securities. Profit targets are set on a monthly, quarterly, or half-yearly basis:

• Monthly: Close the position if it gains 10-15%.

• Within 2–3 months: Close if it gains 15-20%.

• Within 6 months: Close if it gains 20–30%.

This structured approach ensures consistent profit-taking while managing risk.

The real purpose of closing a position is to book profits and free up capital so it can be invested in better opportunities.

💡 For more Tadawul insights, you can follow me. I will also share updates on whether to hold, reconsider, or close this position as the trade develops.

Weekly Bias: Neutral

Monthly Bias: Bullish

Target: SAR 47.56 (approx. +11.74%)

Stop Loss: SAR 41.88 (approx. -1.97%)

Entry Zone: Marked on chart

Timeframe: Daily

The key zones have been carefully marked on the chart for both entry and target areas. The trade setup allows a tight stop compared to the target, giving us a favorable R:R profile.

📌 Chart Highlights:

Price path projection shows approx. 59 days to target if momentum holds.

Our primary objective in the stock market is to grow our capital by 35–40% annually. To achieve this, we diversify our portfolio into 5–10 different securities. Profit targets are set on a monthly, quarterly, or half-yearly basis:

• Monthly: Close the position if it gains 10-15%.

• Within 2–3 months: Close if it gains 15-20%.

• Within 6 months: Close if it gains 20–30%.

This structured approach ensures consistent profit-taking while managing risk.

The real purpose of closing a position is to book profits and free up capital so it can be invested in better opportunities.

💡 For more Tadawul insights, you can follow me. I will also share updates on whether to hold, reconsider, or close this position as the trade develops.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.