✈️ 📅 Date: July 3, 2025 | 🧠 Source: VolanX Hybrid Predictor + SMC Confluence

📍 WaverVanir International LLC

🧭 Macro Backdrop

Fed on Pause, Dollar Cooling → Creates tailwinds for airlines by lowering hedging costs and boosting consumer demand.

Jet Fuel Prices Stable → Crude hovering under $85 keeps operating costs from spiking.

Summer Travel Boom → TSA throughput at 2024 highs, with international and premium segments driving demand. Domestic may lag, but offset by credit card spend rev share.

🧾 Fundamentals

✅ Q1 2025 Net Income Beat: $1.7B FCF, strong card-linked revenue via Barclays/Citi partnerships.

🔁 Deleveraging Story: Reduced net debt, capital discipline post-2023 downcycle.

🧮 P/E Compression Reversal: At 4.9x forward earnings, upside mean reversion likely.

📊 Credit Upgrade Watch: S&P hinted at revision if cash flow stabilizes above 3 quarters.

💬 Sentiment + VolanX Model

🤖 LSTM-GRU Hybrid Predictor: Signals an accelerating uptrend toward $13.70+ by early August.

📈 Model Stats: 50 Epochs | Batch 16 | 100 LSTM / 80 GRU Units | Dropout 0.3

🧠 Sentiment Score: +0.10 → Reflects mildly bullish tone from media & institutional coverage.

🧮 SMC + Fibonacci Confluence

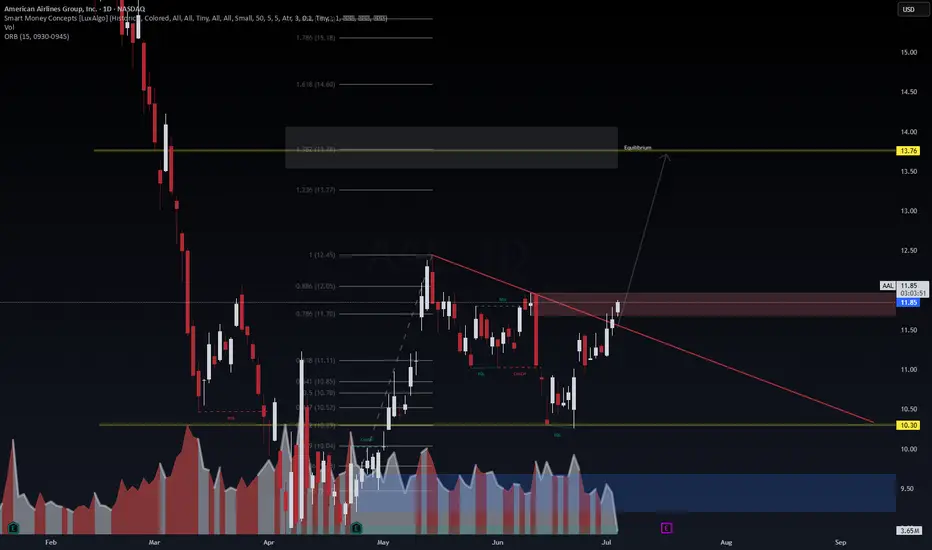

📉 Breakout Confirmed above descending trendline & prior CHoCH zone at $11.70–11.86.

🔥 Liquidity Sweep Complete below $10.30 – smart money accumulation evident.

🎯 Next Zones:

Fibo 1.0 → $12.45

Fibo 1.236 → $13.27

🔱 Equilibrium Zone → $13.76 (main target)

Fibo 1.382 → $13.78 = institutional exit likely

🎯 Trade Plan – Probabilistic Setup

Element Value

Entry Zone $11.75–11.90

SL Below $11.10 (2.5% risk)

TP1 $12.45

TP2 $13.27

TP3 $13.76 (equilibrium)

RR Ratio ~3.8R (high-conviction)

Confidence 🔵 76% short-term uptrend probability (VolanX LSTM)

🛡️ Risk Management

Size for 0.5–1% capital risk if SL triggered.

Avoid overleveraging due to geopolitical/airline sensitivity.

Reduce exposure if $12.05 rejects on volume.

📌 Summary

AAL is breaking out of a multi-month compression with fuel prices in check, debt reduced, and passenger volume growing. VolanX AI expects a move to $13.76 with high probability—if confirmed, this trade offers strong asymmetric upside into late July / early August.

📉 Disclaimer: Not financial advice. Educational use only.

🏛 WaverVanir International LLC | AI-Driven Institutional Strategy

🔗 Follow for SMC + AI-backed trading intelligence.

📍 WaverVanir International LLC

🧭 Macro Backdrop

Fed on Pause, Dollar Cooling → Creates tailwinds for airlines by lowering hedging costs and boosting consumer demand.

Jet Fuel Prices Stable → Crude hovering under $85 keeps operating costs from spiking.

Summer Travel Boom → TSA throughput at 2024 highs, with international and premium segments driving demand. Domestic may lag, but offset by credit card spend rev share.

🧾 Fundamentals

✅ Q1 2025 Net Income Beat: $1.7B FCF, strong card-linked revenue via Barclays/Citi partnerships.

🔁 Deleveraging Story: Reduced net debt, capital discipline post-2023 downcycle.

🧮 P/E Compression Reversal: At 4.9x forward earnings, upside mean reversion likely.

📊 Credit Upgrade Watch: S&P hinted at revision if cash flow stabilizes above 3 quarters.

💬 Sentiment + VolanX Model

🤖 LSTM-GRU Hybrid Predictor: Signals an accelerating uptrend toward $13.70+ by early August.

📈 Model Stats: 50 Epochs | Batch 16 | 100 LSTM / 80 GRU Units | Dropout 0.3

🧠 Sentiment Score: +0.10 → Reflects mildly bullish tone from media & institutional coverage.

🧮 SMC + Fibonacci Confluence

📉 Breakout Confirmed above descending trendline & prior CHoCH zone at $11.70–11.86.

🔥 Liquidity Sweep Complete below $10.30 – smart money accumulation evident.

🎯 Next Zones:

Fibo 1.0 → $12.45

Fibo 1.236 → $13.27

🔱 Equilibrium Zone → $13.76 (main target)

Fibo 1.382 → $13.78 = institutional exit likely

🎯 Trade Plan – Probabilistic Setup

Element Value

Entry Zone $11.75–11.90

SL Below $11.10 (2.5% risk)

TP1 $12.45

TP2 $13.27

TP3 $13.76 (equilibrium)

RR Ratio ~3.8R (high-conviction)

Confidence 🔵 76% short-term uptrend probability (VolanX LSTM)

🛡️ Risk Management

Size for 0.5–1% capital risk if SL triggered.

Avoid overleveraging due to geopolitical/airline sensitivity.

Reduce exposure if $12.05 rejects on volume.

📌 Summary

AAL is breaking out of a multi-month compression with fuel prices in check, debt reduced, and passenger volume growing. VolanX AI expects a move to $13.76 with high probability—if confirmed, this trade offers strong asymmetric upside into late July / early August.

📉 Disclaimer: Not financial advice. Educational use only.

🏛 WaverVanir International LLC | AI-Driven Institutional Strategy

🔗 Follow for SMC + AI-backed trading intelligence.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.