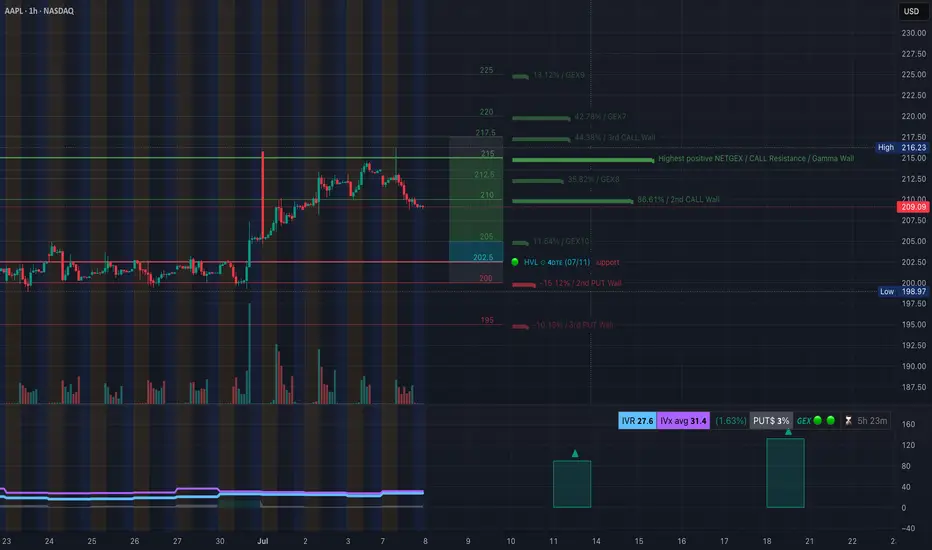

* Gamma Wall / Call Resistance is forming between 213.55 – 216.23, aligning with major GEX levels (GEX7/8) and 2nd/3rd Call Walls. That area is a potential profit-taking zone or rejection spot for bulls if tested again.

* High Volume Level (HVL) at 202.5 is marked with strong support (from the green tag), meaning sellers must break below that level with force for a bearish continuation.

* Below that, we have layered PUT support walls at 200 and 195, reinforcing 198–202 as a major demand zone.

* Current IVR: 27.6, IVx avg: 31.4 — fairly low, suggesting neutral-to-slightly-bearish premium pricing.

* PUTs 3% weighted dominance also implies defensive positioning, but not aggressively bearish.

🔍 Options Insight: If price stays under 213 and fails to reclaim 212.55–213.55 zone, the bias is toward a grind back toward 205–202.5. Watch for volatility around July 11 expiration — if 202.5 fails, 200 strike puts may surge.

📈 Potential Options Trade Setup:

* Bearish setup (if rejection confirmed below 213):

* Entry: Near 212.5

* Target: 202.5

* PUT: July 12 or 19 $205P or $202.5P

* Bullish recovery scenario:

* Entry: Above 213.55 with strength

* Target: 216+

* CALL: July 12 $215C for short-term squeeze play

AAPL 1-Hour Chart – Price Action & Structure

* Break of Structure (BOS) occurred above 212.55 but was not sustained.

* Price is now pulling back from the mid-supply zone (purple box) and is attempting to hold above 209 support.

* Trendline support broken, and now retesting from below — suggesting a weakening trend unless 213 is reclaimed quickly.

* Major support at 199.26 aligns with a previous CHoCH zone, forming a clean demand zone.

* Volume is fading slightly on this decline, but there’s no strong absorption yet.

🧠 Intraday Bias Suggestion: If AAPL can't reclaim 212.5–213 on bounce, the market may pull toward the HVL zone (205–202.5). However, if we get a reclaim of 213.5 with volume, the trendline flip becomes bullish again — target 215–216.

Summary Recommendations

* For Options Traders:

* Favor PUT debit spreads or single directional PUTs if price stays below 212.5.

* Avoid naked CALLs until a break above 213.5 confirms strength.

* IV is low — good time to buy premium, not sell it.

* For Stock Traders (Intraday or Swing):

* Consider shorting pops into 213 with stop above 215.

* Look for long entries near 202.5–200 with tight stops if structure holds.

This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage risk carefully.

* High Volume Level (HVL) at 202.5 is marked with strong support (from the green tag), meaning sellers must break below that level with force for a bearish continuation.

* Below that, we have layered PUT support walls at 200 and 195, reinforcing 198–202 as a major demand zone.

* Current IVR: 27.6, IVx avg: 31.4 — fairly low, suggesting neutral-to-slightly-bearish premium pricing.

* PUTs 3% weighted dominance also implies defensive positioning, but not aggressively bearish.

🔍 Options Insight: If price stays under 213 and fails to reclaim 212.55–213.55 zone, the bias is toward a grind back toward 205–202.5. Watch for volatility around July 11 expiration — if 202.5 fails, 200 strike puts may surge.

📈 Potential Options Trade Setup:

* Bearish setup (if rejection confirmed below 213):

* Entry: Near 212.5

* Target: 202.5

* PUT: July 12 or 19 $205P or $202.5P

* Bullish recovery scenario:

* Entry: Above 213.55 with strength

* Target: 216+

* CALL: July 12 $215C for short-term squeeze play

AAPL 1-Hour Chart – Price Action & Structure

* Break of Structure (BOS) occurred above 212.55 but was not sustained.

* Price is now pulling back from the mid-supply zone (purple box) and is attempting to hold above 209 support.

* Trendline support broken, and now retesting from below — suggesting a weakening trend unless 213 is reclaimed quickly.

* Major support at 199.26 aligns with a previous CHoCH zone, forming a clean demand zone.

* Volume is fading slightly on this decline, but there’s no strong absorption yet.

🧠 Intraday Bias Suggestion: If AAPL can't reclaim 212.5–213 on bounce, the market may pull toward the HVL zone (205–202.5). However, if we get a reclaim of 213.5 with volume, the trendline flip becomes bullish again — target 215–216.

Summary Recommendations

* For Options Traders:

* Favor PUT debit spreads or single directional PUTs if price stays below 212.5.

* Avoid naked CALLs until a break above 213.5 confirms strength.

* IV is low — good time to buy premium, not sell it.

* For Stock Traders (Intraday or Swing):

* Consider shorting pops into 213 with stop above 215.

* Look for long entries near 202.5–200 with tight stops if structure holds.

This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage risk carefully.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.