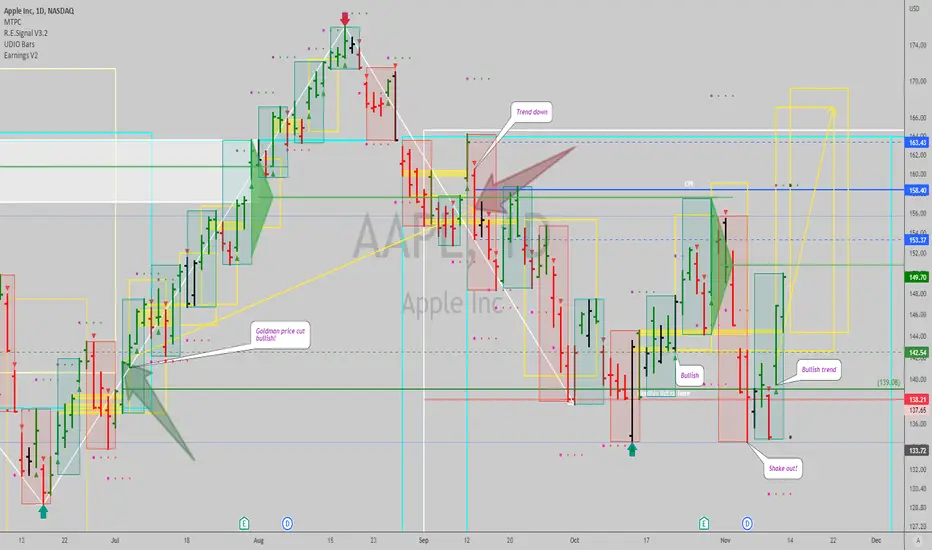

Despite the strength observed after CPI data came out, a lot of people are on the sidelines or still shorting or quoting the similarity to 2008 moves, etc.

Hopefully this is a positive signal from sentiment...

For now, data suggests we should be long and try to manage risk carefully until we have more clarity that we are out of the woods when it comes to downside risk. I'm personally not a fan of

Best of luck!

Ivan Labrie.

Trade closed manually

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.