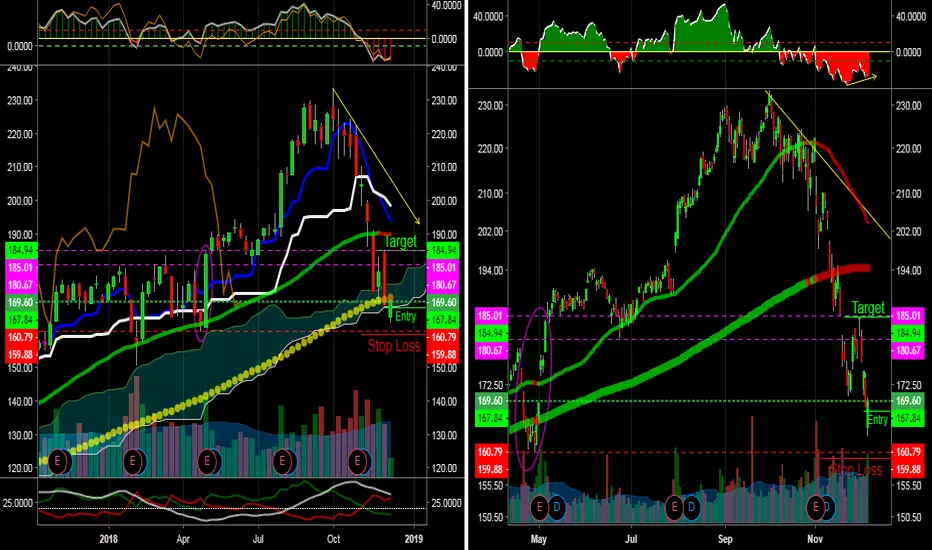

A daily close or gap below the lows from May likely induces some selling, at least intra-day, so if you don't want to own AAPL long-term, a stop loss below 160 may work, but realize that the path higher could include a test below and close above the weekly 100 sma /Ichimoku cloud. Note the orange weekly Chinkou Span/ lagging line on the ichimoku system appears to be bouncing off the weekly 50 sma.. Potentially bullish confirmation that this line will act as support in the near future once again. So starting a position anywhere between 150-180 in longer-term accounts seems like a reasonable plan.

If I already owned AAPL, I'd still consider adding anywhere in the 160's. If we do see the market hold and we don't get a weekly close below Mondays daily close at 169.60, it's possible it is never tested again. The monthly chart suggests we either hold around here or could be headed for 135-140. This also means a failed attempt to squeeze higher and a weekly close below in the next few days could set up a very nice short-sided trade.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.