🍎 AAPL Breaking Structure! Gamma Says Caution — Is $195 Next? 🔻

🧬 GEX Options Sentiment Analysis:

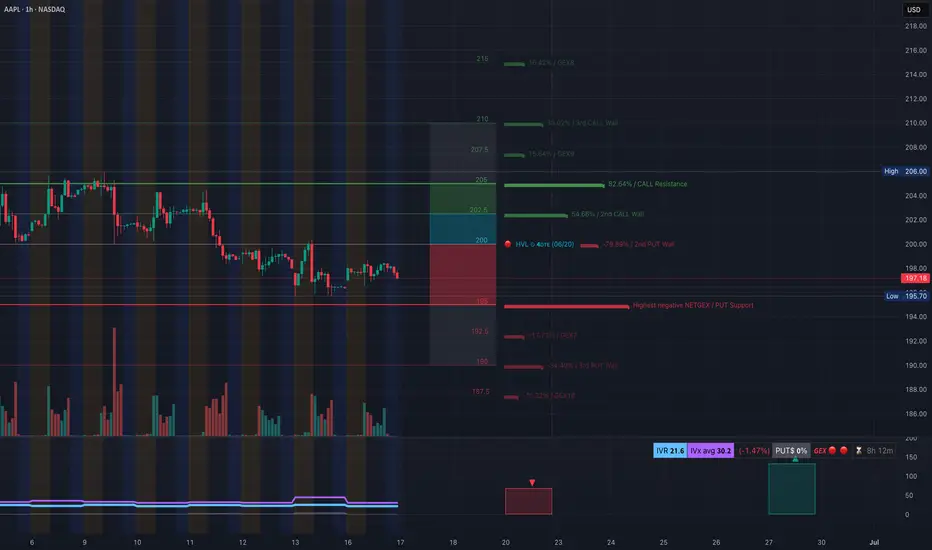

* Gamma Key Levels:

* CALL Walls:

* $202.50 (moderate resistance)

* $205 = Gamma Wall / Call Resistance

* $210–215 = Higher walls unlikely to reach short-term without catalyst

* PUT Walls:

* $198 = 2nd PUT Wall and Heavy Volume Level (HVL)

* $195.70 = Highest negative NET GEX / PUT magnet

* Below $195 opens risk to $192.50, $190 (GEX7/10 cluster)

* Options Metrics:

* IVR: 21.6

* IVx avg: 30.2

* PUT Flow: 0% (!!) – no PUT buyers showing up (caution on reversals)

* GEX Sentiment: 🔴🔴🔴🔴 (very bearish tilt)

* Interpretation:

* AAPL is hugging the gamma flip zone at $198–$200. If it breaks and stays under $198, dealers may accelerate hedging, sending it down toward $195/$192.

* Call side is weak; momentum buyers missing.

🧠 15-Minute SMC Structure Breakdown:

* Current Price: $197.18

* Structure:

* CHoCH confirmed just below supply at $198.50 → bearish sign.

* Repeated rejections from the supply zone (pink box).

* Broke ascending wedge/trendline support on rising volume — bearish pattern confirmation.

* Demand box sits near $195.70–$196.50.

* Volume:

* Bearish volume increasing during rejection = potential for trend continuation lower.

⚔️ Trade Scenarios:

🟥 Bearish Breakdown Setup:

* Trigger: Confirmed close below $196.50 with increasing volume.

* Target 1: $195.70 (GEX/SMC demand)

* Target 2: $192.50 (GEX7 magnet)

* Stop-loss: $198.50

Strong confluence with gamma, SMC structure, and volume break = high-probability short.

🟩 Bullish Reversal Setup (Low Probability):

* Trigger: Reclaim of $198.89 with conviction

* Target 1: $200

* Target 2: $202.50 (CALL wall)

* Stop-loss: Below $196.45

Only consider if SPY/QQQ stage reversal bounce and AAPL leads.

💡 My Thoughts:

* AAPL looks weak and vulnerable heading into Tuesday.

* If price loses $196.45, gamma + structure suggests fast flush to $195 and possibly $192.

* This is not the spot to go long blindly — let the level reclaim first.

* PUT flow being 0% despite this setup suggests retail hasn't stepped in — this could change rapidly.

🔚 Conclusion:

AAPL is breaking down from structure and trending toward gamma PUT support. Options sentiment and Smart Money structure are both aligning for bearish continuation — short bounces are sell opportunities unless $199+ is reclaimed with strength.

Disclaimer: This is for educational purposes only. Always manage your risk and follow your plan.

Would you like to format this for a TradingView post next or combine all into one GEX/TA wrap-up?

🧬 GEX Options Sentiment Analysis:

* Gamma Key Levels:

* CALL Walls:

* $202.50 (moderate resistance)

* $205 = Gamma Wall / Call Resistance

* $210–215 = Higher walls unlikely to reach short-term without catalyst

* PUT Walls:

* $198 = 2nd PUT Wall and Heavy Volume Level (HVL)

* $195.70 = Highest negative NET GEX / PUT magnet

* Below $195 opens risk to $192.50, $190 (GEX7/10 cluster)

* Options Metrics:

* IVR: 21.6

* IVx avg: 30.2

* PUT Flow: 0% (!!) – no PUT buyers showing up (caution on reversals)

* GEX Sentiment: 🔴🔴🔴🔴 (very bearish tilt)

* Interpretation:

* AAPL is hugging the gamma flip zone at $198–$200. If it breaks and stays under $198, dealers may accelerate hedging, sending it down toward $195/$192.

* Call side is weak; momentum buyers missing.

🧠 15-Minute SMC Structure Breakdown:

* Current Price: $197.18

* Structure:

* CHoCH confirmed just below supply at $198.50 → bearish sign.

* Repeated rejections from the supply zone (pink box).

* Broke ascending wedge/trendline support on rising volume — bearish pattern confirmation.

* Demand box sits near $195.70–$196.50.

* Volume:

* Bearish volume increasing during rejection = potential for trend continuation lower.

⚔️ Trade Scenarios:

🟥 Bearish Breakdown Setup:

* Trigger: Confirmed close below $196.50 with increasing volume.

* Target 1: $195.70 (GEX/SMC demand)

* Target 2: $192.50 (GEX7 magnet)

* Stop-loss: $198.50

Strong confluence with gamma, SMC structure, and volume break = high-probability short.

🟩 Bullish Reversal Setup (Low Probability):

* Trigger: Reclaim of $198.89 with conviction

* Target 1: $200

* Target 2: $202.50 (CALL wall)

* Stop-loss: Below $196.45

Only consider if SPY/QQQ stage reversal bounce and AAPL leads.

💡 My Thoughts:

* AAPL looks weak and vulnerable heading into Tuesday.

* If price loses $196.45, gamma + structure suggests fast flush to $195 and possibly $192.

* This is not the spot to go long blindly — let the level reclaim first.

* PUT flow being 0% despite this setup suggests retail hasn't stepped in — this could change rapidly.

🔚 Conclusion:

AAPL is breaking down from structure and trending toward gamma PUT support. Options sentiment and Smart Money structure are both aligning for bearish continuation — short bounces are sell opportunities unless $199+ is reclaimed with strength.

Disclaimer: This is for educational purposes only. Always manage your risk and follow your plan.

Would you like to format this for a TradingView post next or combine all into one GEX/TA wrap-up?

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.