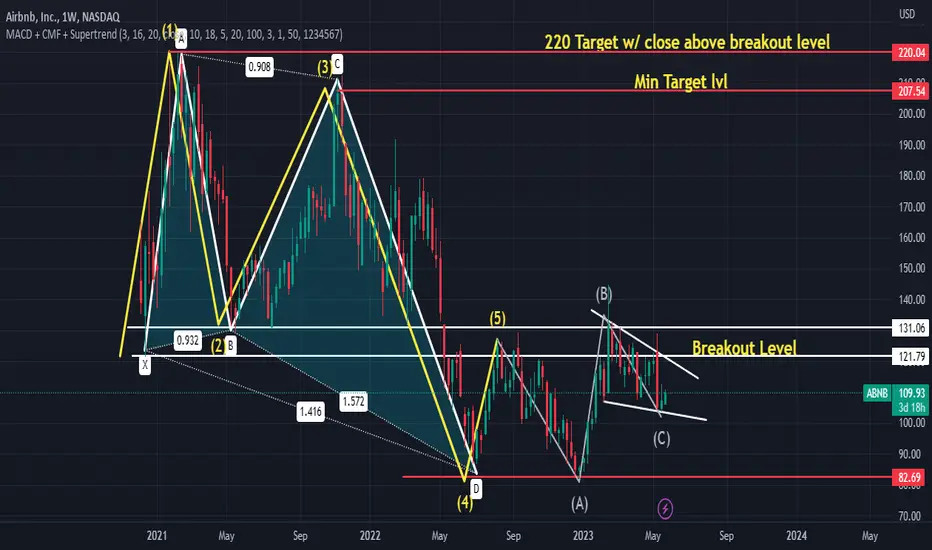

The AD is showing a bullish divergence on the Daily Chart, However on the weekly chart you'll notice a Bull Flag Set Up w/ a bullish Elliot Wave Count. Currently I have a C wave buy set up, but for less seasoned traders I highly recommend buying the confirm breakout.

Somethings to point out

1) you'll notice the 5th wave was rejected by the B leg of the bullish cypher pattern

2) B leg of the ABC pattern was also rejected by the B leg of the Bullish cypher pattern

3) Its important that these levels be flipped from resistances to support w/ a bullish close over both

4) I have 2 targets min. Target 207.50-$210 C leg retrace of the bullish cypher, and a Max $220 which is a X leg retrace of the bullish cypher pattern

Somethings to point out

1) you'll notice the 5th wave was rejected by the B leg of the bullish cypher pattern

2) B leg of the ABC pattern was also rejected by the B leg of the Bullish cypher pattern

3) Its important that these levels be flipped from resistances to support w/ a bullish close over both

4) I have 2 targets min. Target 207.50-$210 C leg retrace of the bullish cypher, and a Max $220 which is a X leg retrace of the bullish cypher pattern

Note

by the ADNote

I haven't touched the chart since May. Monitor price action during and after fomc.. A retrace to 131 (back to wave 2/b leg) sets up a bull flag pattern... We have a potential bearish abcd pattern set up... Protect profitsNote

when overlapped w/ price action on 30min, I get $131 adding puts hereTrade closed manually

cashed my putsDisclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.