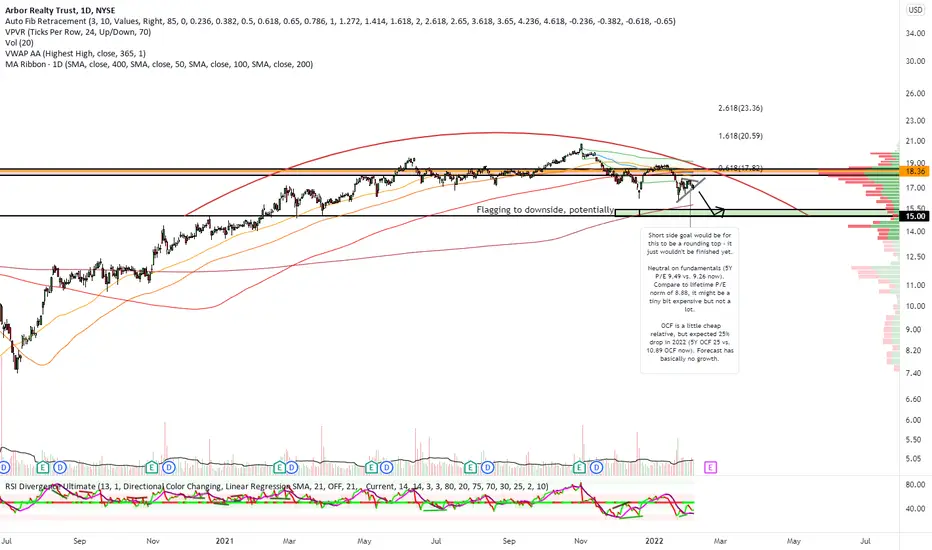

Short side goal would be for this to be a rounding top - it just wouldn't be finished yet.

Neutral on fundamentals (5Y P/E 9.49 vs. 9.26 now). Compare to lifetime P/E norm of 8.88, it might be a tiny bit expensive but not a lot.

OCF is a little cheap relative, but expected 25% drop in 2022 (5Y OCF 25 vs. 10.89 OCF now). Forecast has basically no growth.

Neutral on fundamentals (5Y P/E 9.49 vs. 9.26 now). Compare to lifetime P/E norm of 8.88, it might be a tiny bit expensive but not a lot.

OCF is a little cheap relative, but expected 25% drop in 2022 (5Y OCF 25 vs. 10.89 OCF now). Forecast has basically no growth.

Note

Longer term PT $10.20 based on P/FFO declineDisclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.