🏥 Abbott Labs (ABT) Trade Alert

Positioning in this healthcare giant as it breaks out from consolidation - here's the strategic play:

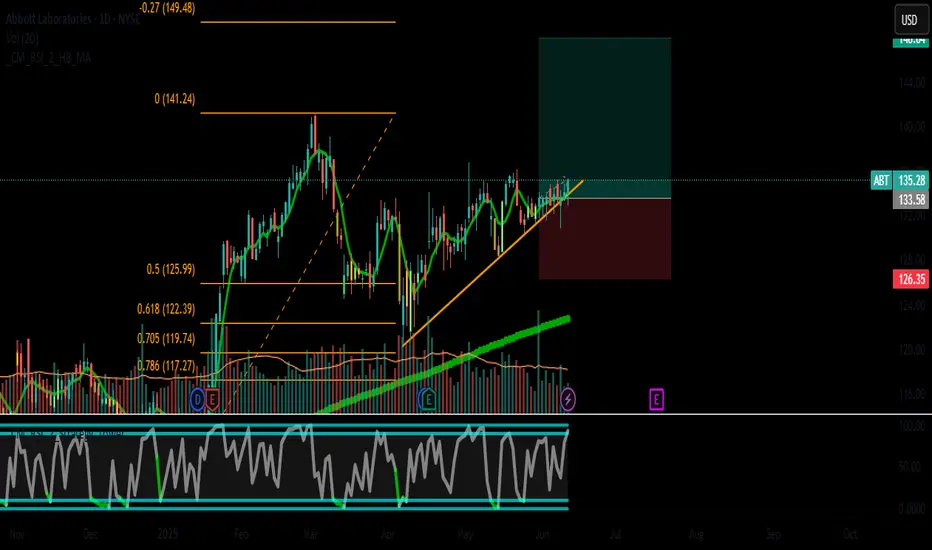

📌 Trade Levels

▶ Entry: $133.12 (confirmed above SMA 50)

🎯 Target: $147.21 (+10.6%)

🛑 Stop Loss: $126.00 (-5.3% risk)

⚖️ Risk/Reward: 1:2

Why ABT Now?

✅ Fundamental Strength:

Net Income Growth: "Strong growth" (+134% YoY in last report)

Dividend Aristocrat: 50+ years of dividend growth (current yield 1.9%)

Debt Health: Score 10/10 (Debt/Equity 0.26, Interest Coverage 15x)

✅ Technical Triggers:

Bullish crossover (50D > 200D MA)

RSI 55 - neutral with room to run

Volume surge on $132 breakout

Measured move target aligns with $147 zone

📊 Trade Management:

Entry: $133.12 (market price)

Scale In: Add at $130 if tested

Adjust Stop: Move to breakeven at $136

Partial Profit: Take 50% at $140

⚠️ Key Risks:

Sector rotation out of healthcare

FDA delays on new devices

Strong resistance at $138 (prior highs)

ABT dominates 4 growth segments:

Medical Devices (44% revenue)

Diagnostics (32%)

Nutrition (12%)

Generics (12%)

Recent FDA approval for Freestyle Libre 3 drives upside.

Trade active until next earnings (Oct 18). Let me know your take! 👇

#HealthcareStocks #DividendInvesting #BreakoutTrade

Positioning in this healthcare giant as it breaks out from consolidation - here's the strategic play:

📌 Trade Levels

▶ Entry: $133.12 (confirmed above SMA 50)

🎯 Target: $147.21 (+10.6%)

🛑 Stop Loss: $126.00 (-5.3% risk)

⚖️ Risk/Reward: 1:2

Why ABT Now?

✅ Fundamental Strength:

Net Income Growth: "Strong growth" (+134% YoY in last report)

Dividend Aristocrat: 50+ years of dividend growth (current yield 1.9%)

Debt Health: Score 10/10 (Debt/Equity 0.26, Interest Coverage 15x)

✅ Technical Triggers:

Bullish crossover (50D > 200D MA)

RSI 55 - neutral with room to run

Volume surge on $132 breakout

Measured move target aligns with $147 zone

📊 Trade Management:

Entry: $133.12 (market price)

Scale In: Add at $130 if tested

Adjust Stop: Move to breakeven at $136

Partial Profit: Take 50% at $140

⚠️ Key Risks:

Sector rotation out of healthcare

FDA delays on new devices

Strong resistance at $138 (prior highs)

ABT dominates 4 growth segments:

Medical Devices (44% revenue)

Diagnostics (32%)

Nutrition (12%)

Generics (12%)

Recent FDA approval for Freestyle Libre 3 drives upside.

Trade active until next earnings (Oct 18). Let me know your take! 👇

#HealthcareStocks #DividendInvesting #BreakoutTrade

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.