5.13.21 2017H +8 PACIFIC

MY PRACTICE MINIMALIST ANALYSIS

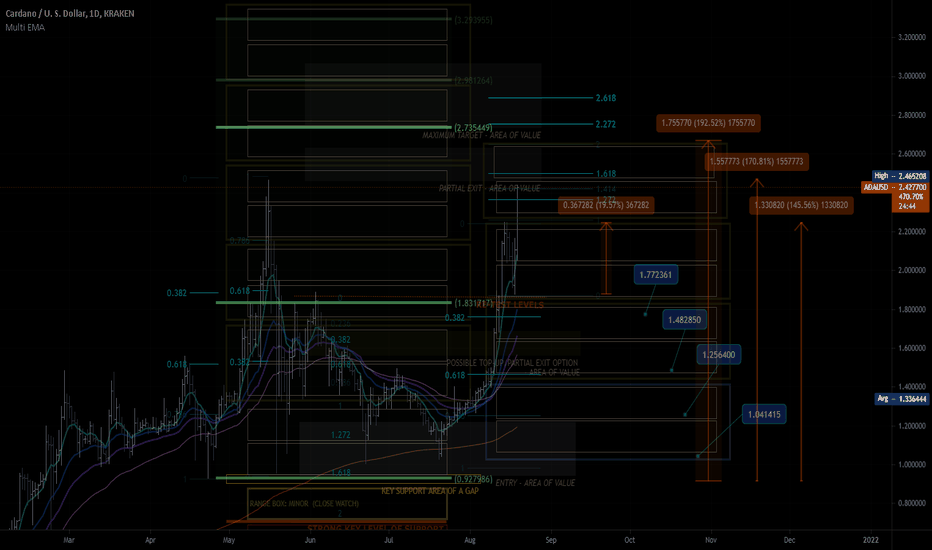

ENTRY AND EXIT POINTS FOR A SWING TRADE

USING RANGE BOXES AND FIBS (NO INDICATORS)

STILL ON TARGET

THE MARKET IS STILL EXPANDING

AFTER A CORRECTION at THE 0.382 FIB LEVEL.

VERY BULLISH ON THIS.

Note

Looking at the daily chart, Yes the Possibility of retracing to the 0.382 and lower retracement levels. very minor correction, it will proceed strong towards the 3rd target zone. This is just an impromptu analysis no structure being formed on the left yet. I will review it later but here is the updated chart upon reading your query.Note

The possible top-up zone is after a correctionTrade active

SORRY DELAYED POSTINGS, Had entered when It fell back to ENTRY AREA OF VALUE. HOPE MY CHART ANALYSIS WAS A GOOD GUIDE, even if I was not able to post.Note

It is failing to make a new high. must correct at 618 so it will have the strength to go beyond retest level.A measured move most likely to take place at around $1.7 (Double Bottom)

Trade closed: target reached

I will wait for retracement at 30% to 70% for the next entry depending on the next price action.

This was a good and well less than 30days trade.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.