*** ***

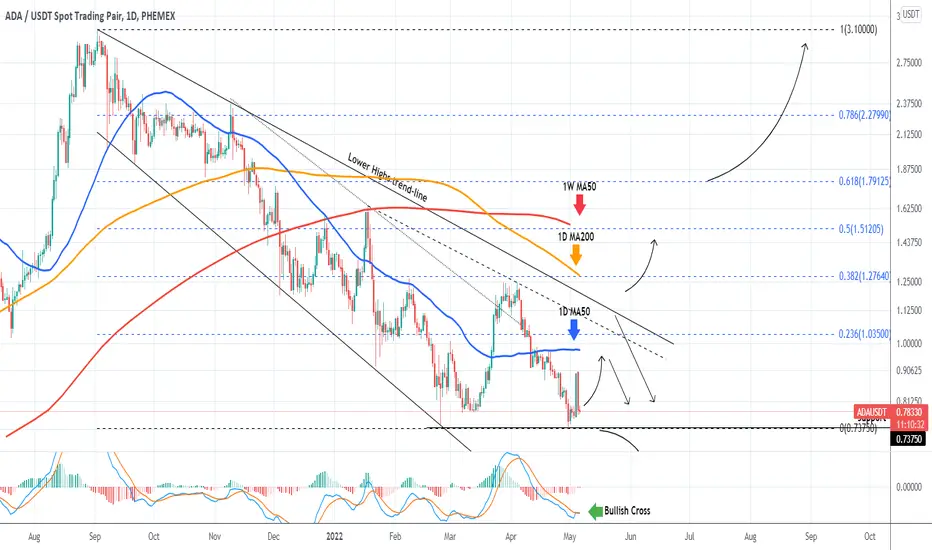

For this particular analysis on CARDANO we are using the ADAUSDT symbol on the Phemex exchange.

*** ***

The idea is on the 1D time-frame with the 1D MA50 (blue trend-line), 1D MA200 (orange trend-line) and the 1W MA50 (red trend-line) displayed as key periods of the analysis. Cardano has rebounded on the 0.73750 Support last week, but yesterday suffered a strong sell-off along with the majority of the market. This came a day after the Fed rate hike of 0.50% (strongest since 2020) and the U.S. Initial Jobless Claims report.

Technically though, as long as the Support remains intact, there are more probabilities to build a base here and test the next two Resistance levels in line, the 1D MA50 and the Lower Highs trend-lines (both dashed and solid). However the short-term is limited to the Lower Highs trend-line so watch out for a rejection there. The long-term bearish sentiment may only be invalidated if the price breaks and closes a 1D candle not just above the Lower Highs trend-line but also the 1D MA200, which is keeping the price action below since November 21 2021.

The 1W MA50, which is usually the support on week-to-week rallies, has had already two clear rejections (December 27, January 18), so count this in as a Resistance. The natural targets after the 1D MA200 breaks though should be the Fibonacci retracement levels of 0.5 (around 1.51200), 0.618 (1.79125) and 0.786 (2.27990). Note that the 1D LMACD is on a Bullish Cross, which favors the upside, at least on the short-term. A 1D candle close below the 0.73750 Support though, may accumulate sellers into aggressive selling towards the -0.236 Fibonacci extension at 0.52550.

--------------------------------------------------------------------------------------------------------

** Please support this idea with your likes and comments, it is the best way to keep it relevant and support me. **

--------------------------------------------------------------------------------------------------------

For this particular analysis on CARDANO we are using the ADAUSDT symbol on the Phemex exchange.

*** ***

The idea is on the 1D time-frame with the 1D MA50 (blue trend-line), 1D MA200 (orange trend-line) and the 1W MA50 (red trend-line) displayed as key periods of the analysis. Cardano has rebounded on the 0.73750 Support last week, but yesterday suffered a strong sell-off along with the majority of the market. This came a day after the Fed rate hike of 0.50% (strongest since 2020) and the U.S. Initial Jobless Claims report.

Technically though, as long as the Support remains intact, there are more probabilities to build a base here and test the next two Resistance levels in line, the 1D MA50 and the Lower Highs trend-lines (both dashed and solid). However the short-term is limited to the Lower Highs trend-line so watch out for a rejection there. The long-term bearish sentiment may only be invalidated if the price breaks and closes a 1D candle not just above the Lower Highs trend-line but also the 1D MA200, which is keeping the price action below since November 21 2021.

The 1W MA50, which is usually the support on week-to-week rallies, has had already two clear rejections (December 27, January 18), so count this in as a Resistance. The natural targets after the 1D MA200 breaks though should be the Fibonacci retracement levels of 0.5 (around 1.51200), 0.618 (1.79125) and 0.786 (2.27990). Note that the 1D LMACD is on a Bullish Cross, which favors the upside, at least on the short-term. A 1D candle close below the 0.73750 Support though, may accumulate sellers into aggressive selling towards the -0.236 Fibonacci extension at 0.52550.

--------------------------------------------------------------------------------------------------------

** Please support this idea with your likes and comments, it is the best way to keep it relevant and support me. **

--------------------------------------------------------------------------------------------------------

👑Best Signals (Forex/Crypto+70% accuracy) & Account Management (+20% profit/month on 10k accounts)

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

👑Best Signals (Forex/Crypto+70% accuracy) & Account Management (+20% profit/month on 10k accounts)

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.