Adobe is a wonderful company with a great array of products and services. The company has been gaining traction with its cloud offerings allowing for the conversion of enterprise customers to Enterprise Term License Agreements (ETLAs), resulting in higher Creative Cloud adoption.

However, with great power comes great responsibility, and Adobe's expenses have been on the move with its foray into AI and Virtual Reality.

A pullback on behalf of higher expenses and guidance becoming slightly more conservative over the longer run is warranted.

I believe the stock's price is not currently pricing in the company's competition and expenses.

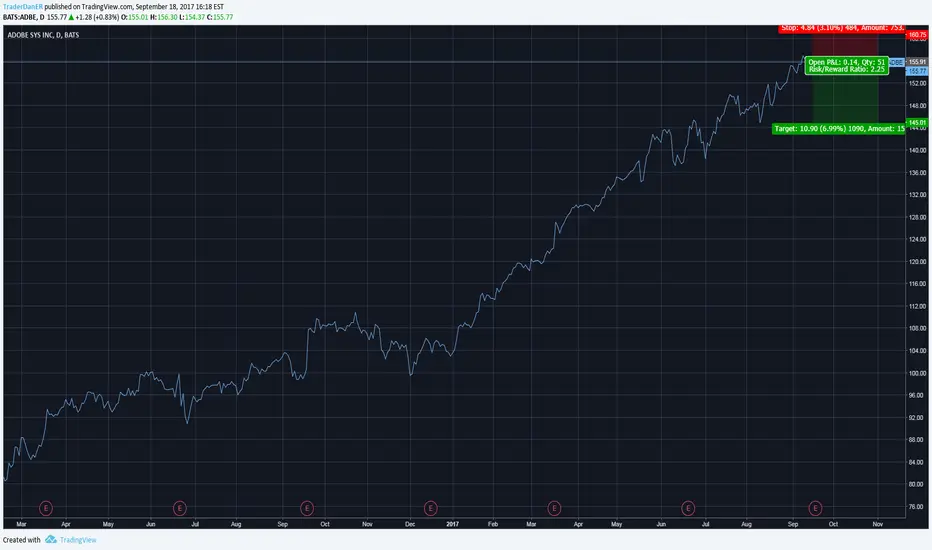

A short term sell with a $145 to $140 PT for the next 2-3 months.

However, with great power comes great responsibility, and Adobe's expenses have been on the move with its foray into AI and Virtual Reality.

A pullback on behalf of higher expenses and guidance becoming slightly more conservative over the longer run is warranted.

I believe the stock's price is not currently pricing in the company's competition and expenses.

A short term sell with a $145 to $140 PT for the next 2-3 months.

Note

Adobe reports EPS of $1.10 on Revenue of $1.84B, beating expectations but guiding for less then expected Cloud sales growth. Share are down 3.32% in After Hours.Trade closed: target reached

$145 target reached. Closed.Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.