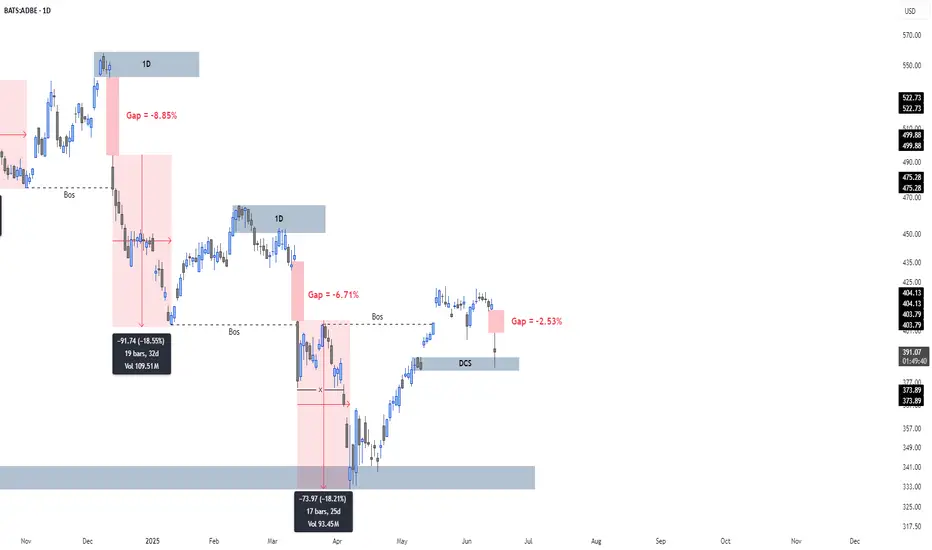

ADBE has printed a surprisingly consistent technical pattern since 2023:

A rejection from supply, followed by a gap-down, then a gradual but deep decline.

We may now be witnessing the early stage of a fourth repeat.

📘 Historical Pattern

Zone 1: ~$575

• Gap: –5.71%

• Drop after gap: –12.11%

• Duration: 49 days

Zone 2: ~$551

• Gap: –8.85%

• Drop after gap: –18.55%

• Duration: 32 days

Zone 3: ~$458

• Gap: –6.71%

• Drop after gap: –18.21%

• Duration: 25 days

Zone 4: ~$425 (current)

• Gap: –2.53%

• Post-gap = in progress

🧠 All three prior moves began with a gap, followed by a small bounce, and then a larger sell-off.

Each of them dropped between –12% and –18% from the post-gap high.

🔍 Current Structure

• Price just rejected from ~$425 (1D supply)

• New gap-down of –2.53% has just occurred

• Currently sitting on critical DCS support zone: $382–$388

This is a high-stakes inflection area. A close below this support could trigger the next leg lower.

⚙️ Options Setup (Bearish Thesis)

💡 Trade Idea: Bear Put Spread (400 / 350, Jul 18 expiry)

• Defined risk with a 2.2:1 reward/risk ratio

• Breakeven ≈ $384

• Thesis becomes actionable if price breaks below the $382 DCS support

• Invalidation: strong reclaim of ~$425 supply

This setup targets a continuation of Adobe’s repeating structure.

It limits downside exposure while offering meaningful reward if breakdown confirms.

🙌 Found this helpful?

If this idea gave you value — a like 👍 or comment 💬 goes a long way!

Follow me for more structured trade setups based on price action + context.

Let’s grow with clarity, not noise. 📊💡

A rejection from supply, followed by a gap-down, then a gradual but deep decline.

We may now be witnessing the early stage of a fourth repeat.

📘 Historical Pattern

Zone 1: ~$575

• Gap: –5.71%

• Drop after gap: –12.11%

• Duration: 49 days

Zone 2: ~$551

• Gap: –8.85%

• Drop after gap: –18.55%

• Duration: 32 days

Zone 3: ~$458

• Gap: –6.71%

• Drop after gap: –18.21%

• Duration: 25 days

Zone 4: ~$425 (current)

• Gap: –2.53%

• Post-gap = in progress

🧠 All three prior moves began with a gap, followed by a small bounce, and then a larger sell-off.

Each of them dropped between –12% and –18% from the post-gap high.

🔍 Current Structure

• Price just rejected from ~$425 (1D supply)

• New gap-down of –2.53% has just occurred

• Currently sitting on critical DCS support zone: $382–$388

This is a high-stakes inflection area. A close below this support could trigger the next leg lower.

⚙️ Options Setup (Bearish Thesis)

💡 Trade Idea: Bear Put Spread (400 / 350, Jul 18 expiry)

• Defined risk with a 2.2:1 reward/risk ratio

• Breakeven ≈ $384

• Thesis becomes actionable if price breaks below the $382 DCS support

• Invalidation: strong reclaim of ~$425 supply

This setup targets a continuation of Adobe’s repeating structure.

It limits downside exposure while offering meaningful reward if breakdown confirms.

🙌 Found this helpful?

If this idea gave you value — a like 👍 or comment 💬 goes a long way!

Follow me for more structured trade setups based on price action + context.

Let’s grow with clarity, not noise. 📊💡

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.