AERO: Coming in to Refuel… or Crash Land!?

📅 Date: May 23, 2025

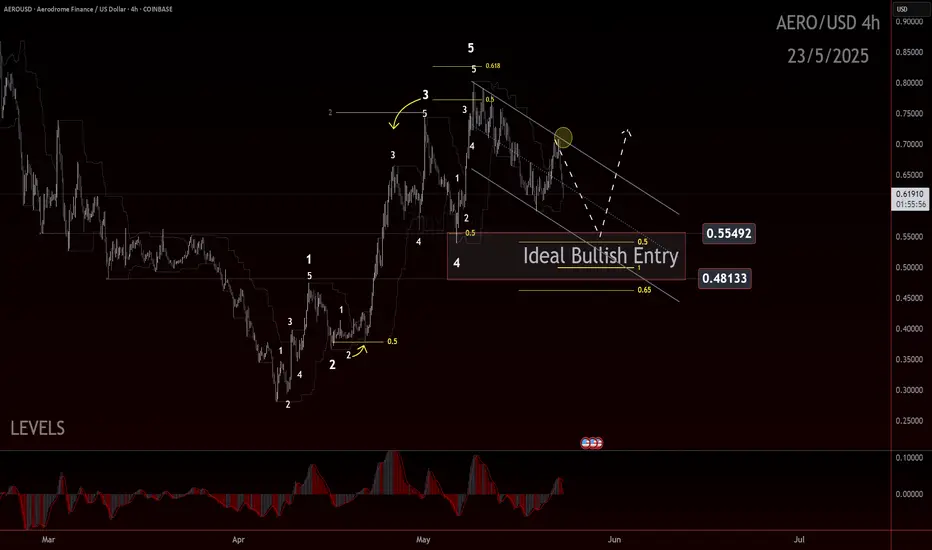

🧠 Framework: Elliott Wave with Fibonacci structure

🔍 Context: 4H timeframe

🔁 Recap of the Move

AERO rallied off the 0.3465–0.3475 double bottom in what appears to be a clean 5-wave impulsive sequence. The price action respected both structural and Fibonacci guidelines:

Wave 2 and Wave 4 both pulled back to 0.5 retracements.

Wave 3 extended and subdivided with strong momentum, a common characteristic

Wave 5 completed between 0.5 and 0.618 of Wave 3 from the Wave 4 low — a textbook termination zone

Subdivisions within Wave 5 were also visible, including a smaller internal Wave 3 and 5, reinforcing the case for a completed motive wave.

⚠️ Current Price Behavior

Post-impulse, the market is showing signs of correction. This pullback could mark the beginning of a deeper retracement, or it may be the early stages of a new larger-degree impulse if the uptrend continues.

📏 Levels to Watch

Retracement zone: 0.54–0.49 (50–61.8% of the full move)

Upside resumption: Requires a strong bounce from the retrace zone and break of the Wave 5 high

🔮 Outlook

Two scenarios remain on the table:

Bullish: This is a Wave 2 retracement in a larger degree move. If support holds, a strong Wave 3 may follow.

Bearish/Neutral: The 5-wave or 3-wave structure is fully complete, and a deeper correction could be in play.

Confirmation will come through structure, not assumption. Keep watching how price behaves around the key retrace levels.

📣 Trade safe, trade clarity. More updates coming as structure evolves.

📅 Date: May 23, 2025

🧠 Framework: Elliott Wave with Fibonacci structure

🔍 Context: 4H timeframe

🔁 Recap of the Move

AERO rallied off the 0.3465–0.3475 double bottom in what appears to be a clean 5-wave impulsive sequence. The price action respected both structural and Fibonacci guidelines:

Wave 2 and Wave 4 both pulled back to 0.5 retracements.

Wave 3 extended and subdivided with strong momentum, a common characteristic

Wave 5 completed between 0.5 and 0.618 of Wave 3 from the Wave 4 low — a textbook termination zone

Subdivisions within Wave 5 were also visible, including a smaller internal Wave 3 and 5, reinforcing the case for a completed motive wave.

⚠️ Current Price Behavior

Post-impulse, the market is showing signs of correction. This pullback could mark the beginning of a deeper retracement, or it may be the early stages of a new larger-degree impulse if the uptrend continues.

📏 Levels to Watch

Retracement zone: 0.54–0.49 (50–61.8% of the full move)

Upside resumption: Requires a strong bounce from the retrace zone and break of the Wave 5 high

🔮 Outlook

Two scenarios remain on the table:

Bullish: This is a Wave 2 retracement in a larger degree move. If support holds, a strong Wave 3 may follow.

Bearish/Neutral: The 5-wave or 3-wave structure is fully complete, and a deeper correction could be in play.

Confirmation will come through structure, not assumption. Keep watching how price behaves around the key retrace levels.

📣 Trade safe, trade clarity. More updates coming as structure evolves.

More on the TradeDevils Discord discord.gg/p9bjnpwnMc

Trade Devils University Sensei: tradedevils.com/my-account/?ref=ebquu4

Certified Elliott Wave Analyst Master: t.co/2GQ7uSjJVG?amp=1

Trade Devils University Sensei: tradedevils.com/my-account/?ref=ebquu4

Certified Elliott Wave Analyst Master: t.co/2GQ7uSjJVG?amp=1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

More on the TradeDevils Discord discord.gg/p9bjnpwnMc

Trade Devils University Sensei: tradedevils.com/my-account/?ref=ebquu4

Certified Elliott Wave Analyst Master: t.co/2GQ7uSjJVG?amp=1

Trade Devils University Sensei: tradedevils.com/my-account/?ref=ebquu4

Certified Elliott Wave Analyst Master: t.co/2GQ7uSjJVG?amp=1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.