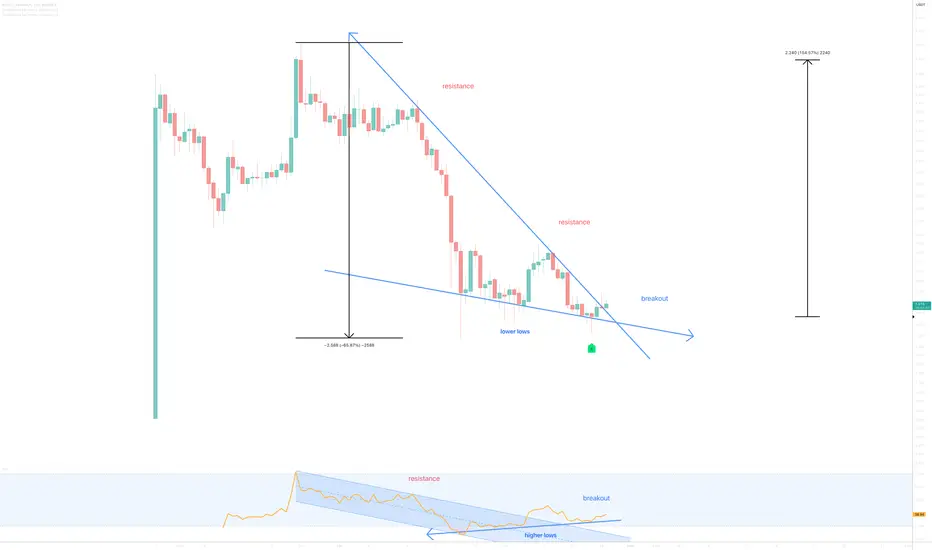

On the above 12hr chart price action has corrected 65% since late March. A number of reasons now exist to be long, including:

1) Price action and RSI resistance breakouts.

2) Bullish divergence. Eight oscillators print positive divergence with price action.

3) Everything that was said above is also true for the AEVO.BTC pair (see below).

Is it possible price action can correct further after a 65% correction? Sure, sellers are like that.

Is it probable? No

Ww

Type: Trade

Risk: <= 6%

Timeframe for long: now

Return: 150% for starters

AEVO - BTC pair

1) Price action and RSI resistance breakouts.

2) Bullish divergence. Eight oscillators print positive divergence with price action.

3) Everything that was said above is also true for the AEVO.BTC pair (see below).

Is it possible price action can correct further after a 65% correction? Sure, sellers are like that.

Is it probable? No

Ww

Type: Trade

Risk: <= 6%

Timeframe for long: now

Return: 150% for starters

AEVO - BTC pair

Note

AEVO devs...youtube.com/watch?v=KHEZCXfyxjU

"On May 15, 827.6 million AEVO tokens ($1.24 billion) will be dropped into the market. Then, 6.13 million AEVO tokens ($9.20 million) will be drip fed into the market each day for the next nine days.

In this case, the majority of tokens will be going to the DAO Treasury followed by the team and “initial private sale investors”. After this, there are no more scheduled token unlocks."

Source: decrypt.co/228564/3-billion-token-unlocks-may-2024

Trade active

NowTrade closed: stop reached

The announcement of token dilution (whether impactful or not) is obviously having a negative impact on price action. Until that changes the idea is closed.Note

" Binance will add it to monitoring because the team unlocked 300 million tokens".It is amazing so many rug pulls and Ponzi schemes find there way to centralised exchanges.

BTC

bc1q2eckdzh0q8vsd7swcc8et6ze7s99khhxyl7zwy

Weblink: patreon.com/withoutworries

Allow 3-6 months on ideas. Not investment advice. DYOR

bc1q2eckdzh0q8vsd7swcc8et6ze7s99khhxyl7zwy

Weblink: patreon.com/withoutworries

Allow 3-6 months on ideas. Not investment advice. DYOR

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

BTC

bc1q2eckdzh0q8vsd7swcc8et6ze7s99khhxyl7zwy

Weblink: patreon.com/withoutworries

Allow 3-6 months on ideas. Not investment advice. DYOR

bc1q2eckdzh0q8vsd7swcc8et6ze7s99khhxyl7zwy

Weblink: patreon.com/withoutworries

Allow 3-6 months on ideas. Not investment advice. DYOR

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.