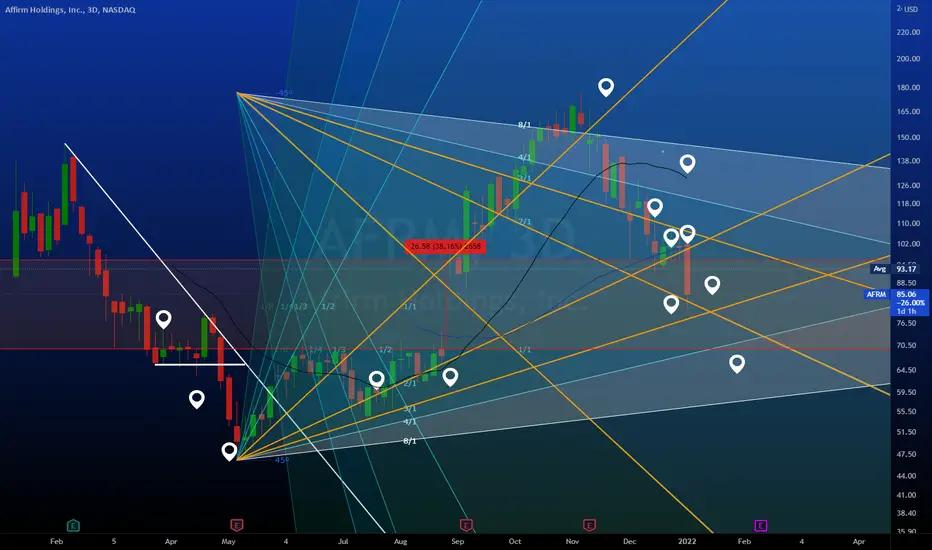

AFRM is currently Trading below its 50/20 MA and its 12/26 EMA

the 12 EMA just crossed under the 26

Note the gap fill attempt

Using the Gann, it looks like support can be assumed along the 3/1 upangle and the 2/1 upangle to act as resistance if AFRM is to turn around

By using the 3/1 upangle AFRM may attempt that turnaround.

Assume the 3/1 downangle as resistance for the next 4-6 weeks as well unless broken by the 3/1 upangle

In my opinion, AFRM is finding a bottom soon

If AFRM decides to fill the gap in the next few weeks, I would look to the 8/1 to be support and this would indicate more bearish price action. ( Lower Lows would be set).

Neutral now, will update as time progresses on this one.

I would suggest keeping an eye on the options chain as well, big rolling down of calls and some big BTO purchases came in today as well.

Ticker Side Stirke C/P Date Spread Spot Size Prem OI Volume

AFRM BUY 95 call 2022-02-18 $7.15 - $7.40 $7.65 15,200 $11.6M 381 16.1K Floor

AFRM BUY 105 call 2022-05-20 $7.60 - $8.20 $8.25 13,950 $11.5M 642 15K Floor

the 12 EMA just crossed under the 26

Note the gap fill attempt

Using the Gann, it looks like support can be assumed along the 3/1 upangle and the 2/1 upangle to act as resistance if AFRM is to turn around

By using the 3/1 upangle AFRM may attempt that turnaround.

Assume the 3/1 downangle as resistance for the next 4-6 weeks as well unless broken by the 3/1 upangle

In my opinion, AFRM is finding a bottom soon

If AFRM decides to fill the gap in the next few weeks, I would look to the 8/1 to be support and this would indicate more bearish price action. ( Lower Lows would be set).

Neutral now, will update as time progresses on this one.

I would suggest keeping an eye on the options chain as well, big rolling down of calls and some big BTO purchases came in today as well.

Ticker Side Stirke C/P Date Spread Spot Size Prem OI Volume

AFRM BUY 95 call 2022-02-18 $7.15 - $7.40 $7.65 15,200 $11.6M 381 16.1K Floor

AFRM BUY 105 call 2022-05-20 $7.60 - $8.20 $8.25 13,950 $11.5M 642 15K Floor

Note

I realized after posting I mark the wrong part of the candle on the beginning of the gap up at the end of August. I use the top of the candle when I should have used the bottom. Honest mistake! We all make them.Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.