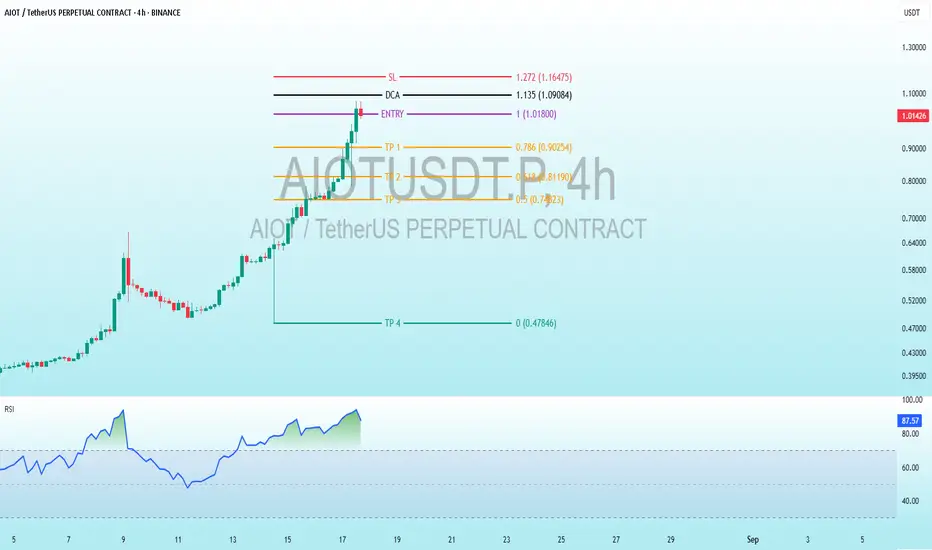

Entry: 1.00 (1.01800 USDT) - The level where the initial purchase is planned.

DCA (Dollar-Cost Averaging): 1.135 (1.09084 USDT) - An additional buying point if the price rises.

SL (Stop Loss): 1.272 (1.16475 USDT) - The level where the loss would be limited.

TP (Take Profit):TP1: 0.786 (0.90254 USDT)

TP2: 0.618 (0.81190 USDT)

TP3: 0.5 (0.74823 USDT)

TP4: 0 (0.47846 USDT) - A lower target, possibly a conservative goal or error.

RSI (Relative Strength Index) Indicator:

The current RSI value is 88.30, which is deeply in the overbought territory (above 70 and nearing 90). This suggests the price may be overextended, indicating a potential reversal or correction soon.

Analysis and Interpretation:

Strategy: The chart uses Fibonacci levels to determine entry, exit, and loss points. The entry is set at 1.01800 USDT, with a DCA at 1.09084 USDT if the price continues to rise, and a stop loss at 1.16475 USDT to protect capital.

Profit Targets: TP1 to TP3 are based on Fibonacci retracement levels (0.786, 0.618, 0.5), indicating a technical approach to taking profits incrementally. TP4 at 0.4786 USDT seems significantly lower and might be a mistake or a long-term target.

RSI: The extremely high RSI value (88.30) signals a strong overbought condition. This could imply an imminent pullback or consolidation, especially if the price fails to sustain its recent upward momentum.

Recommendation:

Monitor the price closely around the entry level (1.01800 USDT) and DCA (1.09084 USDT). Given the overbought RSI, exercise caution with new entries or consider preparing for a potential sell-off.

✅MY Free Signals Telegram

t.me/AltcoinPiooners

✅Personal Telegram (Premium)

t.me/Altcoin_Piooners

✅YouTube

youtube.com/@AltcoinPiooners

t.me/AltcoinPiooners

✅Personal Telegram (Premium)

t.me/Altcoin_Piooners

✅YouTube

youtube.com/@AltcoinPiooners

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

✅MY Free Signals Telegram

t.me/AltcoinPiooners

✅Personal Telegram (Premium)

t.me/Altcoin_Piooners

✅YouTube

youtube.com/@AltcoinPiooners

t.me/AltcoinPiooners

✅Personal Telegram (Premium)

t.me/Altcoin_Piooners

✅YouTube

youtube.com/@AltcoinPiooners

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.