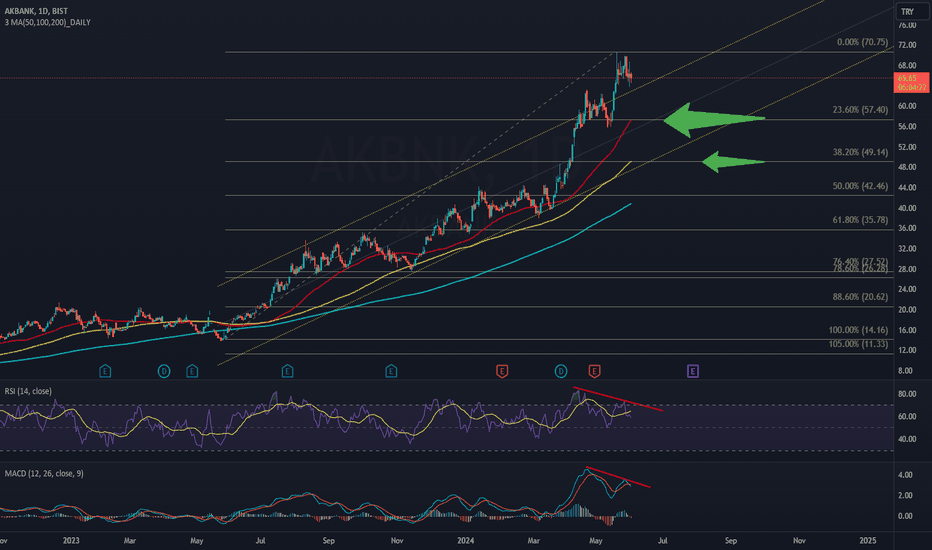

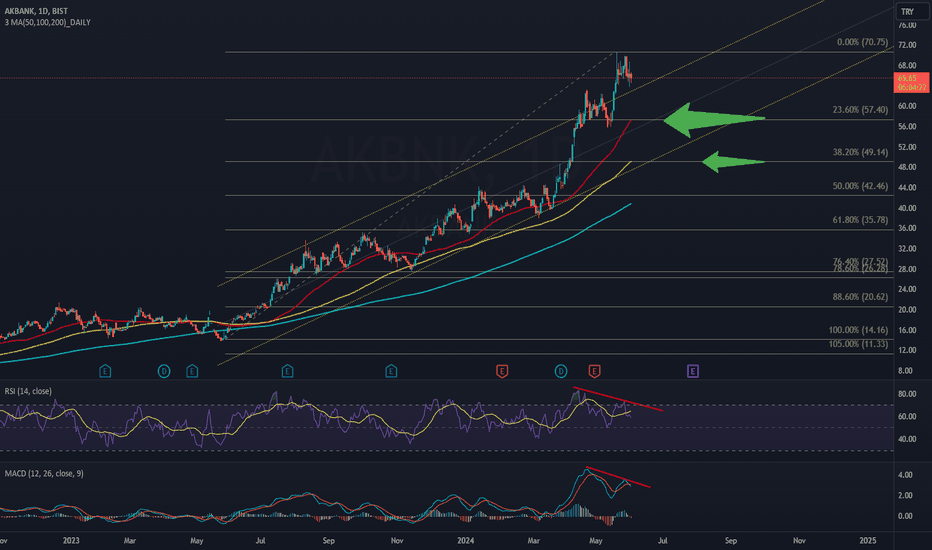

My previous post related to AKBNK was on 3rd of June, 2024 for the maked IV th wave correction.

17th of March, V wave completed and a correction phase has started, we are now heading to marked area to complete the last wave of the correction. Later on we will understand whether this is a simple or a complex correction.

17th of March, V wave completed and a correction phase has started, we are now heading to marked area to complete the last wave of the correction. Later on we will understand whether this is a simple or a complex correction.

Trade active

The main idea was that, following a completed impulsive wave supported by weekly RSI and MACD divergences, an ABC correction would take place. Initially, I expected this correction to be an irregular one, anticipating a reversal around the grey line area. Despite observing that major market players had been accumulating this stock over the past days, I interpreted this as preparation for a final corrective move rather than the beginning of a new trend. I still believe this scenario will hold.The most recent price action has shown that the correction will not be an irregular one. In this case, the weekly and daily outlooks of the scenario are as follows. We will monitor to see whether this scenario plays out or not.

Weekly chart

Daily chart

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.