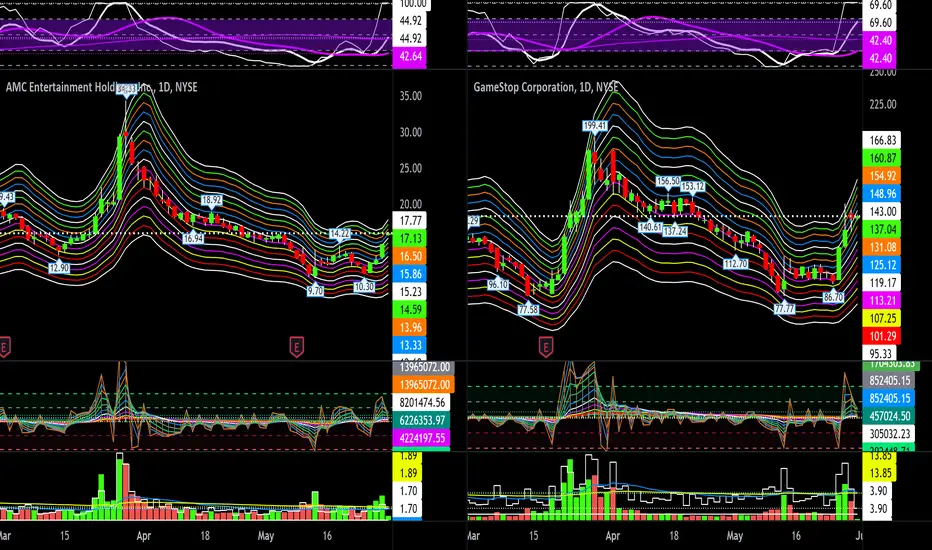

AMC & GME split frame 1 day charts with MTTC2.0 beta, pi RSI, Fibonacci VIP, ATRxxlBeta, Fibonacci MA7, Volume & PivotsHL indicator levels:

Do your own due diligence, your risk is 100% your responsibility. This is for educational and entertainment purposes only. You win some or you learn some. Consider being charitable with some of your profit to help humankind. Good luck and happy trading friends...

*3x lucky 7s of trading*

7pt Trading compass:

Price action, entry/exit

Volume average/direction

Trend, patterns, momentum

Newsworthy current events

Revenue

Earnings

Balance sheet

7 Common mistakes:

+5% portfolio trades, capital risk management

Beware of analyst's motives

Emotions & Opinions

FOMO : bad timing, the market is ruthless, be shrewd

Lack of planning & discipline

Forgetting restraint

Obdurate repetitive errors, no adaptation

7 Important tools:

Trading View app!, Brokerage UI

Accurate indicators & settings

Wide screen monitor/s

Trading log (pencil & graph paper)

Big, organized desk

Reading books, playing chess

Sorted watch-list

Checkout my indicators:

Fibonacci VIP - volume

Fibonacci MA7 - price

pi RSI - trend momentum

TTC - trend channel

AlertiT - notification

tickerTracker - MFI Oscillator

tradingview.com/u/growerik/

Do your own due diligence, your risk is 100% your responsibility. This is for educational and entertainment purposes only. You win some or you learn some. Consider being charitable with some of your profit to help humankind. Good luck and happy trading friends...

*3x lucky 7s of trading*

7pt Trading compass:

Price action, entry/exit

Volume average/direction

Trend, patterns, momentum

Newsworthy current events

Revenue

Earnings

Balance sheet

7 Common mistakes:

+5% portfolio trades, capital risk management

Beware of analyst's motives

Emotions & Opinions

FOMO : bad timing, the market is ruthless, be shrewd

Lack of planning & discipline

Forgetting restraint

Obdurate repetitive errors, no adaptation

7 Important tools:

Trading View app!, Brokerage UI

Accurate indicators & settings

Wide screen monitor/s

Trading log (pencil & graph paper)

Big, organized desk

Reading books, playing chess

Sorted watch-list

Checkout my indicators:

Fibonacci VIP - volume

Fibonacci MA7 - price

pi RSI - trend momentum

TTC - trend channel

AlertiT - notification

tickerTracker - MFI Oscillator

tradingview.com/u/growerik/

Note

AMC intraday volume speaks volumes 🤣Note

GME earnings tomorrow Wednesday 6/1 @ 4:05pmNote

AMC 6/3 expiry options data:Put Volume Total 40,310

Call Volume Total 95,400

Put/Call Volume Ratio 0.42

Put Open Interest Total 90,944

Call Open Interest Total 190,502

Put/Call Open Interest Ratio 0.48

AMC 6/17 expiry options data:

Put Volume Total 18,740

Call Volume Total 23,287

Put/Call Volume Ratio 0.80

Put Open Interest Total 186,734

Call Open Interest Total 263,018

Put/Call Open Interest Ratio 0.71

AMC LEAPS 1/20/2023 expiry options data:

Put Volume Total 2,189

Call Volume Total 2,068

Put/Call Volume Ratio 1.06

Put Open Interest Total 171,108

Call Open Interest Total 212,524

Put/Call Open Interest Ratio 0.81

Note

*options use 100x leverage you could lose everything*There are many types of options trading strategies and positions, simple to sophisticated & hybrids. I group them into theta, delta or mix strategies and bull, bear or neutral positions. There's a buy side and sell side to every trade. If you check the open interest (OI), you can see how liquid it is. Check how wide the bid vs ask spread is.

Theta:

iron condor

iron fly

covered call

cash secured put

calendar spread

collar

Delta:

call

put

straddle

strangle

debit spread

credit spread

Bull:

call

put credit spread

call debit spread

cash secured put

Bear:

put

call credit spread

put debit spread

covered call

Neutral:

straddle

strangle

iron condor

iron fly

collar (often used for downside insurance)

calendar spread (short or long time)

Options important variables:

Strike = share price

itm, atm, otm = strike position

Expiry = Date of expiration

Value = H, L & Mark

Liquidity = bid vs ask spread

Direction = put or call

OI = open interest

V = volume

CP = chance of profit

IV = implied volatility

Delta = price

Theta = time

Vega = volatility

Gamma = momentum

Note

GME 6/3 expiry options data:Put Volume Total 16,104

Call Volume Total 29,255

Put/Call Volume Ratio 0.55

Put Open Interest Total 46,897

Call Open Interest Total 64,188

Put/Call Open Interest Ratio 0.73

GME 6/17 expiry options data:

Put Volume Total 3,109

Call Volume Total 4,505

Put/Call Volume Ratio 0.69

Put Open Interest Total 63,994

Call Open Interest Total 101,171

Put/Call Open Interest Ratio 0.63

GME LEAPS 1/20/2023 expiry options data:

Put Volume Total 1,269

Call Volume Total 482

Put/Call Volume Ratio 2.63

Put Open Interest Total 121,057

Call Open Interest Total 52,754

Put/Call Open Interest Ratio 2.29

Note

GME is up after earnings. InterestingNote

GME green again todayNote

looks like GME making a leg up todayTrade active

Got 100 shares of APE because it should equal 100 shares of AMC once APE options go live. Totally speculative only small position.Trading indicators:

tradingview.com/u/Options360/

tradingview.com/u/Options360/

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Trading indicators:

tradingview.com/u/Options360/

tradingview.com/u/Options360/

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.