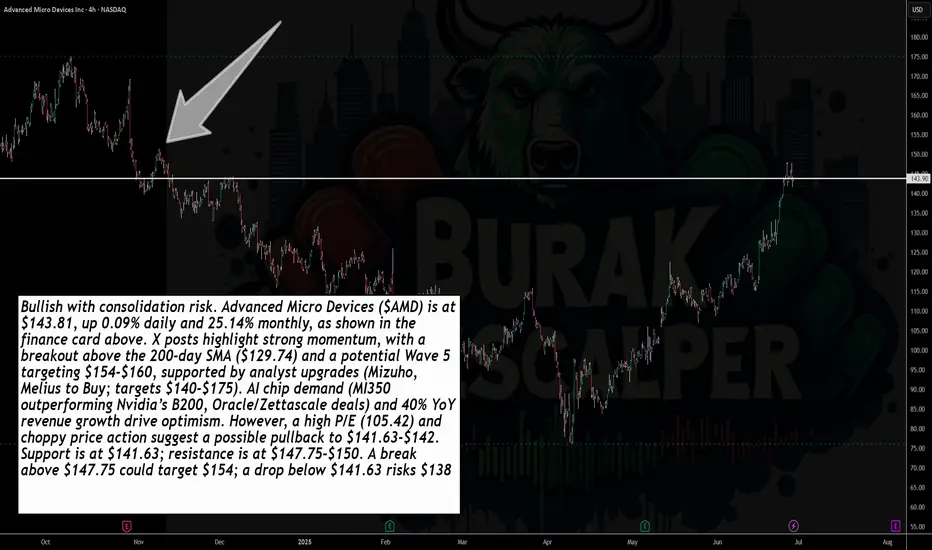

Bullish with consolidation risk. Advanced Micro Devices ( AMD) is at $143.81, up 0.09% daily and 25.14% monthly, as shown in the finance card above. X posts highlight strong momentum, with a breakout above the 200-day SMA ($129.74) and a potential Wave 5 targeting $154-$160, supported by analyst upgrades (Mizuho, Melius to Buy; targets $140-$175). AI chip demand (MI350 outperforming Nvidia’s B200, Oracle/Zettascale deals) and 40% YoY revenue growth drive optimism. However, a high P/E (105.42) and choppy price action suggest a possible pullback to $141.63-$142. Support is at $141.63; resistance is at $147.75-$150. A break above $147.75 could target $154; a drop below $141.63 risks $138

AMD) is at $143.81, up 0.09% daily and 25.14% monthly, as shown in the finance card above. X posts highlight strong momentum, with a breakout above the 200-day SMA ($129.74) and a potential Wave 5 targeting $154-$160, supported by analyst upgrades (Mizuho, Melius to Buy; targets $140-$175). AI chip demand (MI350 outperforming Nvidia’s B200, Oracle/Zettascale deals) and 40% YoY revenue growth drive optimism. However, a high P/E (105.42) and choppy price action suggest a possible pullback to $141.63-$142. Support is at $141.63; resistance is at $147.75-$150. A break above $147.75 could target $154; a drop below $141.63 risks $138

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.