AMZN Breakdown in Progress!

🔍 GEX Insights & Options Trading Thoughts (1H Perspective)

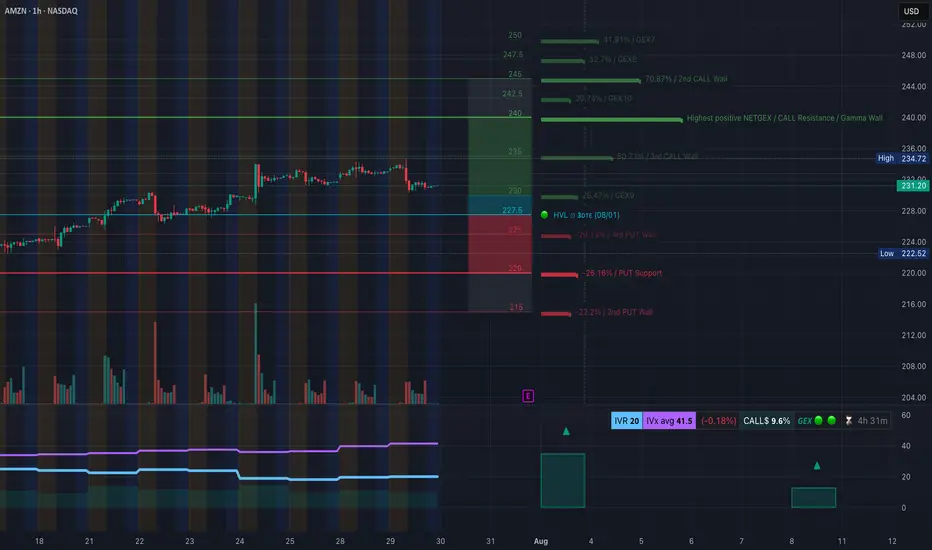

Amazon (AMZN) is transitioning from a distribution phase into a potential gamma-driven selloff, and the current GEX setup confirms that bias. The GEX walls are sharply stacked on the downside, while call walls remain heavy above current price—creating strong overhead pressure.

🔸 Gamma Exposure Breakdown:

* Highest Positive GEX (Call Resistance):

* $236 → this is where market makers lean short, and we see strong rejection wicks from this zone.

* 3rd Call Wall: $236

* 2nd Call Wall: $242.5

* GEX Flip Zone / Transition Area: $231–227.5

* Below this = gamma turns negative, increasing downside velocity

* PUT Walls:

* $225 = 3rd PUT Wall (-20.13%)

* $220 = Major PUT Support (-26.16%)

* $215 = 2nd PUT Wall (-22.2%)

The positioning suggests a gamma gravity pull toward $225 → $222, with high risk of flush to $215 if $222 breaks.

🔸 Options Setup Suggestions:

* Bias: Bearish

* Ideal Option Play:

* Aug 2 / Aug 9 $225P or $220P

* Enter on failed retest of $231

* Exit partial at $225, full at $222 or $215

* Avoid chasing puts too late—look for retest rejection near $231–232

If you're conservative, watch for a break and close below $227.5 to confirm further drop before entering.

🧠 1H Intraday Technical Analysis (TA)

Market Structure:

* AMZN broke below the ascending trendline, showing a clean CHoCH (Change of Character) after price rejected $236 twice—clear sign of distribution.

* BOS → CHoCH sequence confirmed, showing the shift from bullish to bearish order flow.

* Price is now trapped below the former support zone ($231.5), which has turned into supply.

Supply & Demand Zones:

* Supply Zone (Resistance): $234.5–236

* Micro Supply (Retest Area): $231.5–232.5

* Demand Zone (Support): $223–222

* Next Key Demand: $215

* If $222 fails, there’s minimal liquidity support until $215

Volume & Confirmation:

* Volume profile shows declining participation on upside pushes, followed by heavy sell volume candles post-CHoCH.

* This supports the idea of institutional distribution above $234.

🧭 Trading Outlook

🔻 Bearish Intraday Play (Favored):

* Entry 1: Retest rejection at $231.5–232

* Entry 2: Breakdown below $227.5

* Target 1: $225

* Target 2: $222.5

* Target 3: $215 (if panic flush triggers)

* Stop Loss: Above $234

🔼 Bullish Reclaim (Less Likely):

* Needs to reclaim $234.5 with strength

* Would target $236, $240

* Not supported by GEX or volume—low probability

🧠 Final Take:

AMZN is now trapped beneath heavy call walls and has shifted structure with a confirmed CHoCH. GEX shows negative gamma territory below $227.5, creating a slippery slope toward $222. The option market is positioning for further downside while intraday structure aligns for a potential flush into lower demand zones. Unless bulls reclaim $234+ with volume, this setup remains bearish biased with favor to PUT side trading.

🛑 This breakdown is for educational purposes only and does not constitute financial advice. Trade at your own risk and always manage your positions carefully.

🔍 GEX Insights & Options Trading Thoughts (1H Perspective)

Amazon (AMZN) is transitioning from a distribution phase into a potential gamma-driven selloff, and the current GEX setup confirms that bias. The GEX walls are sharply stacked on the downside, while call walls remain heavy above current price—creating strong overhead pressure.

🔸 Gamma Exposure Breakdown:

* Highest Positive GEX (Call Resistance):

* $236 → this is where market makers lean short, and we see strong rejection wicks from this zone.

* 3rd Call Wall: $236

* 2nd Call Wall: $242.5

* GEX Flip Zone / Transition Area: $231–227.5

* Below this = gamma turns negative, increasing downside velocity

* PUT Walls:

* $225 = 3rd PUT Wall (-20.13%)

* $220 = Major PUT Support (-26.16%)

* $215 = 2nd PUT Wall (-22.2%)

The positioning suggests a gamma gravity pull toward $225 → $222, with high risk of flush to $215 if $222 breaks.

🔸 Options Setup Suggestions:

* Bias: Bearish

* Ideal Option Play:

* Aug 2 / Aug 9 $225P or $220P

* Enter on failed retest of $231

* Exit partial at $225, full at $222 or $215

* Avoid chasing puts too late—look for retest rejection near $231–232

If you're conservative, watch for a break and close below $227.5 to confirm further drop before entering.

🧠 1H Intraday Technical Analysis (TA)

Market Structure:

* AMZN broke below the ascending trendline, showing a clean CHoCH (Change of Character) after price rejected $236 twice—clear sign of distribution.

* BOS → CHoCH sequence confirmed, showing the shift from bullish to bearish order flow.

* Price is now trapped below the former support zone ($231.5), which has turned into supply.

Supply & Demand Zones:

* Supply Zone (Resistance): $234.5–236

* Micro Supply (Retest Area): $231.5–232.5

* Demand Zone (Support): $223–222

* Next Key Demand: $215

* If $222 fails, there’s minimal liquidity support until $215

Volume & Confirmation:

* Volume profile shows declining participation on upside pushes, followed by heavy sell volume candles post-CHoCH.

* This supports the idea of institutional distribution above $234.

🧭 Trading Outlook

🔻 Bearish Intraday Play (Favored):

* Entry 1: Retest rejection at $231.5–232

* Entry 2: Breakdown below $227.5

* Target 1: $225

* Target 2: $222.5

* Target 3: $215 (if panic flush triggers)

* Stop Loss: Above $234

🔼 Bullish Reclaim (Less Likely):

* Needs to reclaim $234.5 with strength

* Would target $236, $240

* Not supported by GEX or volume—low probability

🧠 Final Take:

AMZN is now trapped beneath heavy call walls and has shifted structure with a confirmed CHoCH. GEX shows negative gamma territory below $227.5, creating a slippery slope toward $222. The option market is positioning for further downside while intraday structure aligns for a potential flush into lower demand zones. Unless bulls reclaim $234+ with volume, this setup remains bearish biased with favor to PUT side trading.

🛑 This breakdown is for educational purposes only and does not constitute financial advice. Trade at your own risk and always manage your positions carefully.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.